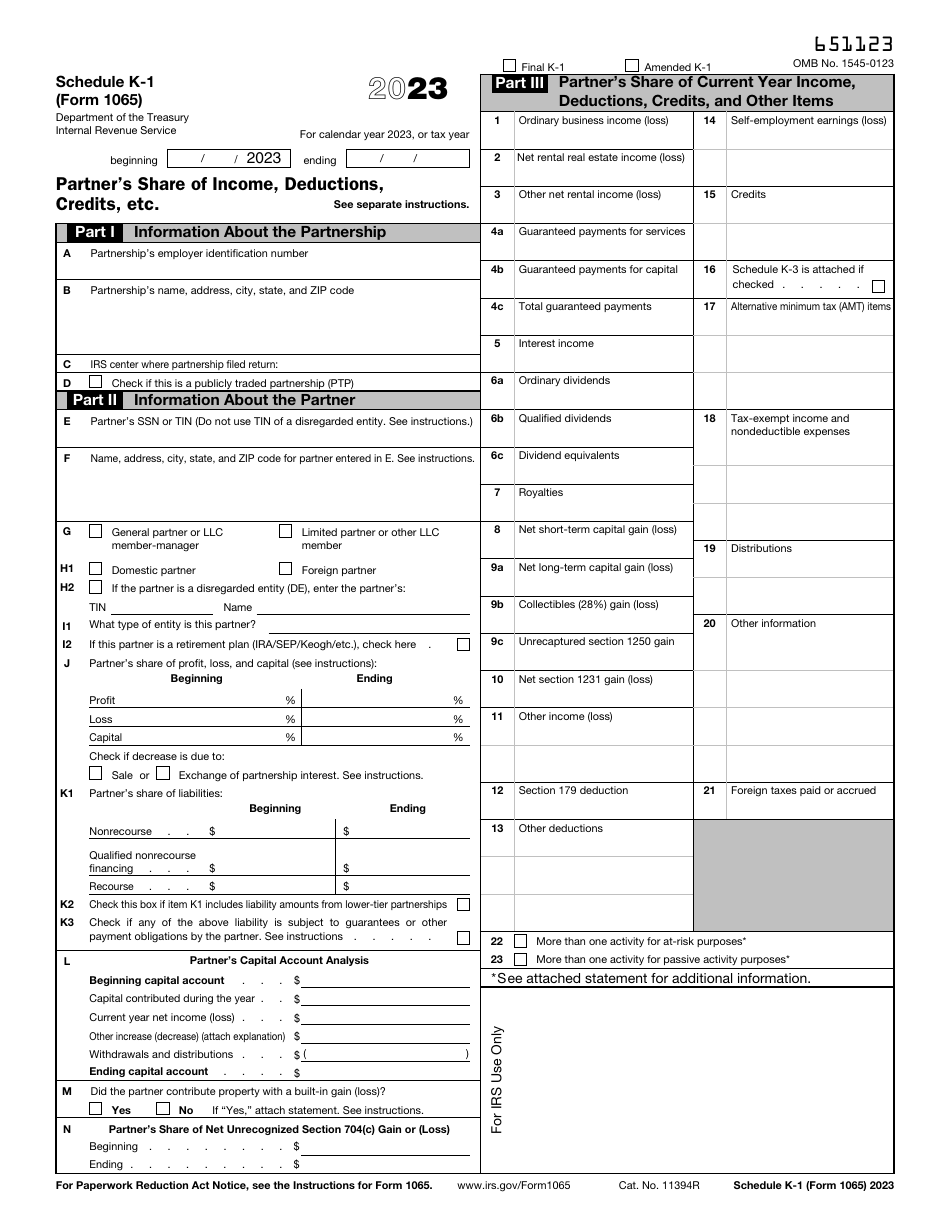

IRS Form 1065 Schedule K-1 Partner's Share of Income, Deductions, Credits, Etc.

What Is IRS Form 1065 Schedule K-1?

IRS Form 1065 Schedule K-1, Partner's Share of Income, Deductions, Credits, Etc. , is a detailed instrument a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

Alternate Name:

- Form 1065 Schedule K-1.

This tool is indispensable for partners that need to compute their income, capital gain, losses, and dividends - every partnership is required to provide the partners with a copy of a schedule during the time these individuals and entities are completing their tax returns.

This schedule was issued by the Internal Revenue Service (IRS) on , making older editions obsolete. An IRS Form 1065 Schedule K-1 fillable version is available for download below.

What Is the Purpose of Schedule K-1 Form 1065?

Every member of the partnership is obliged to inform the IRS about the part they play financially in the entity in question. A schedule K-1 filled out by every partner demonstrates the exact amount of returns the partner gets on the basis of their partnership capital.

Although there is no requirement to submit this document with the tax return the partner files with the fiscal authorities, a schedule like this is essential when it comes to figuring out the accurate income they are supposed to report to the IRS. Instead of sending multiple documents to the IRS, the partnership covers all the details related to its activity on an IRS Form 1065, U.S. Return of Partnership Income.

Form 1065 Schedule K-1 Instructions

Form 1065 Schedule K-1 Instructions are as follows:

-

Check the box to specify whether you are preparing an original version of the schedule or it will be used to provide information necessary for the filing of an amended partnership return . Specify the calendar year or tax year that will be covered in the schedule.

-

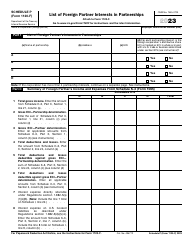

Outline the partnership you operate - add its employer identification number, name, legal address, and the IRS center where the enterprise submits its tax returns. In case you are representing a publicly traded partnership, check the appropriate box.

-

Identify yourself by a social security number or taxpayer identification number, full name, and physical address that can be used for future correspondence . Indicate your partner status in further detail - it is of particular importance to elaborate on it if you represent a disregarded entity.

-

Record your share of capital, profit, and loss as a percentage at the beginning of the year you describe in the form as well as at the end of the year . Clarify your share of liabilities in U.S. dollars, explain how your capital account has changed throughout the year, confirm you contributed property with a built-in gain or loss to the partnership, and state your gain or loss in line with the Net Unrecognized Section 704(c).

-

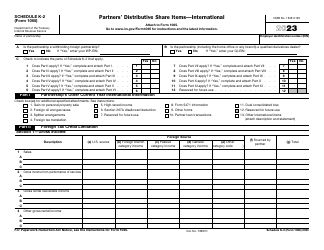

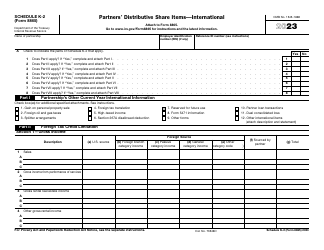

Provide more specifics about your business activities that have affected the partnership during the year . Enter the income you have generated while doing ordinary business, renting out real estate, receiving payments for capital and services, and collecting interest, dividends, and royalties. State the amount of short- and long-term capital gain or loss and specify the deductions you believe you qualify for. In case there were any earnings from self-employment or credits you were entitled to, mention them in the schedule as well.

-

List the distributions the partnership made to you in the form of marketable securities and cash, certify how much tax you have paid or accrued abroad, and check the boxes if certain operations can be qualified as at-risk or passive activities.