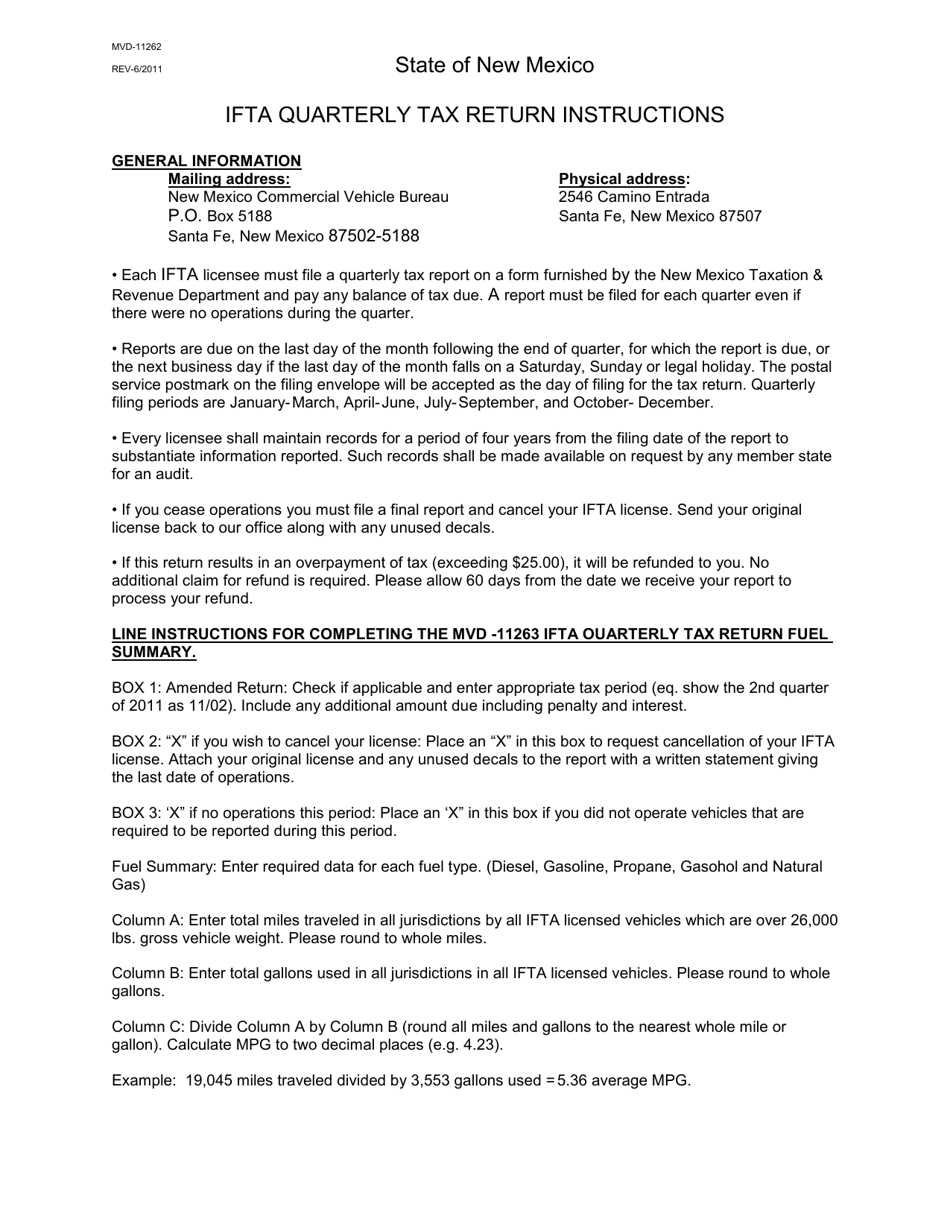

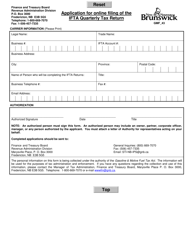

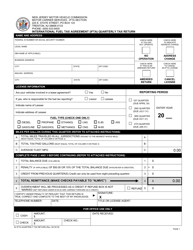

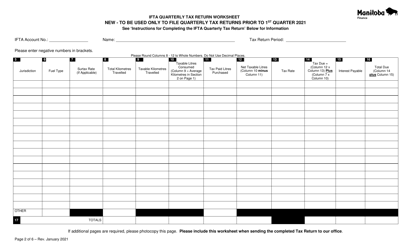

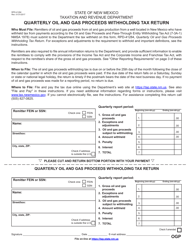

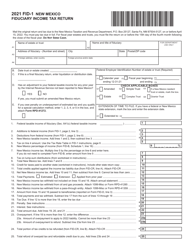

Instructions for Form MVD-11263 Ifta Quarterly Tax Return - New Mexico

This document contains official instructions for Form MVD-11263 , Ifta Quarterly Tax Return - a form released and collected by the New Mexico Taxation and Revenue Department.

FAQ

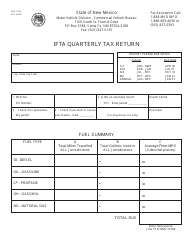

Q: What is Form MVD-11263?

A: Form MVD-11263 is the IFTA Quarterly Tax Return for New Mexico.

Q: What is IFTA?

A: IFTA stands for International Fuel Tax Agreement, which is an agreement among U.S. states and Canadian provinces to simplify the reporting of fuel use by commercial motor vehicles operating in multiple jurisdictions.

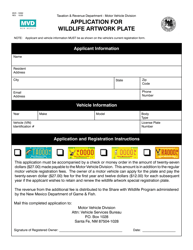

Q: Who needs to file Form MVD-11263?

A: Motor carriers operating qualified motor vehicles in New Mexico under the International Fuel Tax Agreement (IFTA) must file Form MVD-11263.

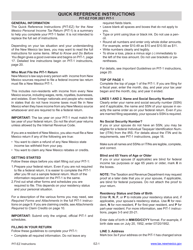

Q: When is Form MVD-11263 due?

A: Form MVD-11263 is due on the last day of the month following the end of the quarter. For example, the first quarter return is due by April 30th.

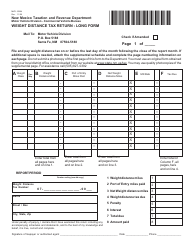

Q: What information is required to complete Form MVD-11263?

A: To complete Form MVD-11263, you will need information such as total miles traveled, total gallons of fuel purchased, and jurisdiction-specific fuel usage.

Q: Are there any penalties for late filing of Form MVD-11263?

A: Yes, there are penalties for late filing or failure to file Form MVD-11263, including interest charges and possible license suspension.

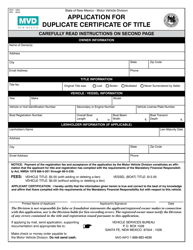

Q: Can I amend a previously filed Form MVD-11263?

A: Yes, you can file an amended Form MVD-11263 if you discover errors or omissions in your original filing.

Q: Who can I contact for help with Form MVD-11263?

A: You can contact the New Mexico Motor Vehicle Division (MVD) for assistance with Form MVD-11263.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Mexico Taxation and Revenue Department.