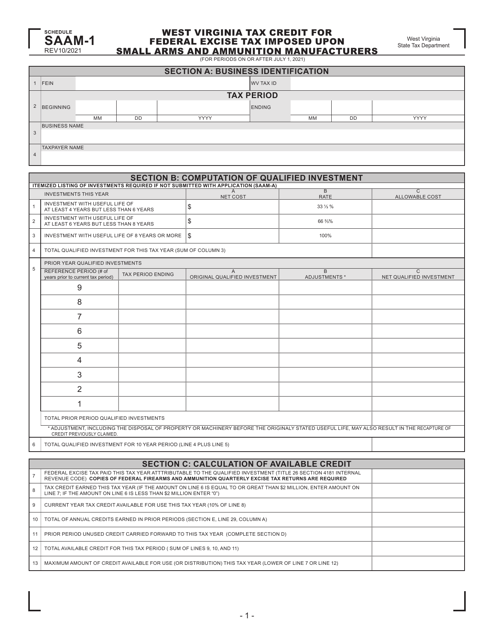

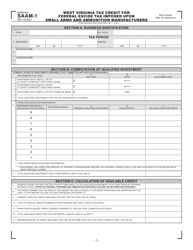

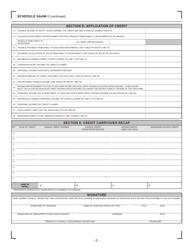

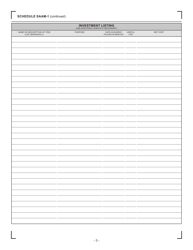

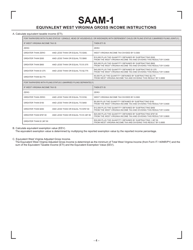

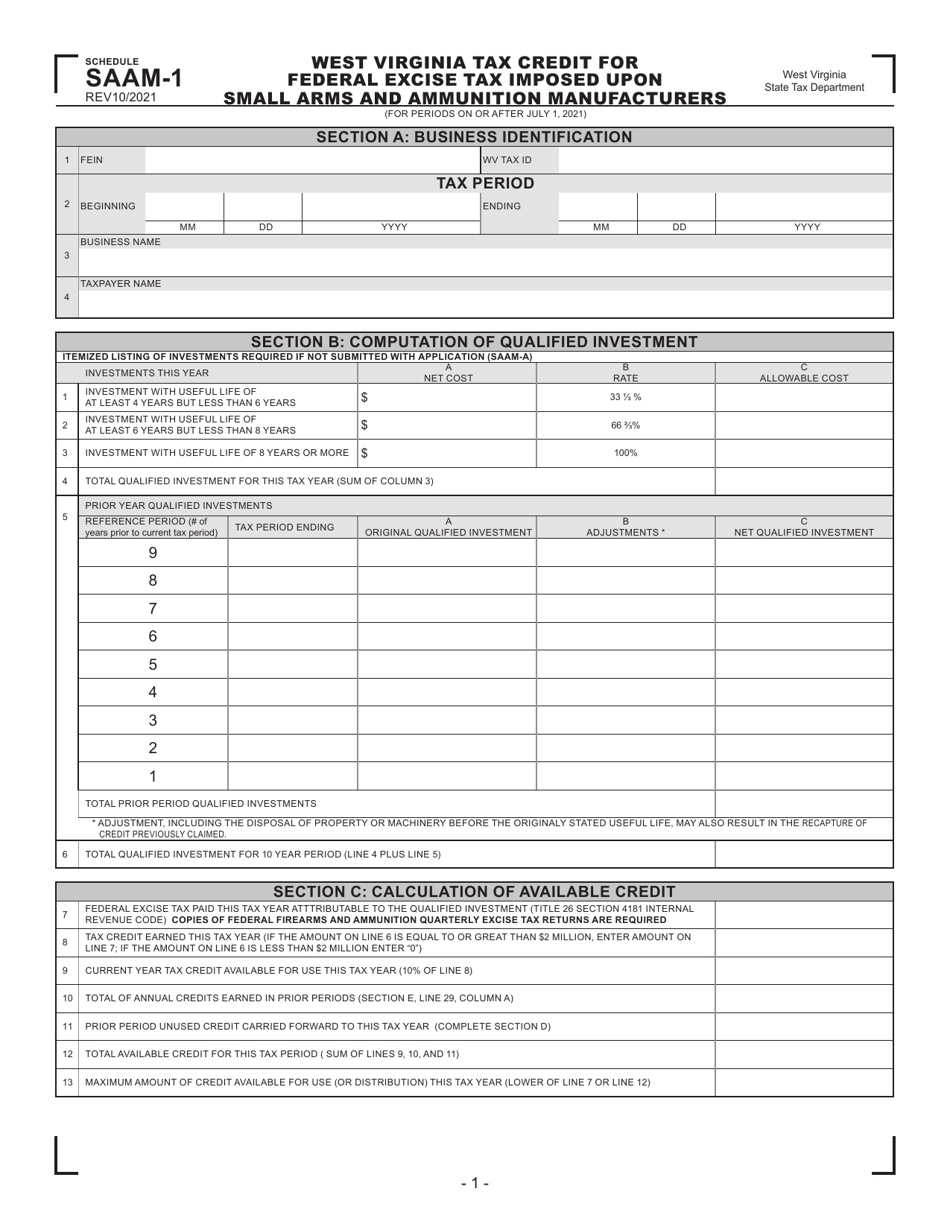

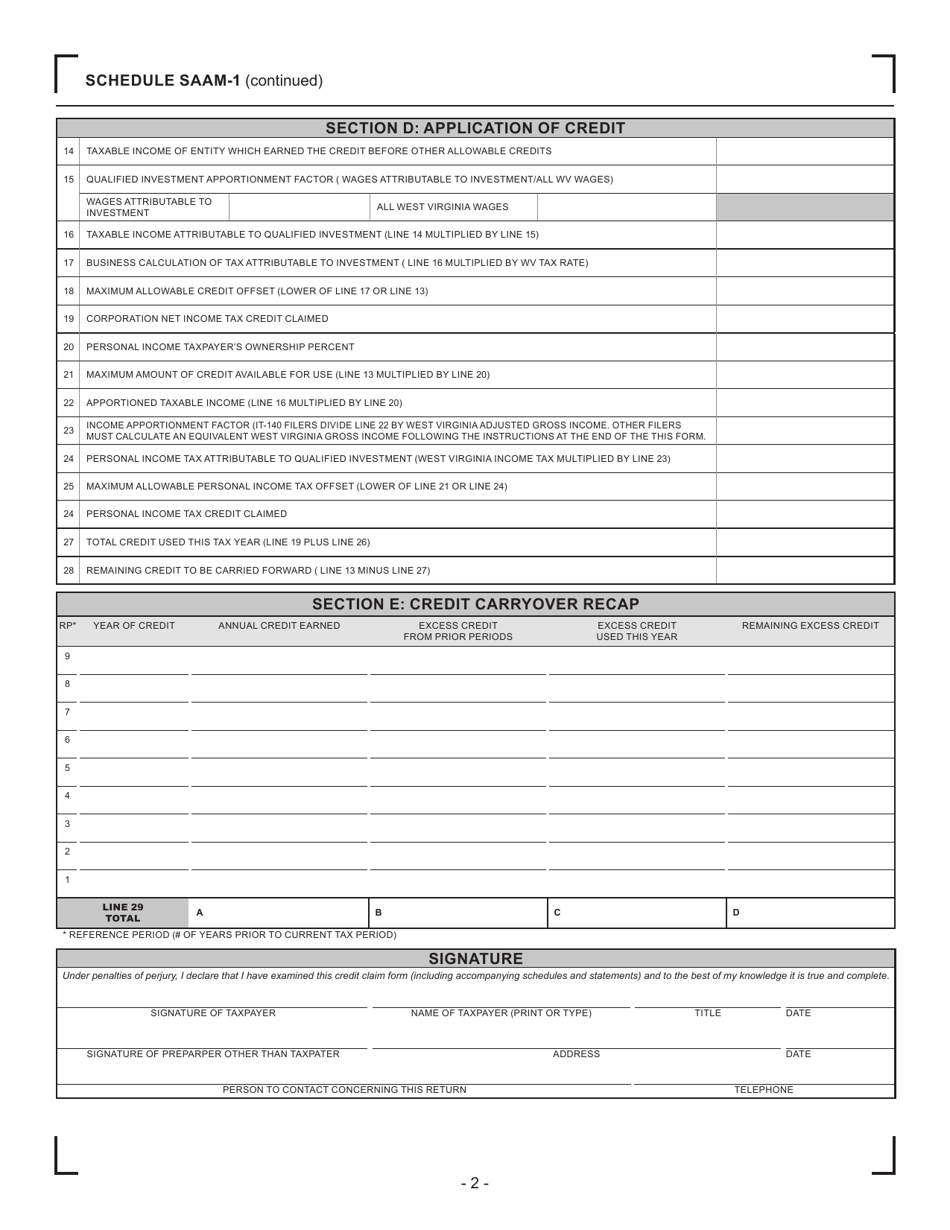

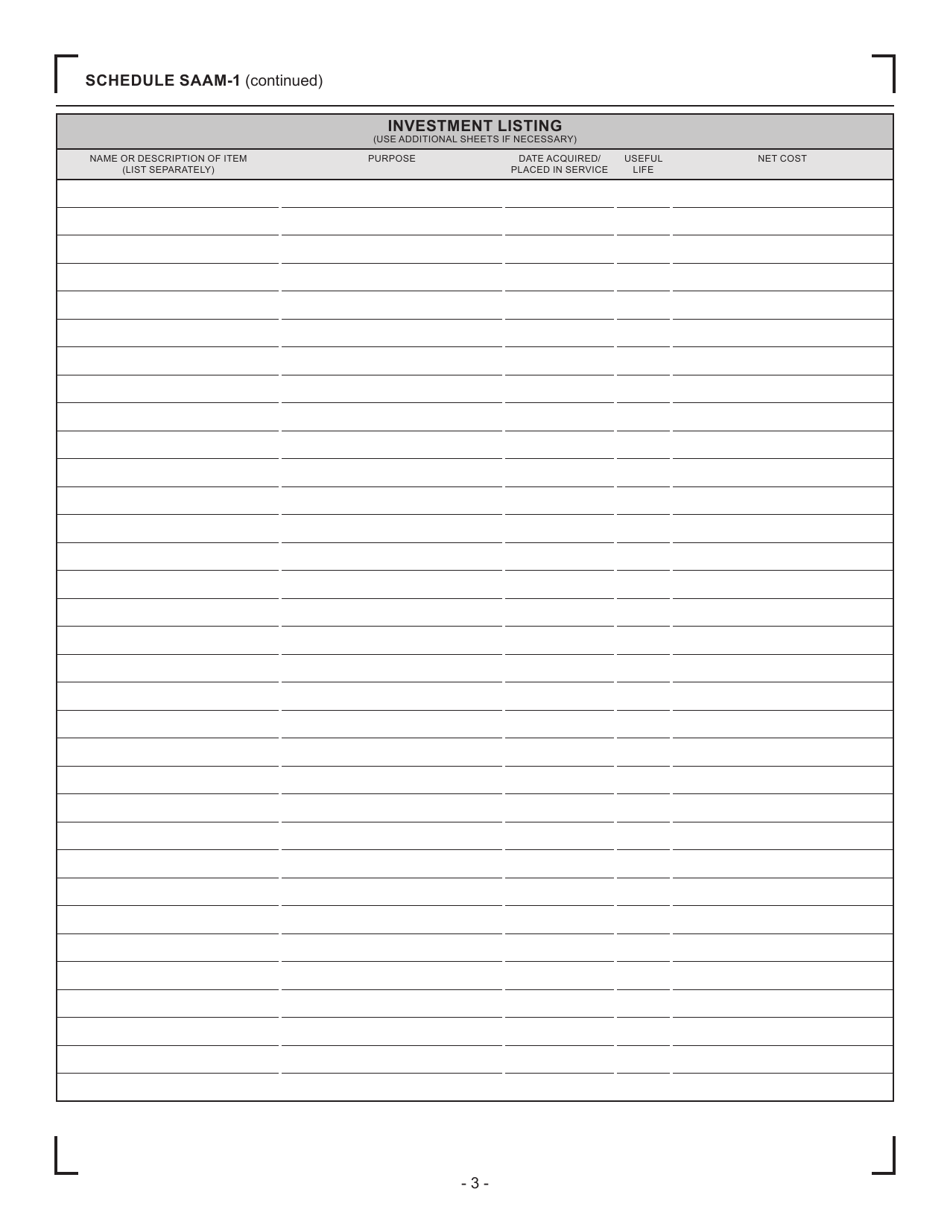

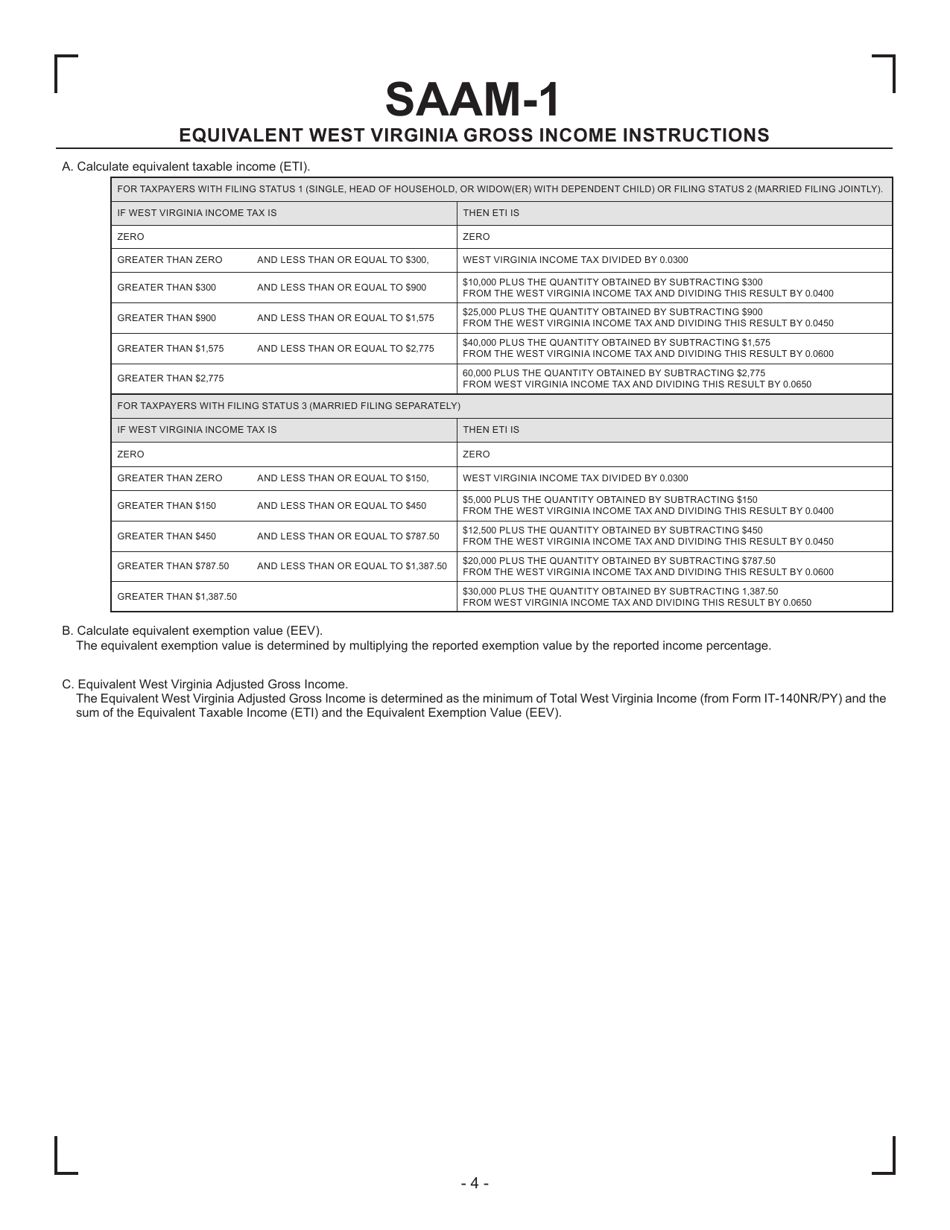

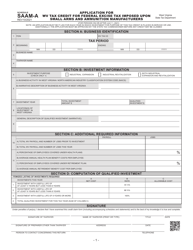

Schedule SAAM-1 West Virginia Tax Credit for Federal Excise Tax Imposed Upon Small Arms and Ammunition Manufacturers - West Virginia

What Is Schedule SAAM-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SAAM-1?

A: SAAM-1 stands for Schedule SAAM-1, which is a tax credit program in West Virginia.

Q: What does SAAM-1 stand for?

A: SAAM-1 stands for Schedule SAAM-1, which is a tax credit program in West Virginia.

Q: What is the purpose of SAAM-1?

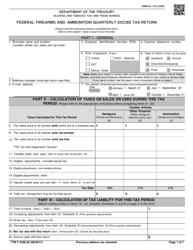

A: The purpose of SAAM-1 is to provide a tax credit for federal excise tax imposed upon small arms and ammunition manufacturers in West Virginia.

Q: Who is eligible for SAAM-1?

A: Small arms and ammunition manufacturers in West Virginia are eligible for SAAM-1 tax credit.

Q: How does SAAM-1 work?

A: SAAM-1 provides a tax credit to small arms and ammunition manufacturers in West Virginia for the federal excise tax they pay.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule SAAM-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.