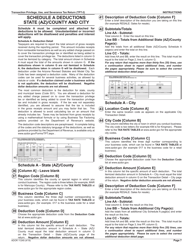

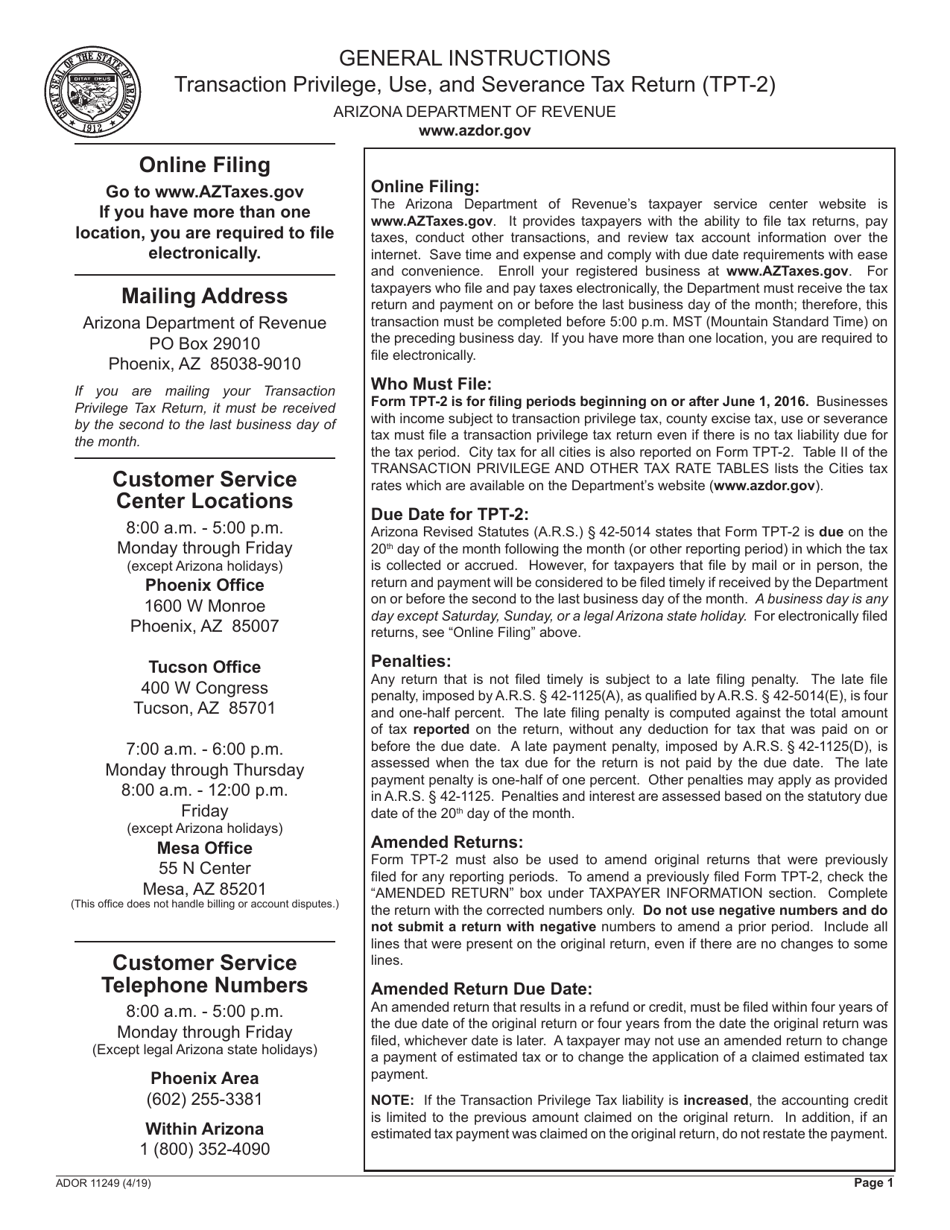

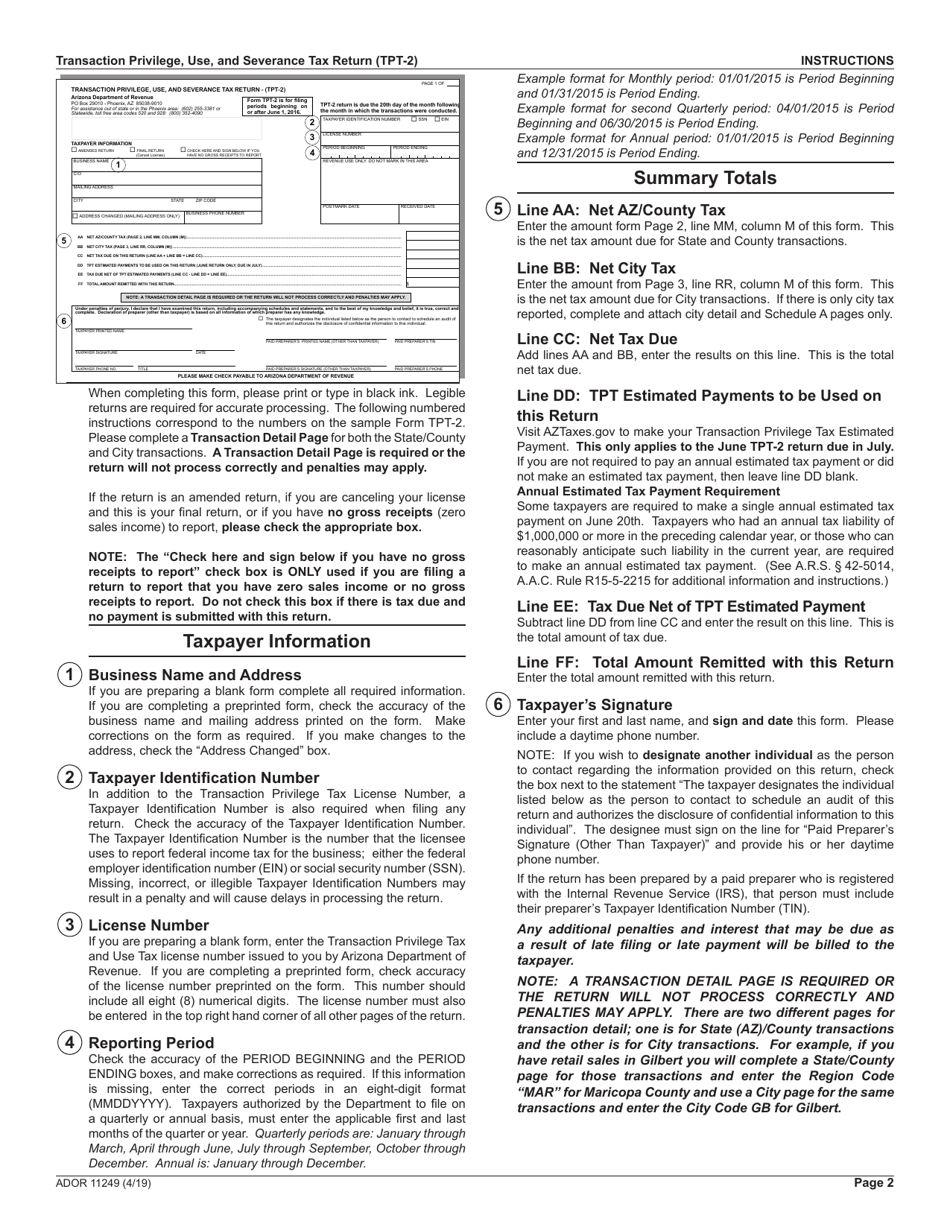

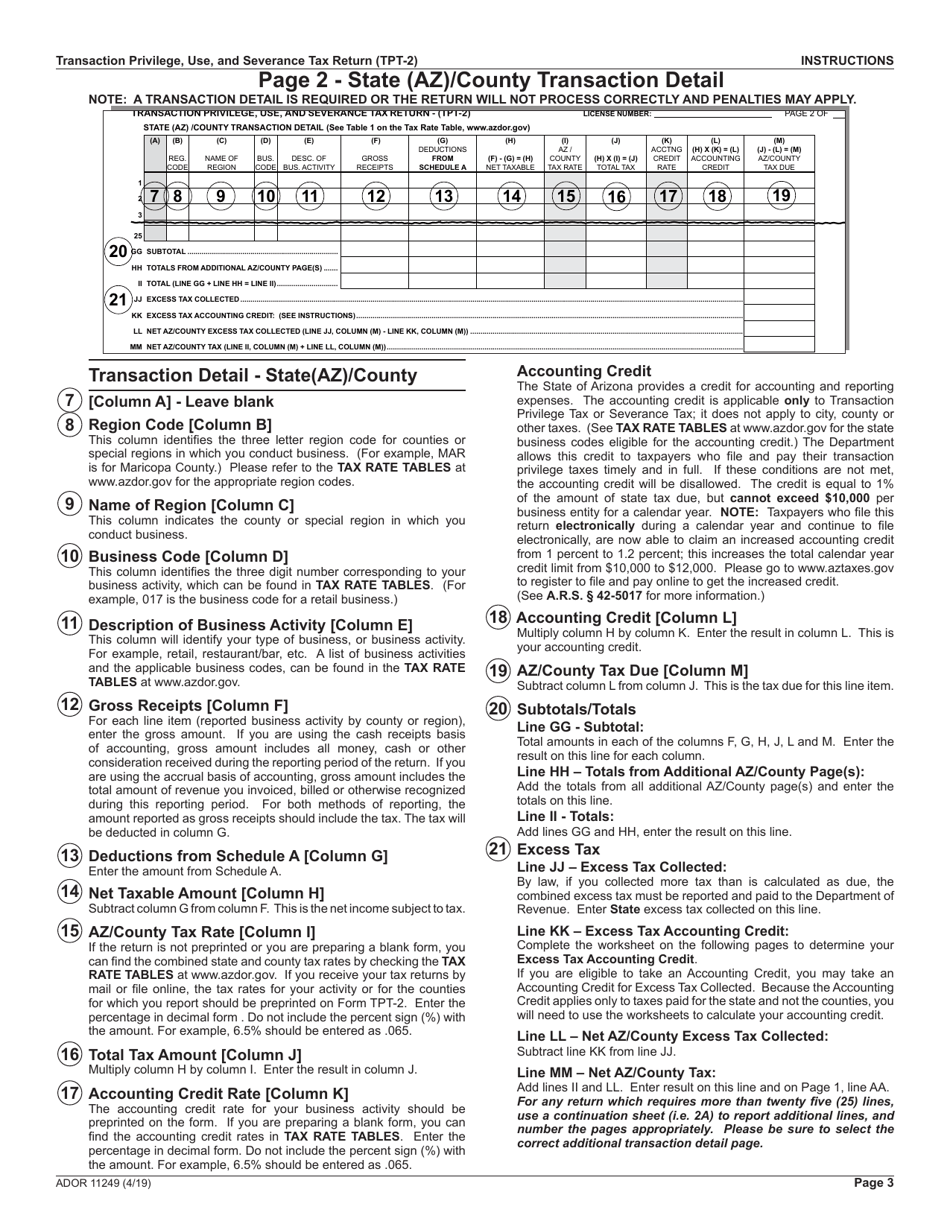

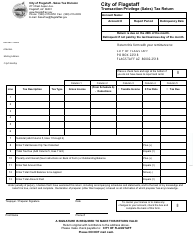

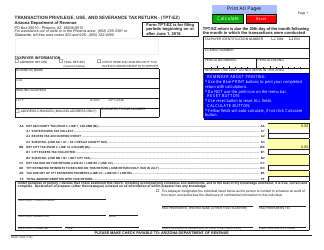

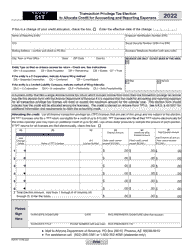

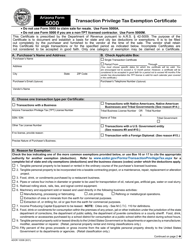

Instructions for Form TPT-2, ADOR11249 Transaction Privilege, Use, and Severance Tax Return - Arizona

This document contains official instructions for Form TPT-2 , and Form ADOR11249 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Form TPT-2 (ADOR11249) is available for download through this link.

FAQ

Q: What is Form TPT-2?

A: Form TPT-2 is the Transaction Privilege, Use, and Severance Tax Return for the state of Arizona.

Q: When should I file Form TPT-2?

A: Form TPT-2 should be filed on a monthly, quarterly, or annual basis depending on your reporting frequency.

Q: What taxes does Form TPT-2 cover?

A: Form TPT-2 covers transaction privilege tax, use tax, and severance tax.

Q: Who needs to file Form TPT-2?

A: Businesses engaged in taxable activities in Arizona are required to file Form TPT-2.

Q: What information do I need to complete Form TPT-2?

A: You will need information about your gross income, deductions, and tax liability for the reporting period.

Q: What happens if I don't file Form TPT-2?

A: Failure to file Form TPT-2 or pay the taxes owed may result in penalties and interest.

Q: Is there a deadline for filing Form TPT-2?

A: Yes, the filing deadline for Form TPT-2 depends on your reporting frequency. Check the instructions for specific deadlines.

Q: Can I amend my Form TPT-2?

A: Yes, you can file an amended Form TPT-2 if you need to correct any errors or make changes to your original filing.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.