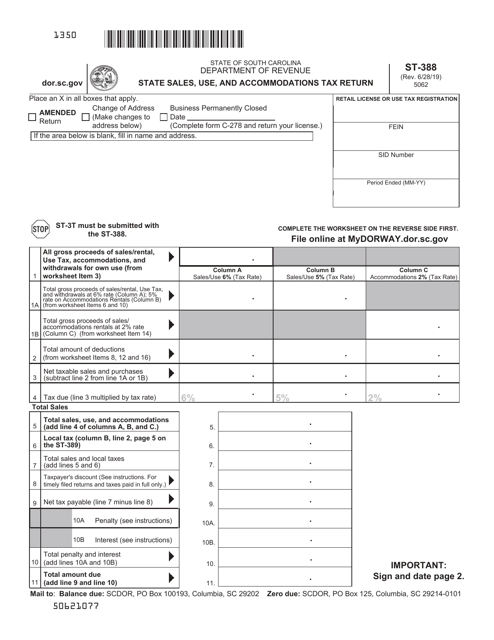

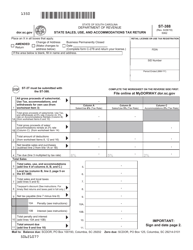

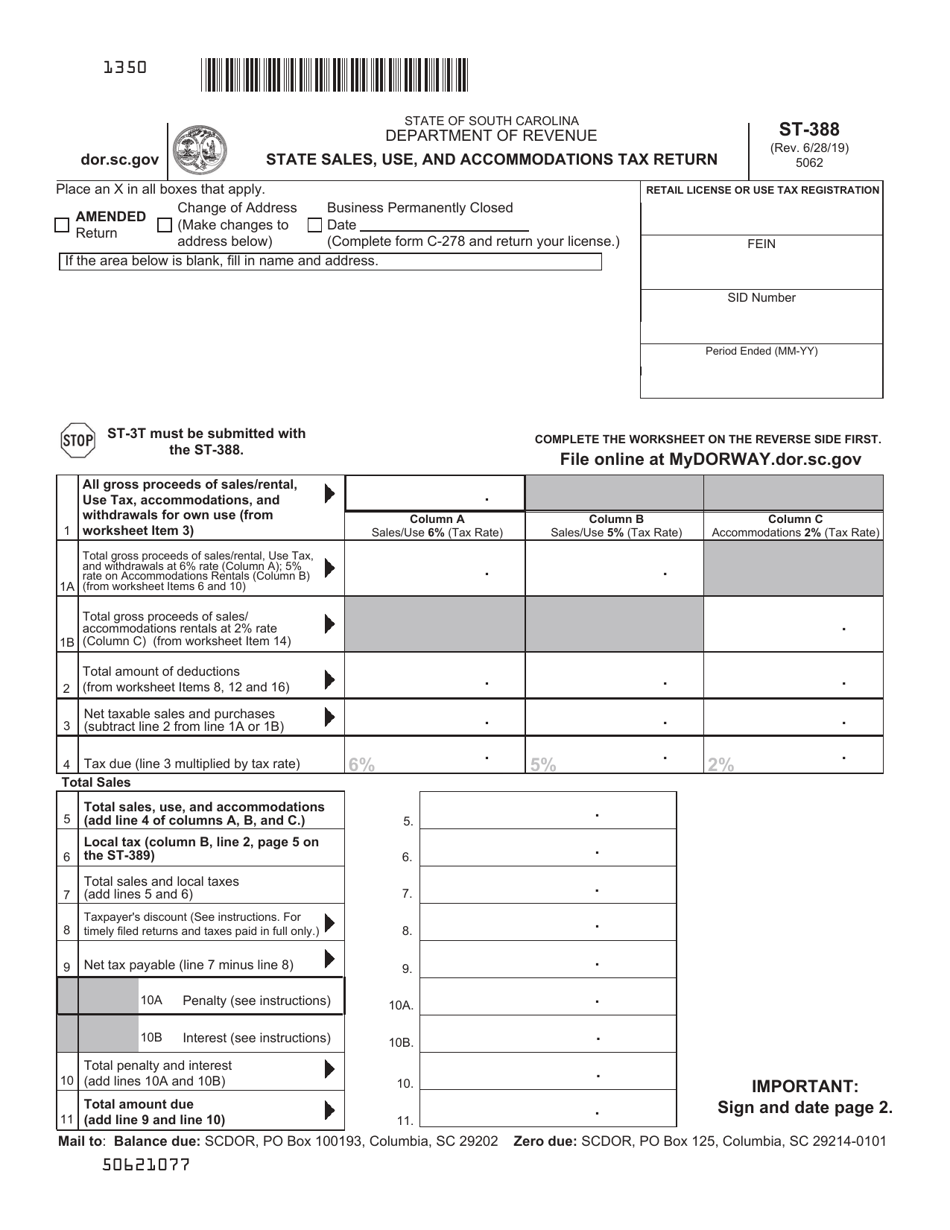

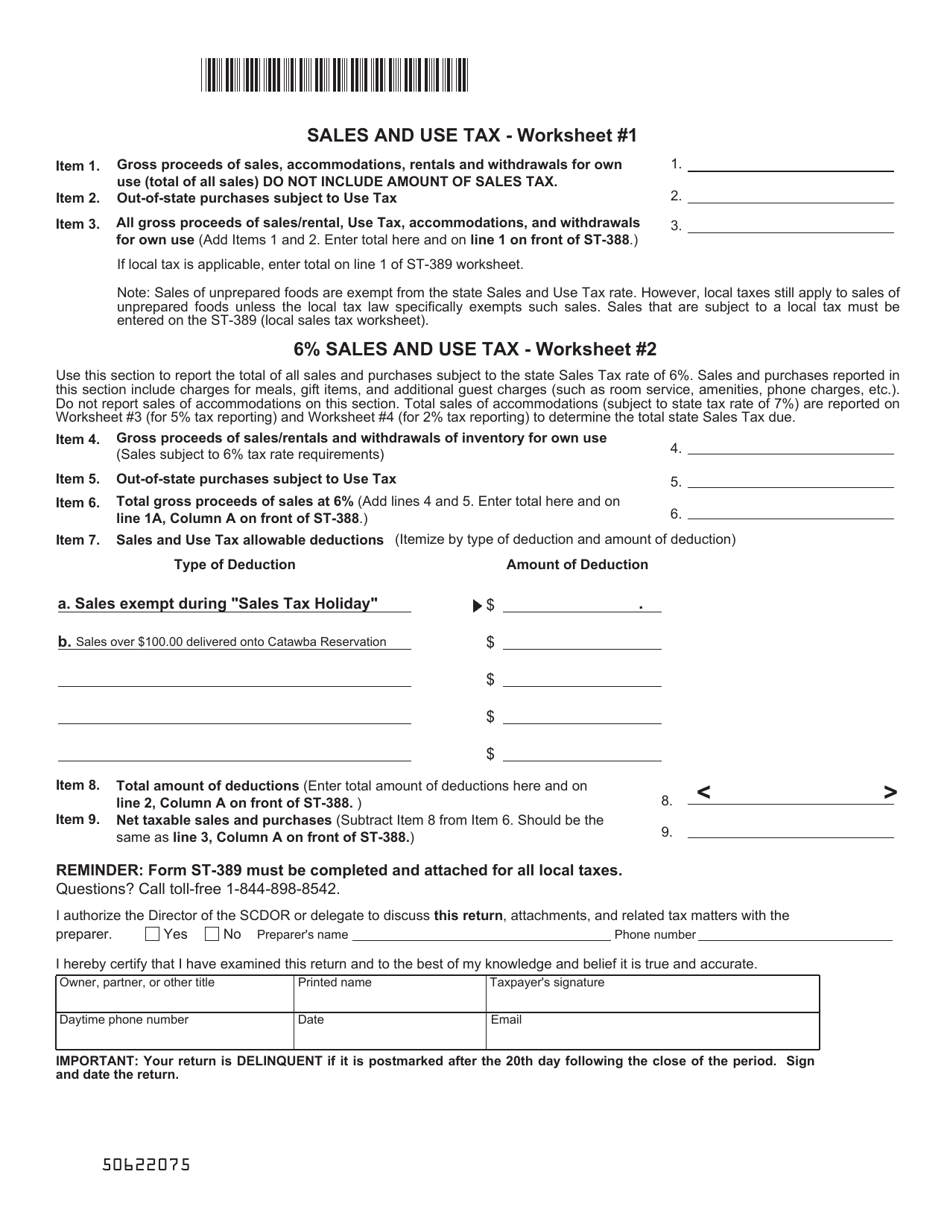

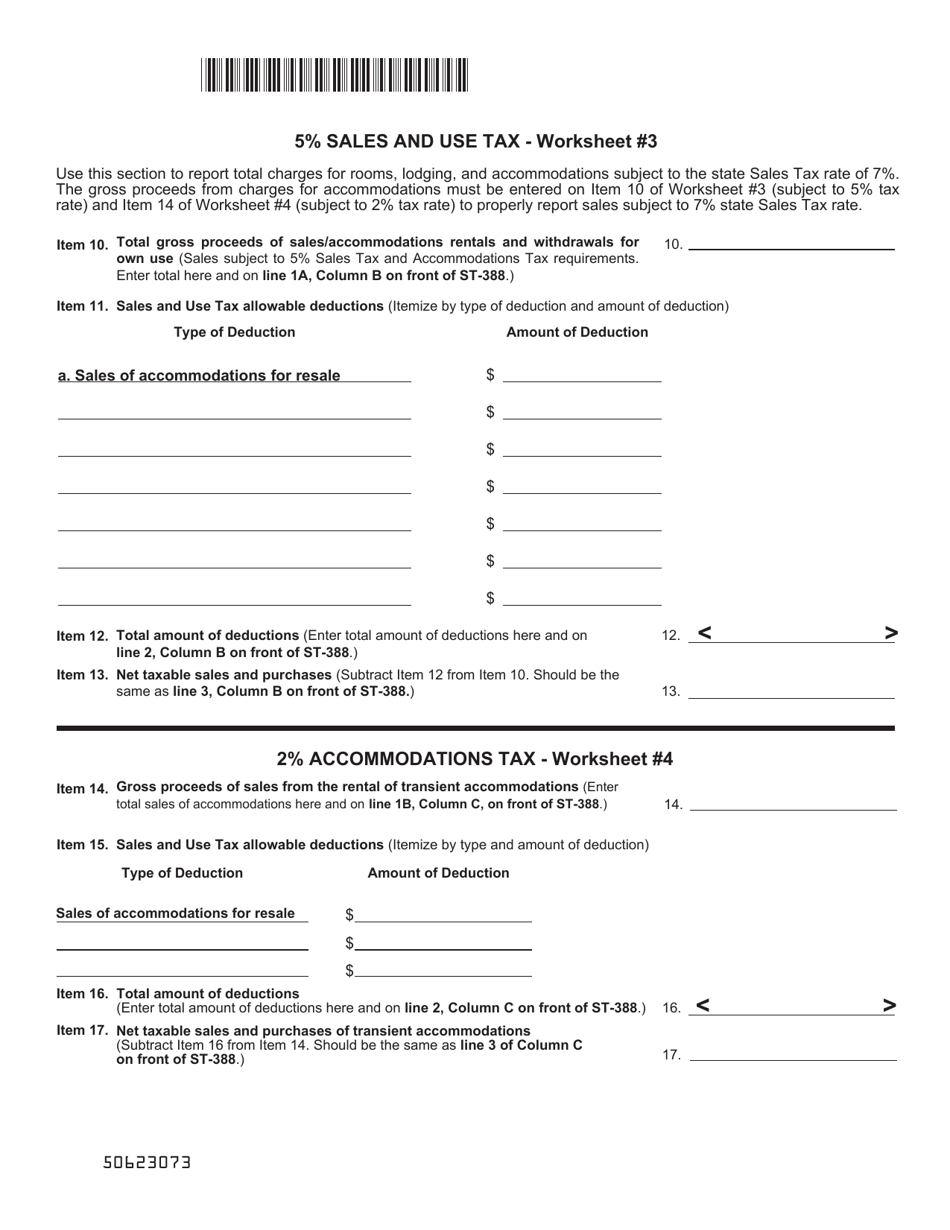

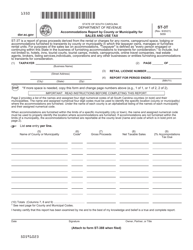

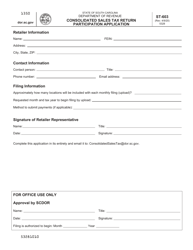

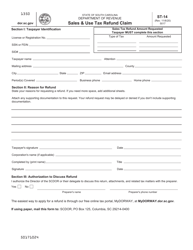

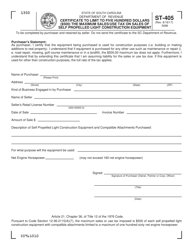

Form ST-388 State Sales and Use and Accommodations Tax Return - South Carolina

What Is Form ST-388?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ST-388?

A: Form ST-388 is the State Sales and Use and Accommodations Tax Return for South Carolina.

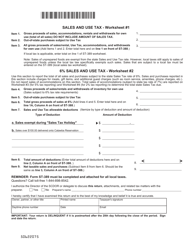

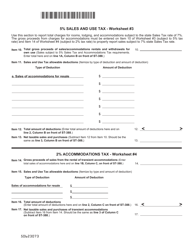

Q: What taxes does Form ST-388 cover?

A: Form ST-388 covers Sales and Use Tax as well as Accommodations Tax.

Q: Who is required to file Form ST-388?

A: Businesses engaged in sales and use tax activities or accommodations tax activities in South Carolina are required to file Form ST-388.

Q: How often is Form ST-388 filed?

A: Form ST-388 is filed monthly or quarterly, depending on the taxpayer's tax liability.

Q: Are there any penalties for not filing Form ST-388?

A: Yes, there are penalties for late or non-filing of Form ST-388, including monetary fines and interest charges.

Form Details:

- Released on June 28, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-388 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.