This version of the form is not currently in use and is provided for reference only. Download this version of

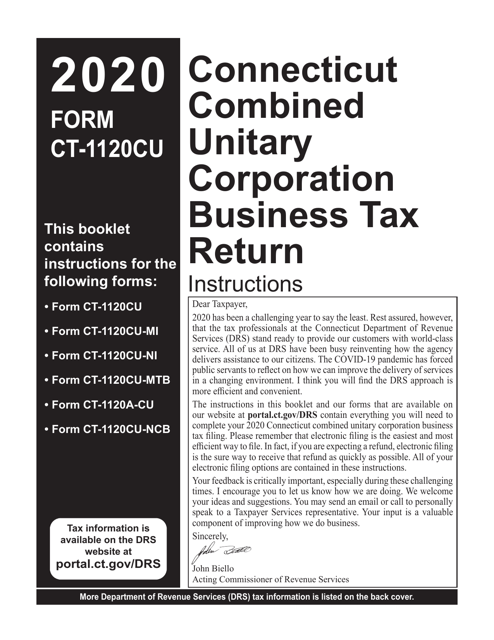

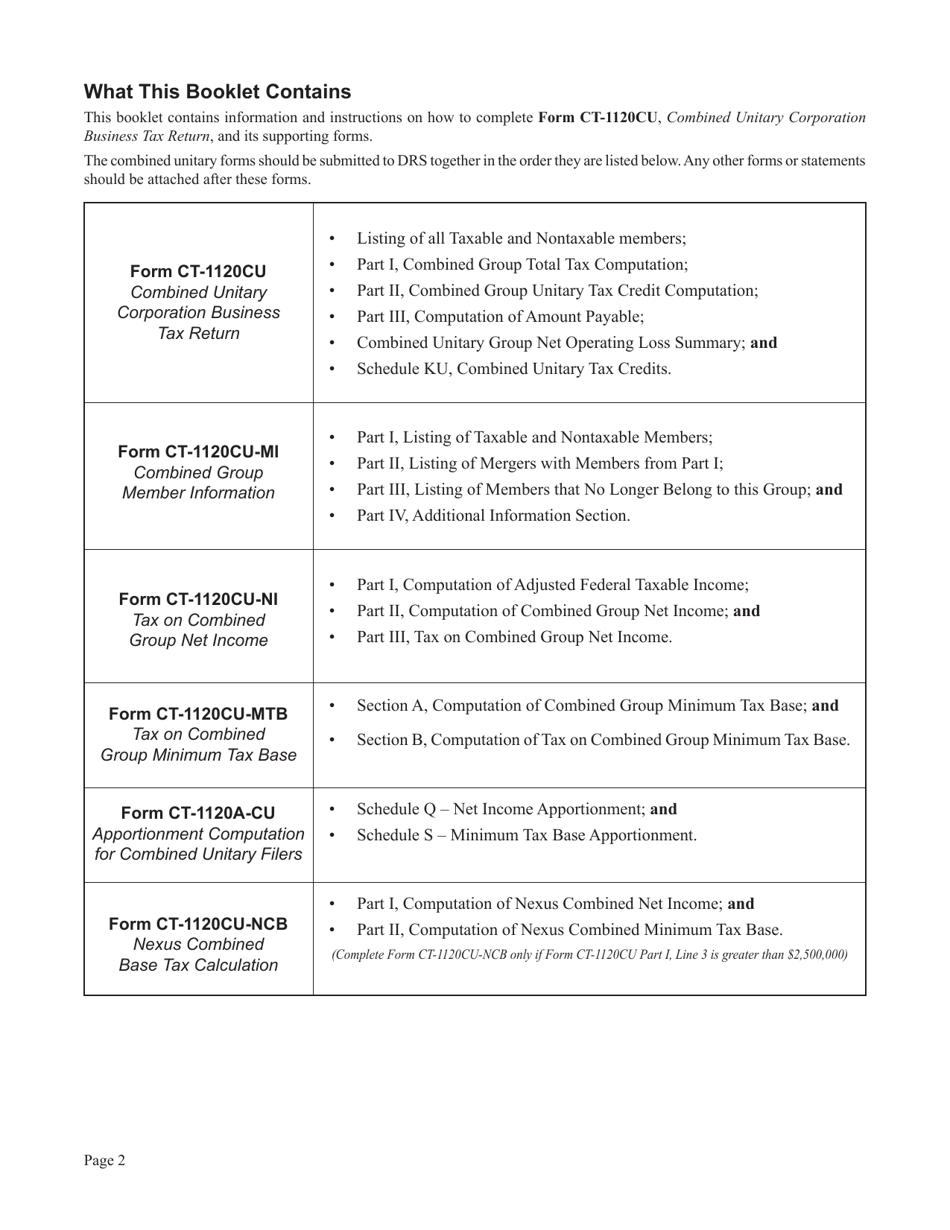

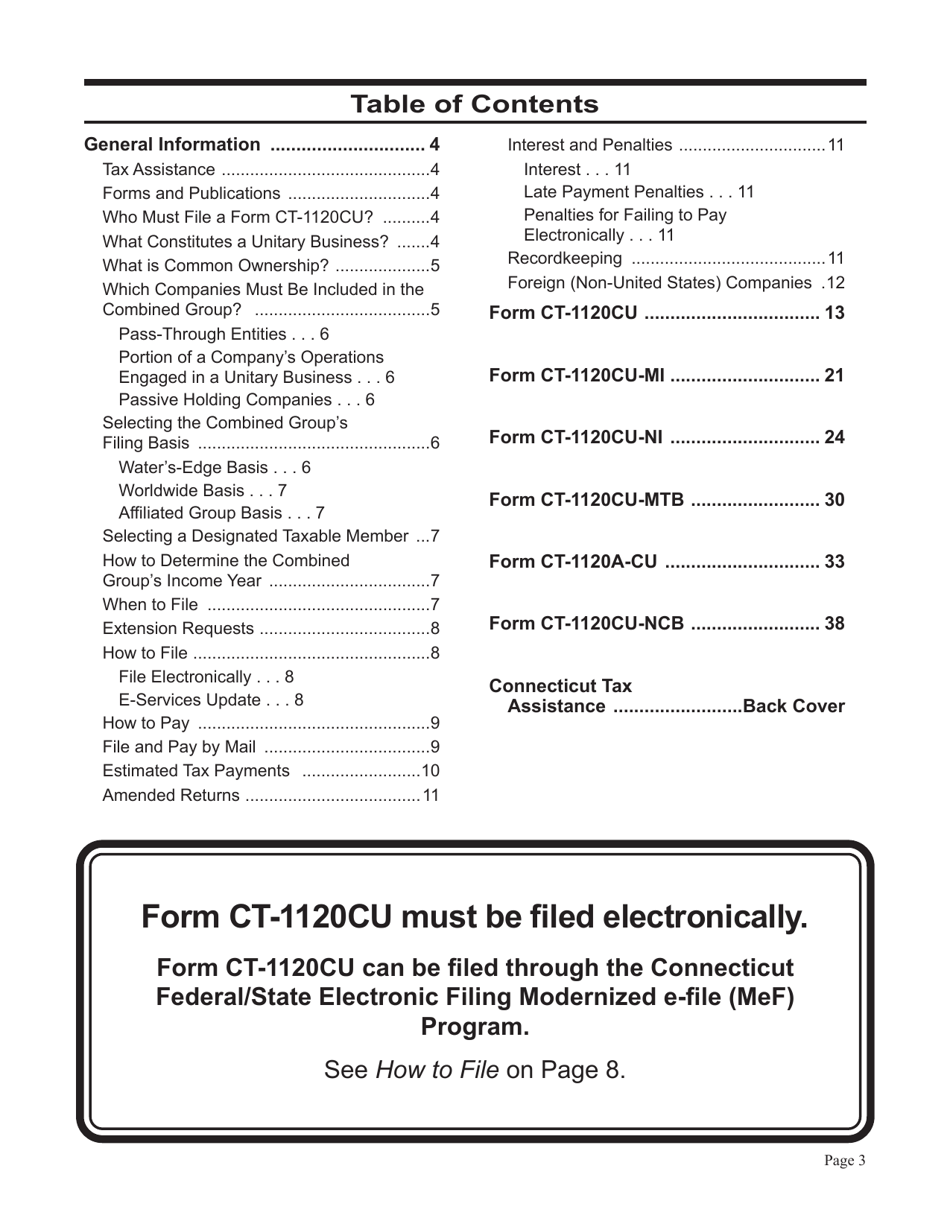

Instructions for Form CT-1120CU, CT-1120CU-MI, CT-1120CU-NI, CT-1120CU-MTB, CT-1120A-CU, CT-1120CU-NCB

for the current year.

Instructions for Form CT-1120CU, CT-1120CU-MI, CT-1120CU-NI, CT-1120CU-MTB, CT-1120A-CU, CT-1120CU-NCB - Connecticut

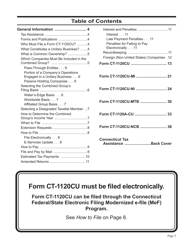

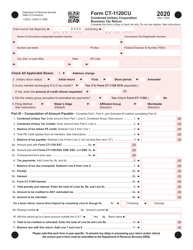

Form CT-1120CU Combined Unitary Corporation Business Tax Return - Connecticut

Form CT-1120CU Combined Unitary Corporation Business Tax Return - Connecticut

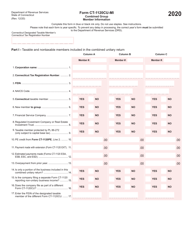

Form CT-1120CU-MI Combined Group Member Information - Connecticut

Form CT-1120CU-MI Combined Group Member Information - Connecticut

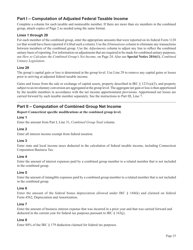

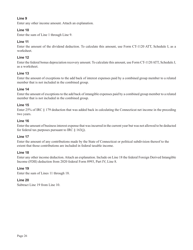

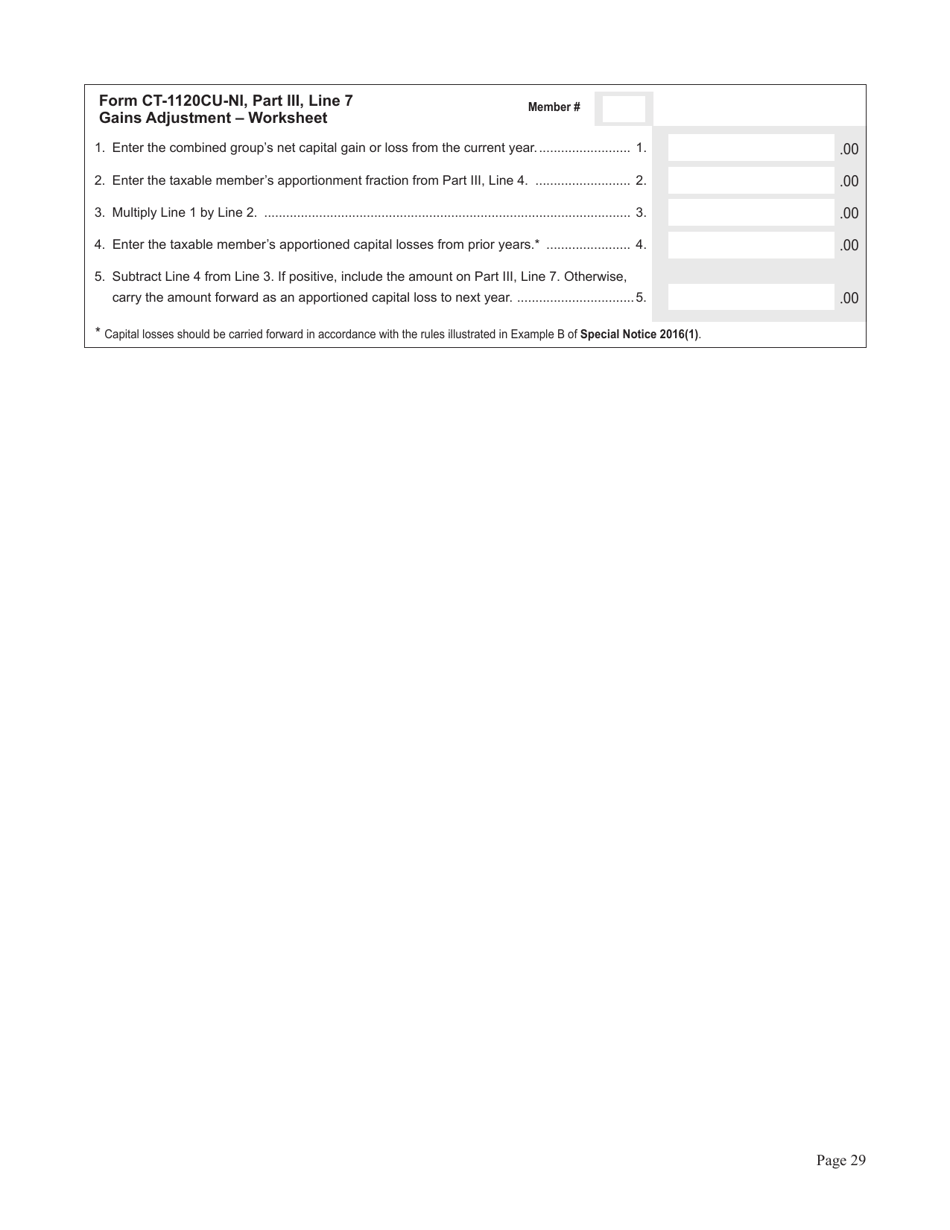

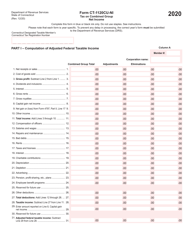

Form CT-1120CU-NI Tax on Combined Group Net Income - Connecticut

Form CT-1120CU-NI Tax on Combined Group Net Income - Connecticut

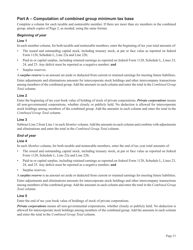

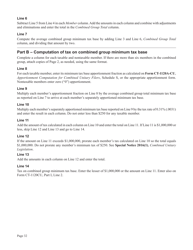

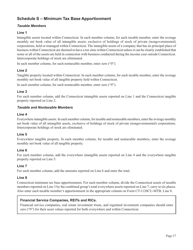

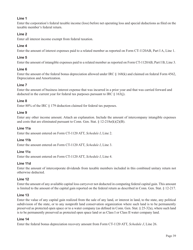

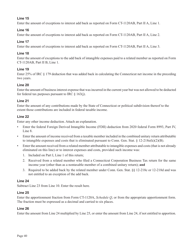

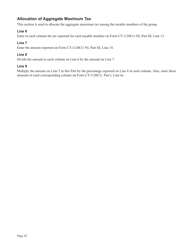

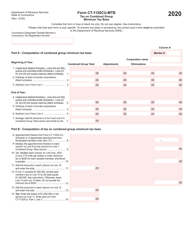

Form CT-1120CU-MTB Tax on Combined Group Minimum Tax Base - Connecticut

Form CT-1120CU-MTB Tax on Combined Group Minimum Tax Base - Connecticut

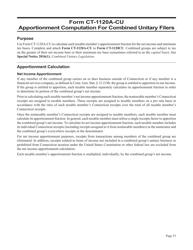

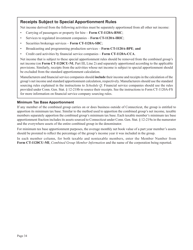

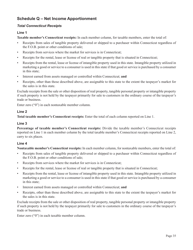

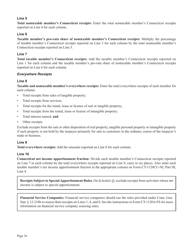

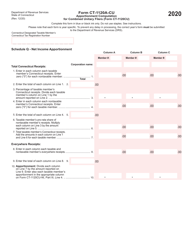

Form CT-1120A-CU Apportionment Computation for Combined Unitary Filers - Connecticut

Form CT-1120A-CU Apportionment Computation for Combined Unitary Filers - Connecticut

Form CT-1120CU-NCB Nexus Combined Base Tax Calculation - Connecticut

Form CT-1120CU-NCB Nexus Combined Base Tax Calculation - Connecticut

This document contains official instructions for Form CT-1120CU , Form CT-1120CU-MI , Form CT-1120CU-NI , Form CT-1120CU-MTB , Form CT-1120A-CU , and Form CT-1120CU-NCB . All forms are released and collected by the Connecticut Department of Revenue Services. An up-to-date fillable Form CT-1120CU is available for download through this link. The latest available Form CT-1120CU-MI can be downloaded through this link. Form CT-1120CU-NI can be found here. The newest Form CT-1120CU-MTB can be downloaded here. An up-to-date fillable Form CT-1120A-CU is available for download through this link. The latest available Form CT-1120CU-NCB can be downloaded through this link.

FAQ

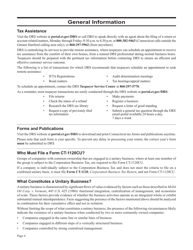

Q: What is Form CT-1120CU?

A: Form CT-1120CU is a tax form used by C-corporations in Connecticut to report their unitary combined business income or loss.

Q: What is the purpose of Form CT-1120CU?

A: The purpose of Form CT-1120CU is to calculate and report the combined income or loss of a group of C-corporations that are engaged in a unitary business.

Q: Who needs to file Form CT-1120CU?

A: C-corporations that are part of a unitary business group in Connecticut need to file Form CT-1120CU.

Q: When is the due date for Form CT-1120CU?

A: The due date for Form CT-1120CU is the same as the due date for the federal tax return, which is generally March 15th.

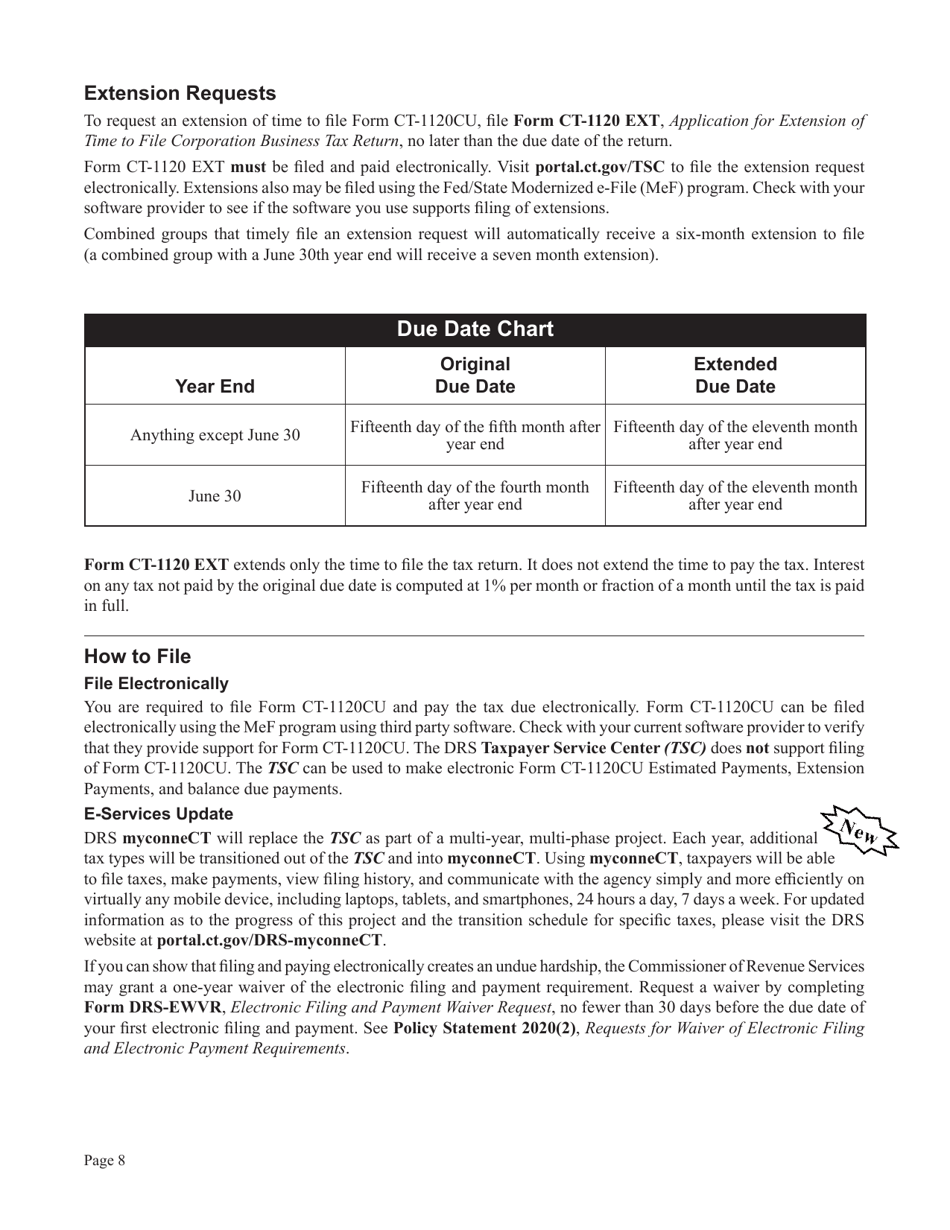

Q: Are there any extensions available for filing Form CT-1120CU?

A: Yes, Connecticut allows for a six-month extension to file Form CT-1120CU, extending the due date to September 15th.

Q: What are the other related forms to Form CT-1120CU?

A: The other related forms to Form CT-1120CU are CT-1120CU-MI (Member Information), CT-1120CU-NI (Net Income (Loss) Computation), CT-1120CU-MTB (General Business Data Schedule), CT-1120CU-NCB (Non-Connecticut Business Allocation and Apportionment Schedule), and CT-1120A-CU, (Exempt Organization Nonstock CorporationBusiness Income Tax Return).

Instruction Details:

- This 44-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Connecticut Department of Revenue Services.