This version of the form is not currently in use and is provided for reference only. Download this version of

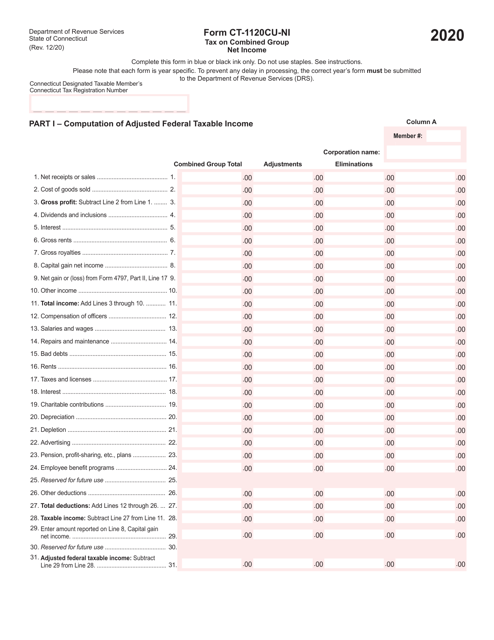

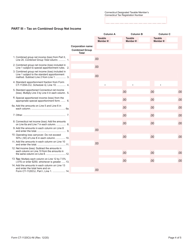

Form CT-1120CU-NI

for the current year.

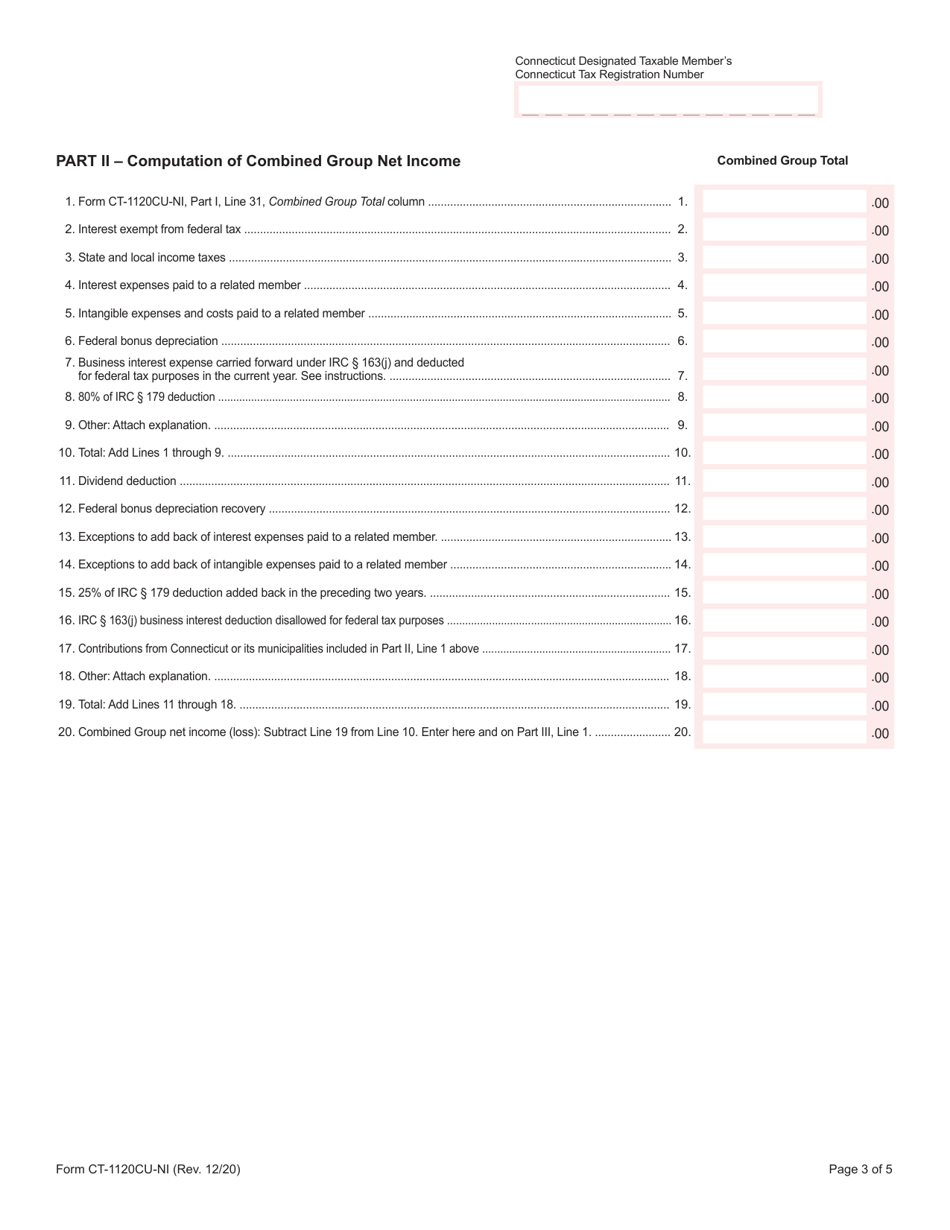

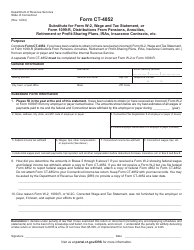

Form CT-1120CU-NI Tax on Combined Group Net Income - Connecticut

What Is Form CT-1120CU-NI?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120CU-NI?

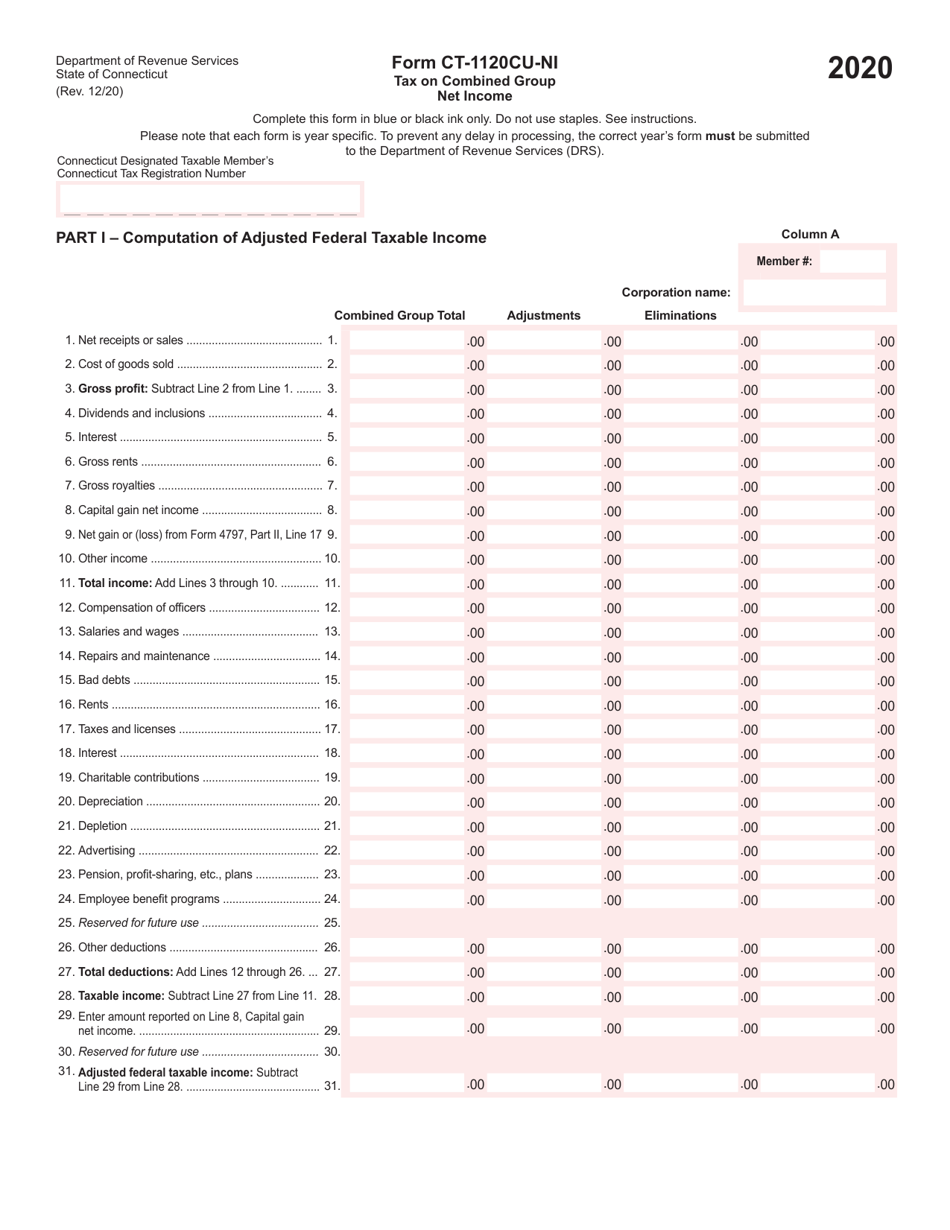

A: Form CT-1120CU-NI is a tax form used in Connecticut to calculate the tax on the combined net income of a group.

Q: Who needs to file Form CT-1120CU-NI?

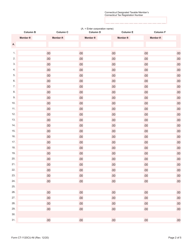

A: Form CT-1120CU-NI must be filed by combined groups of corporations that have nexus in Connecticut.

Q: What is a combined group for tax purposes?

A: A combined group for tax purposes is a group of corporations that meet certain ownership and control requirements and elect to file a combined return.

Q: What is net income?

A: Net income is the amount of income left after subtracting deductions, exemptions, and credits from gross income.

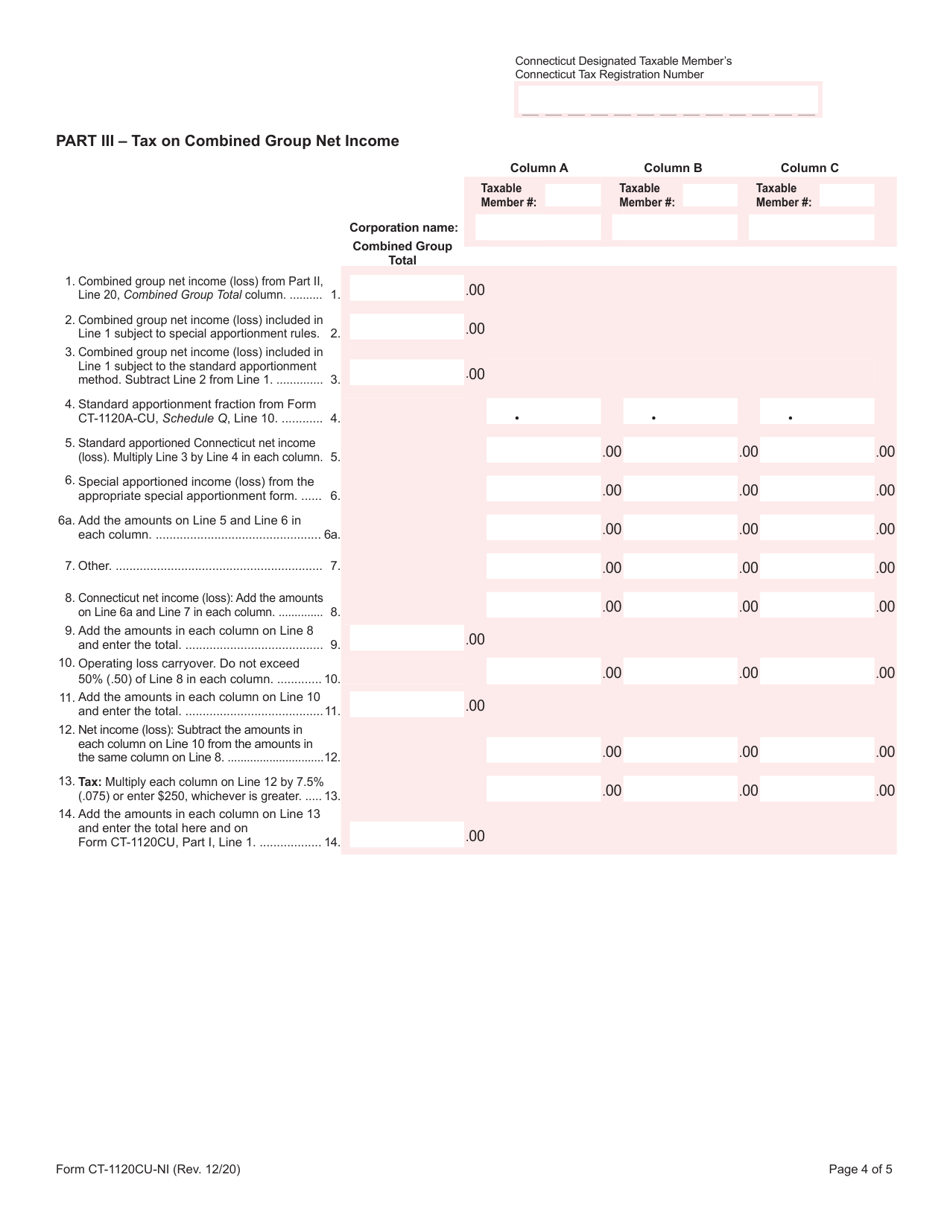

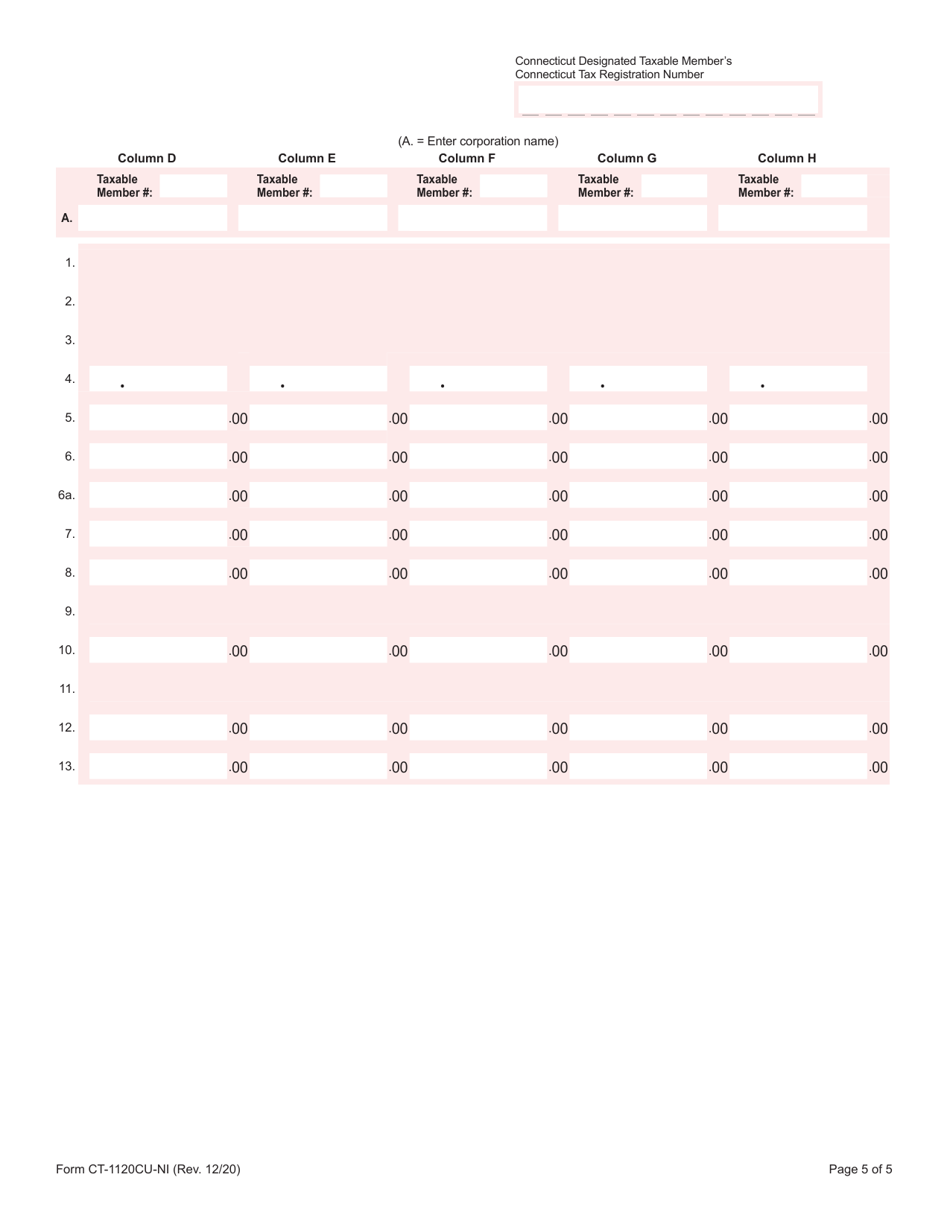

Q: How is the tax on combined group net income calculated?

A: The tax on combined group net income is calculated by applying Connecticut's corporate tax rate to the combined group's net income.

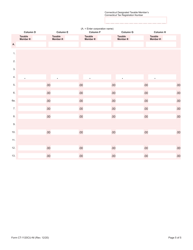

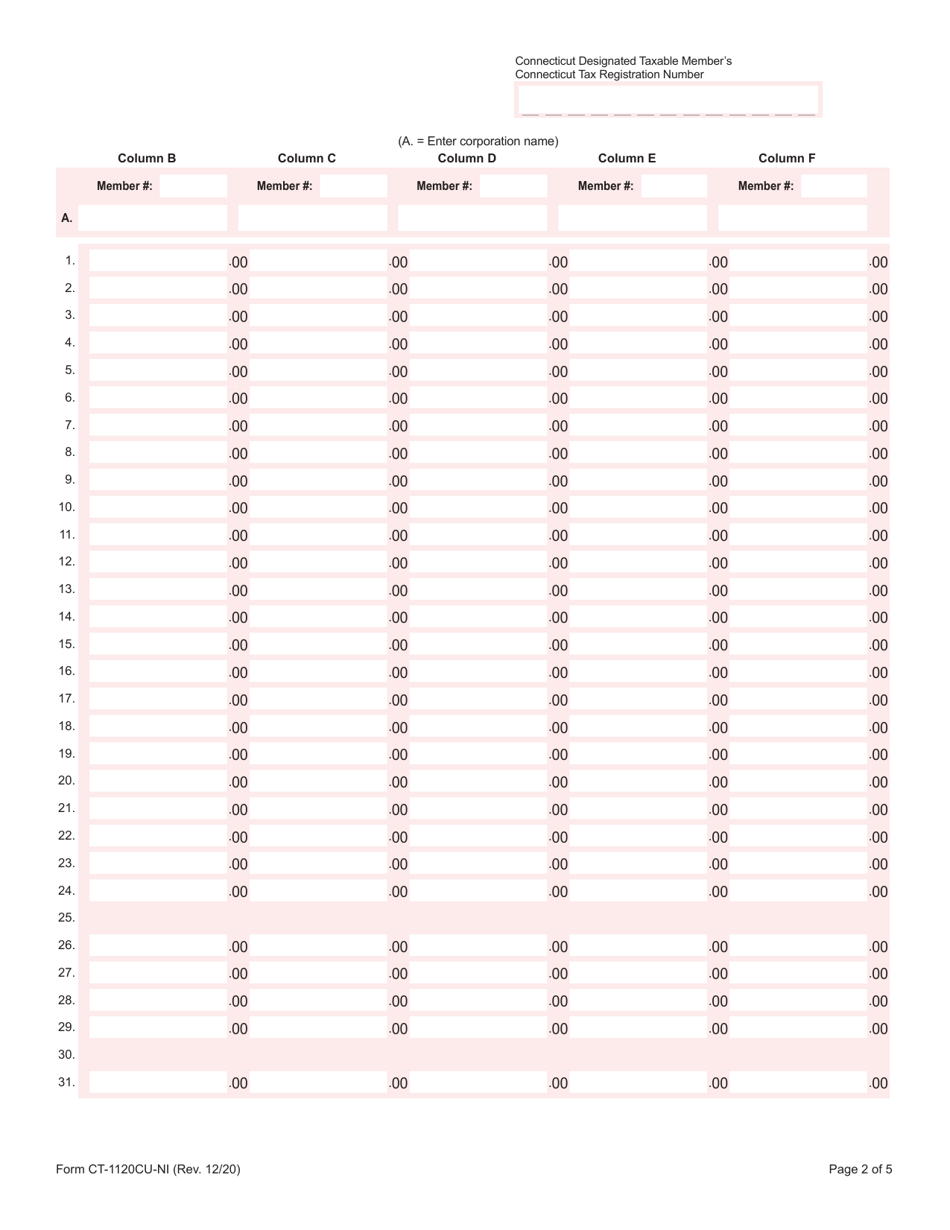

Q: Are there any additional forms or schedules that need to be filed with Form CT-1120CU-NI?

A: Yes, combined groups are required to file Schedule CU with Form CT-1120CU-NI to report the apportionment and allocation of income.

Q: When is Form CT-1120CU-NI due?

A: Form CT-1120CU-NI is due on the same date as the group's federal income tax return, usually on March 15th.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120CU-NI by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.