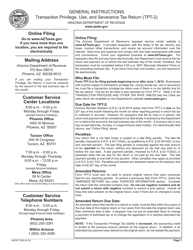

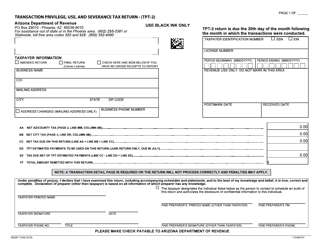

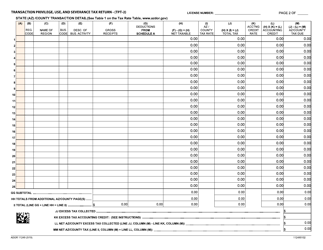

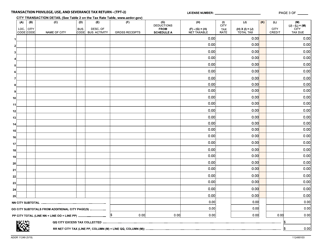

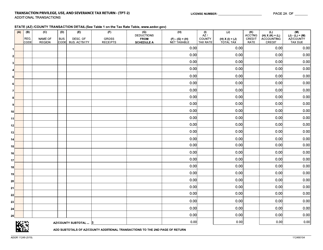

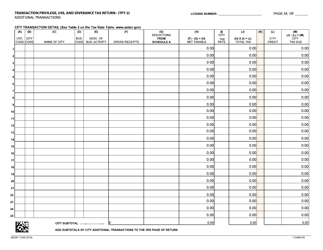

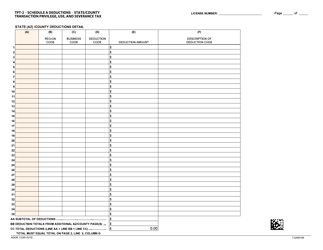

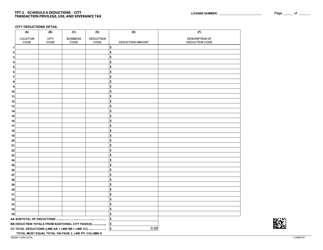

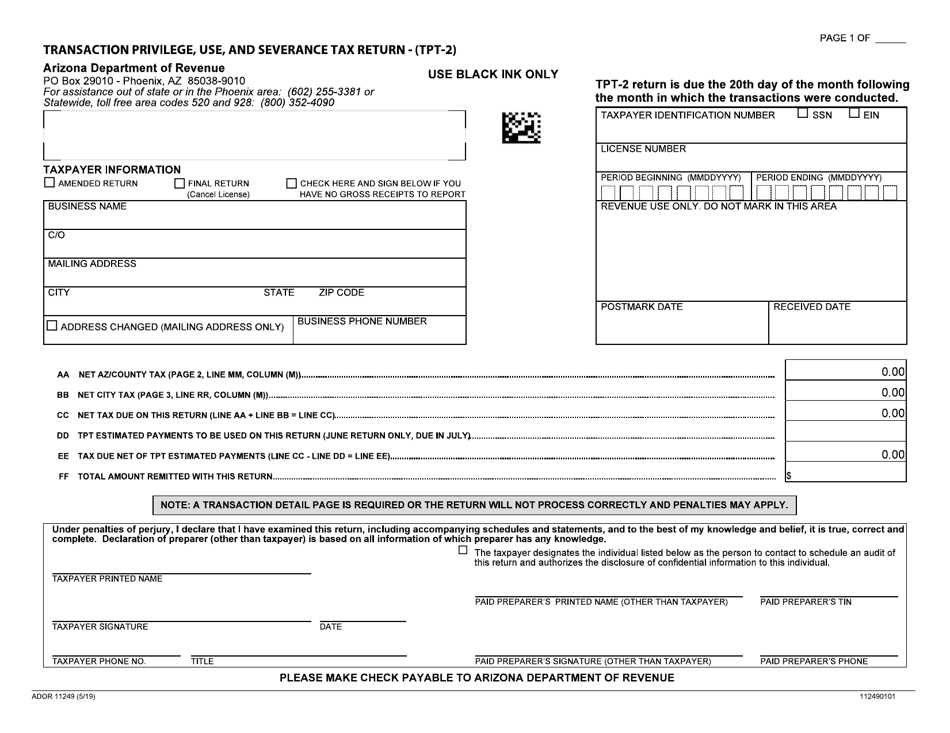

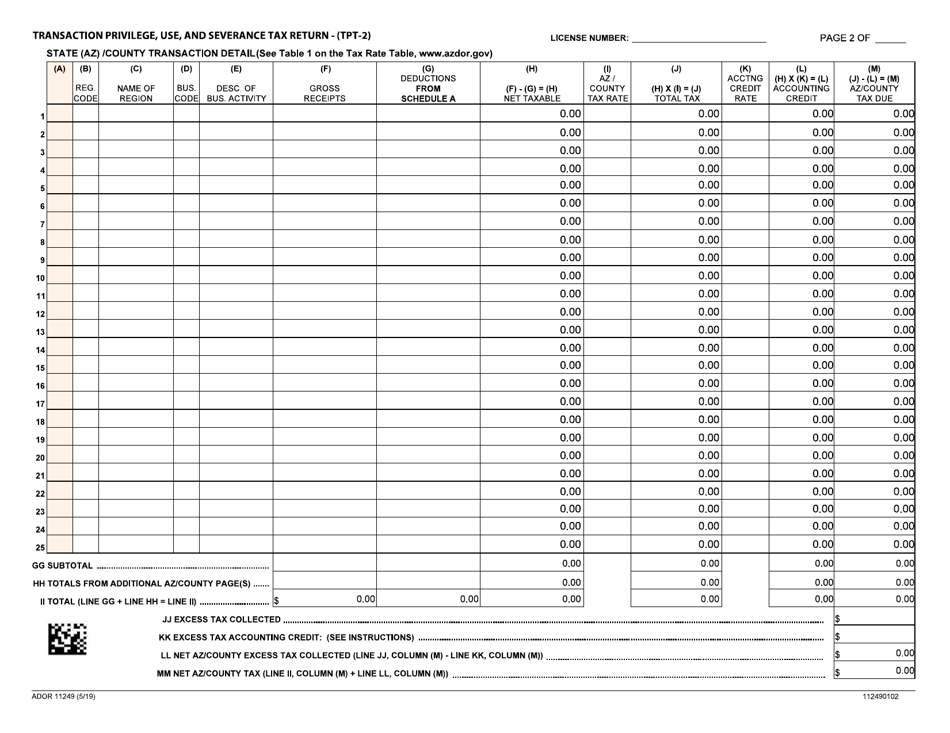

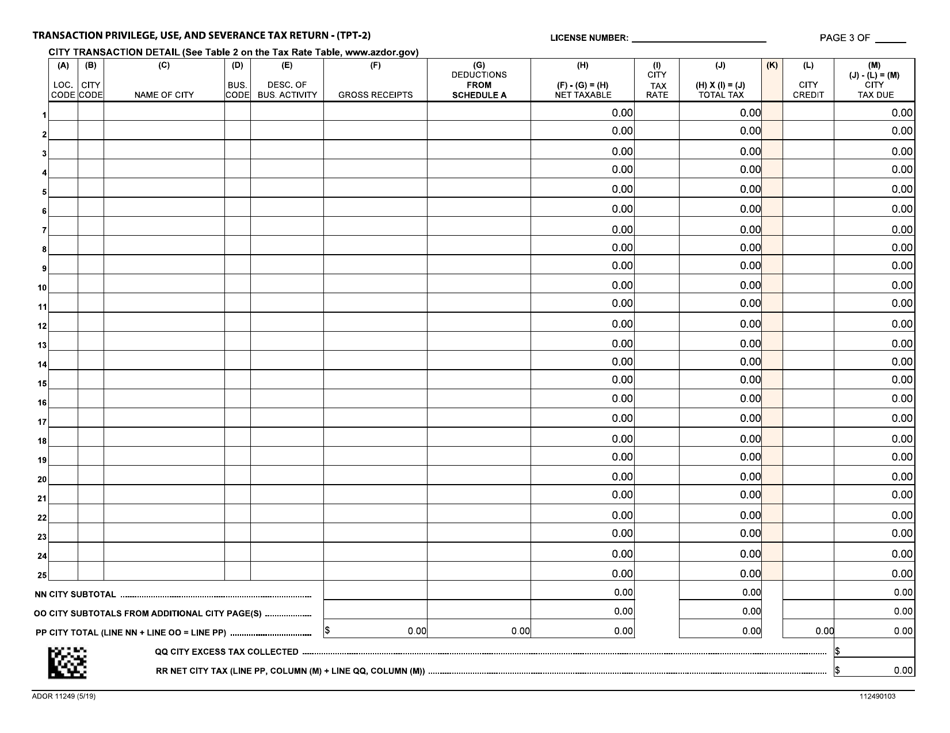

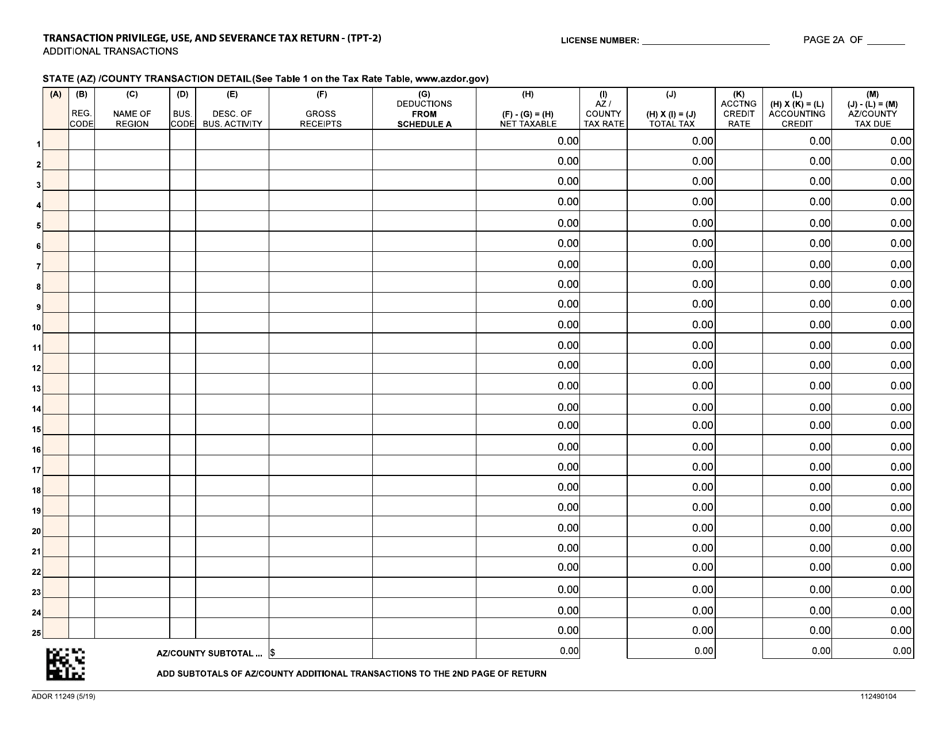

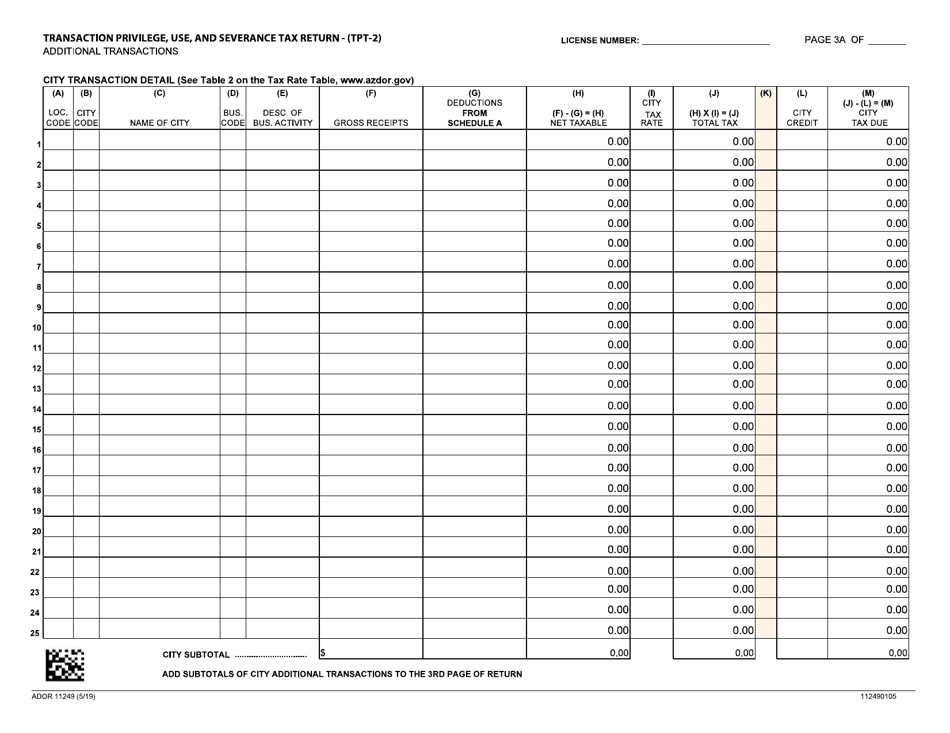

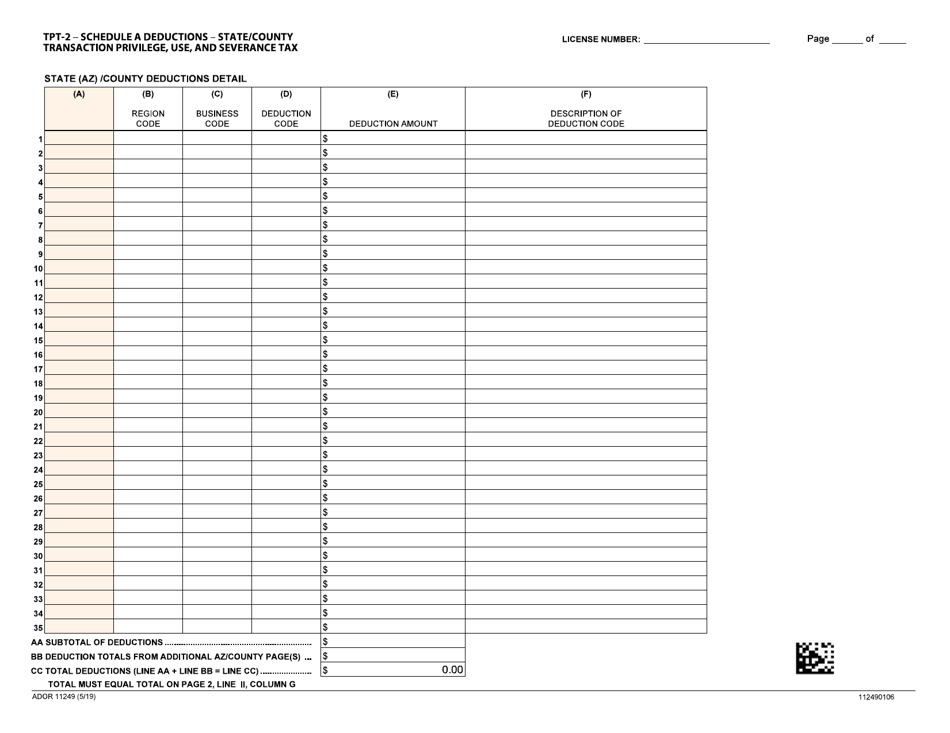

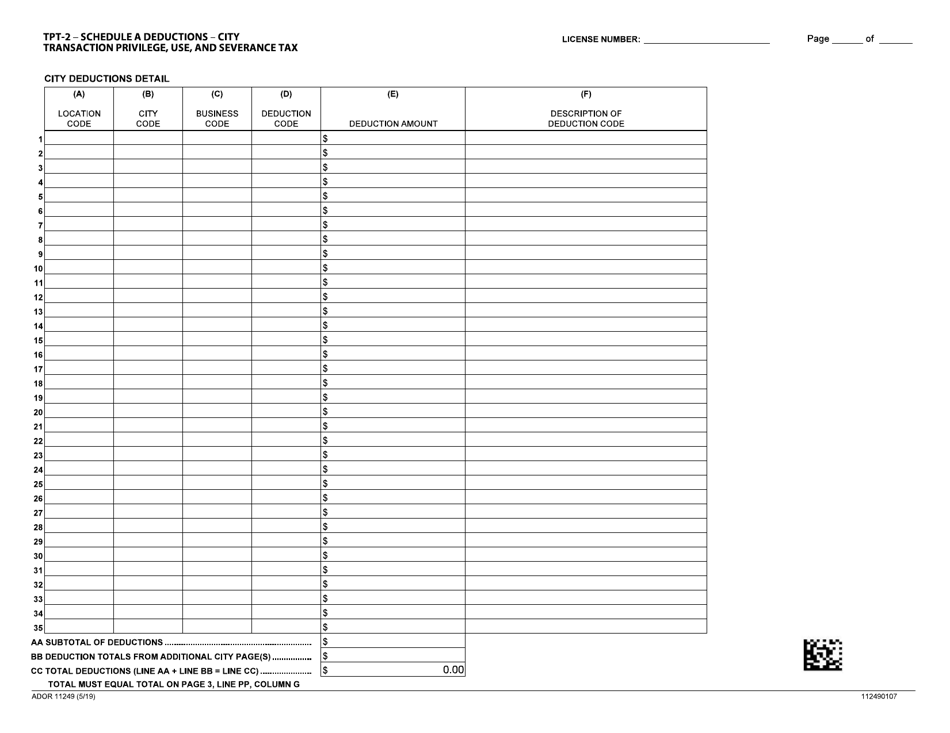

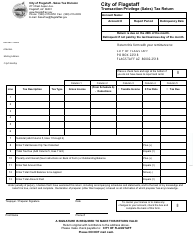

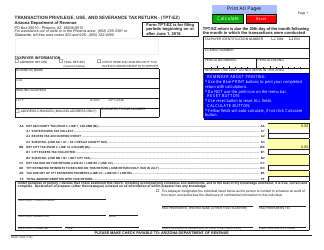

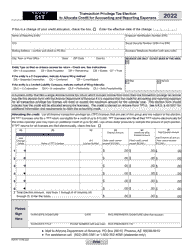

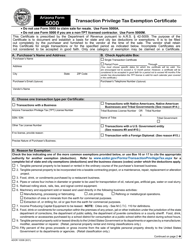

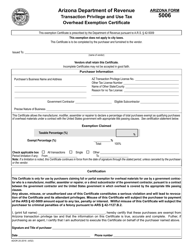

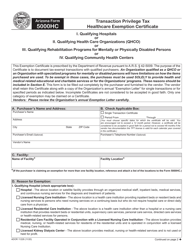

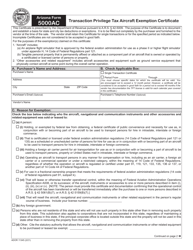

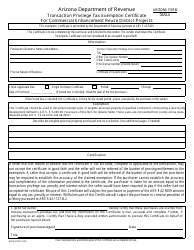

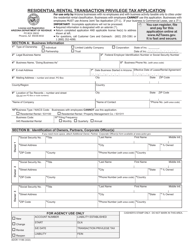

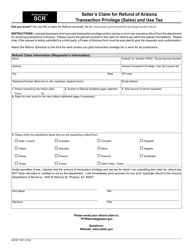

Form TPT-2 (ADOR11249) Transaction Privilege, Use, and Severance Tax Return - Arizona

What Is Form TPT-2 (ADOR11249)?

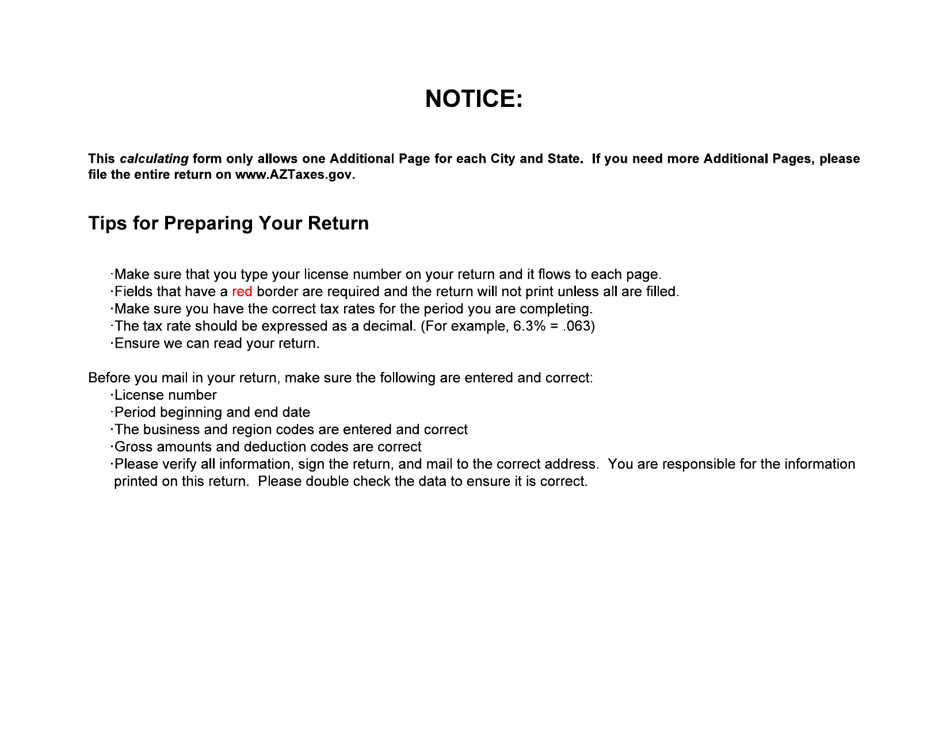

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form TPT-2?

A: Form TPT-2 is a tax return used in Arizona for reporting Transaction Privilege, Use, and Severance taxes.

Q: What taxes are reported on Form TPT-2?

A: Transaction Privilege, Use, and Severance taxes are reported on Form TPT-2.

Q: Who needs to file Form TPT-2?

A: Businesses engaged in certain taxable activities in Arizona need to file Form TPT-2.

Q: How often is Form TPT-2 filed?

A: Form TPT-2 is generally filed on a monthly or quarterly basis, depending on the amount of tax liability.

Q: What should I do if I made a mistake on my Form TPT-2?

A: If you made a mistake on your Form TPT-2, you should file an amended return as soon as possible to correct the error.

Q: Are there any penalties for not filing Form TPT-2?

A: Yes, there are penalties for not filing Form TPT-2, including late filing penalties and interest on unpaid taxes.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TPT-2 (ADOR11249) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.