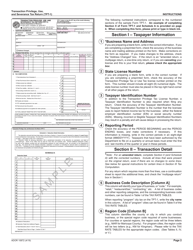

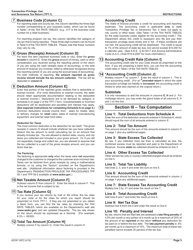

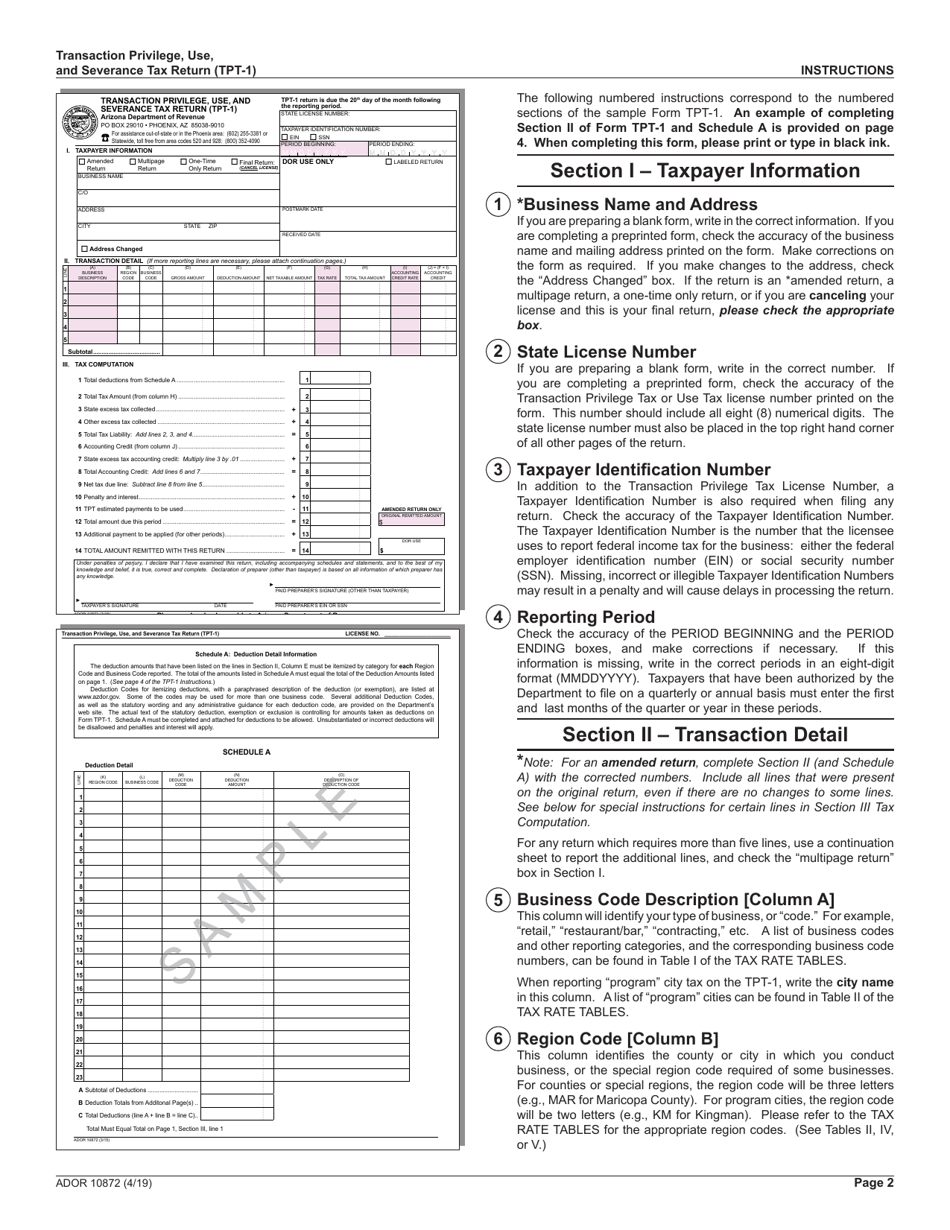

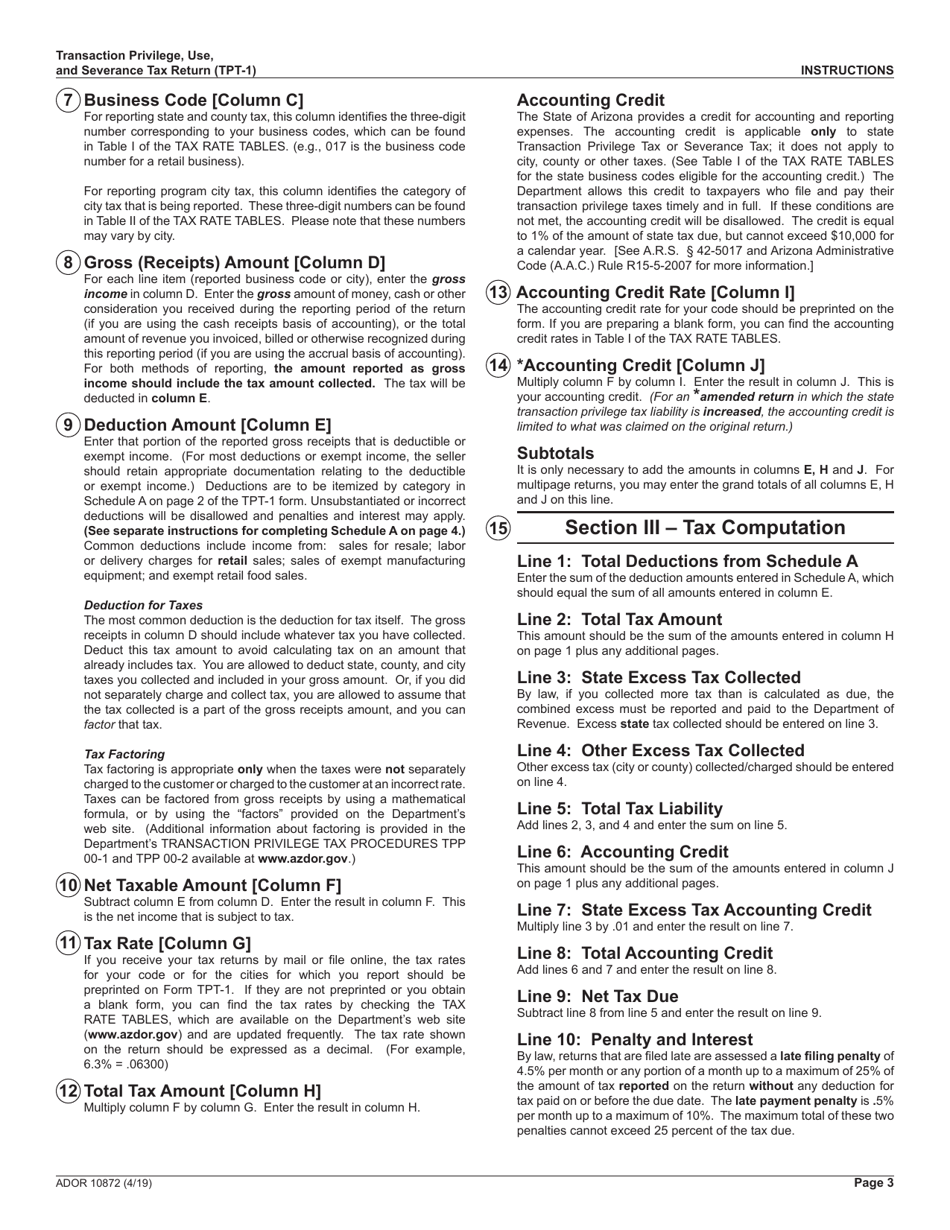

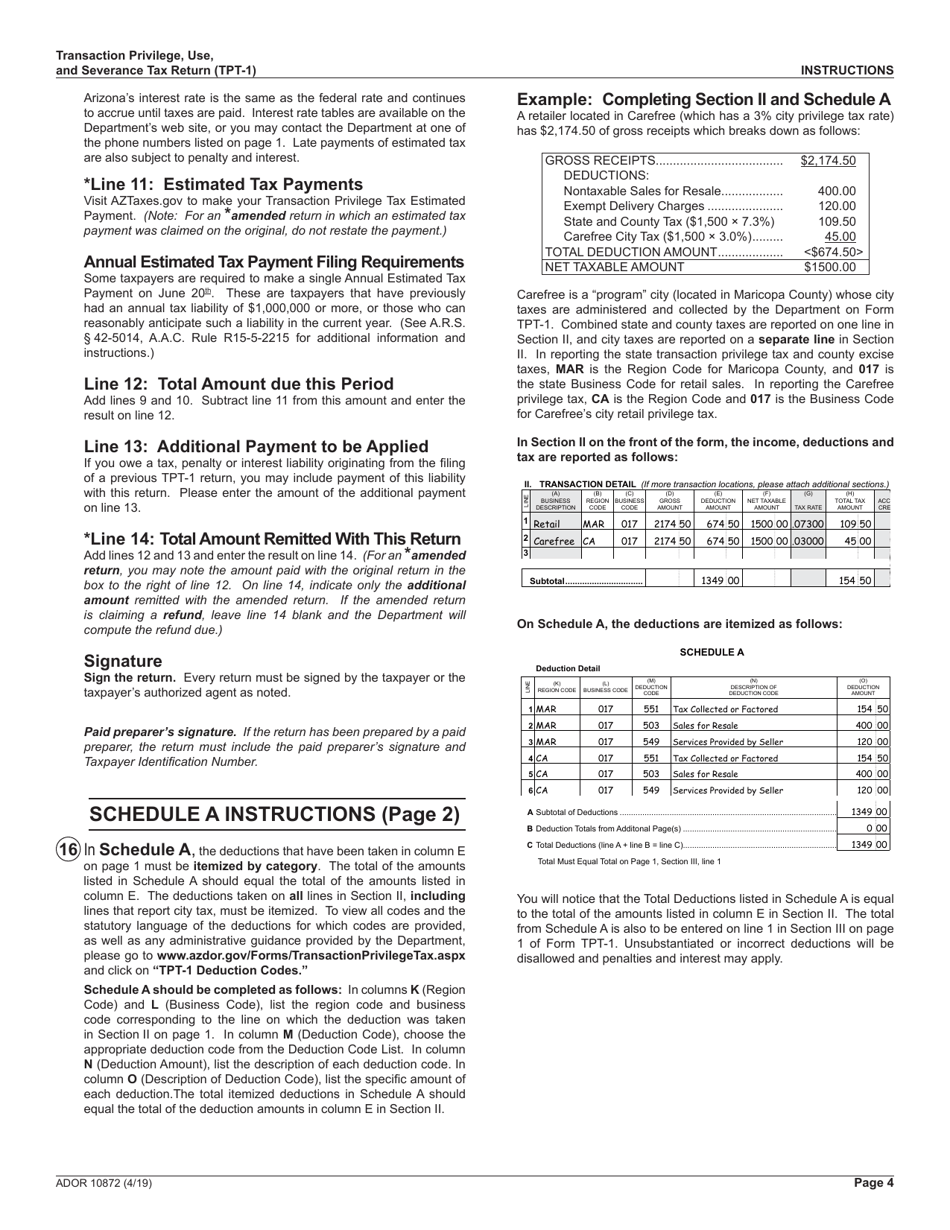

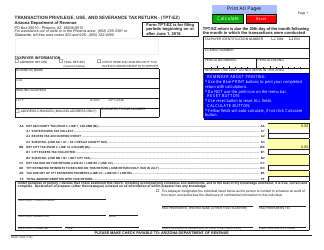

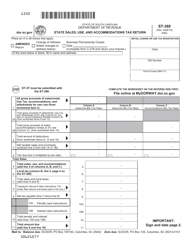

Instructions for Form TPT-1, ADOR10872 Transaction Privilege, Use, and Severance Tax Return - Arizona

This document contains official instructions for Form TPT-1 , and Form ADOR10872 . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

Q: What is Form TPT-1?

A: Form TPT-1 is the Transaction Privilege, Use, and Severance Tax Return.

Q: Who should file Form TPT-1?

A: Individuals or businesses engaged in taxable activities in Arizona must file Form TPT-1.

Q: What is Transaction Privilege Tax?

A: Transaction Privilege Tax is a tax imposed on the privilege of conducting business in Arizona.

Q: What is Use Tax?

A: Use Tax is a tax imposed on the use, consumption, or storage of tangible personal property in Arizona.

Q: What is Severance Tax?

A: Severance Tax is a tax imposed on the extraction of natural resources in Arizona.

Q: How often should Form TPT-1 be filed?

A: Form TPT-1 should be filed either monthly, quarterly, or annually, depending on the taxpayer's total tax liability.

Q: Is there a due date for filing Form TPT-1?

A: Yes, the due date for filing Form TPT-1 depends on the filing frequency and is usually on the 20th day of the month following the reporting period.

Q: Is there any penalty for late filing of Form TPT-1?

A: Yes, there is a penalty for late filing, and it is based on the tax liability.

Instruction Details:

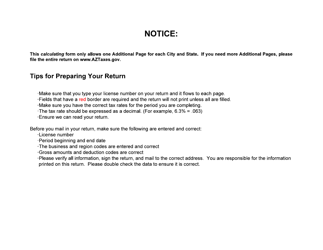

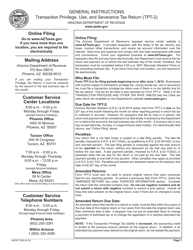

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.