This version of the form is not currently in use and is provided for reference only. Download this version of

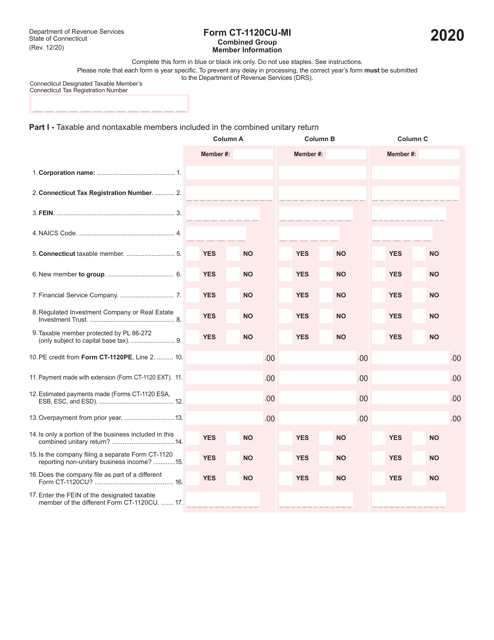

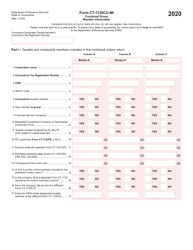

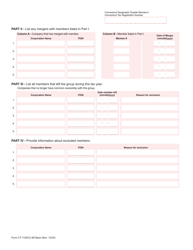

Form CT-1120CU-MI

for the current year.

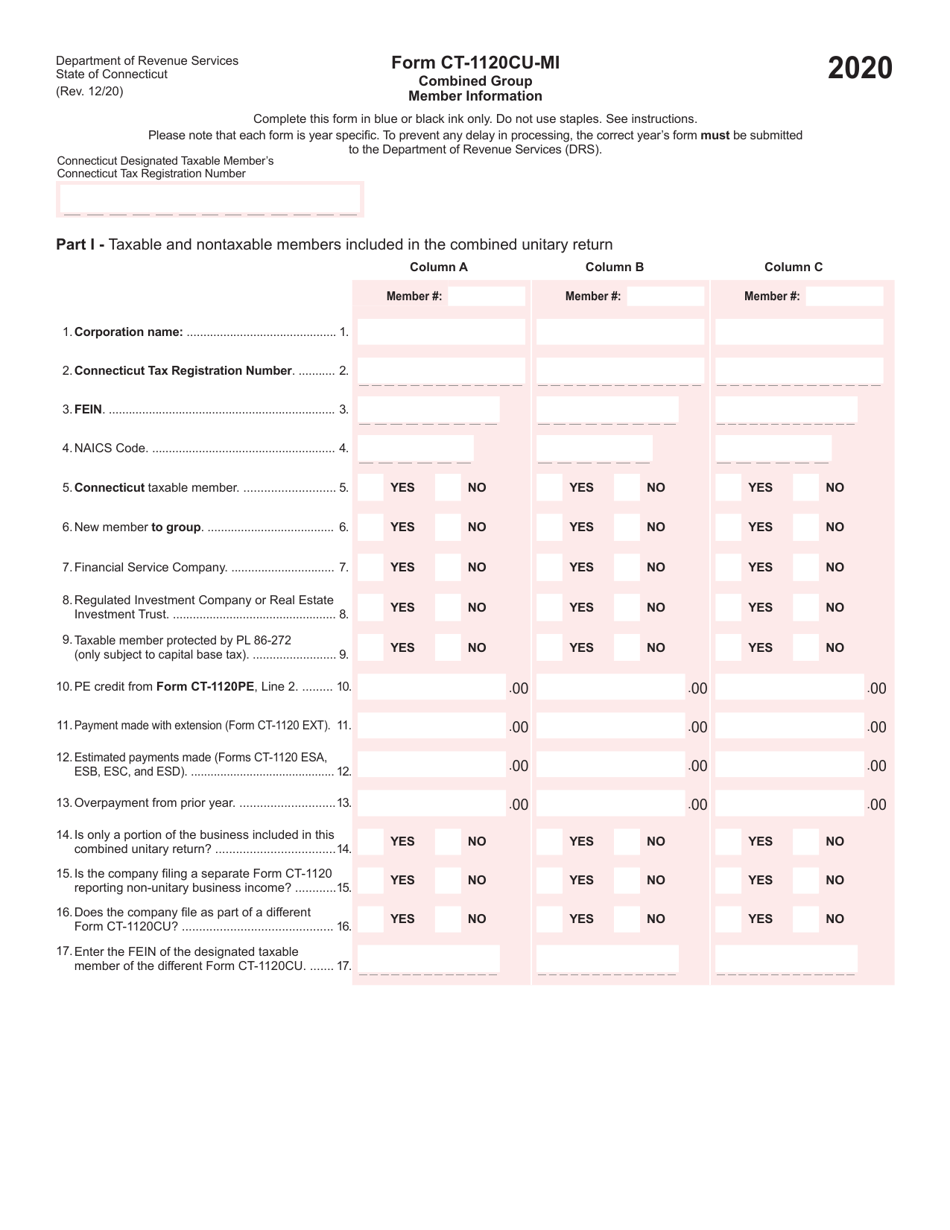

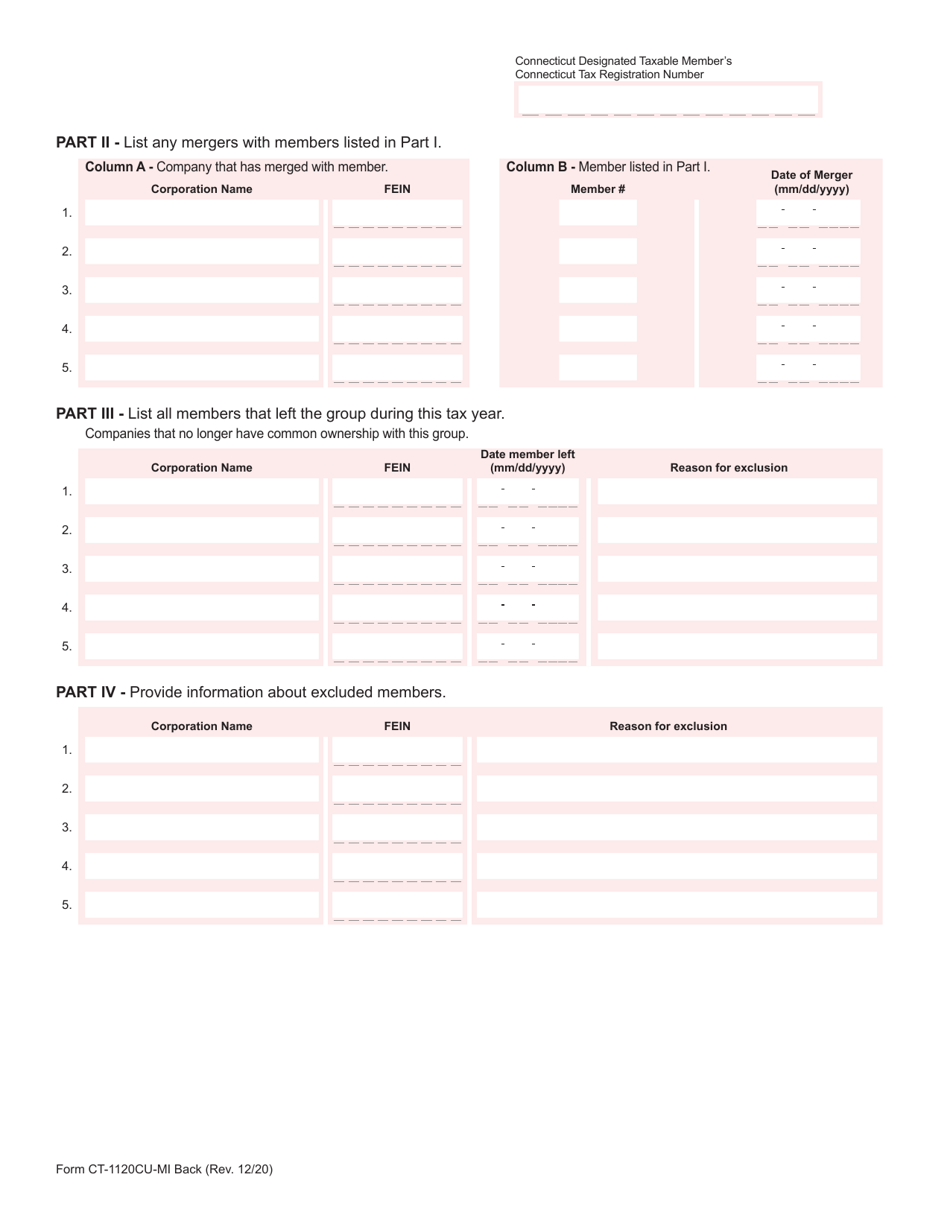

Form CT-1120CU-MI Combined Group Member Information - Connecticut

What Is Form CT-1120CU-MI?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120CU-MI?

A: Form CT-1120CU-MI is the Combined Group Member Information form for Connecticut.

Q: Who needs to file Form CT-1120CU-MI?

A: This form is used by corporations in a combined group to provide information about each member of the group.

Q: What information is required on Form CT-1120CU-MI?

A: The form requires information such as member names, federal employer identification numbers (EINs), business activities, and ownership percentages.

Q: When is Form CT-1120CU-MI due?

A: The form is due on or before the due date of the combined group's Connecticut corporation business tax return.

Q: Can Form CT-1120CU-MI be filed electronically?

A: Yes, the form can be filed electronically using the Connecticut Taxpayer Service Center.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120CU-MI by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.