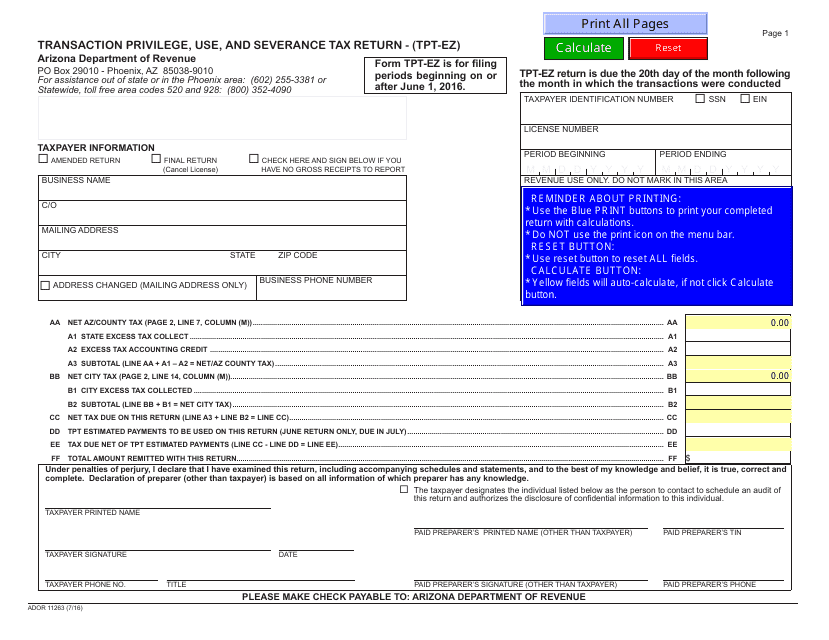

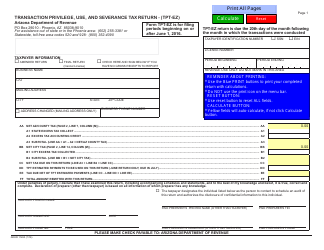

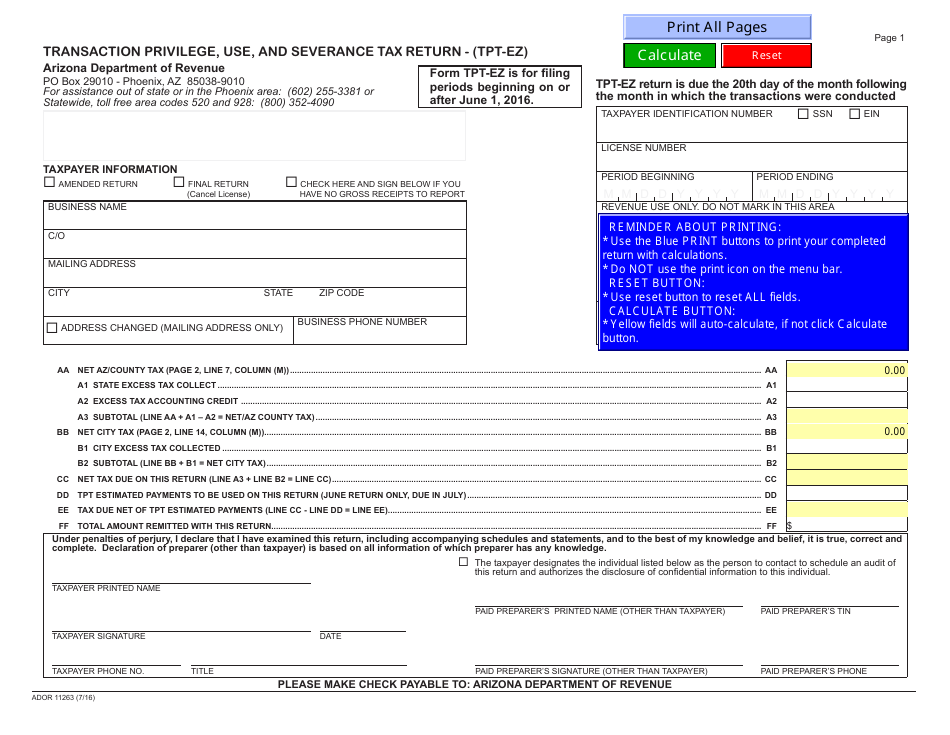

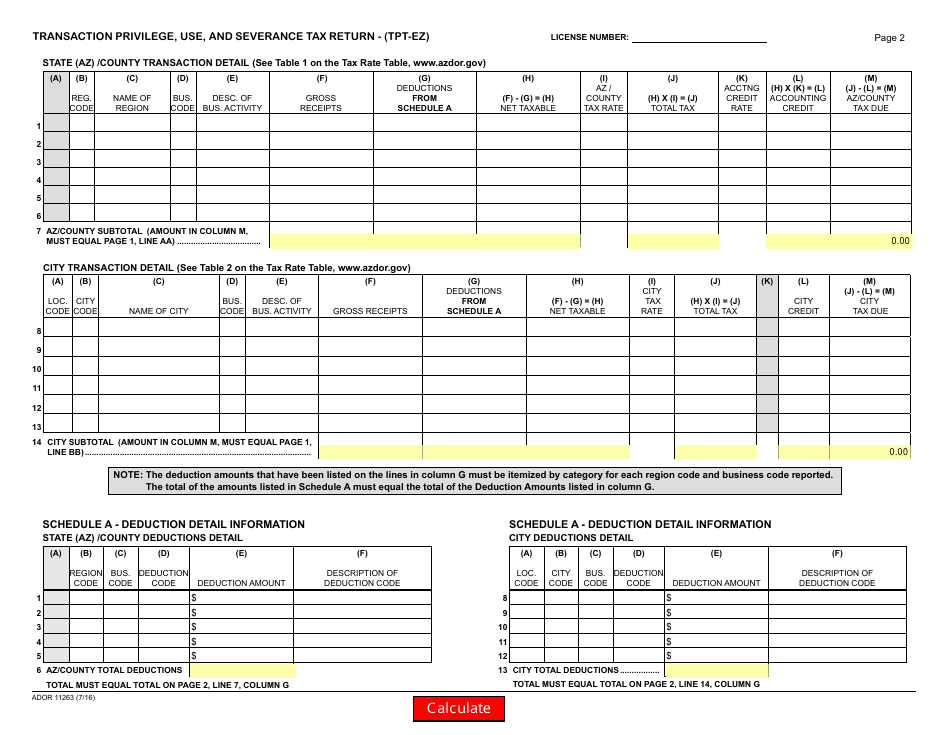

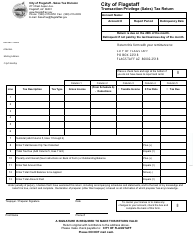

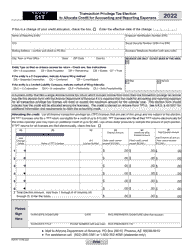

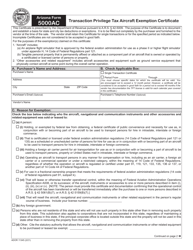

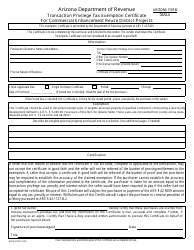

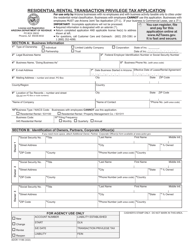

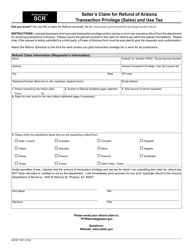

Form ADOR11263 Transaction Privilege, Use, and Severance Tax Return - (Tpt-Ez) - Arizona

What Is Form ADOR11263?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ADOR11263?

A: Form ADOR11263 is the Transaction Privilege, Use, and Severance Tax Return, also known as Tpt-Ez, in Arizona.

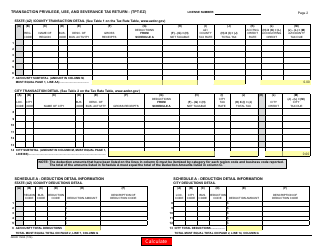

Q: What taxes does Form ADOR11263 cover?

A: Form ADOR11263 covers transaction privilege tax, use tax, and severance tax.

Q: Who needs to file Form ADOR11263?

A: Businesses in Arizona that are engaged in taxable activities, such as selling goods or services, need to file Form ADOR11263.

Q: What is transaction privilege tax?

A: Transaction privilege tax is a tax on the privilege of doing business in Arizona.

Q: What is use tax?

A: Use tax is a tax on the use or consumption of taxable goods or services in Arizona when the transaction privilege tax has not been paid.

Q: What is severance tax?

A: Severance tax is a tax on the extraction of natural resources, such as minerals or gas, in Arizona.

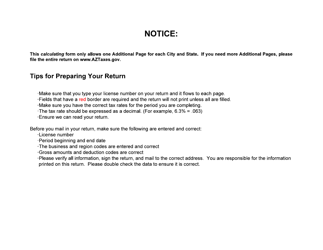

Q: Is Form ADOR11263 easy to fill out?

A: Form ADOR11263, also known as Tpt-Ez, is designed to be a simplified version of the tax return. However, it is always recommended to seek professional assistance or consult the instructions provided by the Arizona Department of Revenue to ensure accurate completion.

Q: When is Form ADOR11263 due?

A: Form ADOR11263 is generally due on the 20th day of the month following the reporting period. However, it is important to check the specific due dates for each reporting period.

Q: Are there any penalties for not filing Form ADOR11263?

A: Yes, there can be penalties for not filing or late filing of Form ADOR11263. It is important to comply with the filing requirements to avoid these penalties.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR11263 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.