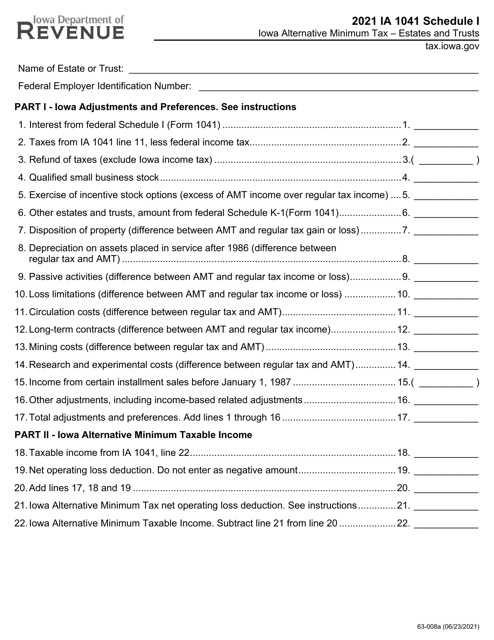

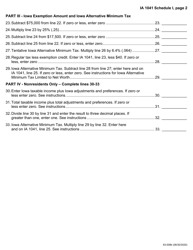

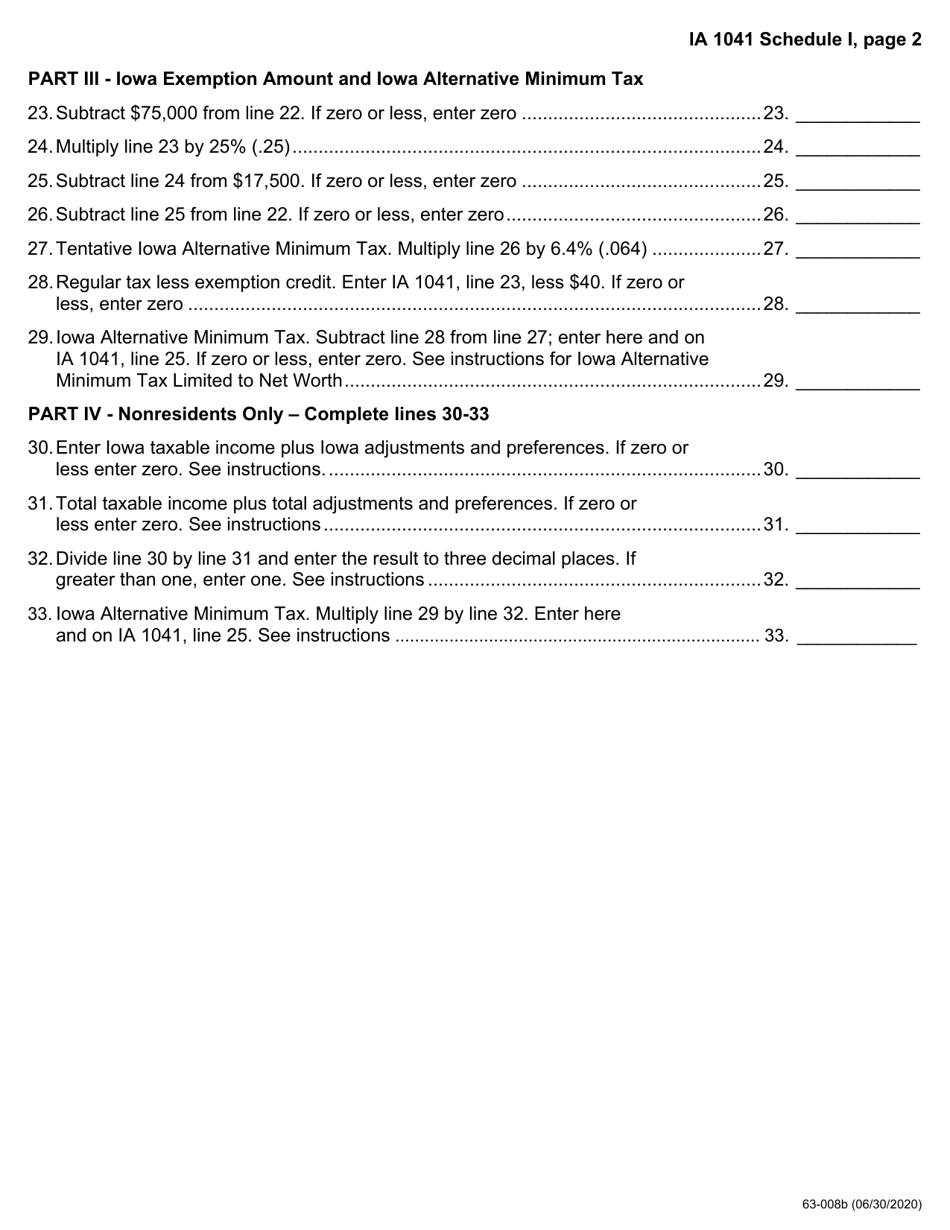

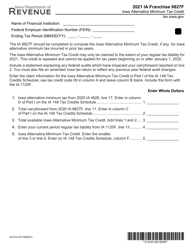

Form IA1041 (63-008) Schedule I Iowa Alternative Minimum Tax - Estates and Trusts - Iowa

What Is Form IA1041 (63-008) Schedule I?

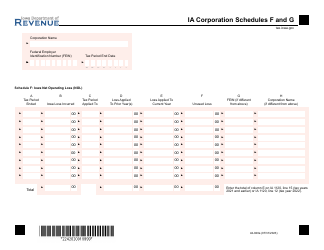

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa.The document is a supplement to Form IA1041, Iowa Fiduciary Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA1041 (63-008)?

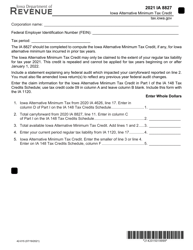

A: Form IA1041 (63-008) is a schedule for calculating the Iowa Alternative Minimum Tax (AMT) for estates and trusts in Iowa.

Q: What is the Iowa Alternative Minimum Tax (AMT)?

A: The Iowa Alternative Minimum Tax (AMT) is a separate tax calculation that ensures taxpayers with high deductions and exemptions still pay a minimum amount of tax.

Q: Who needs to file Form IA1041 (63-008)?

A: Estates and trusts in Iowa that are subject to the Alternative Minimum Tax (AMT) need to file Form IA1041 (63-008).

Q: What is the purpose of Schedule I on Form IA1041 (63-008)?

A: Schedule I on Form IA1041 (63-008) is used to calculate the Iowa Alternative Minimum Tax (AMT) for estates and trusts.

Form Details:

- Released on June 23, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1041 (63-008) Schedule I by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.