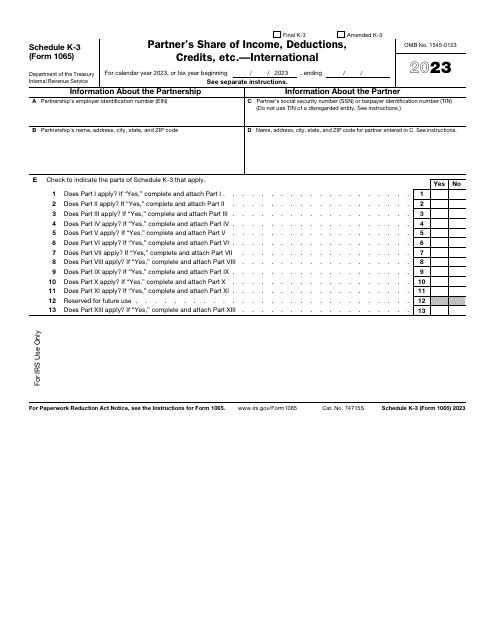

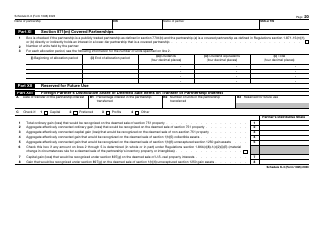

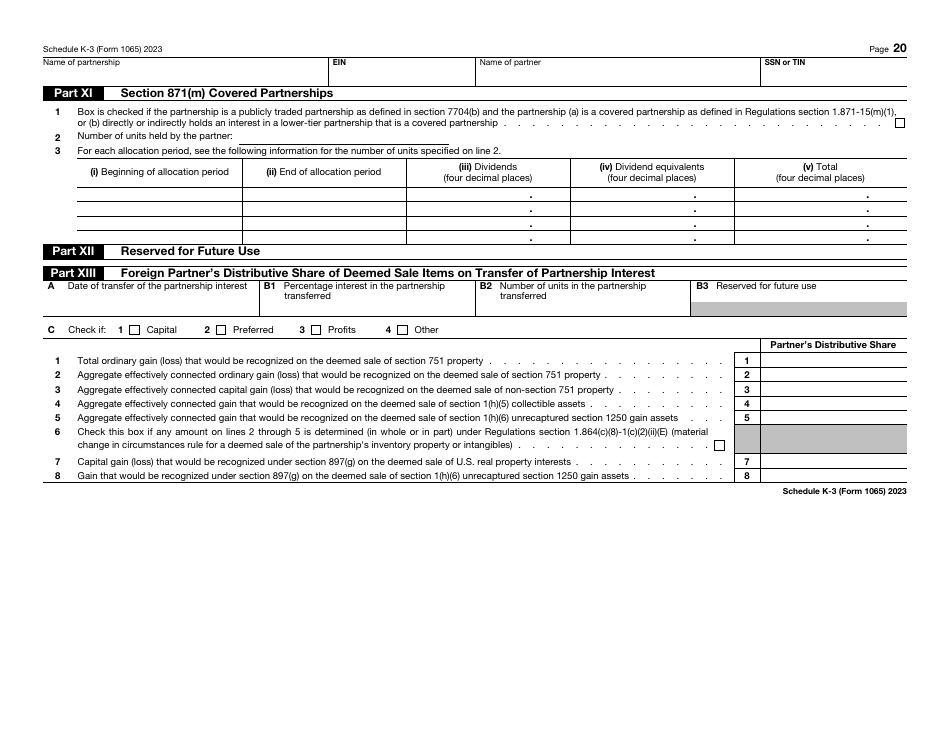

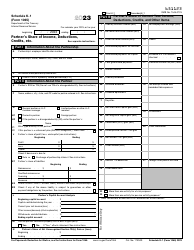

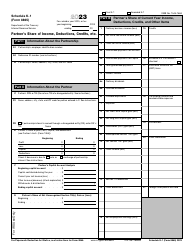

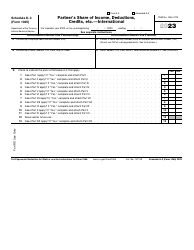

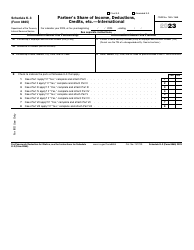

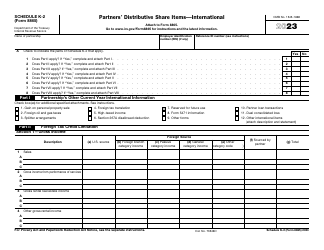

IRS Form 1065 Schedule K-3 Partner's Share of Income, Deductions, Credits, Etc. - International

What Is IRS Form 1065 Schedule K-3?

IRS Form 1065 Schedule K-3, Partner's Share of Income, Deductions, Credits, Etc. - International , is a fiscal document designed to specify the partner's distributive share of various items that have international tax relevance.

Alternate Name:

- K-3 Tax Form.

This instrument is an extension of IRS Form 1065, U.S. Return of Partnership Income, and must be filed by the partnership in case the entity has foreign partners who have to recount their gains or losses from the exchange or sale of partnership interests - attach a copy of this form to the main return and submit it with the authorities by March 15 of the year that follows the calendar year described in Form 1065 Schedule K-3.

This schedule was released by the Internal Revenue Service (IRS) on , rendering older editions of the document obsolete. You may download an IRS Form 1065 Schedule K-3 fillable version below.

Form 1065 Schedule K-3 Instructions

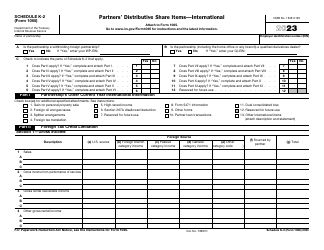

Follow the Form 1065 Schedule K-3 Instructions to outline the foreign business activities of a particular partner during the previous calendar year:

-

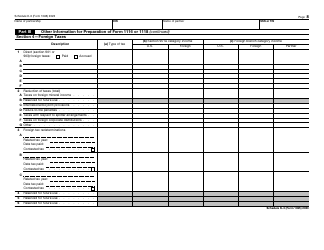

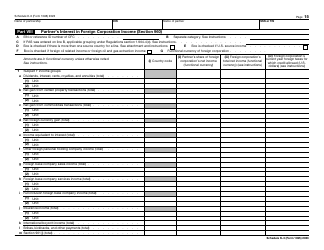

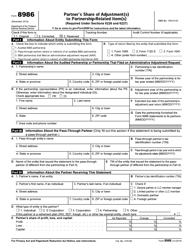

Identify the partnership and the partner - state their names, addresses, and taxpayer identification numbers . Check the rest of the form to figure out what sections apply in your case and tick the boxes to certify which fields of the schedule will be filled out.

-

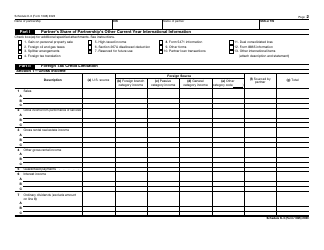

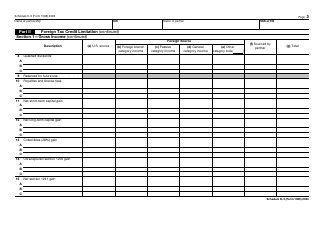

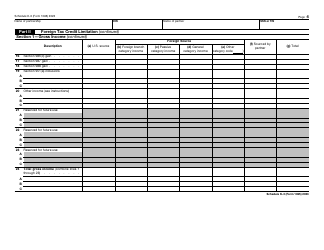

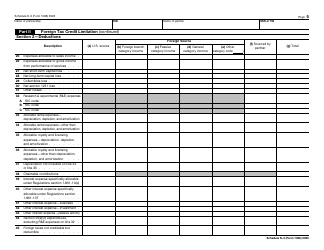

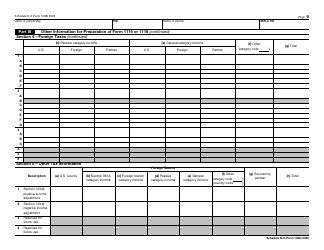

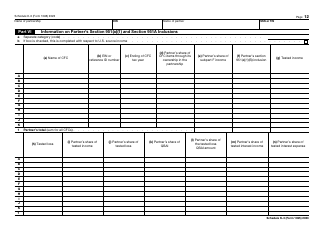

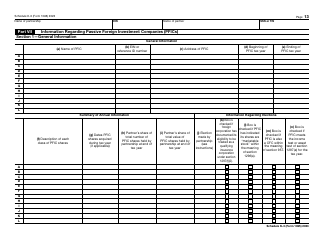

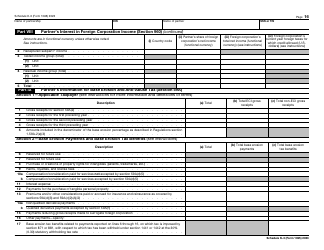

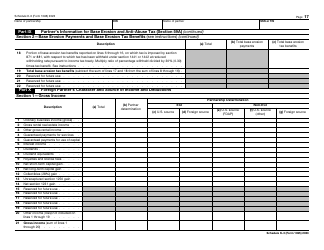

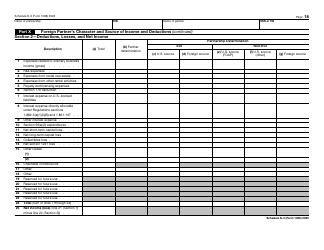

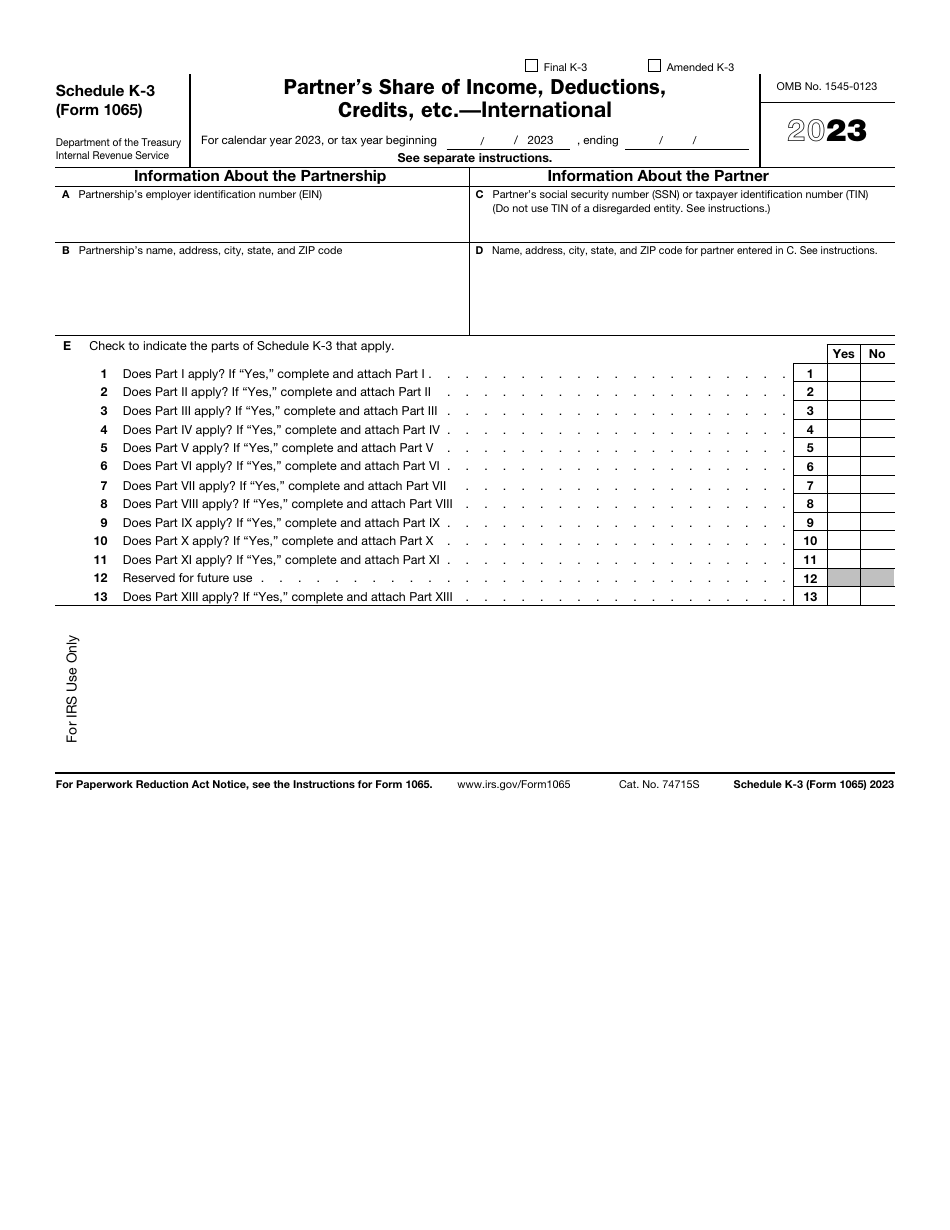

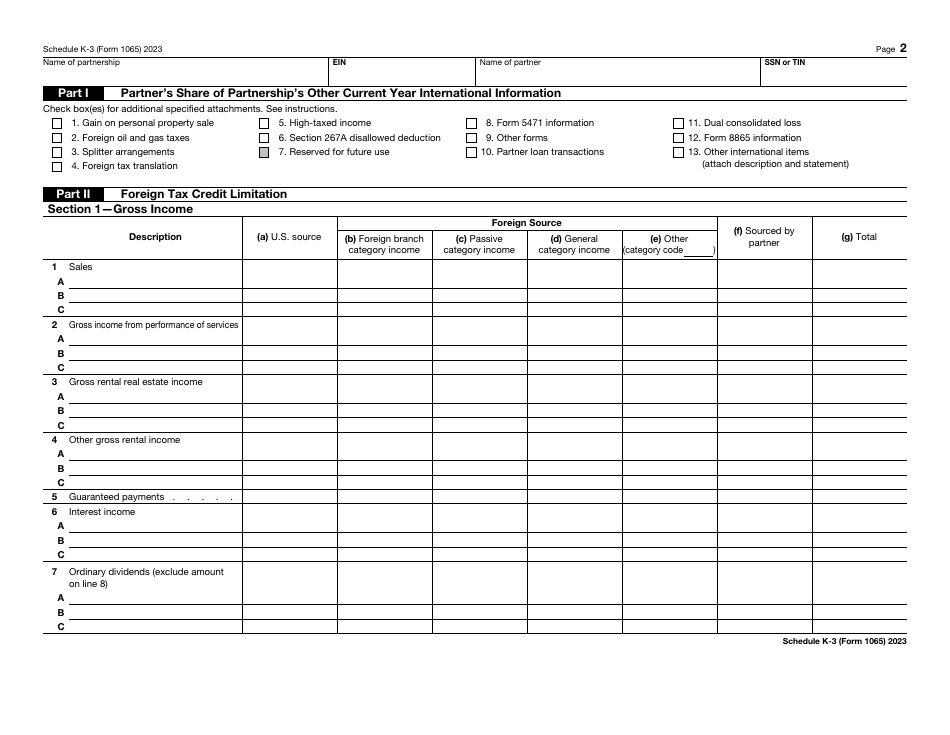

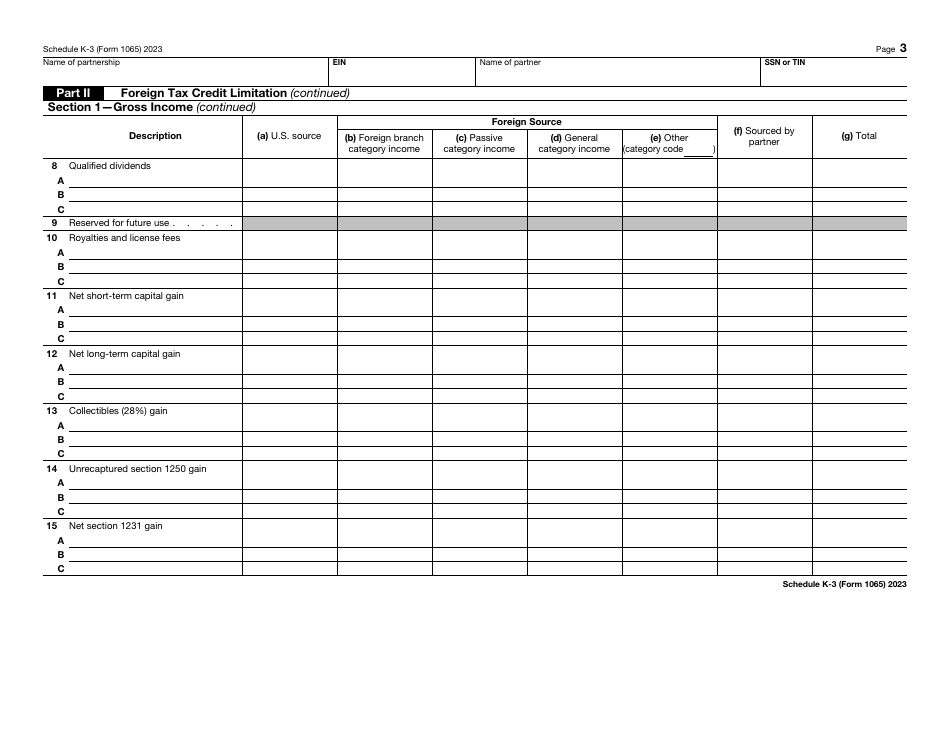

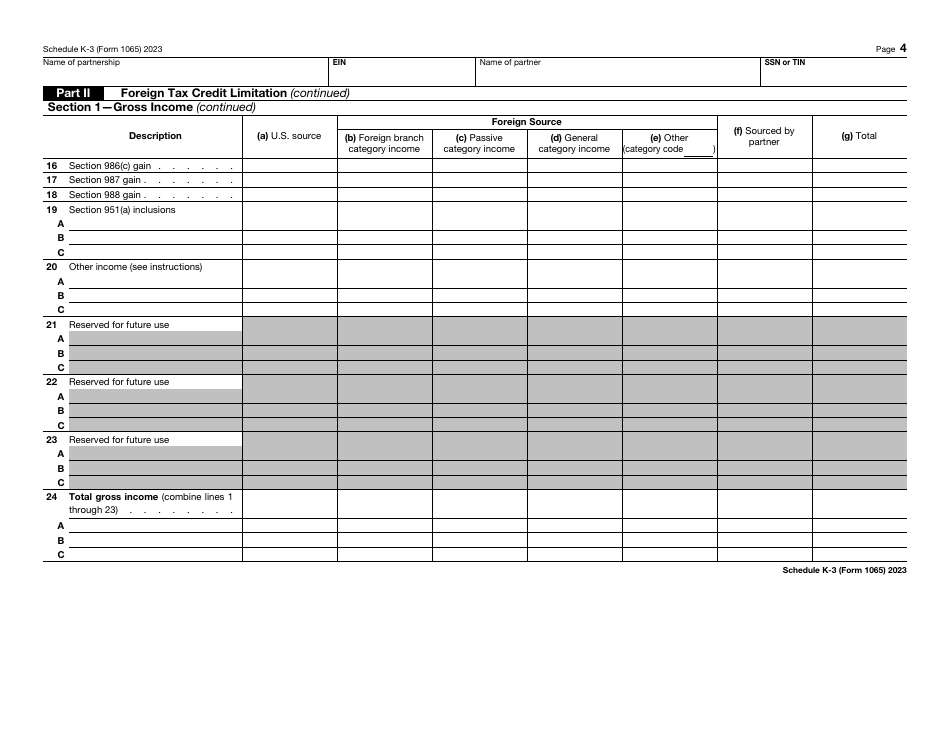

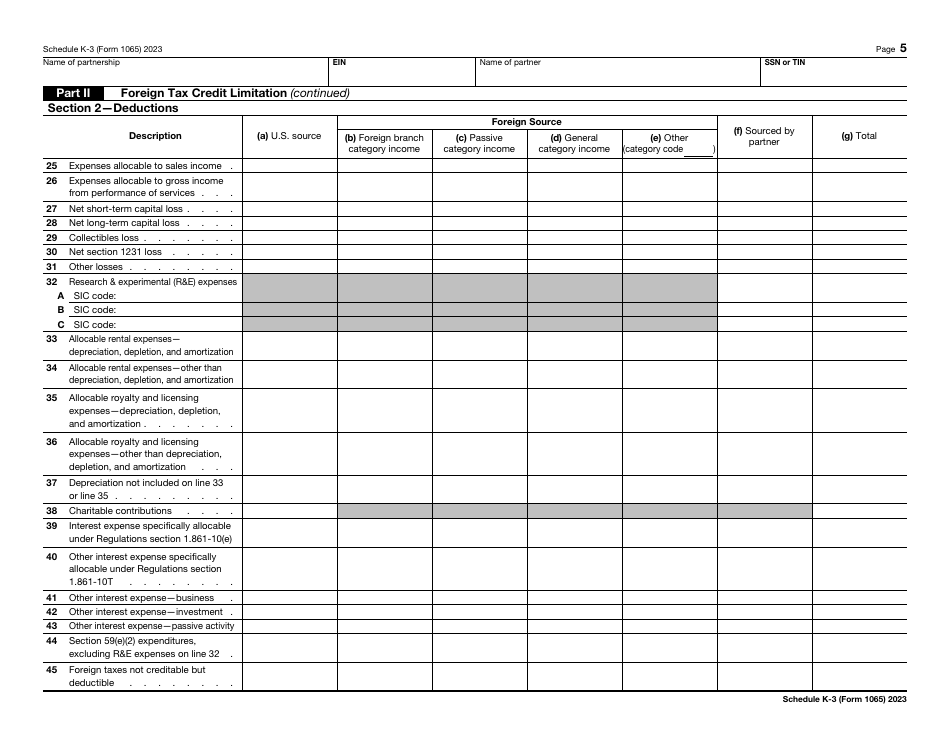

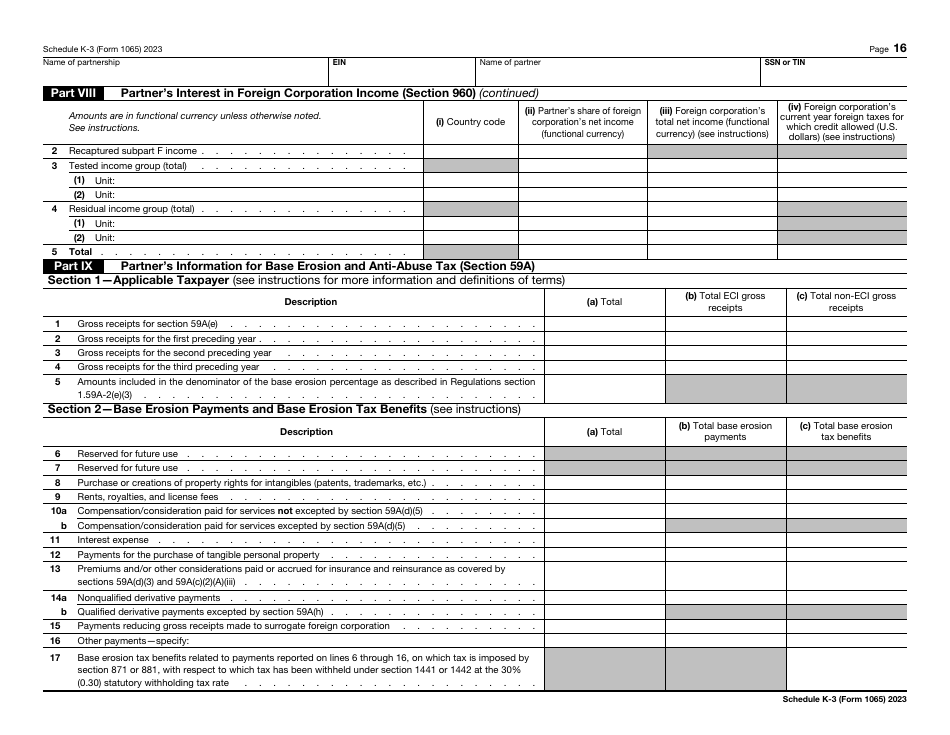

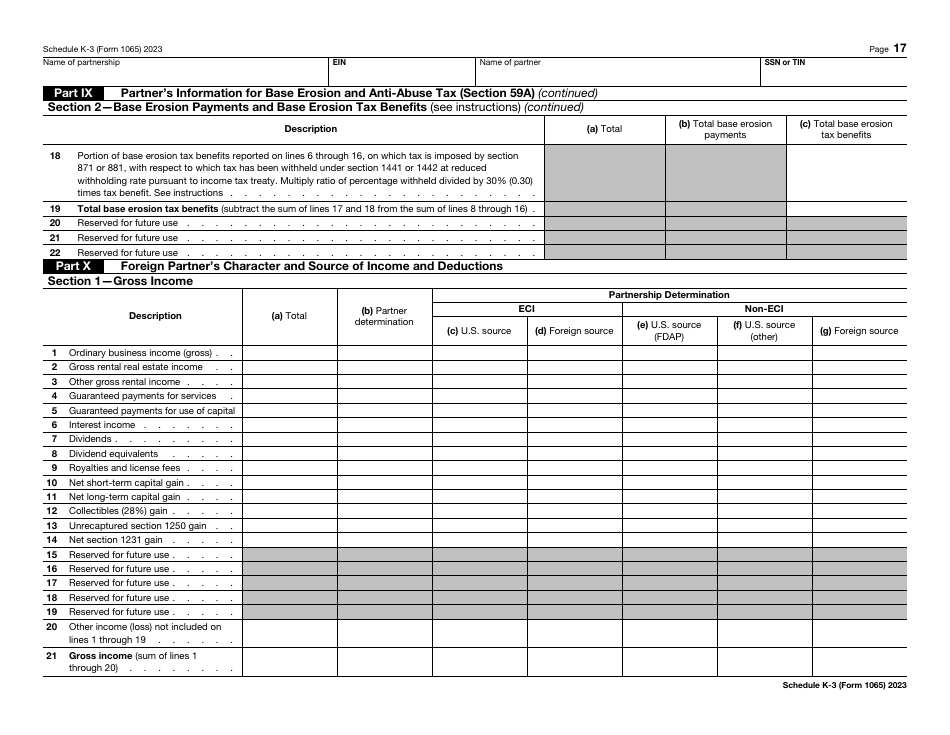

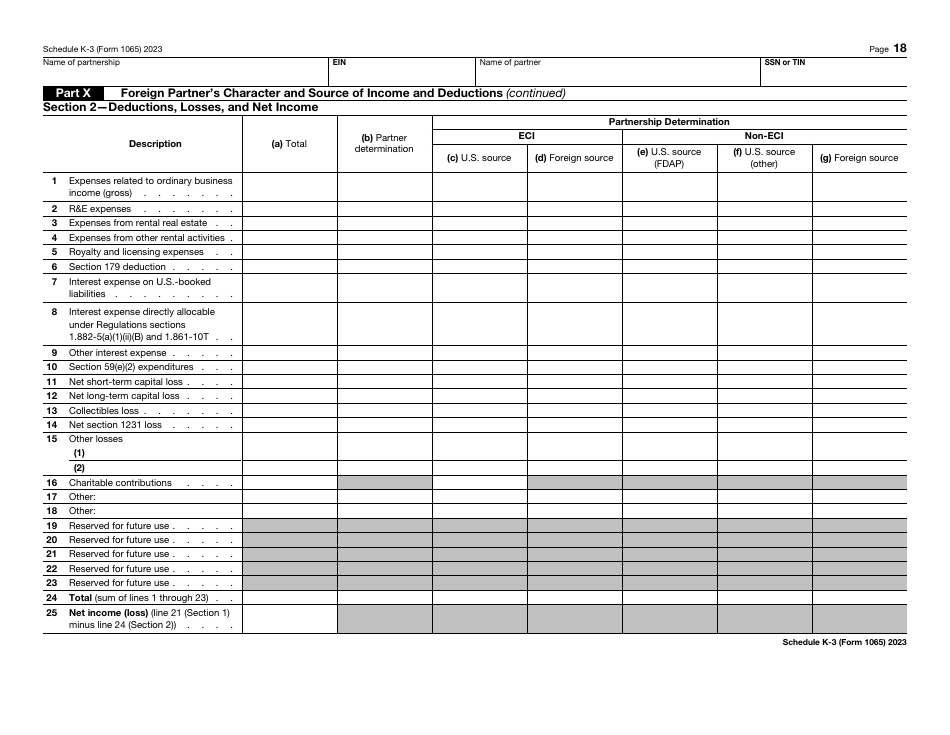

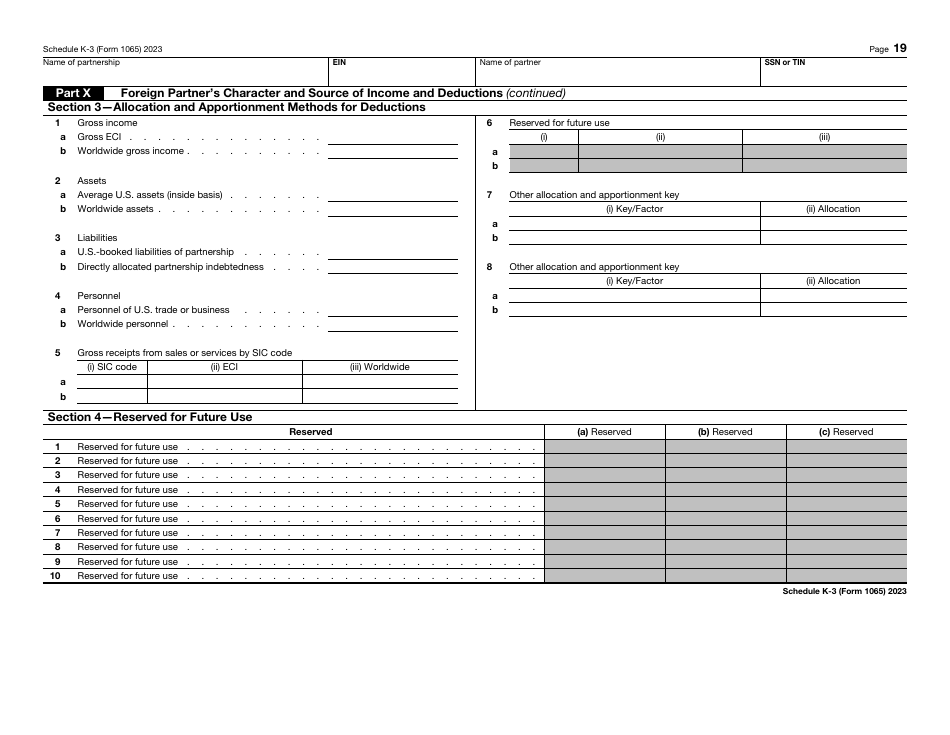

Indicate what international tax items you will outline in the documentation attached to the schedule . Determine your share of income and loss in regard to the partnership - you have to describe the income and deductions and calculate their total amount. The instrument separates different types of income and deductions into numerous categories - only complete the fields that relate to your sources of income and deductions you are entitled to claim.

-

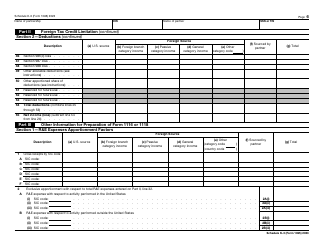

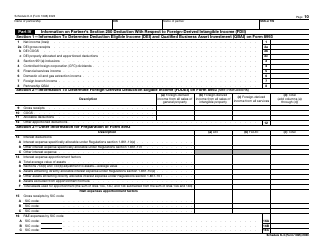

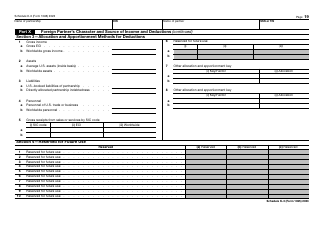

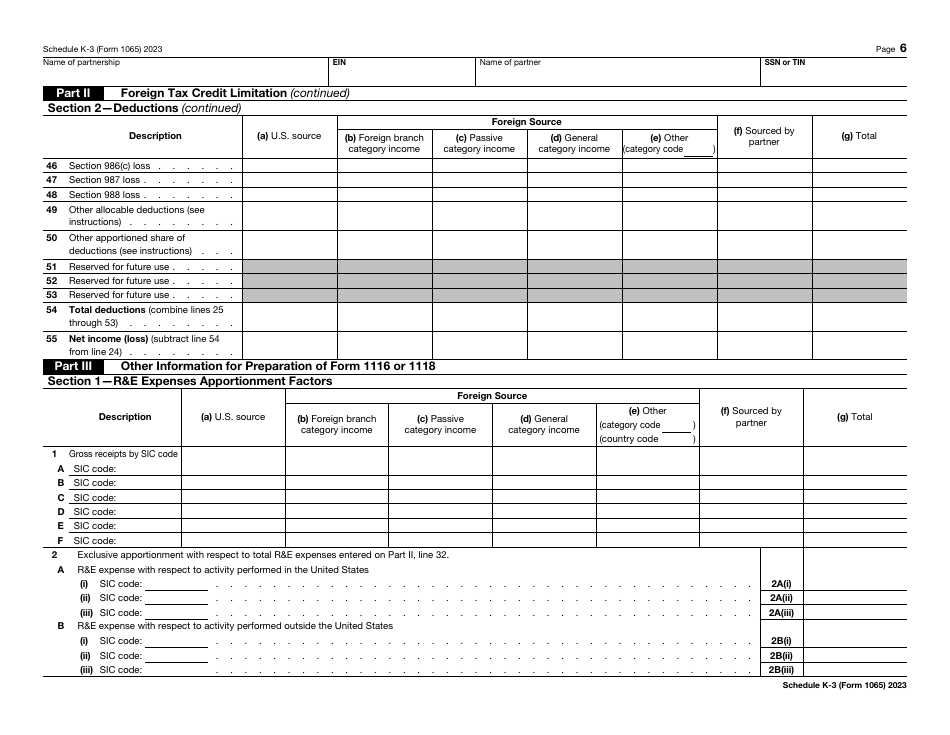

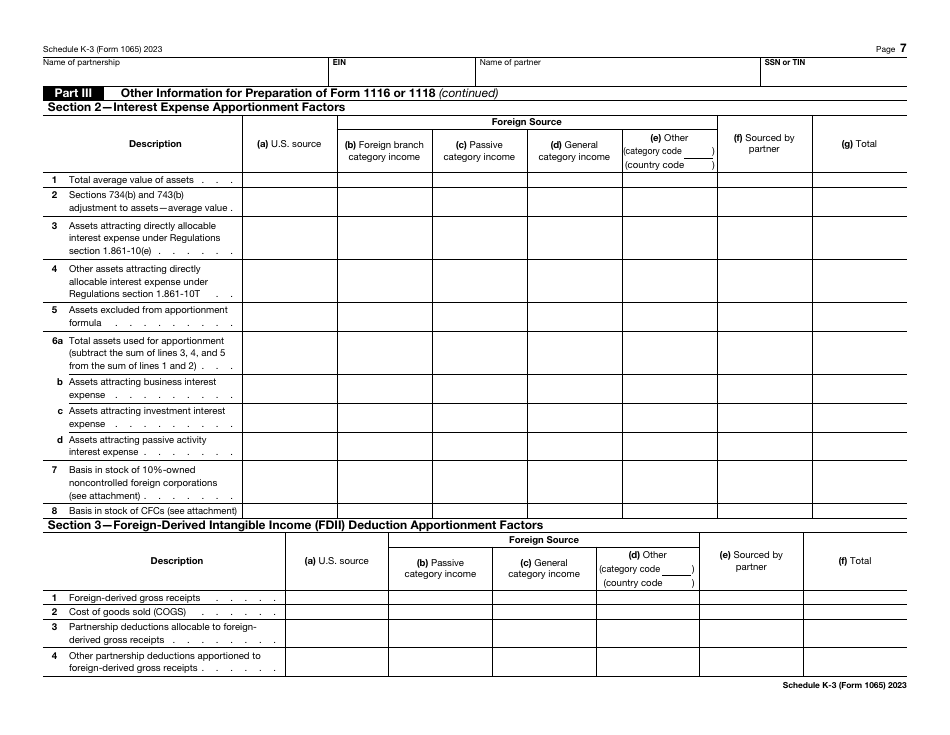

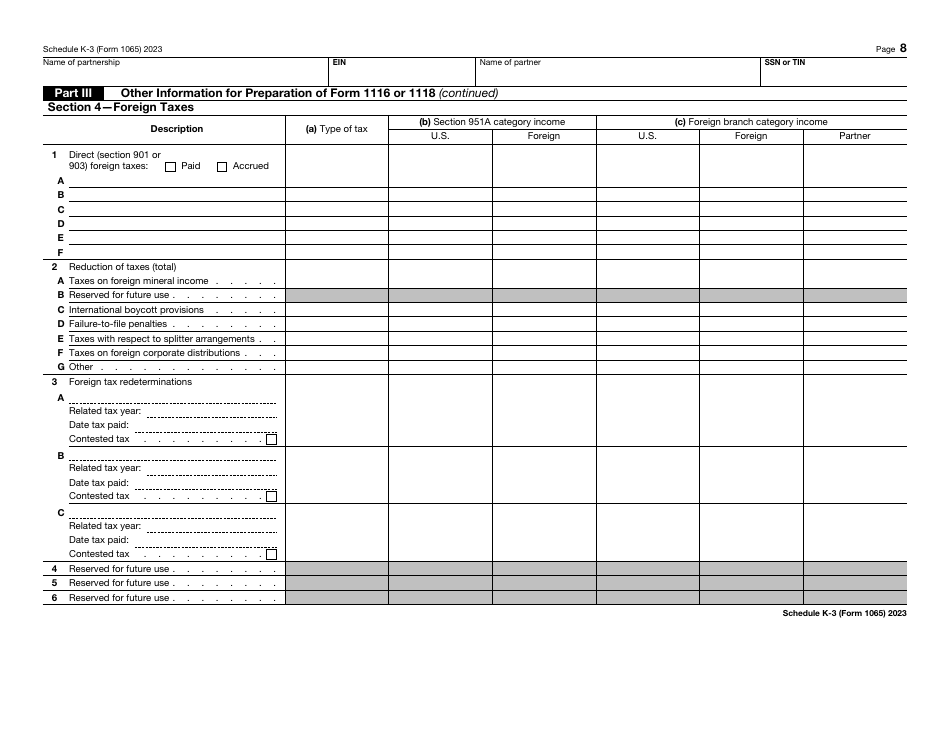

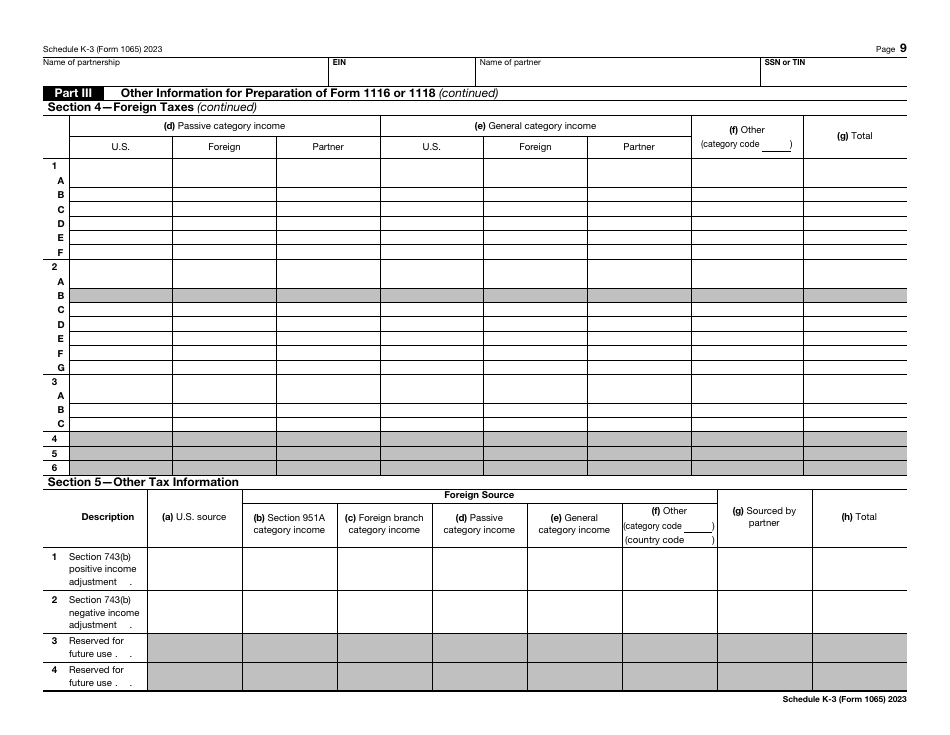

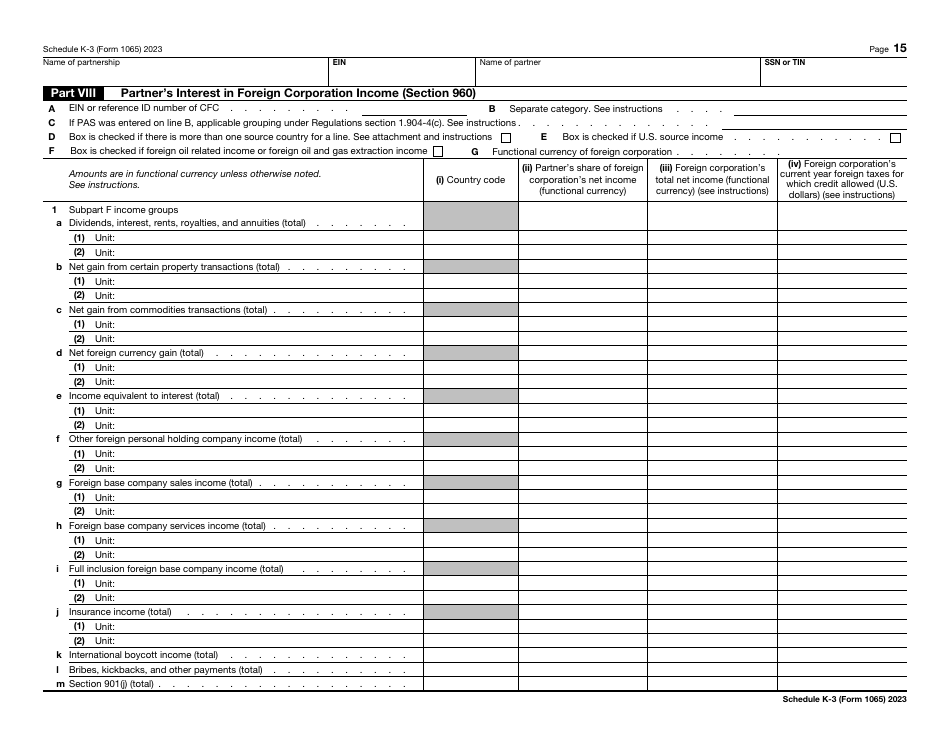

Compute the expenses and deductions that will be allocated to limit the foreign tax credit - you need to find out income adjustments and inform the tax organs about your share of partnership foreign taxes already paid or accumulated.

-

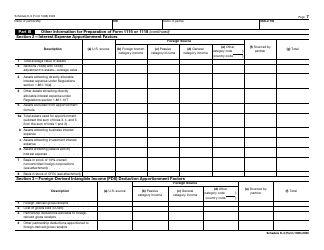

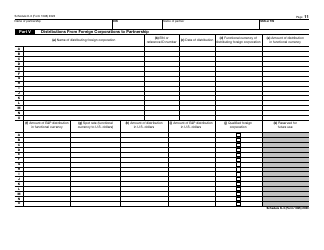

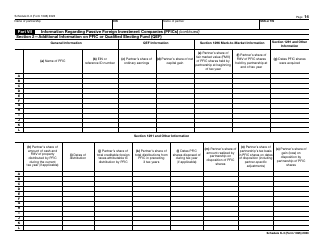

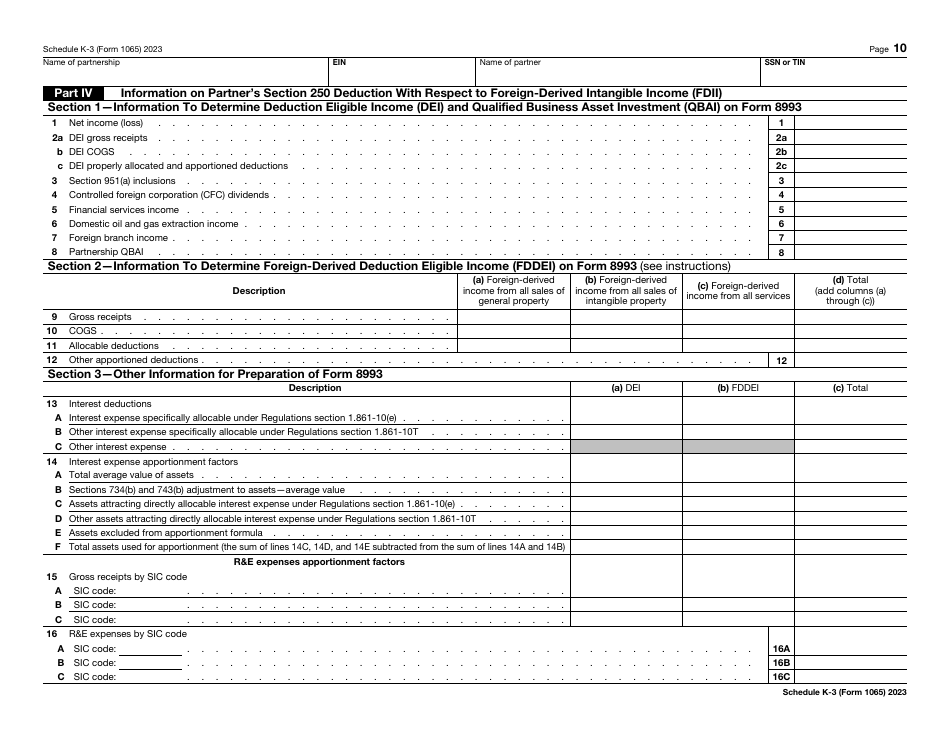

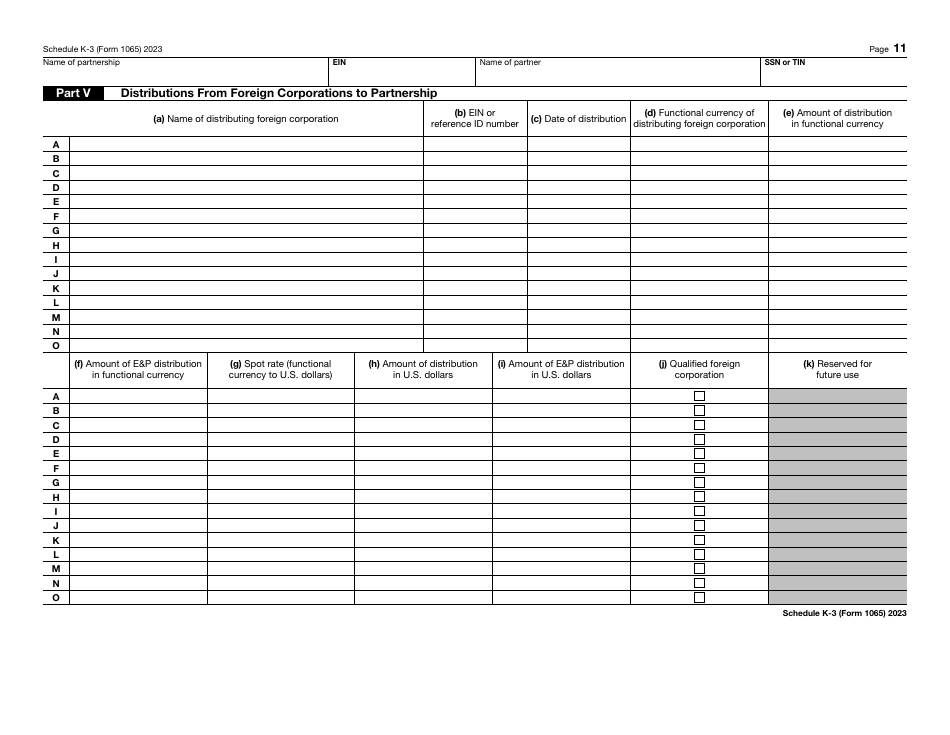

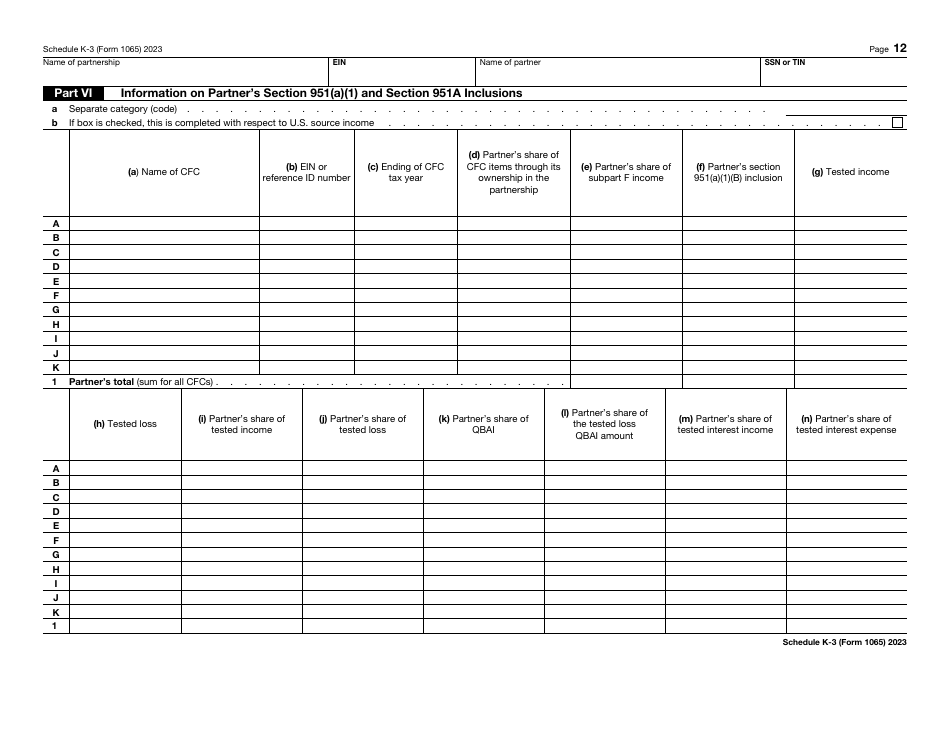

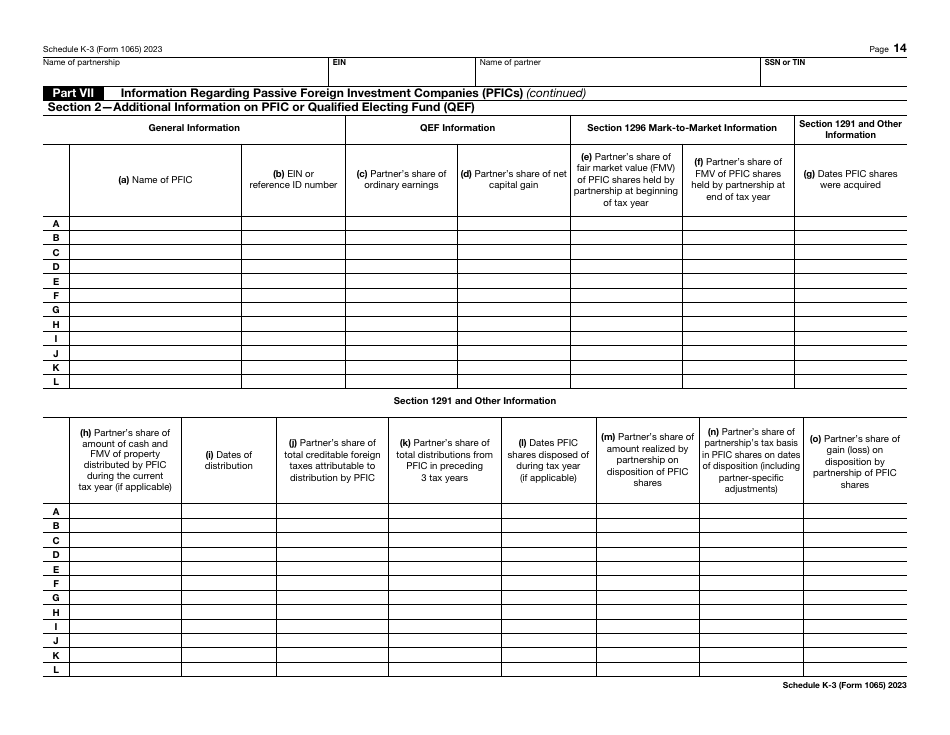

Calculate the foreign-derived intangible income and record the deduction you are able to claim . If any foreign corporations made distributions to the partnership, the schedule has to reflect that. Complete the fields that elaborate on income inclusions, your share of ordinary earnings and capital gain, and the interest you have generated due to income from foreign corporations.