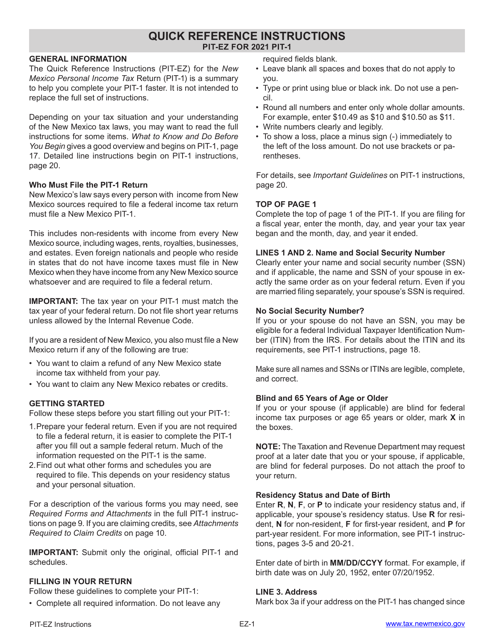

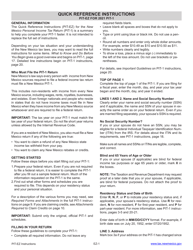

Form PIT-EZ Quick Reference Instructions for New Mexico Personal Income Tax Return - New Mexico

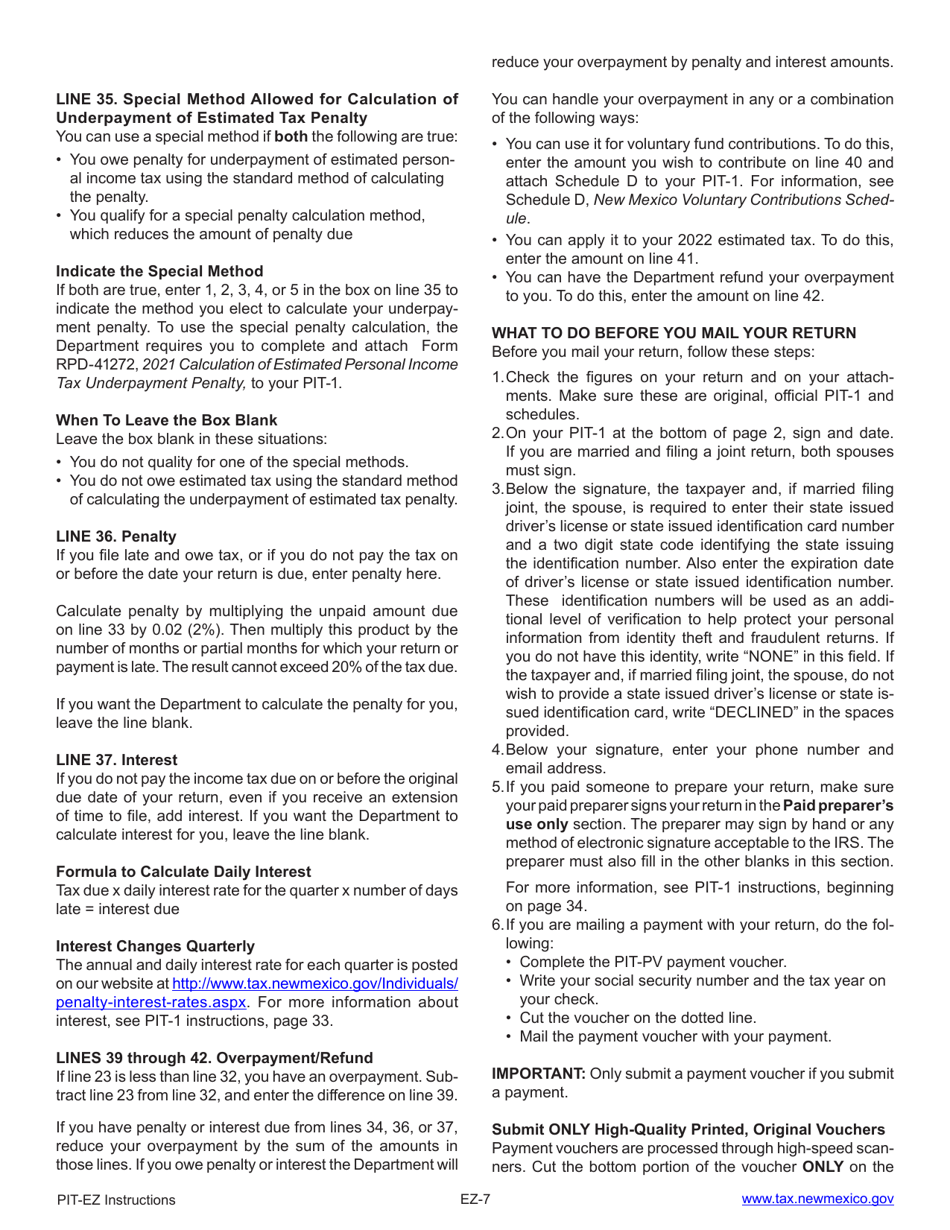

What Is Form PIT-EZ?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

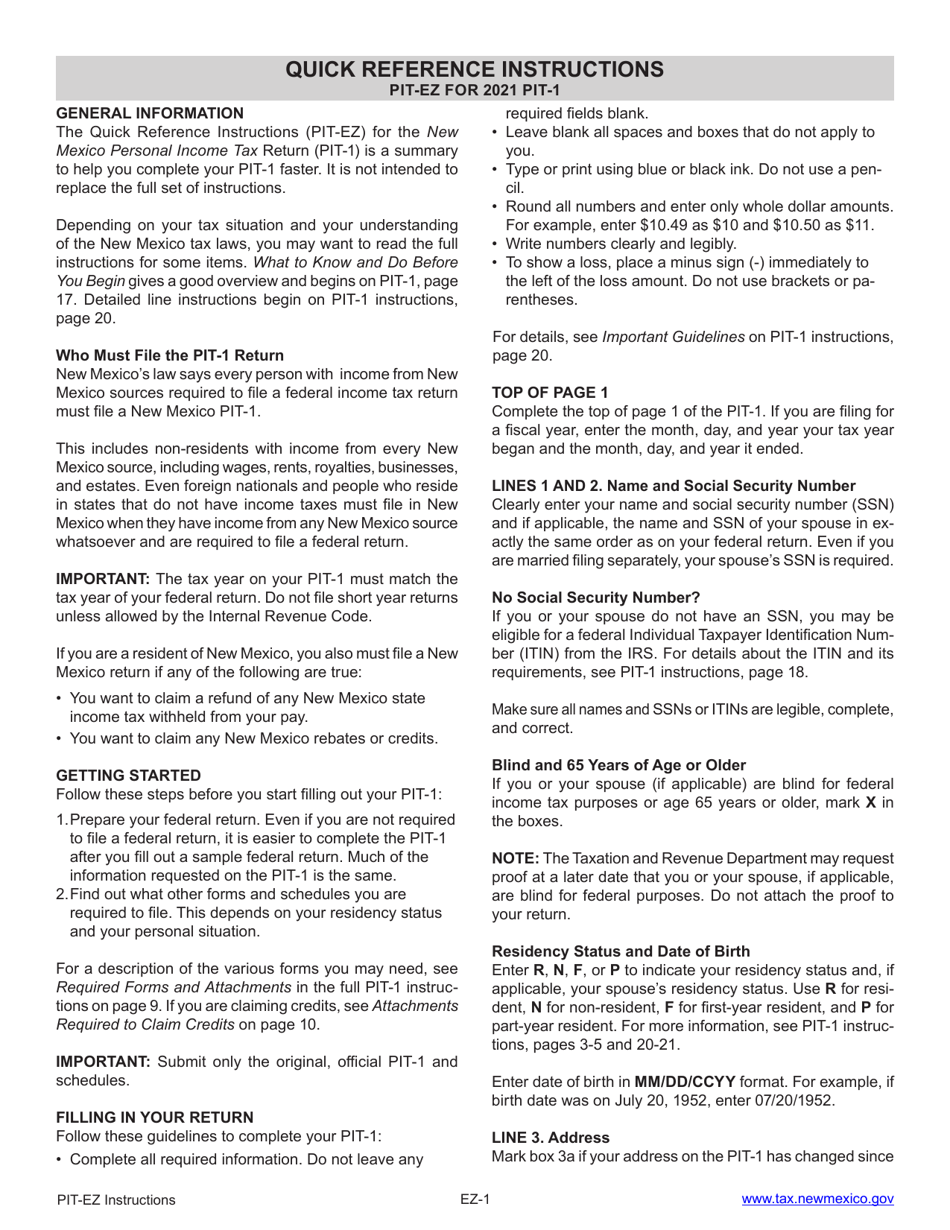

Q: What is the PIT-EZ form?

A: The PIT-EZ form is the New Mexico Personal Income Tax Return form.

Q: Who should use the PIT-EZ form?

A: The PIT-EZ form is for New Mexico residents who have simple tax situations.

Q: What is the purpose of the PIT-EZ form?

A: The purpose of the PIT-EZ form is to report and calculate New Mexico personal income tax.

Q: Is the PIT-EZ form available for non-residents?

A: No, the PIT-EZ form is only for New Mexico residents.

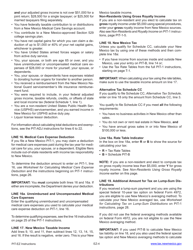

Q: What types of income should be reported on the PIT-EZ form?

A: The PIT-EZ form should include income from wages, salaries, dividends, and other sources.

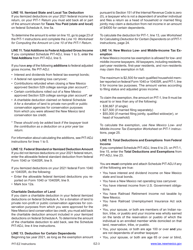

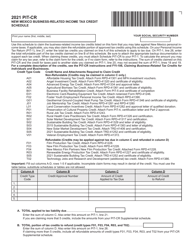

Q: Are there any deductions or credits available on the PIT-EZ form?

A: Yes, deductions and credits for dependents, retirement contributions, and other expenses may be claimed on the PIT-EZ form.

Q: When is the deadline to file the PIT-EZ form?

A: The deadline to file the PIT-EZ form is usually April 15th of each year.

Q: Can I file the PIT-EZ form electronically?

A: Yes, the PIT-EZ form can be filed electronically through the New Mexico Taxpayer Access Point (TAP) system.

Q: What should I do if I need help with the PIT-EZ form?

A: If you need help with the PIT-EZ form, you can contact the New Mexico Taxation and Revenue Department or seek assistance from a tax professional.

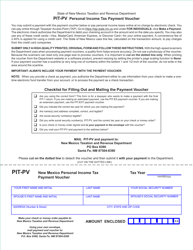

Form Details:

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

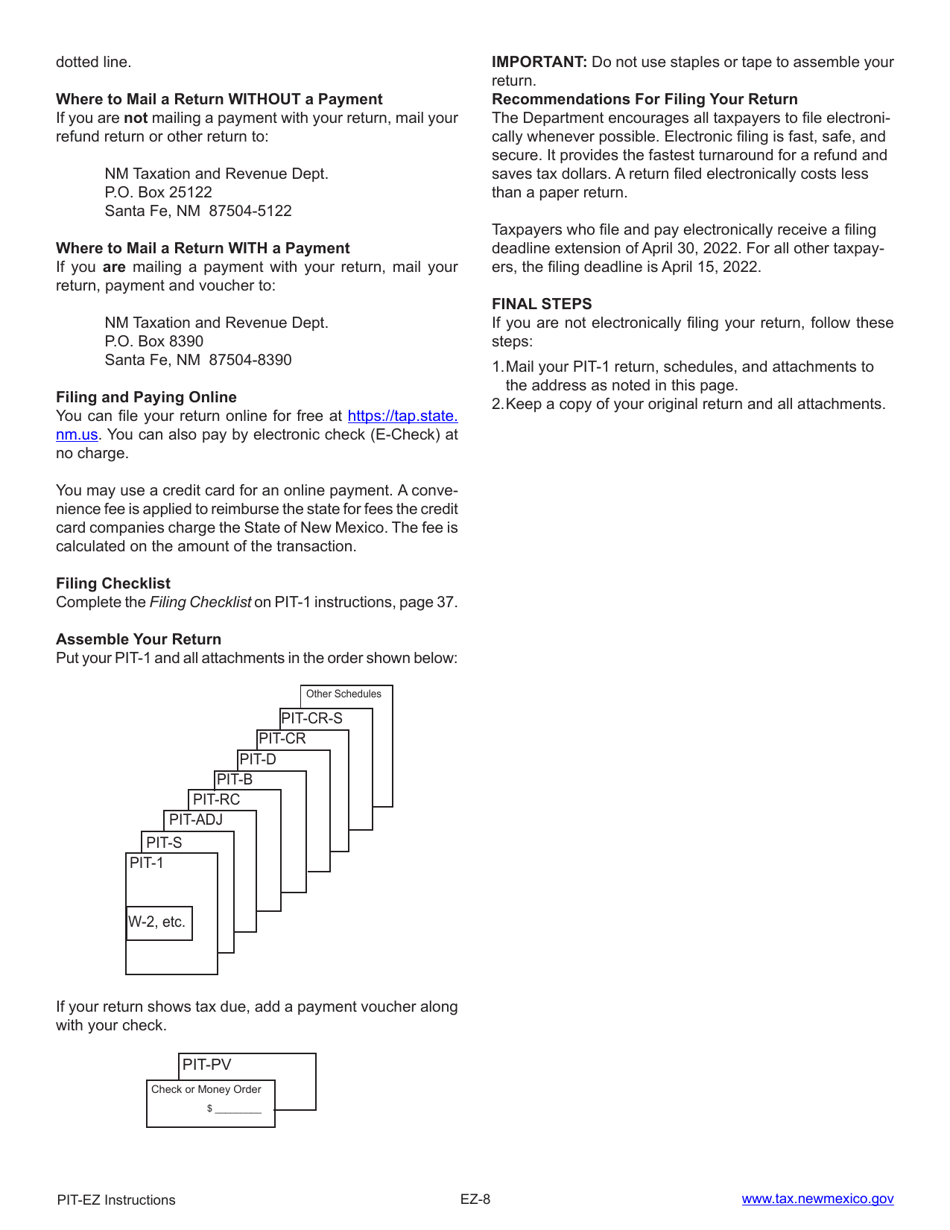

Download a printable version of Form PIT-EZ by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.