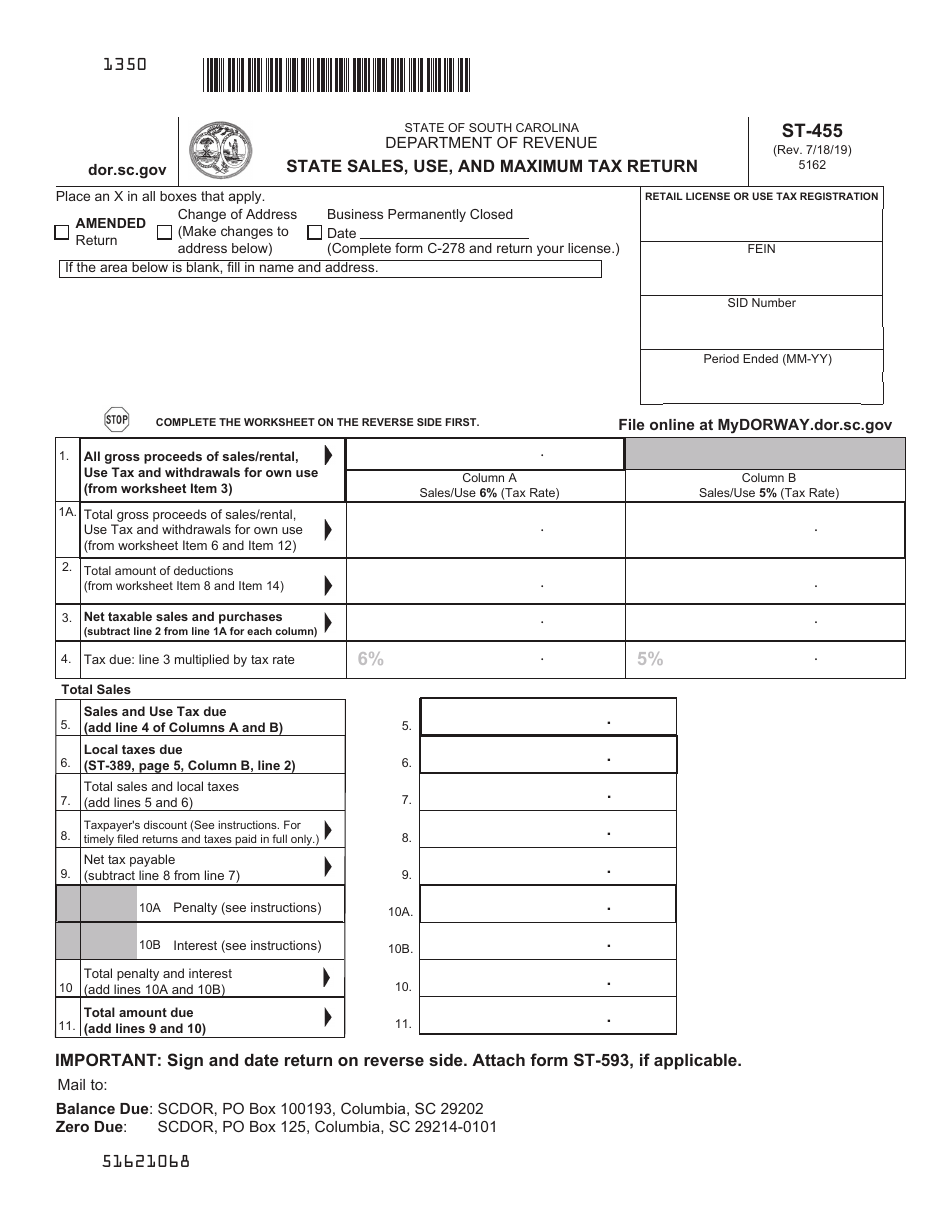

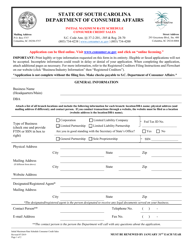

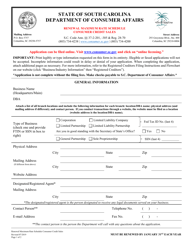

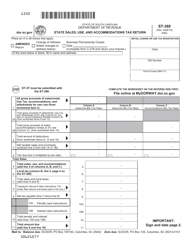

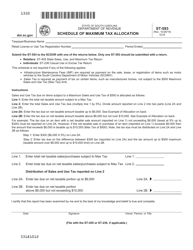

Form ST-455 State Sales, Use, and Maximum Tax Return - South Carolina

What Is Form ST-455?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ST-455?

A: Form ST-455 is the State Sales, Use, and Maximum Tax Return for South Carolina.

Q: Who should file Form ST-455?

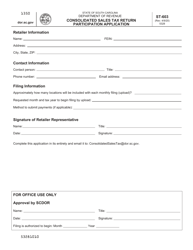

A: Businesses that sell or use taxable items in South Carolina and have a sales and use tax license should file Form ST-455.

Q: What is the purpose of Form ST-455?

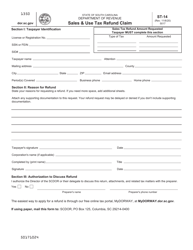

A: Form ST-455 is used to report and remit sales and use tax to the South Carolina Department of Revenue.

Q: How often should Form ST-455 be filed?

A: Form ST-455 is generally filed monthly, but businesses with a small amount of tax liability may qualify for quarterly filing.

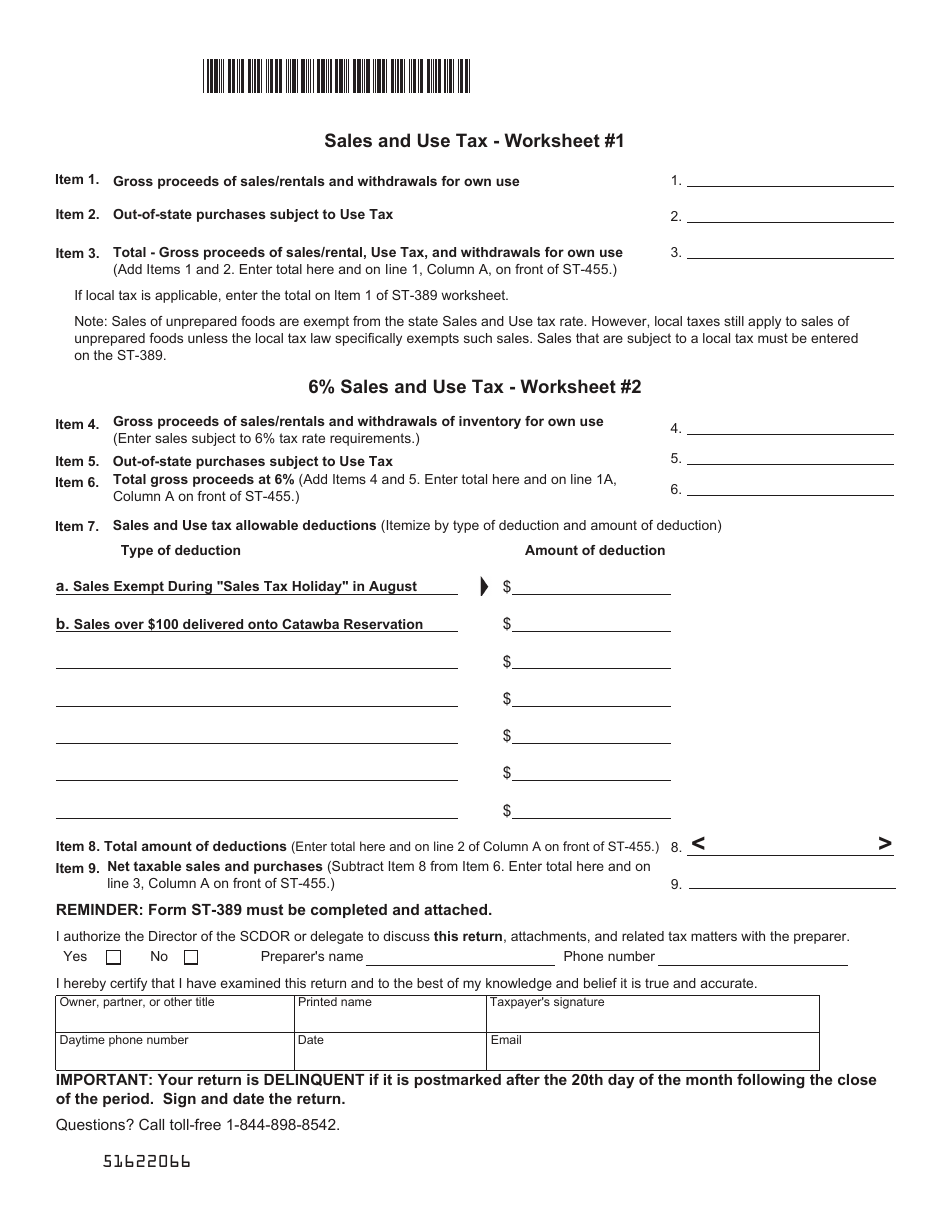

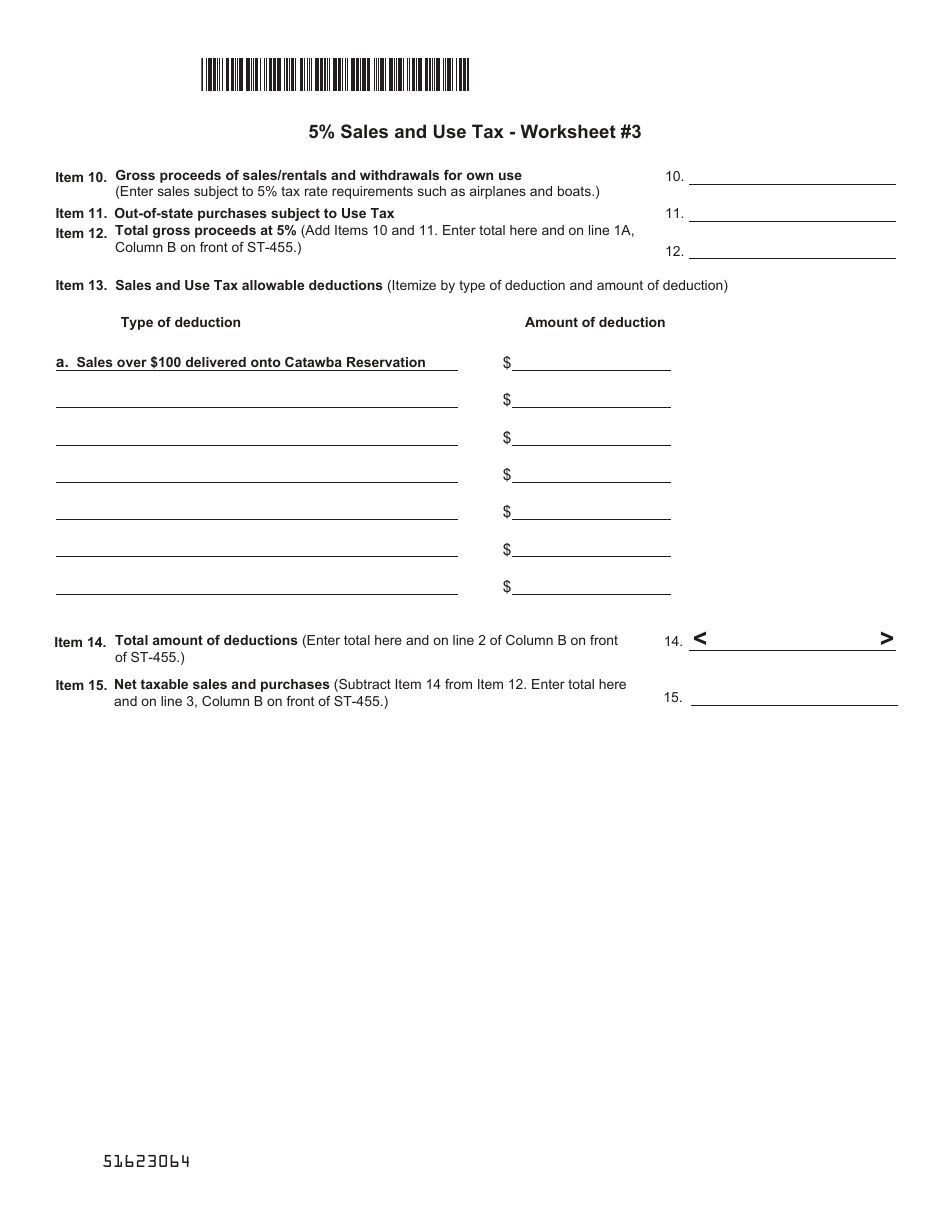

Q: What information is required on Form ST-455?

A: Form ST-455 requires information such as gross sales, deductions, taxable sales, and the amount of tax due.

Q: What are the penalties for not filing Form ST-455?

A: Failure to file Form ST-455 or pay the tax due may result in penalties, interest, and possible legal consequences.

Q: Are there any exemptions or deductions available on Form ST-455?

A: Yes, there are certain exemptions and deductions available on Form ST-455. These include items like groceries, prescription drugs, and manufacturing machinery.

Q: Who can I contact for more information about Form ST-455?

A: For more information about Form ST-455, you can contact the South Carolina Department of Revenue's Taxpayer Services Division.

Form Details:

- Released on July 18, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-455 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.