This version of the form is not currently in use and is provided for reference only. Download this version of

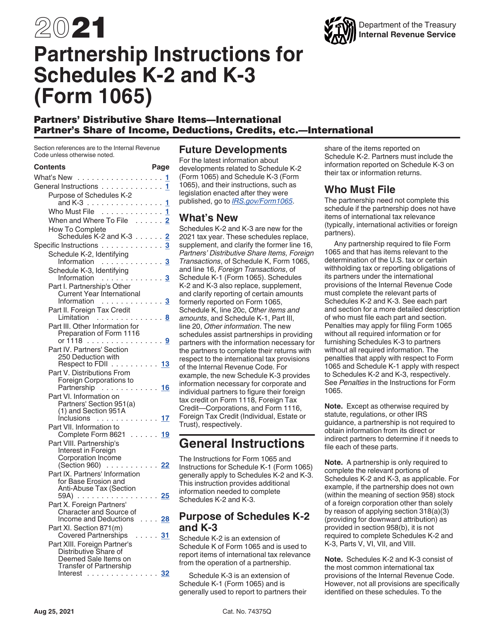

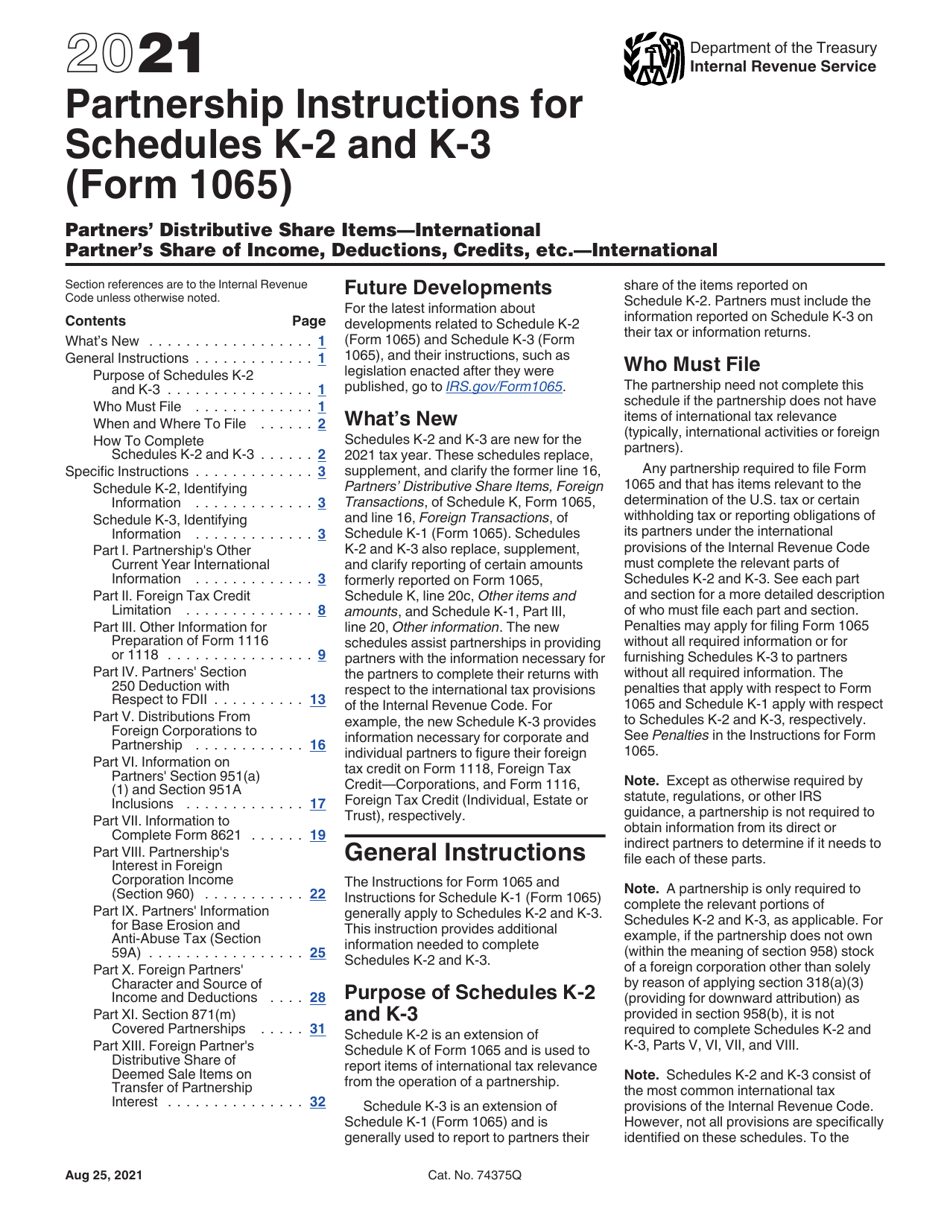

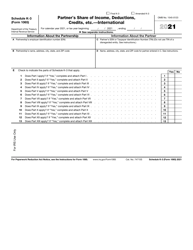

Instructions for IRS Form 1065 Schedule K-2, K-3

for the current year.

Instructions for IRS Form 1065 Schedule K-2, K-3

This document contains official instructions for IRS Form 1065 Schedule K-2 and Schedule K-3 . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1065 Schedule K-2?

A: IRS Form 1065 Schedule K-2 is a supplemental schedule for reporting a partner's distributive share of income, deductions, credits, etc., on a partnership tax return.

Q: What is IRS Form 1065 Schedule K-3?

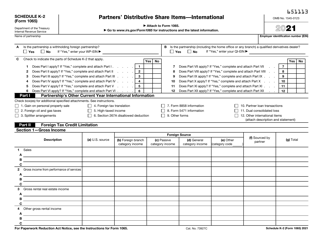

A: IRS Form 1065 Schedule K-3 is a supplemental schedule used to report a partner's share of items from foreign operations on a partnership tax return.

Q: Who needs to file IRS Form 1065 Schedule K-2 and K-3?

A: Partnerships that have partners with distributive shares of income, deductions, credits, etc., or partners with shares of items from foreign operations need to file IRS Form 1065 Schedule K-2 and K-3.

Q: What information is required on IRS Form 1065 Schedule K-2 and K-3?

A: IRS Form 1065 Schedule K-2 requires the reporting of each partner's share of income, deductions, credits, etc., while IRS Form 1065 Schedule K-3 requires the reporting of each partner's share of items from foreign operations.

Q: When is the deadline for filing IRS Form 1065 Schedule K-2 and K-3?

A: The deadline for filing IRS Form 1065 Schedule K-2 and K-3 is the same as the deadline for filing the partnership tax return, which is typically March 15th or September 15th depending on the tax year.

Q: Are there any penalties for not filing IRS Form 1065 Schedule K-2 and K-3?

A: Yes, failure to file IRS Form 1065 Schedule K-2 and K-3 or filing it with incomplete or incorrect information may result in penalties imposed by the IRS.

Q: Can IRS Form 1065 Schedule K-2 and K-3 be filed electronically?

A: Yes, IRS Form 1065 Schedule K-2 and K-3 can be filed electronically using the IRS e-file system.

Q: Do I need to submit any supporting documents with IRS Form 1065 Schedule K-2 and K-3?

A: No, you do not need to submit any supporting documents with IRS Form 1065 Schedule K-2 and K-3 when filing, but you should keep them for your records in case of an IRS audit.

Instruction Details:

- This 34-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.