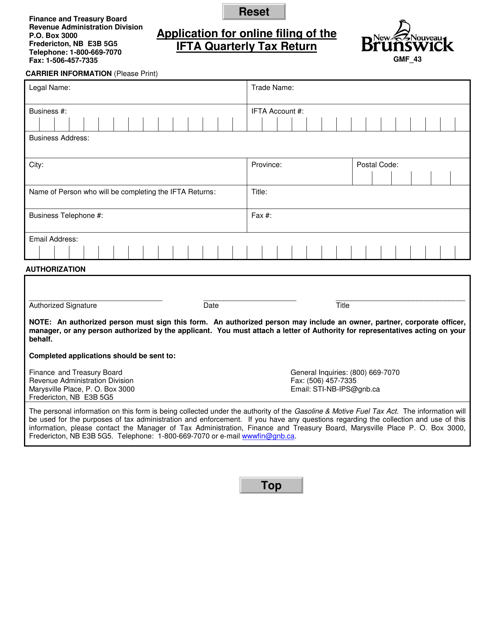

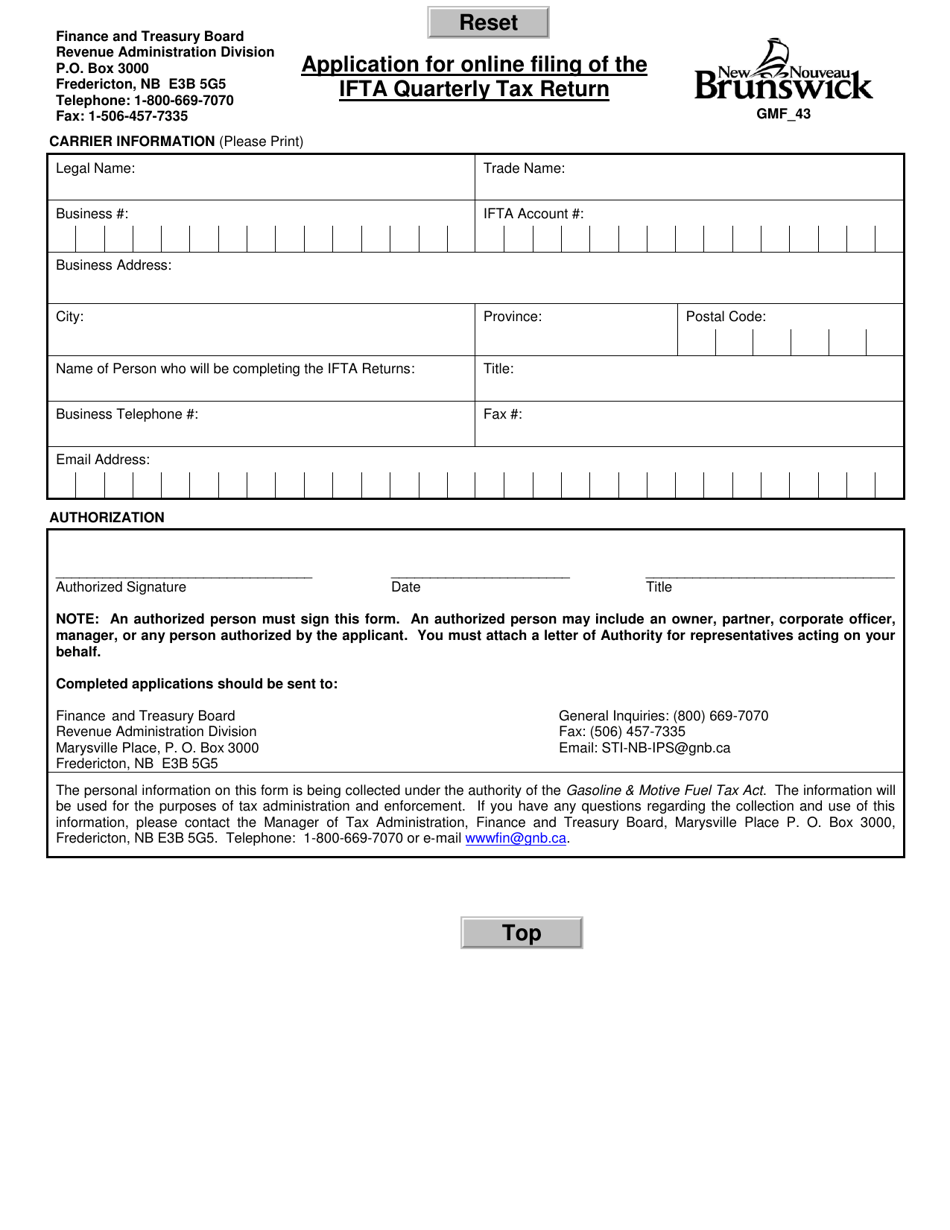

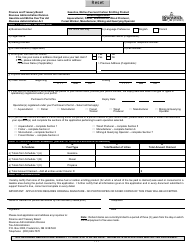

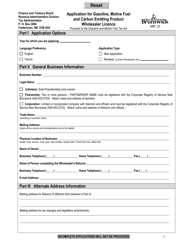

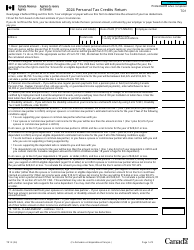

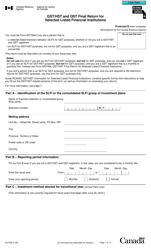

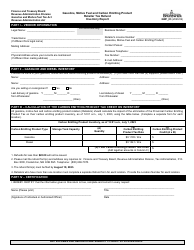

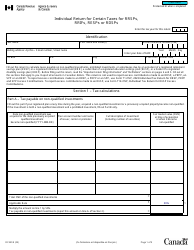

Form GMF_43 Application for Online Filing of the Ifta Quarterly Tax Return - New Brunswick, Canada

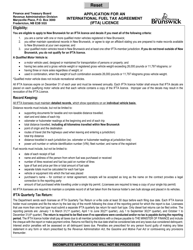

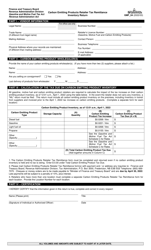

Form GMF_43 Application for Online Filing of the Ifta Quarterly Tax Return is used in New Brunswick, Canada for filing the IFTA (International Fuel Tax Agreement) quarterly tax return online. This form is specifically for reporting and calculating the taxes owed on fuel usage by commercial motor vehicles that operate in multiple jurisdictions.

The Form GMF_43 Application for Online Filing of the Ifta Quarterly Tax Return in New Brunswick, Canada is filed by commercial vehicle operators who are registered under the International Fuel Tax Agreement (IFTA).

FAQ

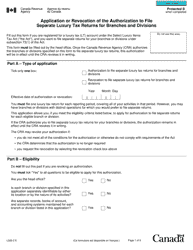

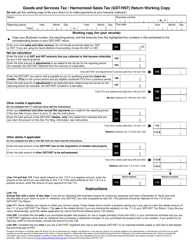

Q: What is IFTA?

A: IFTA stands for International Fuel Tax Agreement. It is an agreement among U.S. states and Canadian provinces for the redistribution of fuel taxes paid by interstate motor carriers.

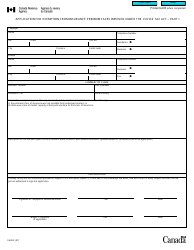

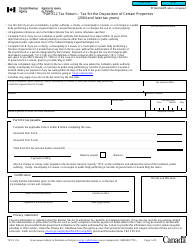

Q: Who needs to file the IFTA Quarterly Tax Return?

A: Motor carriers who operate qualifying vehicles in more than one jurisdiction and are registered under IFTA need to file the IFTA Quarterly Tax Return.

Q: What is the purpose of filing the IFTA Quarterly Tax Return?

A: The purpose is to report and pay the fuel taxes owed to the jurisdictions in which the motor carriers have operated their vehicles.

Q: Is the GMF_43 Application mandatory?

A: Yes, if you are a registered motor carrier under IFTA in New Brunswick, Canada, you must file the IFTA Quarterly Tax Return using the GMF_43 Application.

Q: Are there any penalties for not filing the IFTA Quarterly Tax Return?

A: Yes, failure to file the IFTA Quarterly Tax Return or pay the required taxes can result in penalties, fines, and the suspension or revocation of IFTA credentials.