This version of the form is not currently in use and is provided for reference only. Download this version of

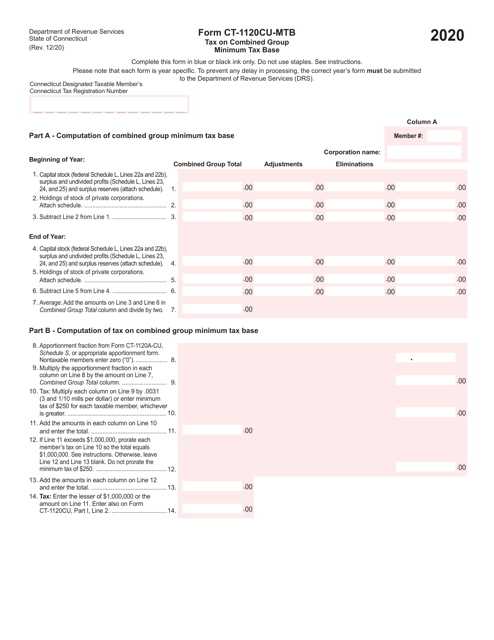

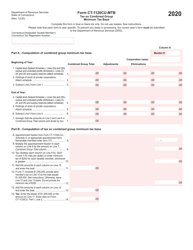

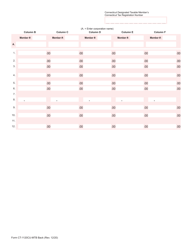

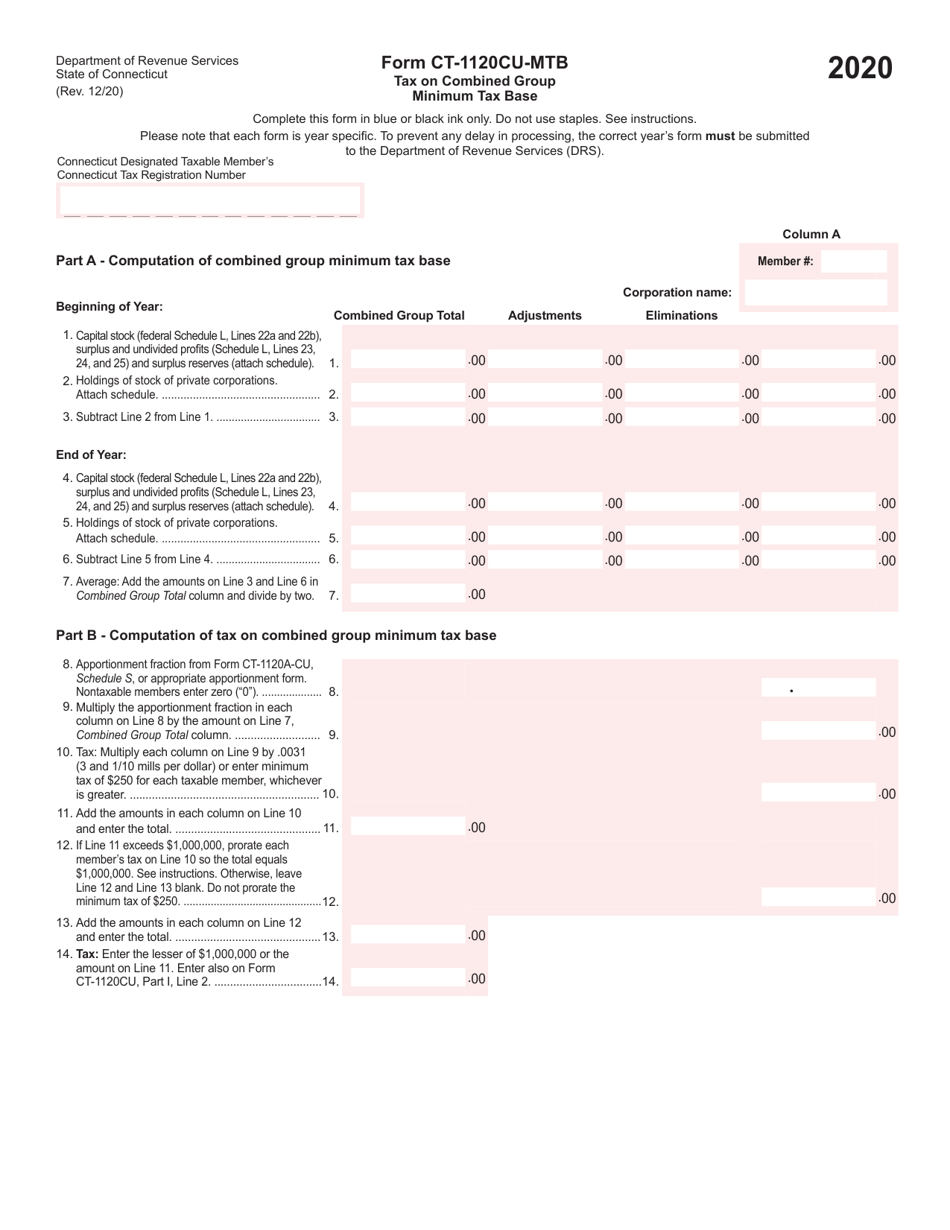

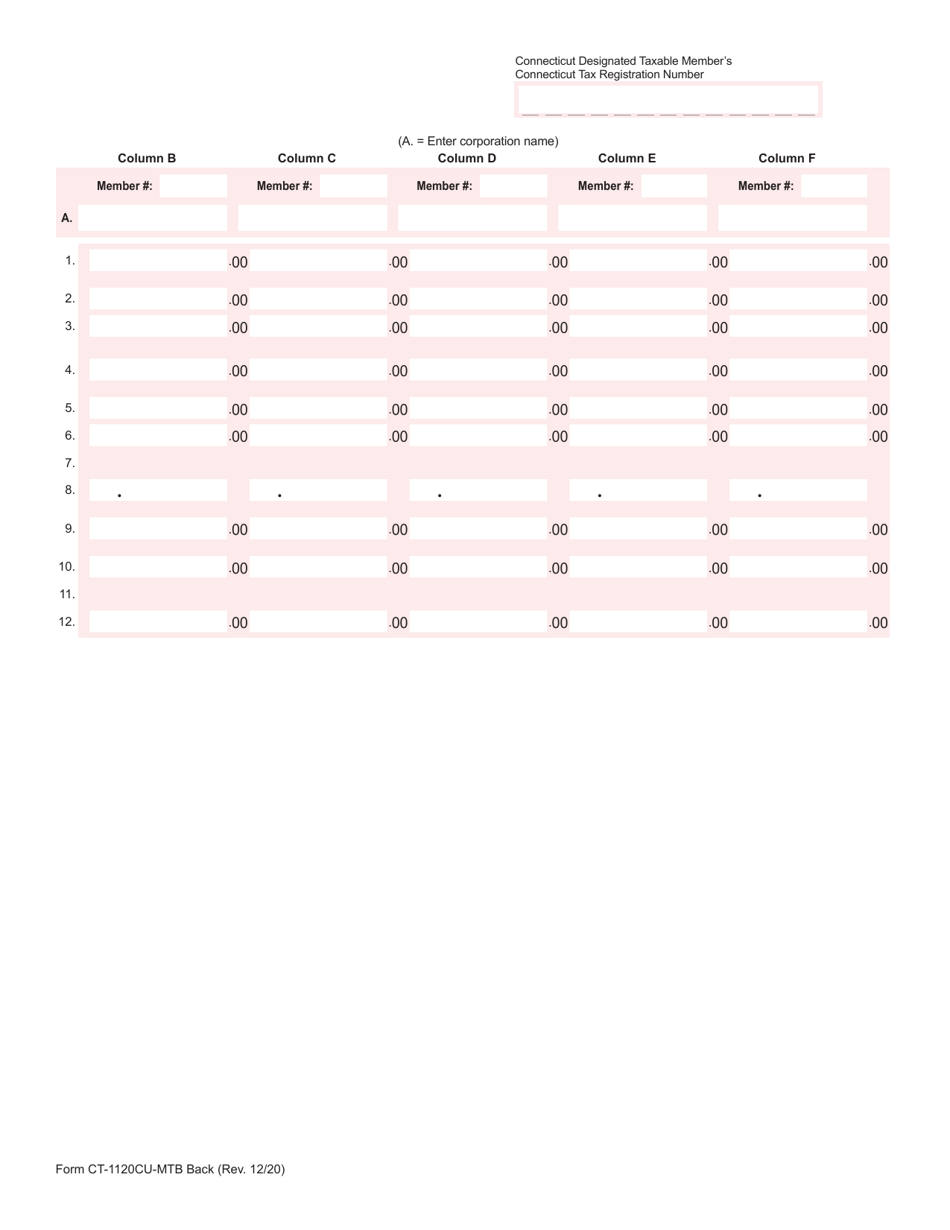

Form CT-1120CU-MTB

for the current year.

Form CT-1120CU-MTB Tax on Combined Group Minimum Tax Base - Connecticut

What Is Form CT-1120CU-MTB?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120CU-MTB?

A: Form CT-1120CU-MTB is a tax form used to calculate the tax on the combined groupminimum tax base in Connecticut.

Q: What is the combined group minimum tax base?

A: The combined group minimum tax base is the total income of a combined group of corporations subject to the Connecticut corporation income tax.

Q: What is the purpose of Form CT-1120CU-MTB?

A: Form CT-1120CU-MTB is used to determine the amount of tax owed on the combined group minimum tax base in Connecticut.

Q: Who needs to file Form CT-1120CU-MTB?

A: Any combined group of corporations subject to the Connecticut corporation income tax needs to file Form CT-1120CU-MTB.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120CU-MTB by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.