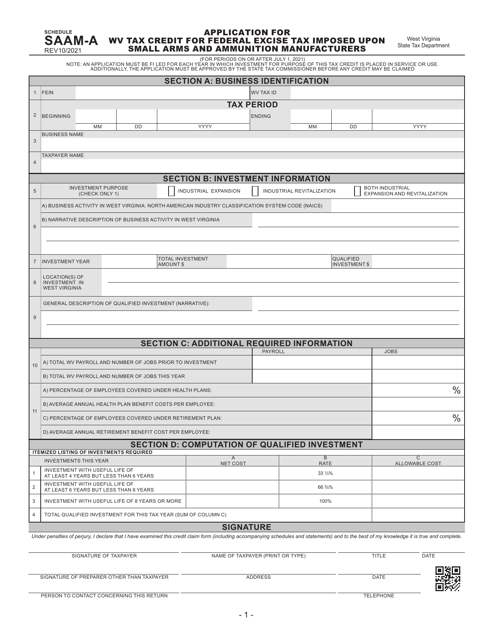

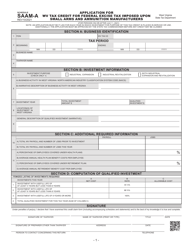

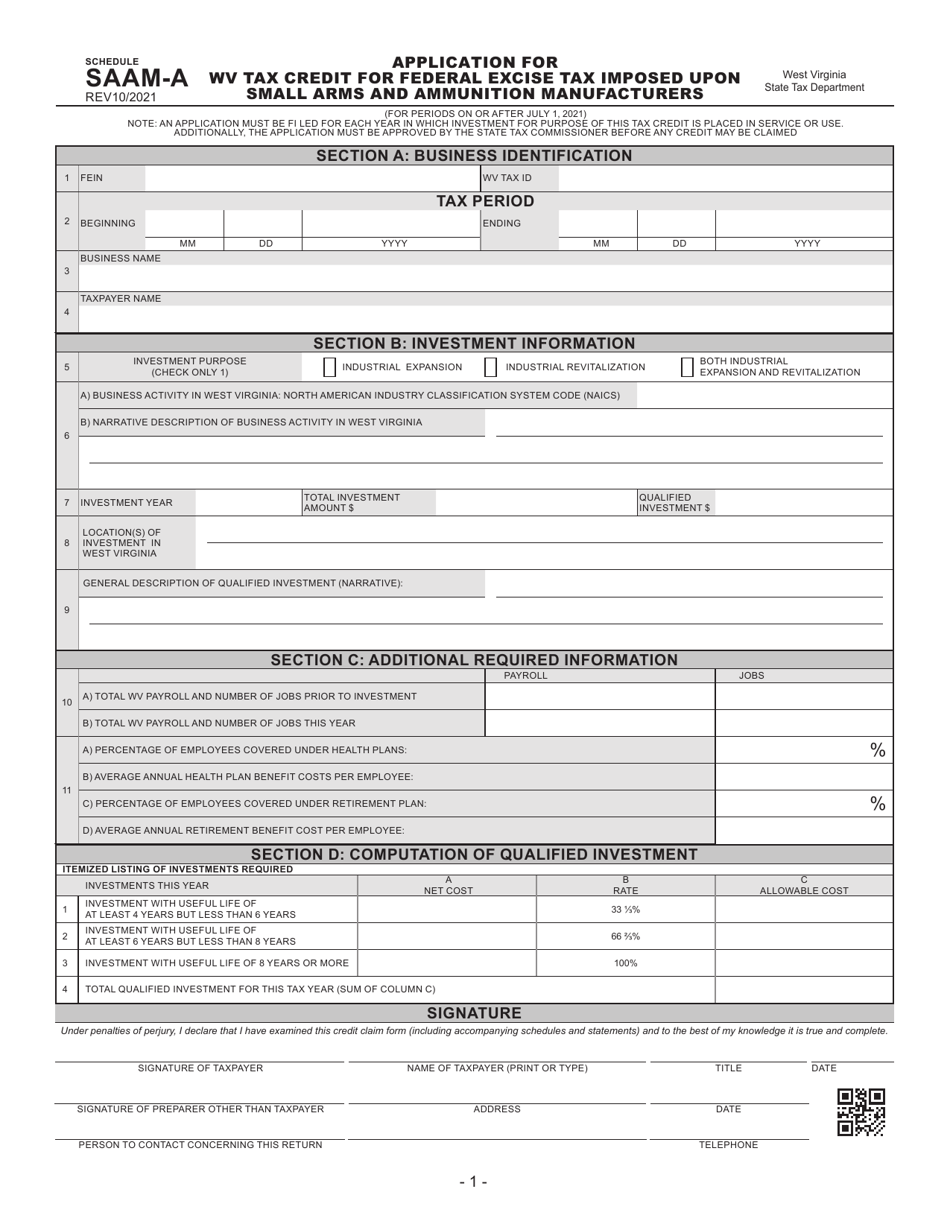

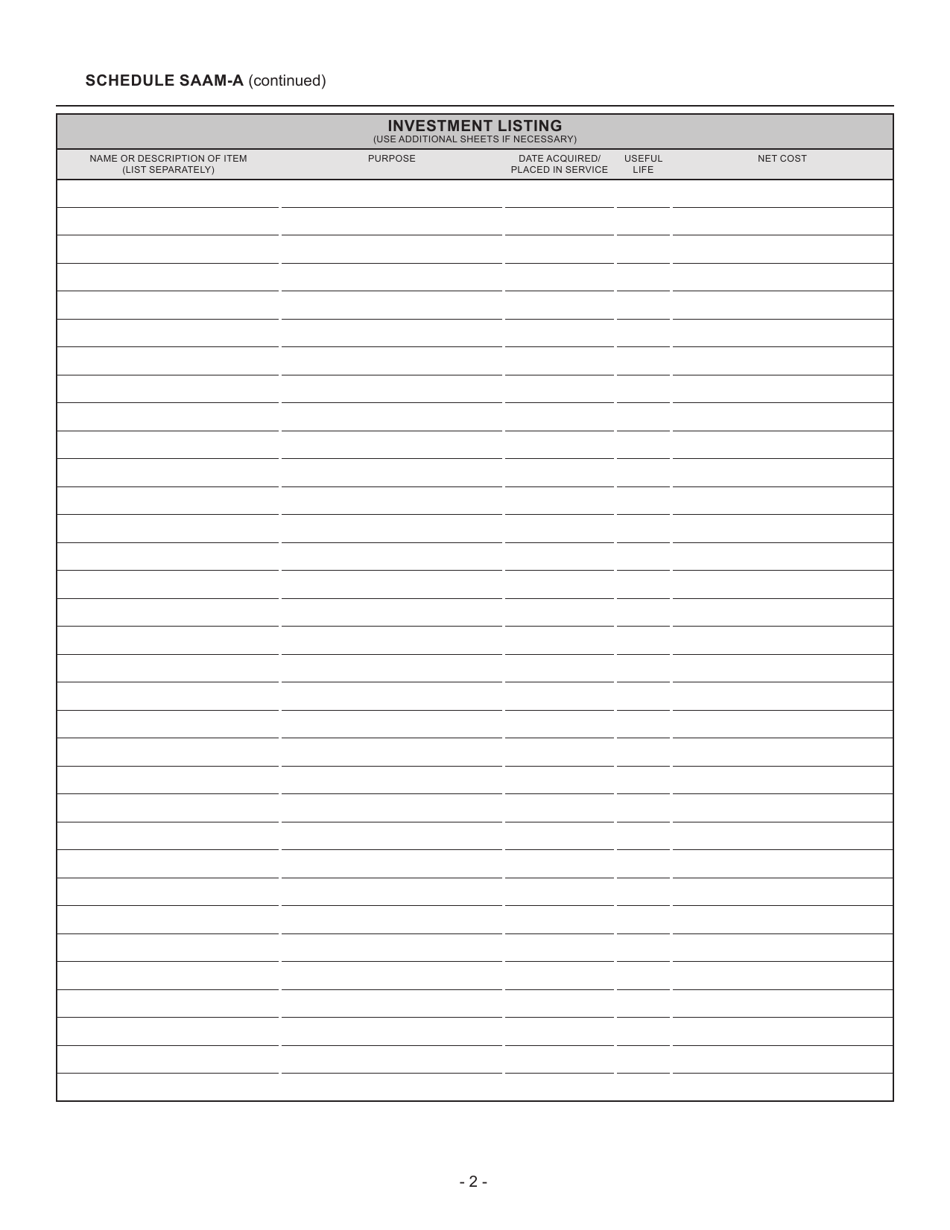

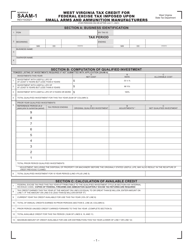

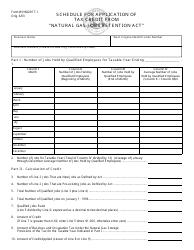

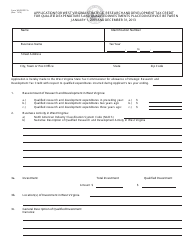

Schedule SAAM-A Application for Wv Tax Credit for Federal Excise Tax Imposed Upon Small Arms and Ammunition Manufacturers - West Virginia

What Is Schedule SAAM-A?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SAAM-A application?

A: The SAAM-A application is an application for the West Virginia Tax Credit for Federal Excise Tax Imposed Upon Small Arms and Ammunition Manufacturers.

Q: What is the purpose of the SAAM-A application?

A: The purpose of the SAAM-A application is to apply for a tax credit for federal excise tax imposed on small arms and ammunition manufacturers in West Virginia.

Q: Who can apply for the SAAM-A application?

A: Small arms and ammunition manufacturers in West Virginia can apply for the SAAM-A application.

Q: What does the tax credit cover?

A: The tax credit covers the federal excise tax imposed on small arms and ammunition manufacturers in West Virginia.

Q: How can I schedule the SAAM-A application?

A: To schedule the SAAM-A application, you may need to contact the relevant tax authorities in West Virginia for more information.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule SAAM-A by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.