This version of the form is not currently in use and is provided for reference only. Download this version of

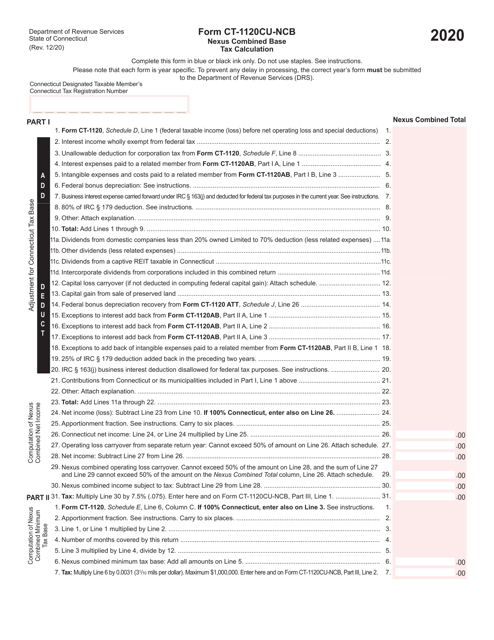

Form CT-1120CU-NCB

for the current year.

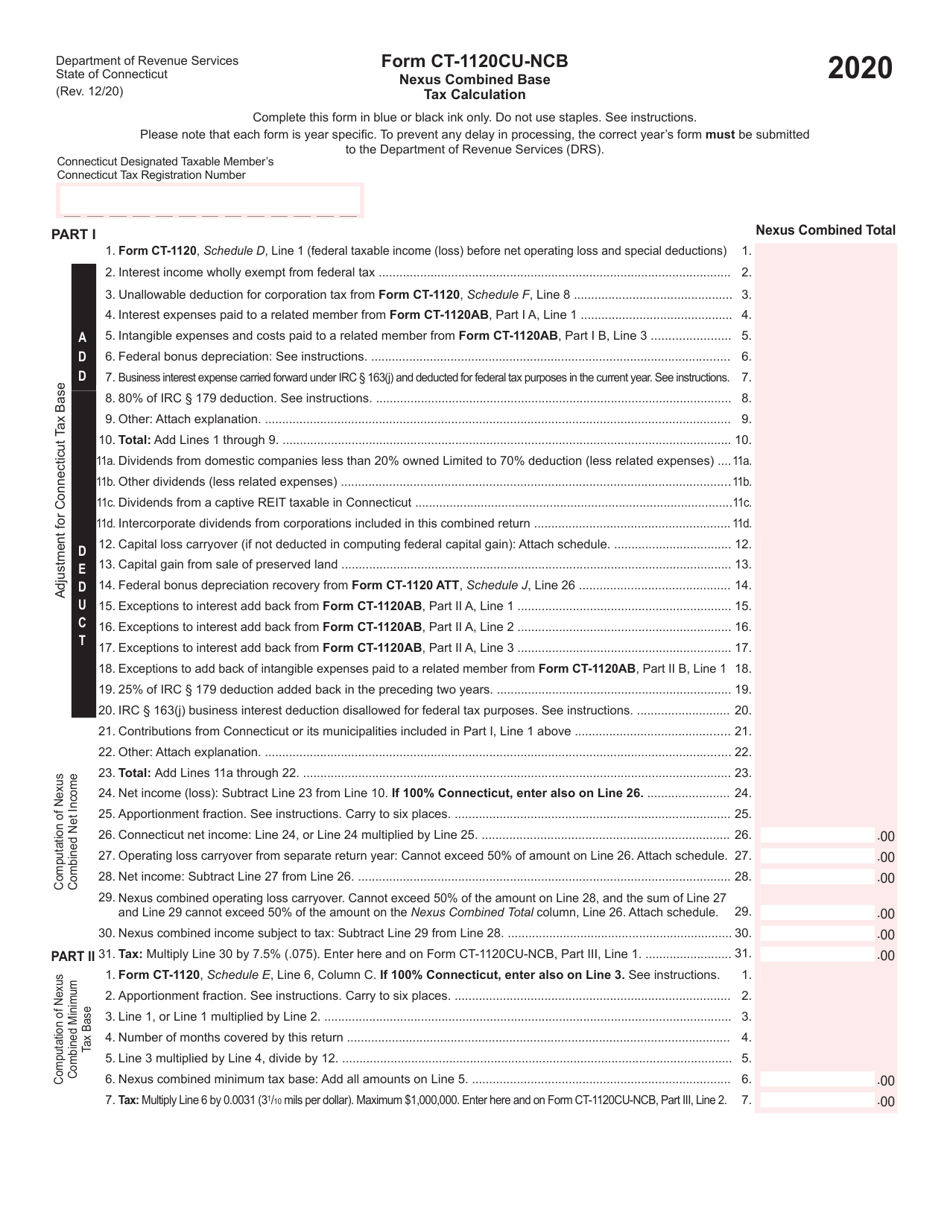

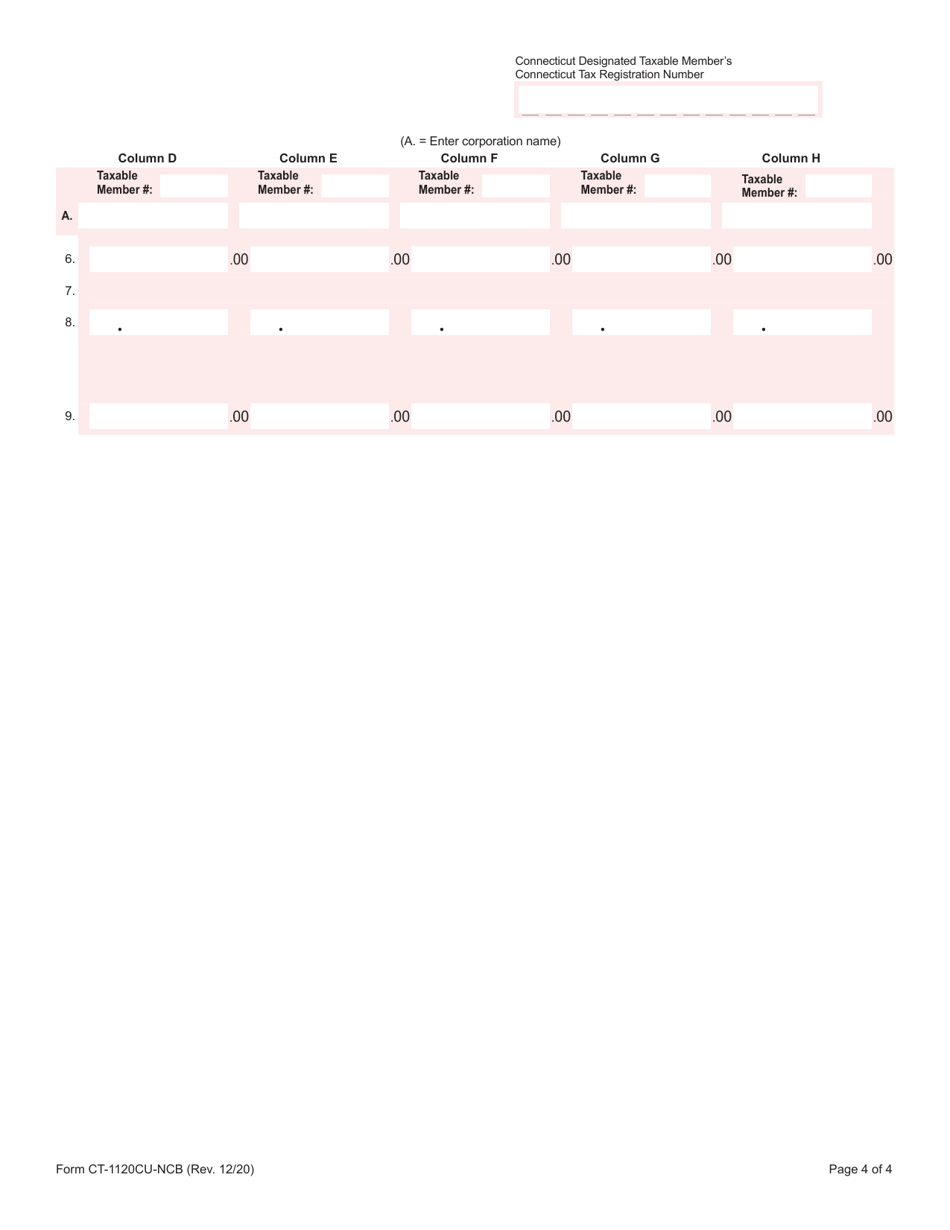

Form CT-1120CU-NCB Nexus Combined Base Tax Calculation - Connecticut

What Is Form CT-1120CU-NCB?

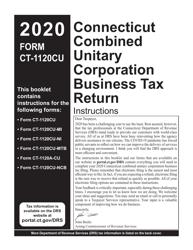

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120CU-NCB?

A: Form CT-1120CU-NCB is a tax form used for nexus combined base tax calculation in the state of Connecticut.

Q: What is nexus?

A: Nexus refers to the connection or presence that a business has in a particular state, which may require them to pay taxes in that state.

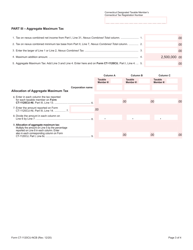

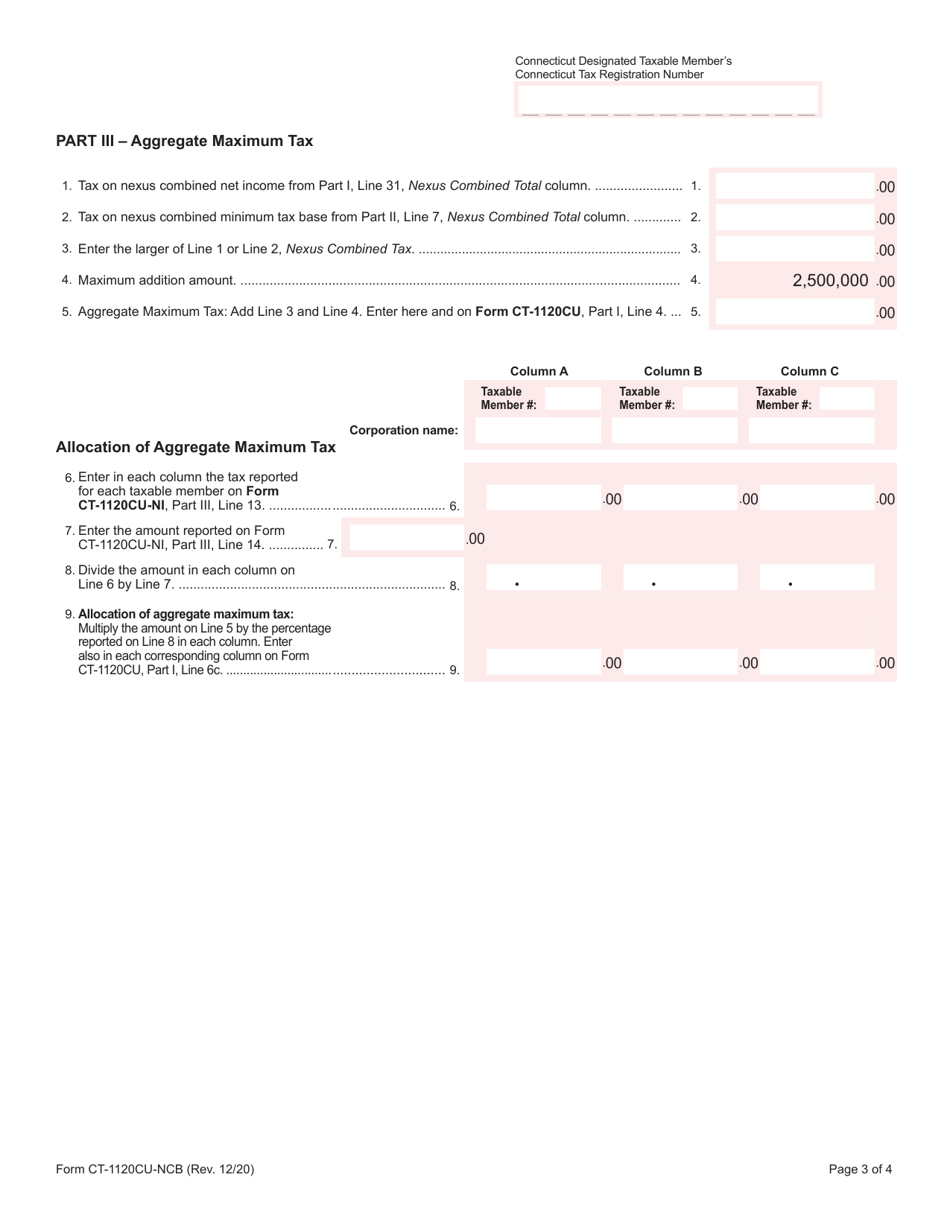

Q: What does combined base tax calculation mean?

A: Combined base tax calculation refers to the method used to determine the amount of tax due by combining the taxable income of affiliated businesses.

Q: Who needs to file Form CT-1120CU-NCB?

A: Businesses with nexus in Connecticut and affiliated entities that are required to file a combined return must use Form CT-1120CU-NCB.

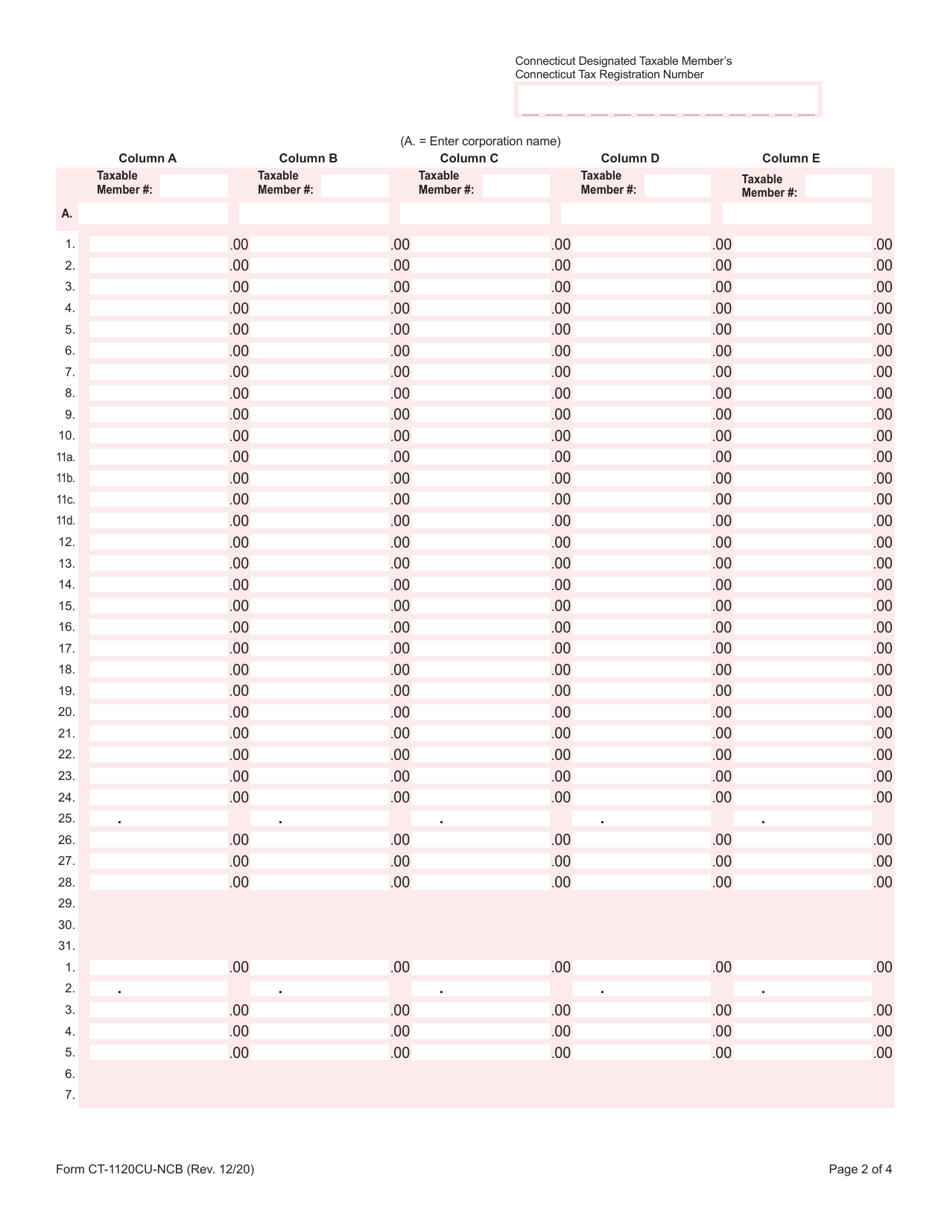

Q: What information is needed to complete this form?

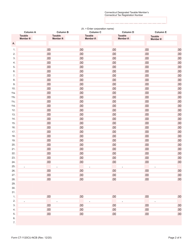

A: To complete Form CT-1120CU-NCB, you will need information regarding the taxable income of each affiliated entity and their respective nexus attributes.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120CU-NCB by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.