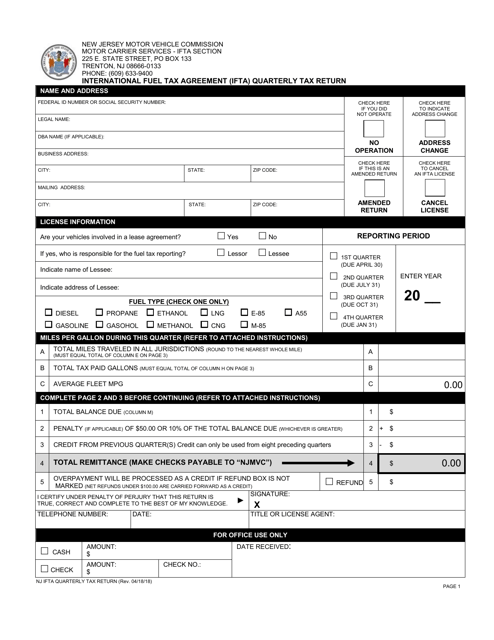

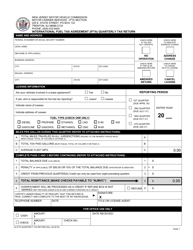

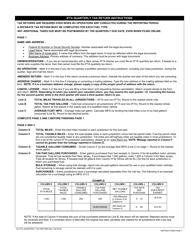

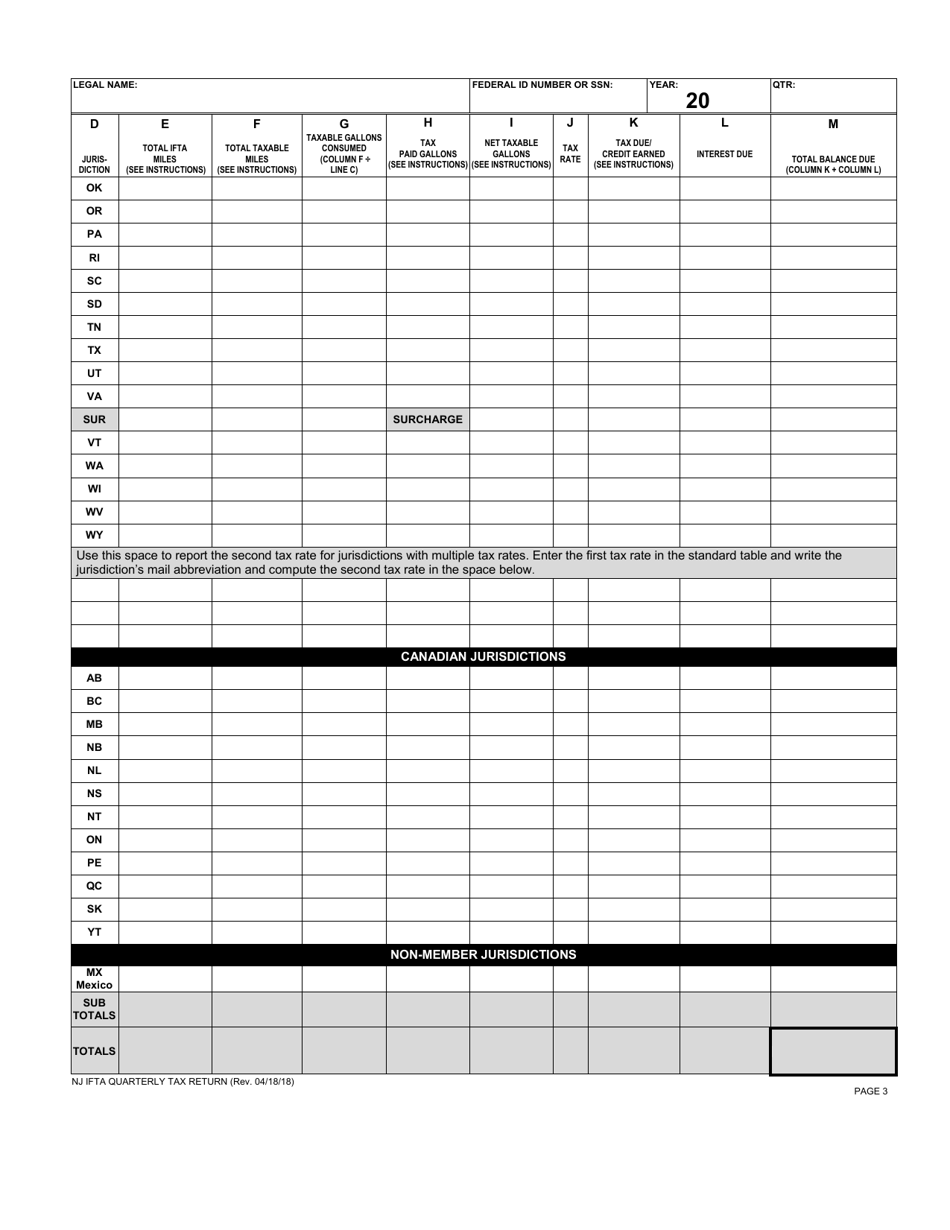

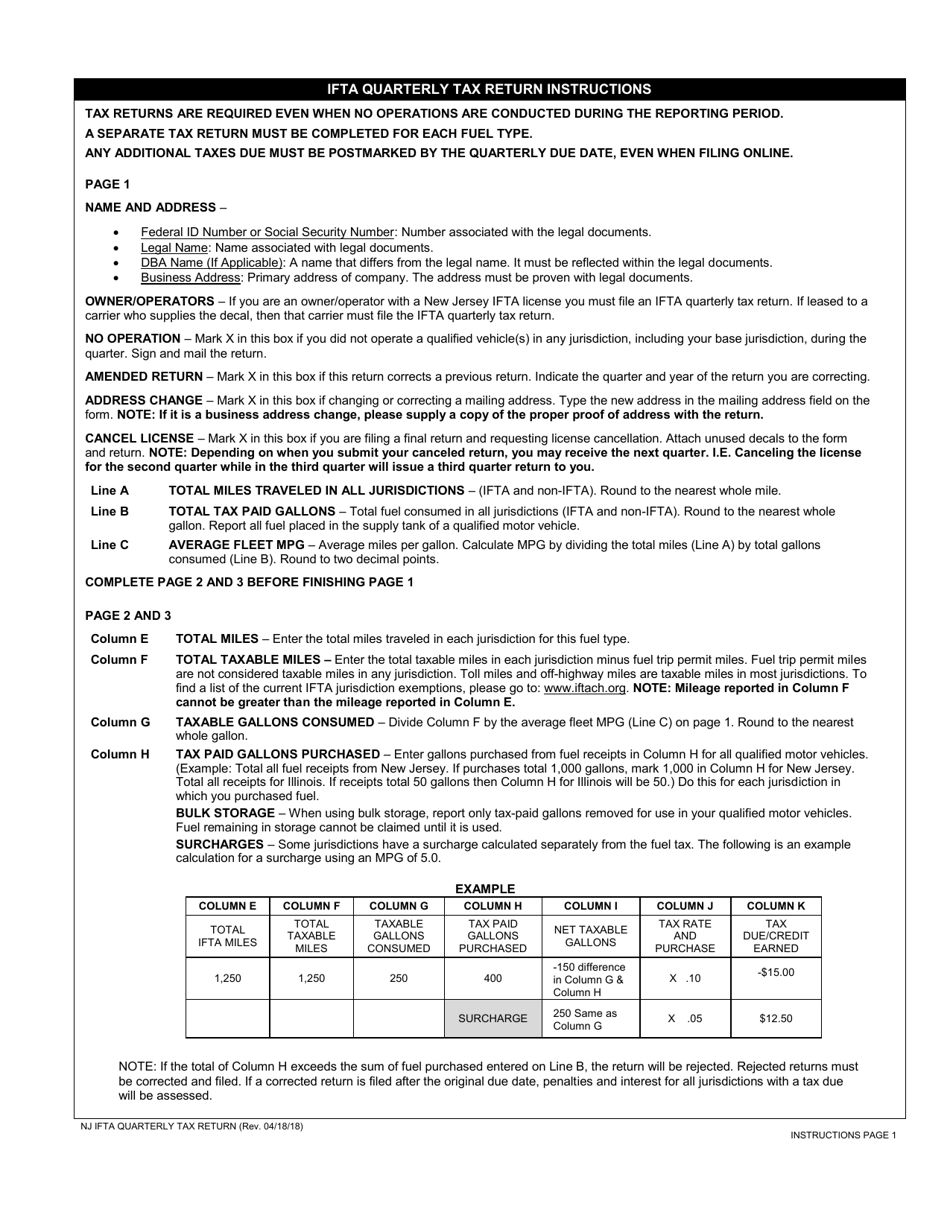

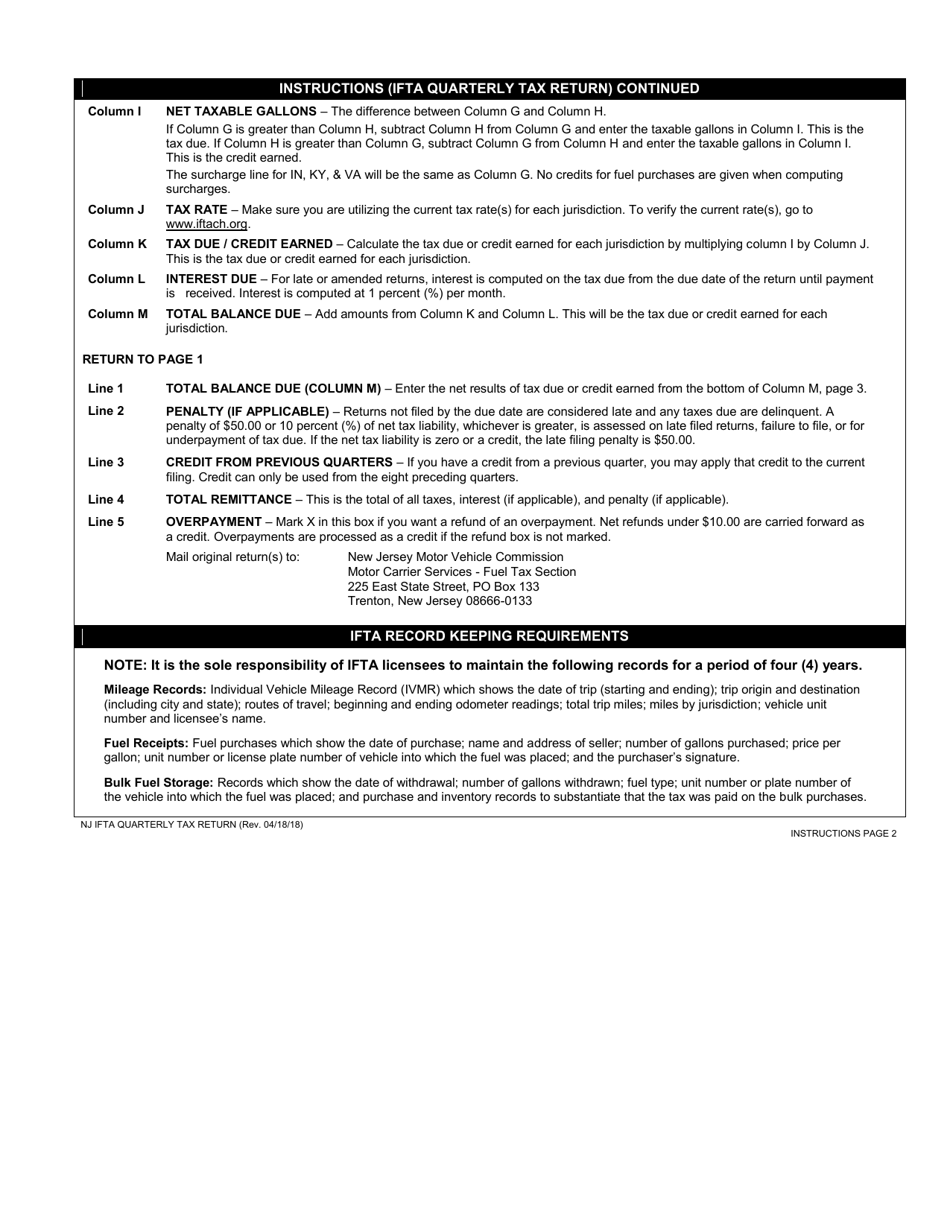

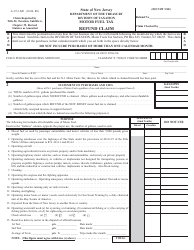

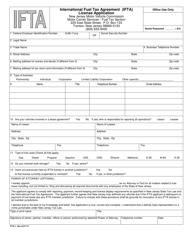

International Fuel Tax Agreement (Ifta) Quarterly Tax Return - New Jersey

International Fuel Quarterly Tax Return is a legal document that was released by the New Jersey Motor Vehicle Commission - a government authority operating within New Jersey.

FAQ

Q: What is the International Fuel Tax Agreement (IFTA)?

A: The International Fuel Tax Agreement (IFTA) is an agreement among U.S. states and Canadian provinces to simplify the reporting and payment of fuel taxes for motor carriers operating in multiple jurisdictions.

Q: What is the IFTA Quarterly Tax Return?

A: The IFTA Quarterly Tax Return is a report that motor carriers must file to calculate and report the amount of fuel taxes owed to each jurisdiction under the IFTA.

Q: Who needs to file the IFTA Quarterly Tax Return?

A: Motor carriers who operate qualified motor vehicles in multiple jurisdictions and meet the IFTA mileage requirements are required to file the IFTA Quarterly Tax Return.

Q: What is a qualified motor vehicle?

A: A qualified motor vehicle is a motor vehicle used, designed, or maintained for transportation of persons or property and fits one or more of the following criteria: (1) have two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds; (2) have three or more axles regardless of weight; or (3) is used in combination, when the weight of such combination exceeds 26,000 pounds gross vehicle or registered gross vehicle weight.

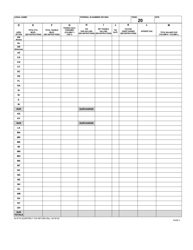

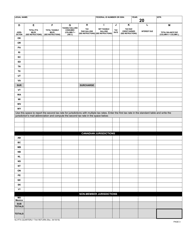

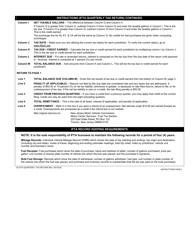

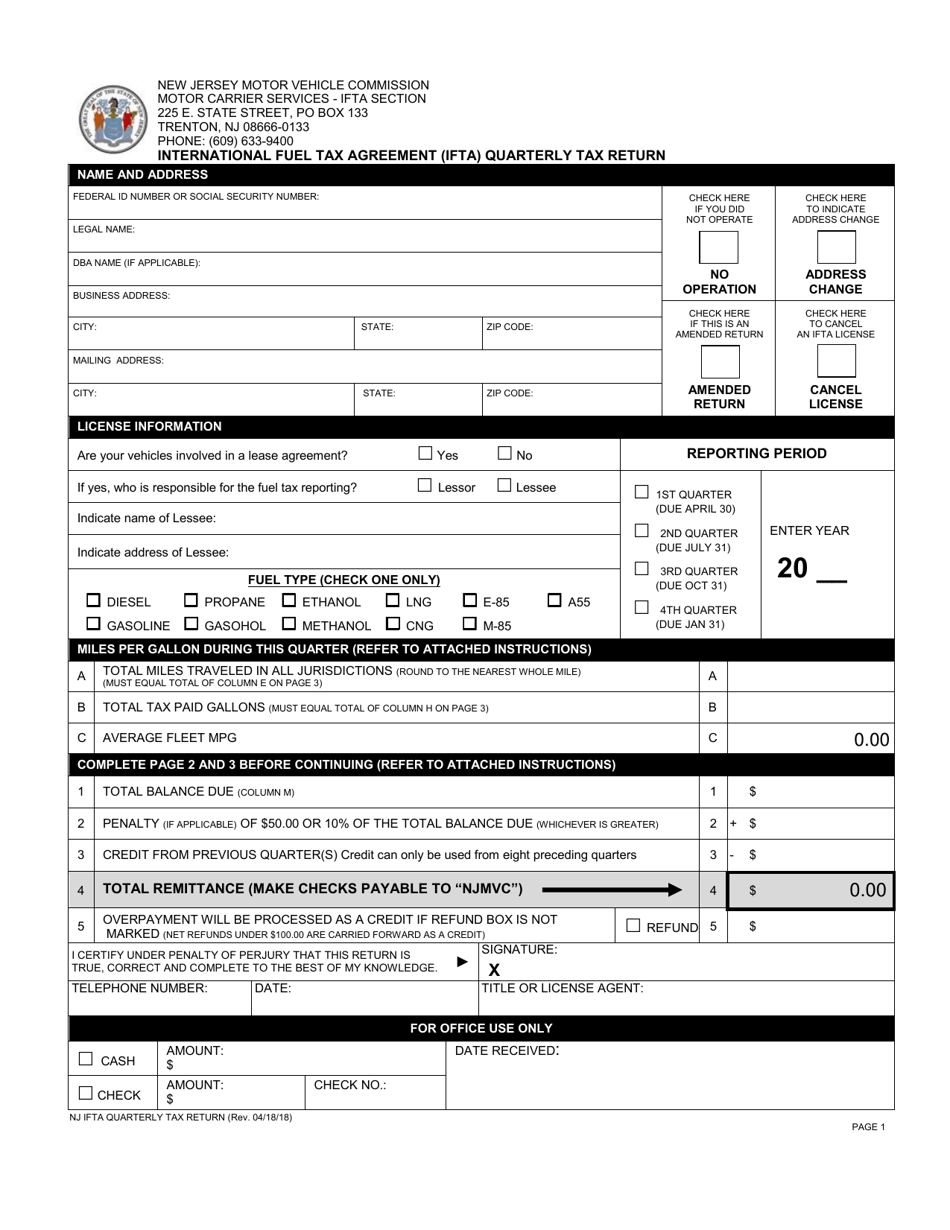

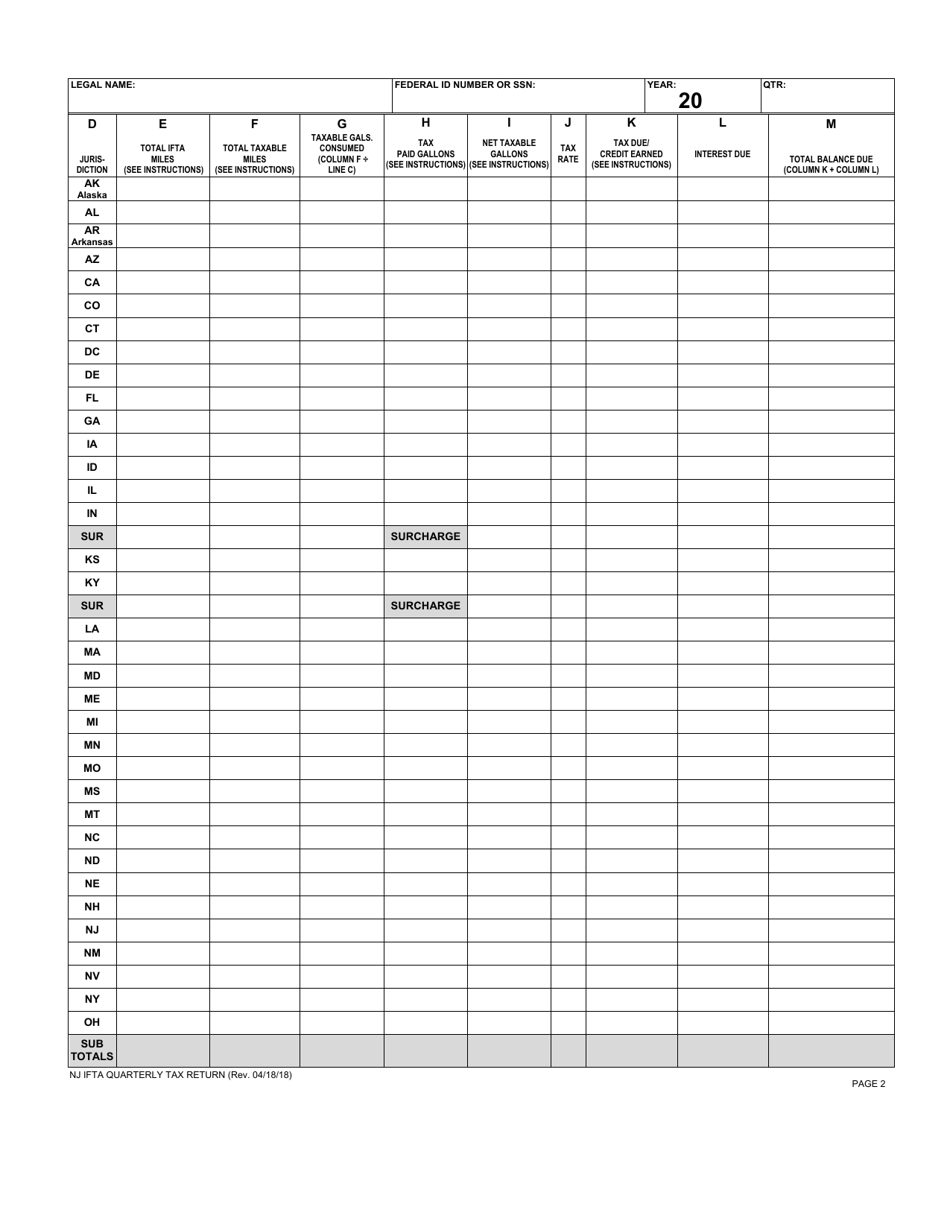

Q: What information do I need to complete the IFTA Quarterly Tax Return?

A: To complete the IFTA Quarterly Tax Return, you will need information about the total miles traveled and the total gallons of fuel consumed in each jurisdiction, as well as other relevant information such as fuel purchases, fuel credits, and fuel tax rates for each jurisdiction.

Q: How often do I need to file the IFTA Quarterly Tax Return?

A: The IFTA Quarterly Tax Return must be filed with the jurisdiction where you are registered on a quarterly basis. The due dates for filing vary by jurisdiction, but generally fall on the last day of the month following the end of each quarter.

Q: What happens if I fail to file or pay the IFTA taxes?

A: Failure to file or pay the IFTA taxes can result in penalties and interest charges, as well as possible suspension or revocation of your IFTA license.

Form Details:

- Released on April 18, 2018;

- The latest edition currently provided by the New Jersey Motor Vehicle Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Motor Vehicle Commission.