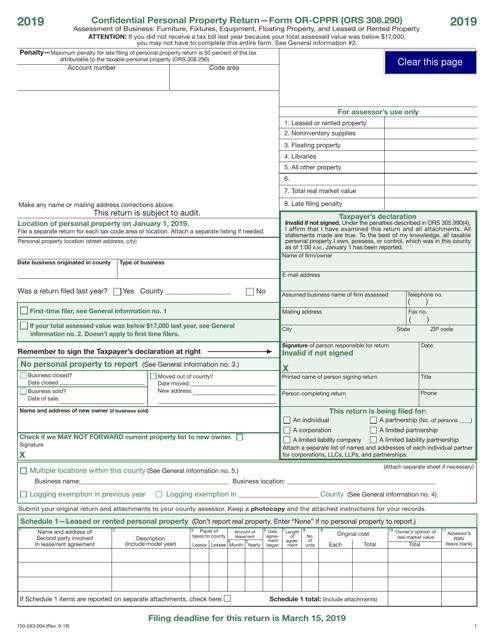

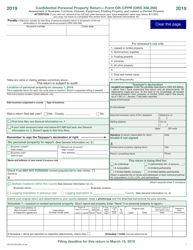

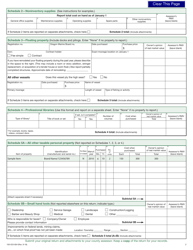

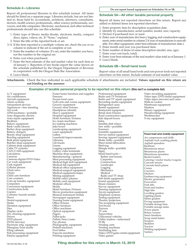

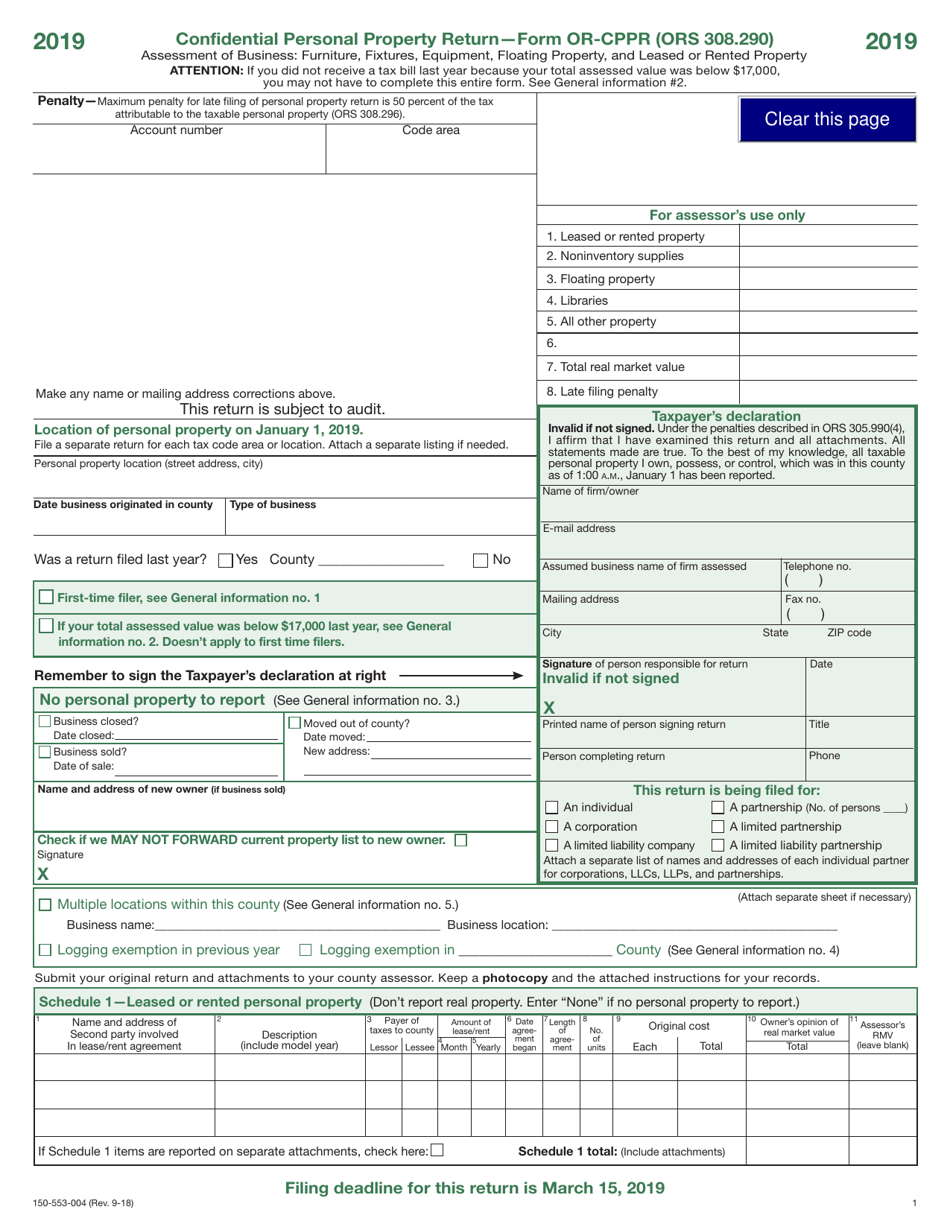

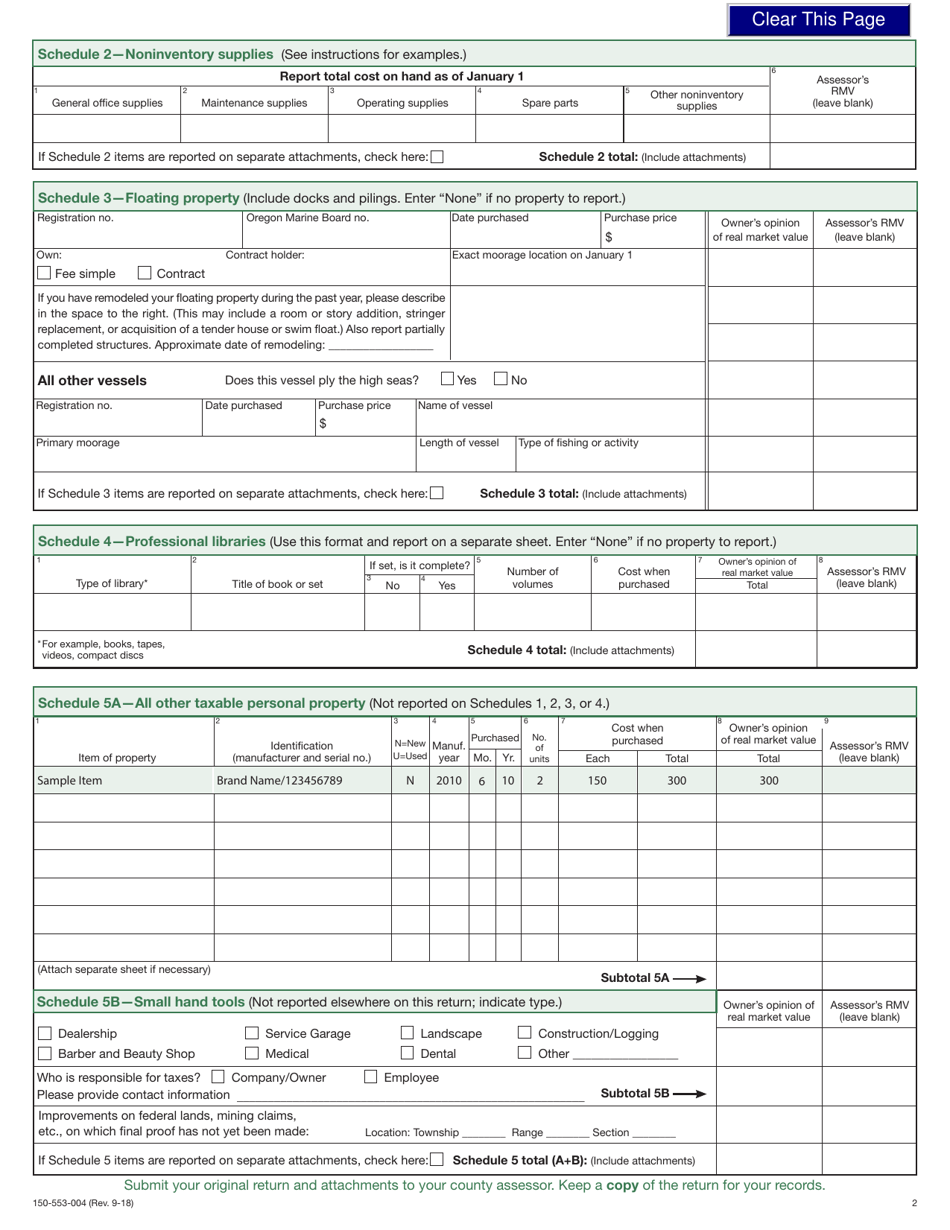

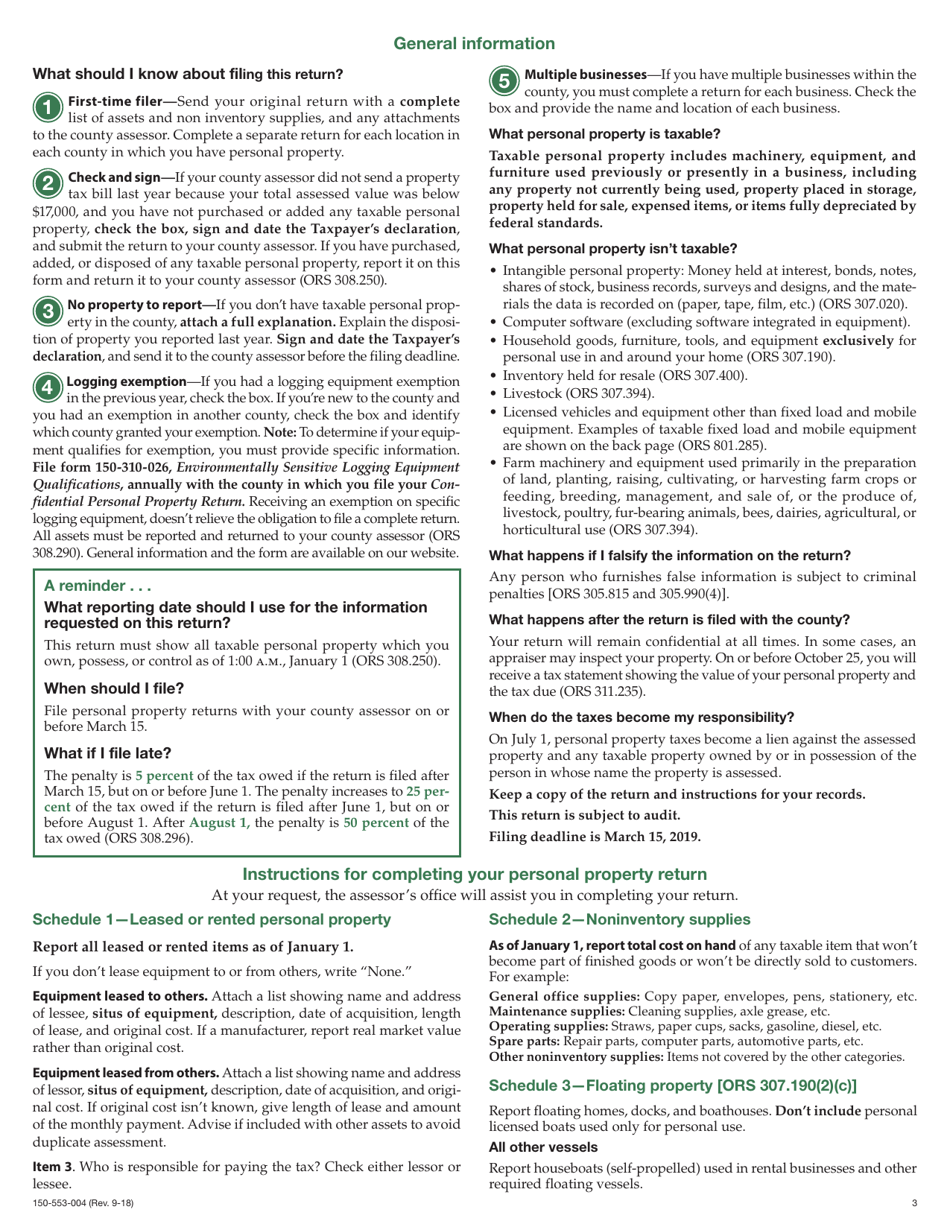

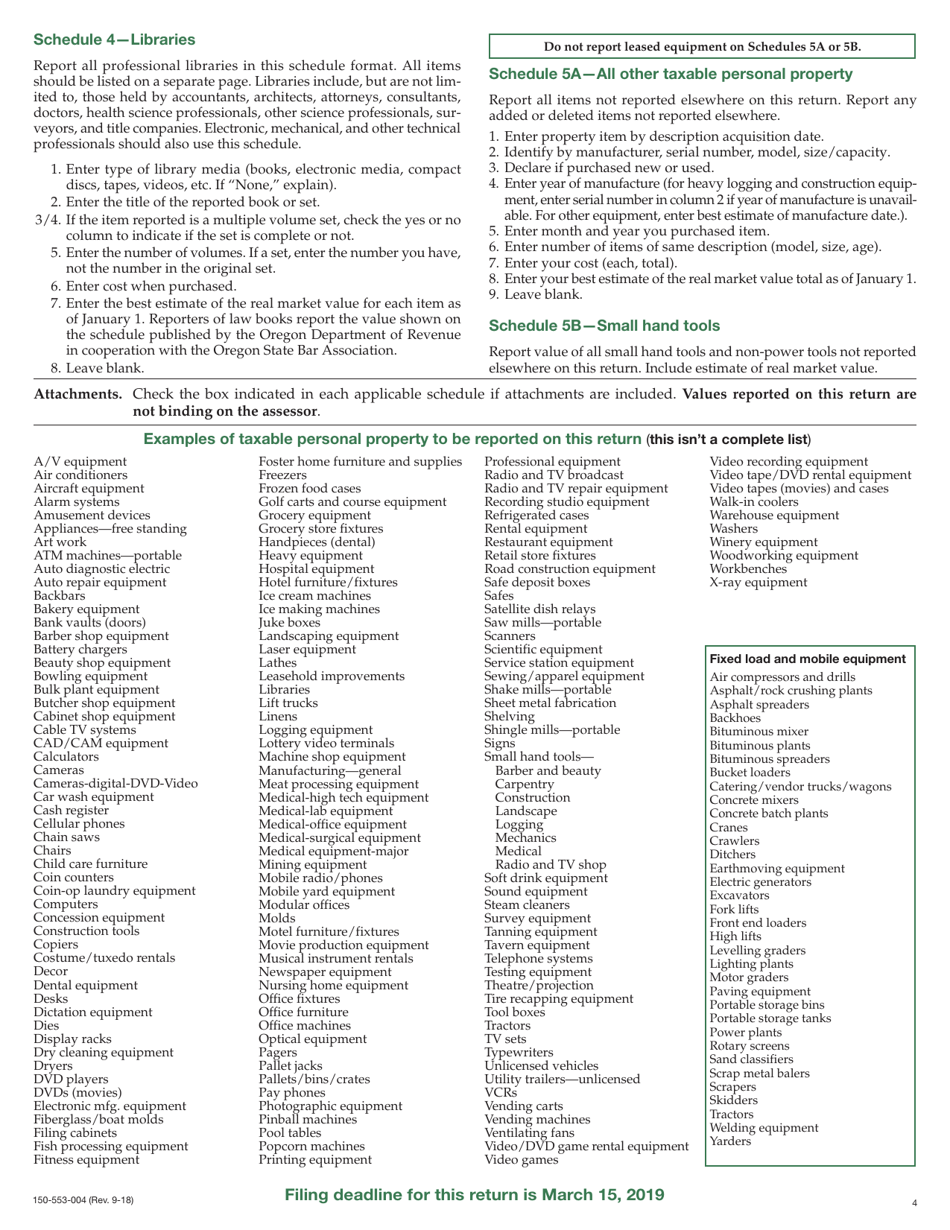

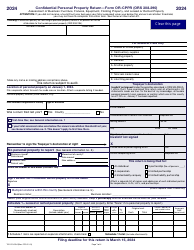

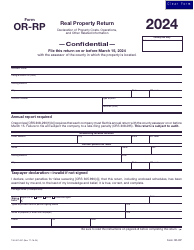

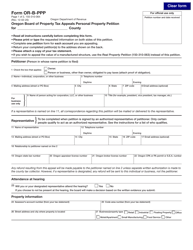

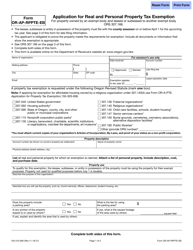

Form 150-553-004 (OR-CPPR) Confidential Personal Property Return - Oregon

What Is Form 150-553-004 (OR-CPPR)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-553-004?

A: Form 150-553-004 is the Confidential Personal Property Return for the state of Oregon.

Q: Who needs to file Form 150-553-004?

A: Any business or individual who owns tangible personal property located in Oregon that is subject to property tax must file this form.

Q: What is the purpose of Form 150-553-004?

A: The purpose of this form is to report and assess property taxes on tangible personal property.

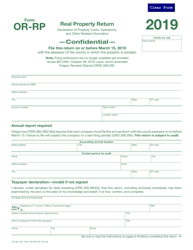

Q: When is Form 150-553-004 due?

A: Form 150-553-004 is due on March 15th of each year.

Q: Is Form 150-553-004 confidential?

A: Yes, Form 150-553-004 is considered confidential, and the information provided on it is protected under Oregon law.

Q: What happens if I don't file Form 150-553-004?

A: Failure to file this form may result in penalties and interest being assessed by the Oregon Department of Revenue.

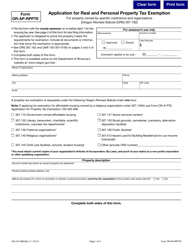

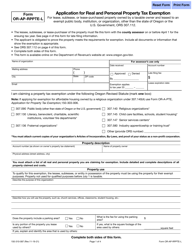

Q: Are there any exemptions to filing Form 150-553-004?

A: Yes, there are certain exemptions available for specific types of property. You should consult the instructions provided with the form or contact the Oregon Department of Revenue for guidance on exemptions.

Q: Is there a fee for filing Form 150-553-004?

A: No, there is no fee for filing this form.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-553-004 (OR-CPPR) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.