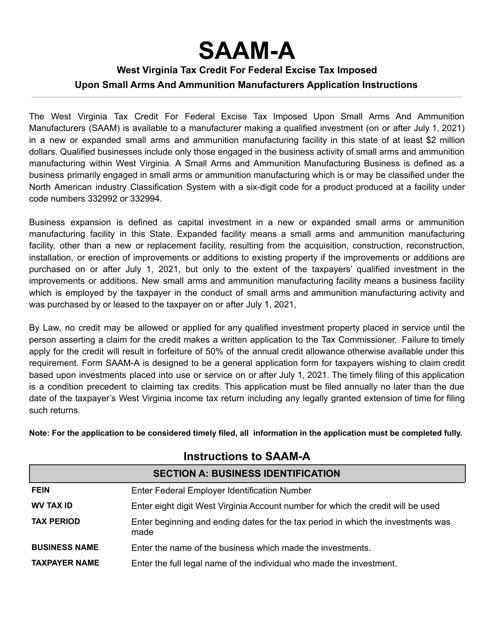

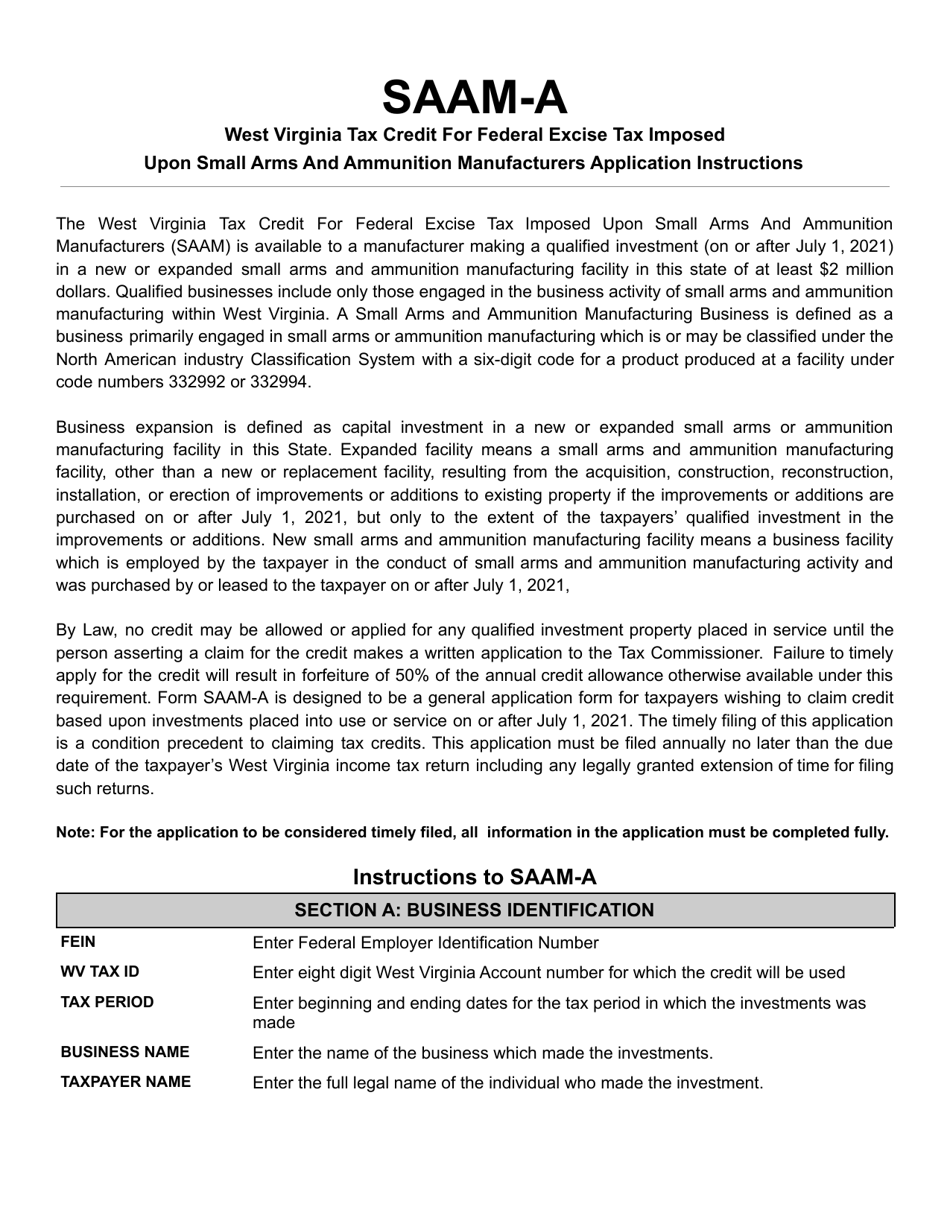

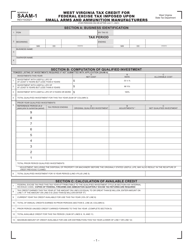

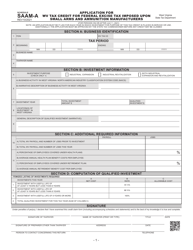

Instructions for Schedule SAAM-A Application for Wv Tax Credit for Federal Excise Tax Imposed Upon Small Arms and Ammunition Manufacturers - West Virginia

This document contains official instructions for Schedule SAAM-A , Application for Wv Small Arms and Ammunition Manufacturers - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Schedule SAAM-A?

A: Schedule SAAM-A is an application for a tax credit in West Virginia for federal excise tax imposed upon small arms and ammunition manufacturers.

Q: Who can use Schedule SAAM-A?

A: Small arms and ammunition manufacturers in West Virginia can use Schedule SAAM-A.

Q: What is the purpose of Schedule SAAM-A?

A: The purpose of Schedule SAAM-A is to claim a tax credit for the federal excise tax imposed upon small arms and ammunition manufacturers.

Q: How do I apply for the tax credit using Schedule SAAM-A?

A: To apply for the tax credit, complete Schedule SAAM-A and include it with your West Virginia tax return.

Q: Are there any eligibility requirements to claim the tax credit?

A: Yes, there are eligibility requirements. Please refer to the instructions on Schedule SAAM-A for more information.

Q: What is the deadline for filing Schedule SAAM-A?

A: The deadline for filing Schedule SAAM-A is the same as the deadline for filing your West Virginia tax return.

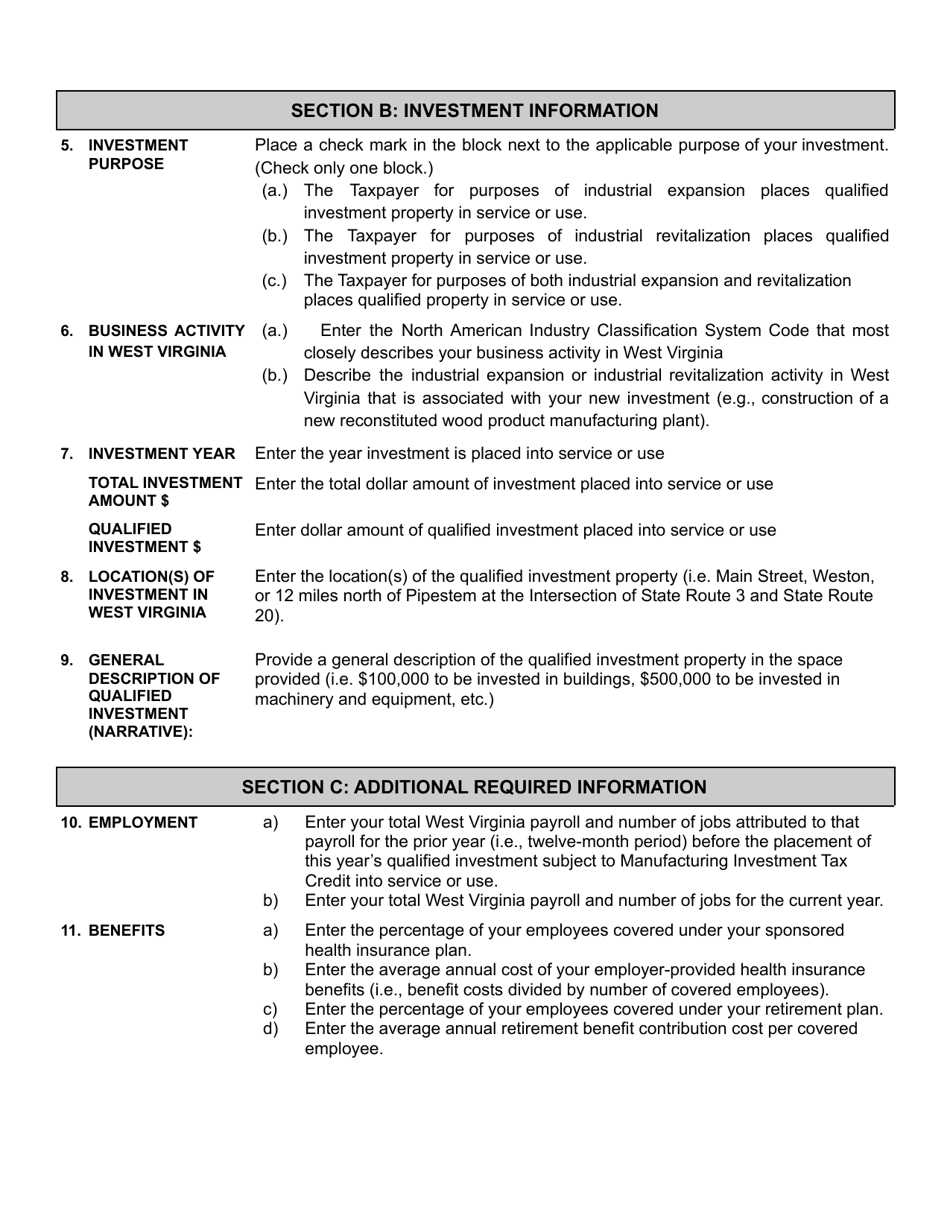

Instruction Details:

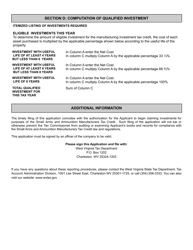

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.