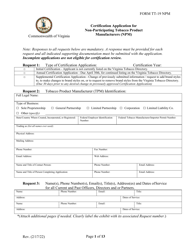

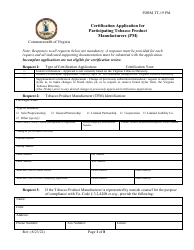

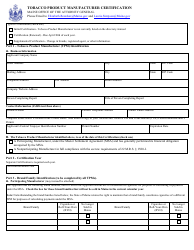

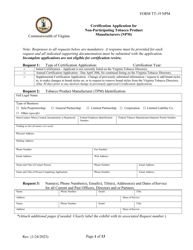

Instructions for State of West Virginia Certification of Tobacco Product Manufacturers - West Virginia

This document was released by West Virginia State Tax Department and contains the most recent official instructions for State of West Virginia Certification of Tobacco Product Manufacturers .

FAQ

Q: What is the purpose of the State of West Virginia Certification of Tobacco Product Manufacturers?

A: The purpose is to ensure that tobacco product manufacturers comply with state laws and regulations.

Q: Who needs to obtain the State of West Virginia Certification as a tobacco product manufacturer?

A: Any tobacco product manufacturer that intends to sell or distribute tobacco products in West Virginia needs to obtain the certification.

Q: How can a tobacco product manufacturer obtain the State of West Virginia Certification?

A: The manufacturer must submit an application, pay the required fees, and provide the necessary documentation to the West Virginia State Tax Department.

Q: What documents are required for the State of West Virginia Certification?

A: The manufacturer needs to provide proof of compliance with federal tobacco product laws, a list of all tobacco products sold or distributed in West Virginia, and any additional documentation required by the State Tax Department.

Q: How much does the State of West Virginia Certification cost?

A: The fee for the certification is $500 for each brand or style of tobacco product.

Q: Is the State of West Virginia Certification valid indefinitely?

A: No, the certification is valid for one year and needs to be renewed annually.

Q: What happens if a tobacco product manufacturer fails to obtain or renew the State of West Virginia Certification?

A: The manufacturer may face penalties, including fines and possible suspension of their ability to sell or distribute tobacco products in West Virginia.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the West Virginia State Tax Department.