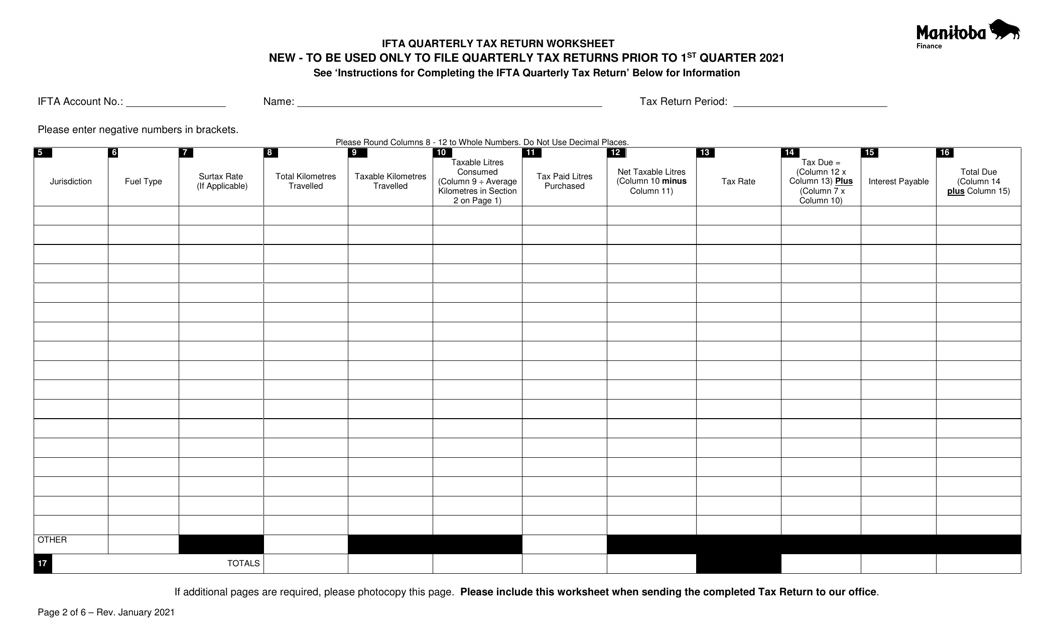

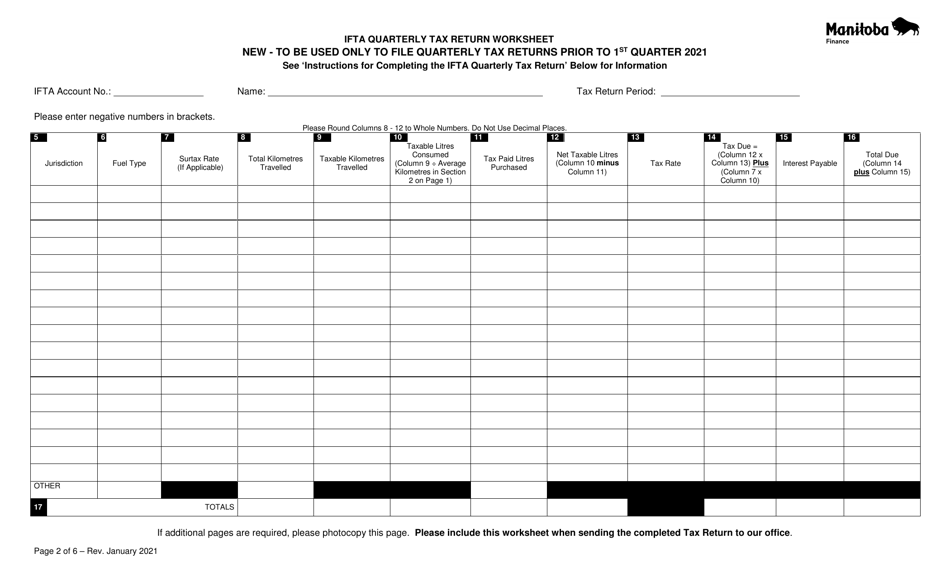

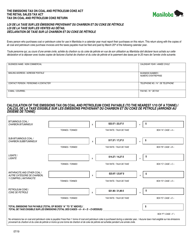

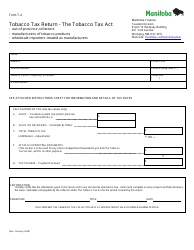

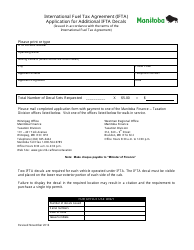

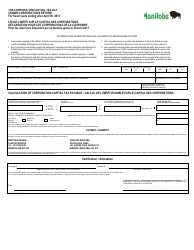

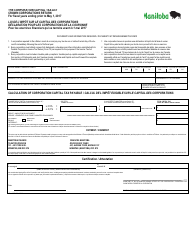

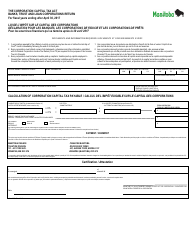

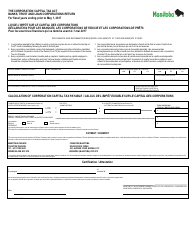

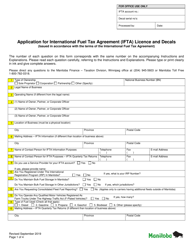

Ifta Quarterly Tax Return Worksheet - Manitoba, Canada

The IFTA Quarterly Tax Return Worksheet is a document used in Manitoba, Canada for reporting and calculating fuel taxes owed by qualified motor carriers operating in multiple jurisdictions.

The IFTA Quarterly Tax Return Worksheet in Manitoba, Canada is filed by the motor carrier or fleet owner.

FAQ

Q: What is the IFTA Quarterly Tax Return Worksheet?

A: The IFTA (International Fuel Tax Agreement) Quarterly Tax Return Worksheet is a form used to report and calculate fuel taxes for commercial vehicles operating in multiple jurisdictions.

Q: Who needs to file the IFTA Quarterly Tax Return Worksheet?

A: Commercial vehicle operators who travel across multiple jurisdictions and use taxable fuel are required to file the IFTA Quarterly Tax Return Worksheet.

Q: What is the purpose of the IFTA Quarterly Tax Return Worksheet?

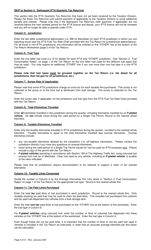

A: The purpose of the IFTA Quarterly Tax Return Worksheet is to calculate and report the amount of fuel tax owed based on the number of miles traveled in each jurisdiction.

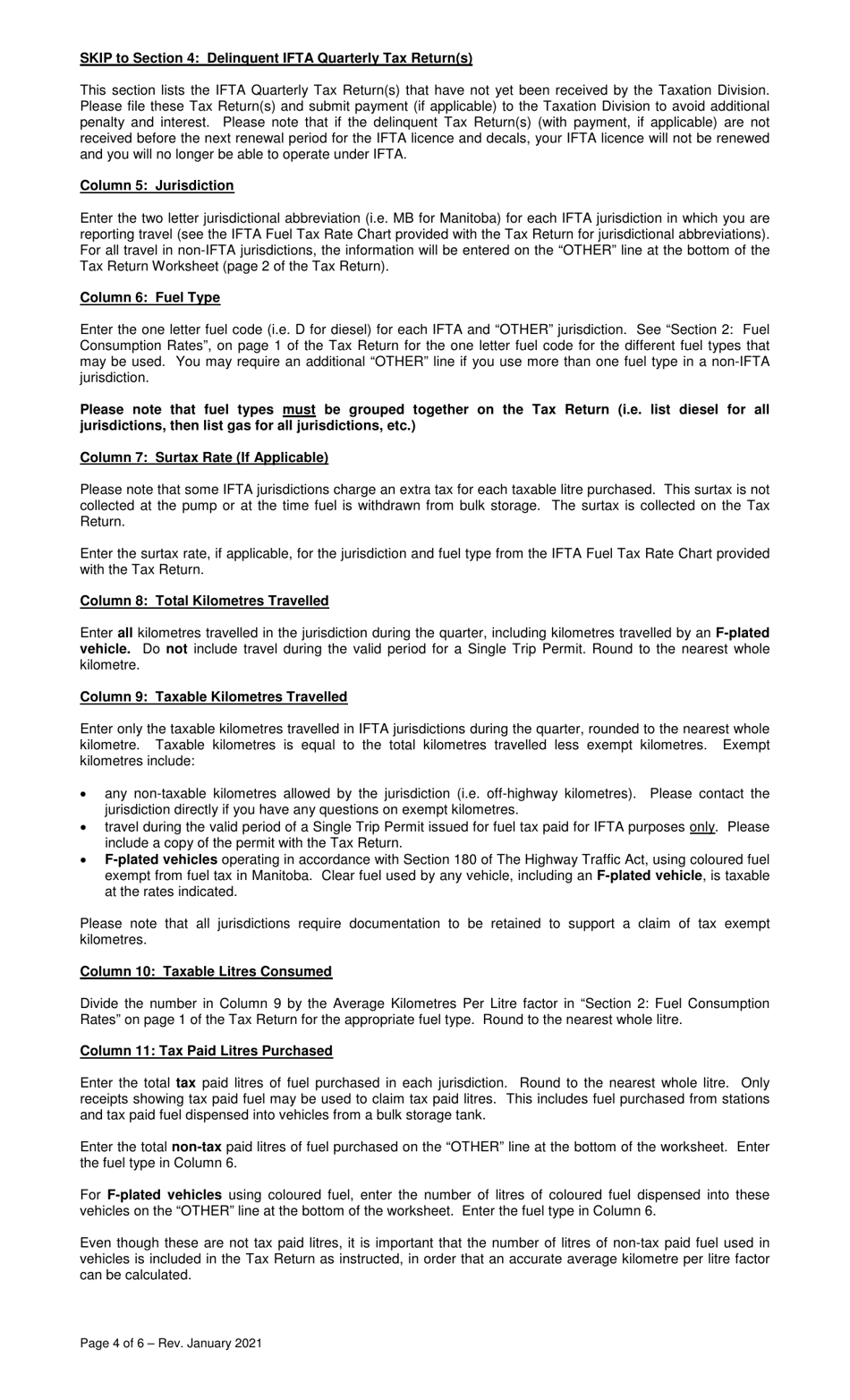

Q: What information is required to complete the IFTA Quarterly Tax Return Worksheet?

A: To complete the IFTA Quarterly Tax Return Worksheet, you will need information on the total miles traveled in each jurisdiction, total gallons of fuel purchased, and fuel consumed in each jurisdiction.

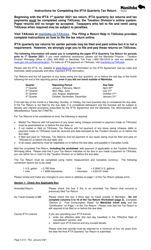

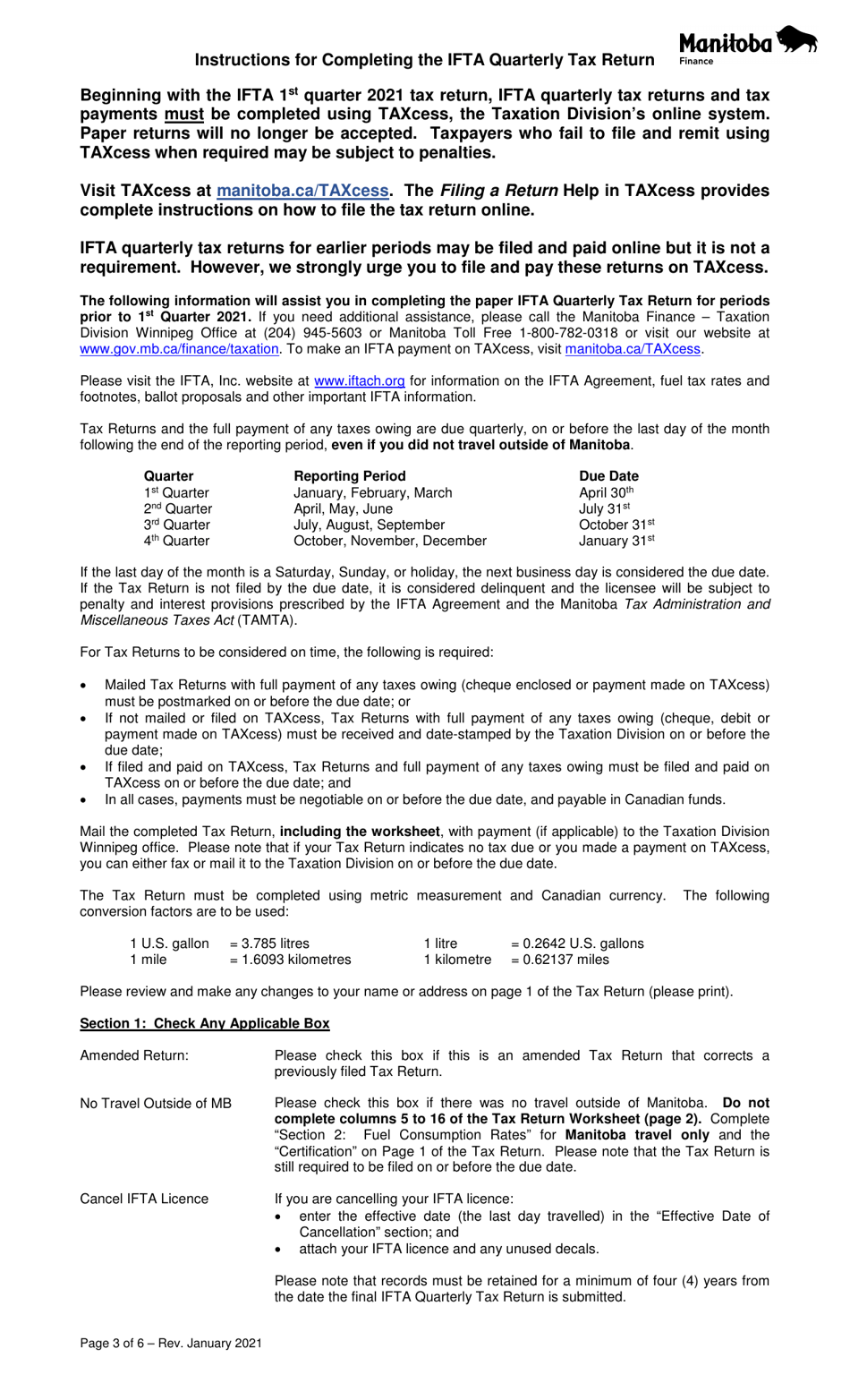

Q: How often do I need to file the IFTA Quarterly Tax Return Worksheet?

A: The IFTA Quarterly Tax Return Worksheet needs to be filed on a quarterly basis, with the due dates generally falling on the last day of the month following the end of the quarter.