This version of the form is not currently in use and is provided for reference only. Download this version of

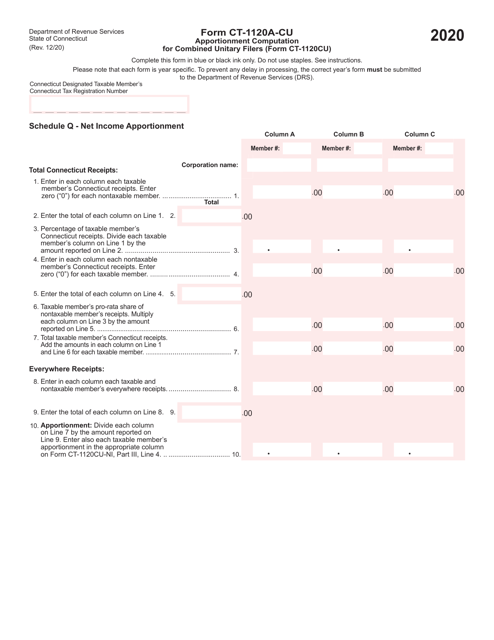

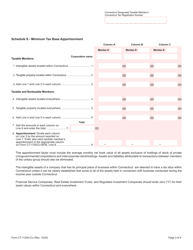

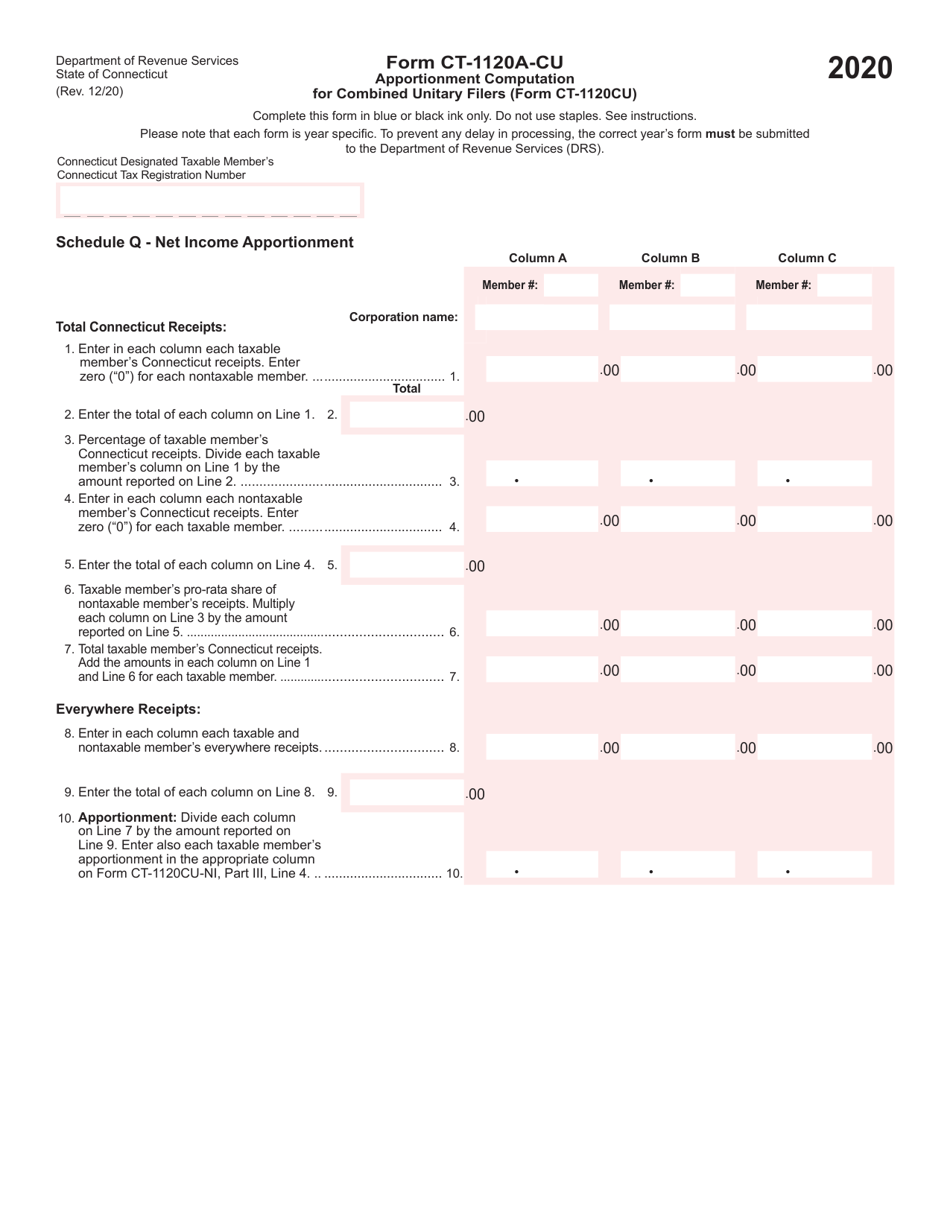

Form CT-1120A-CU

for the current year.

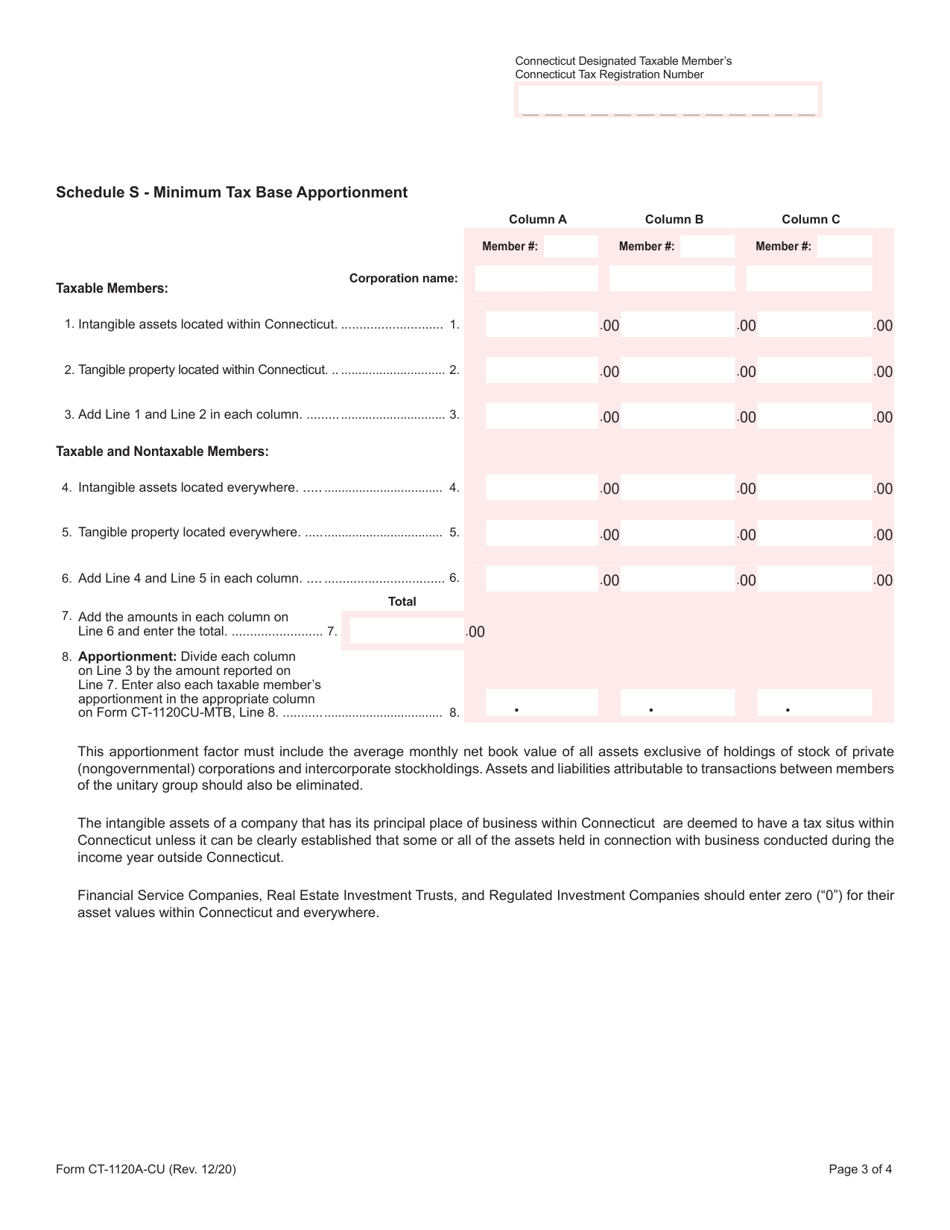

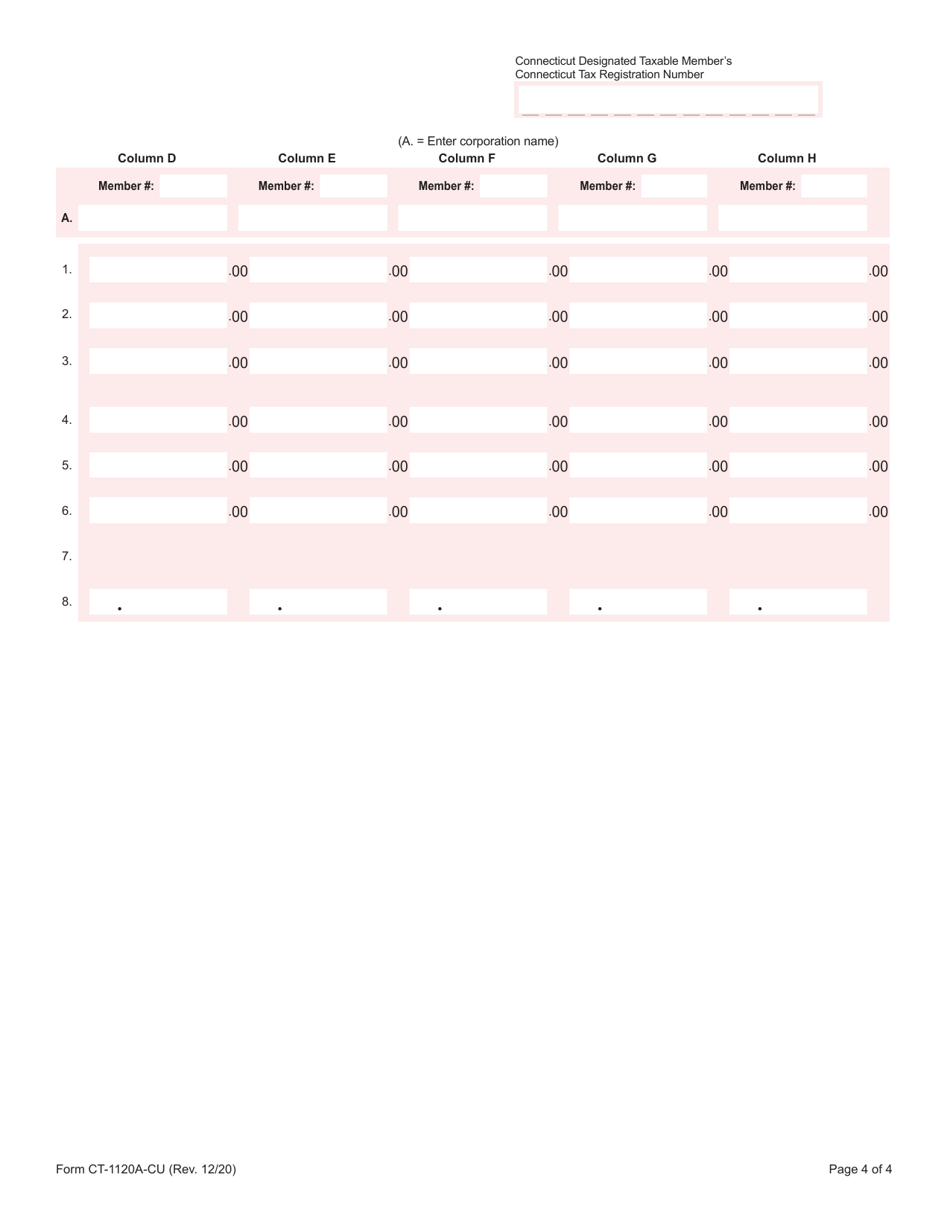

Form CT-1120A-CU Apportionment Computation for Combined Unitary Filers - Connecticut

What Is Form CT-1120A-CU?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120A-CU?

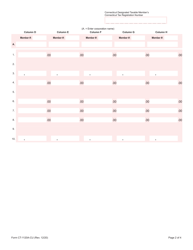

A: Form CT-1120A-CU is a tax form used by combined unitary filers in Connecticut to calculate apportionment.

Q: Who needs to file Form CT-1120A-CU?

A: Form CT-1120A-CU must be filed by combined unitary filers in Connecticut.

Q: What is apportionment?

A: Apportionment is the process of dividing income or expenses among multiple jurisdictions based on a specified formula.

Q: Why is apportionment necessary for combined unitary filers?

A: Apportionment is necessary for combined unitary filers because they operate in multiple jurisdictions and need to allocate income and expenses among those jurisdictions for tax purposes.

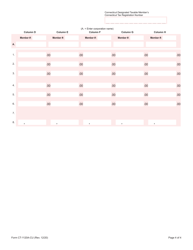

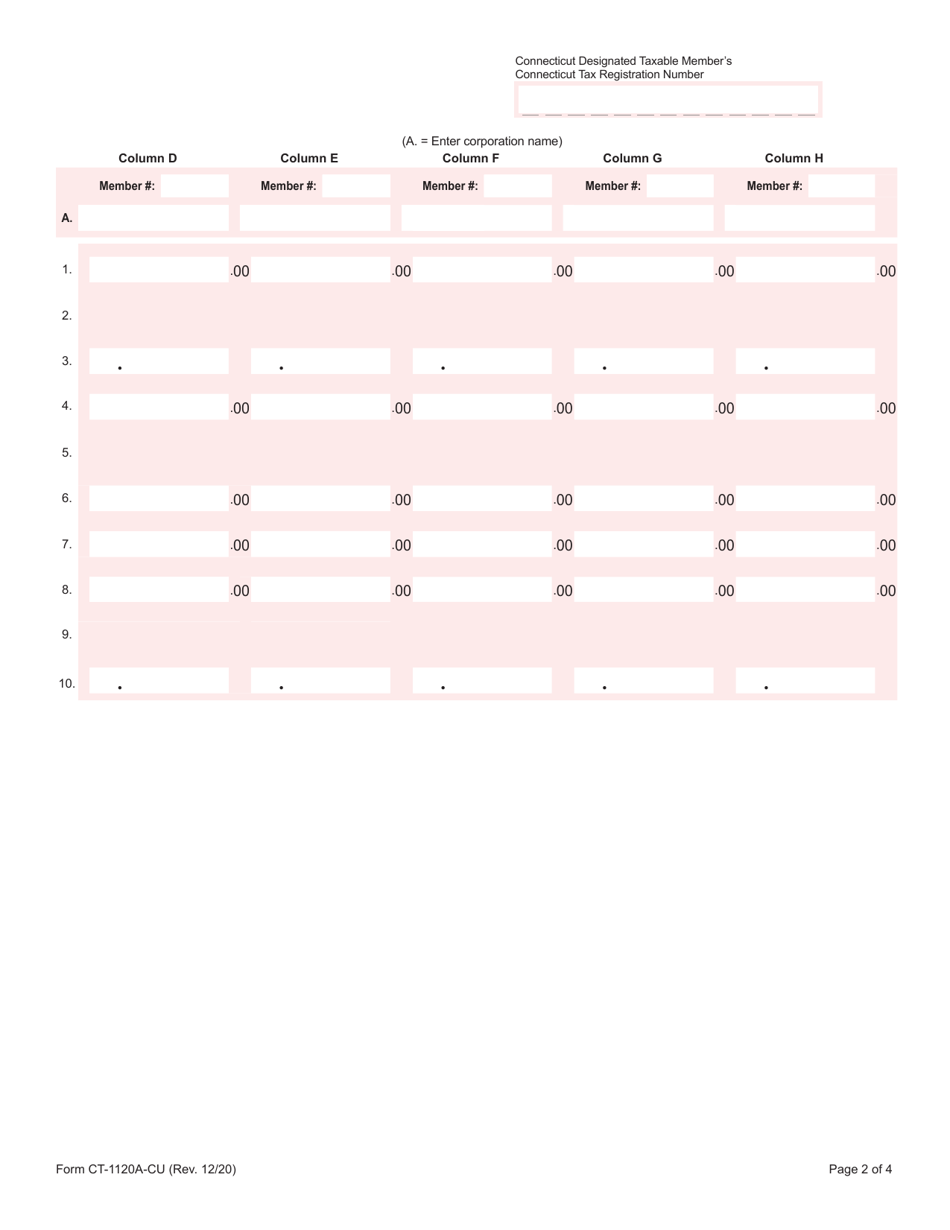

Q: How do I fill out Form CT-1120A-CU?

A: To fill out Form CT-1120A-CU, you will need to provide information about your business's income, deductions, and apportionment factors. Follow the instructions provided with the form.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120A-CU by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.