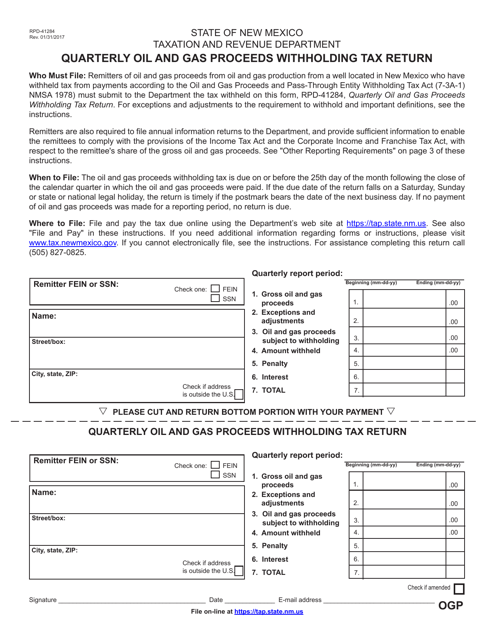

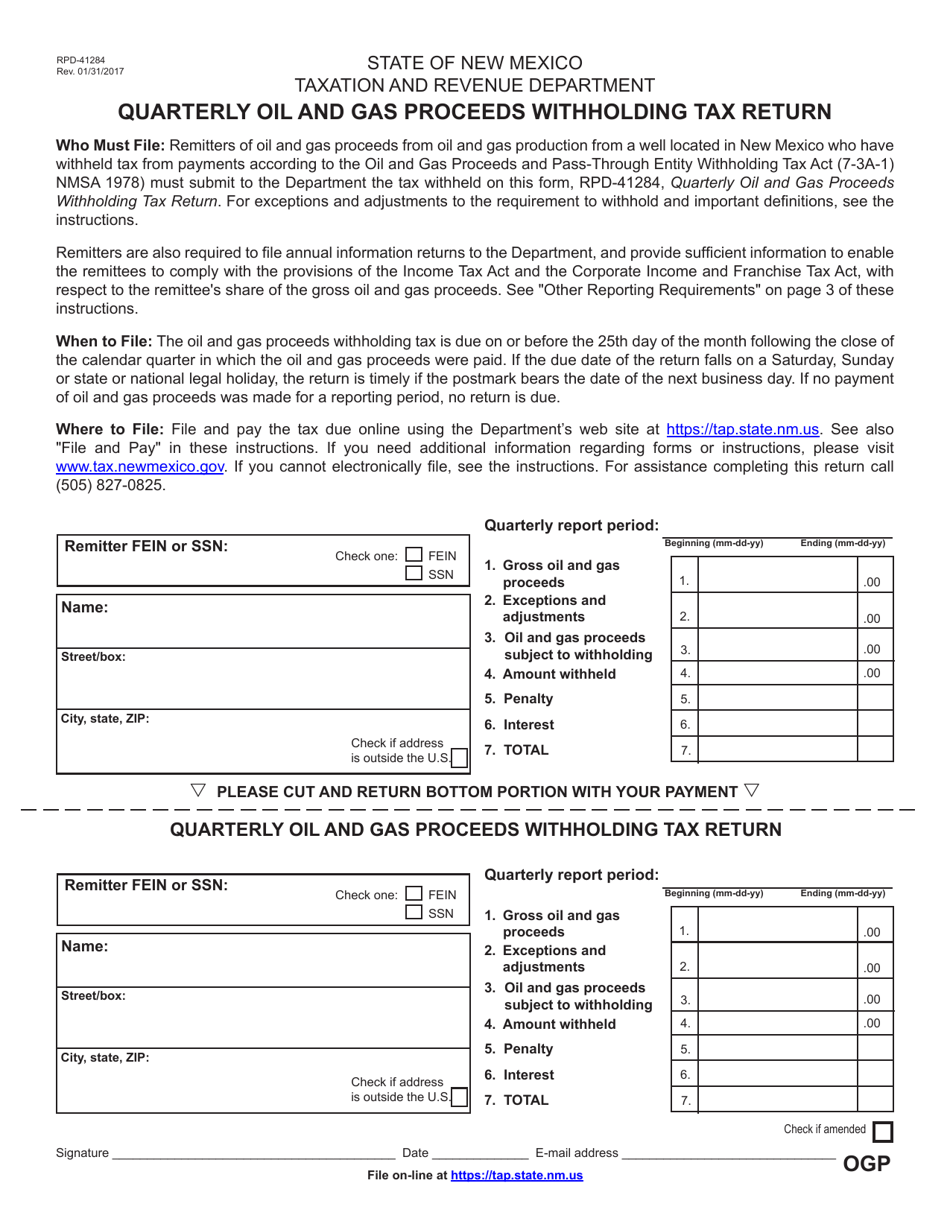

Form RPD-41284 Quarterly Oil and Gas Proceeds Withholding Tax Return - New Mexico

What Is Form RPD-41284?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RPD-41284?

A: Form RPD-41284 is a Quarterly Oil and Gas Proceeds Withholding Tax Return in New Mexico.

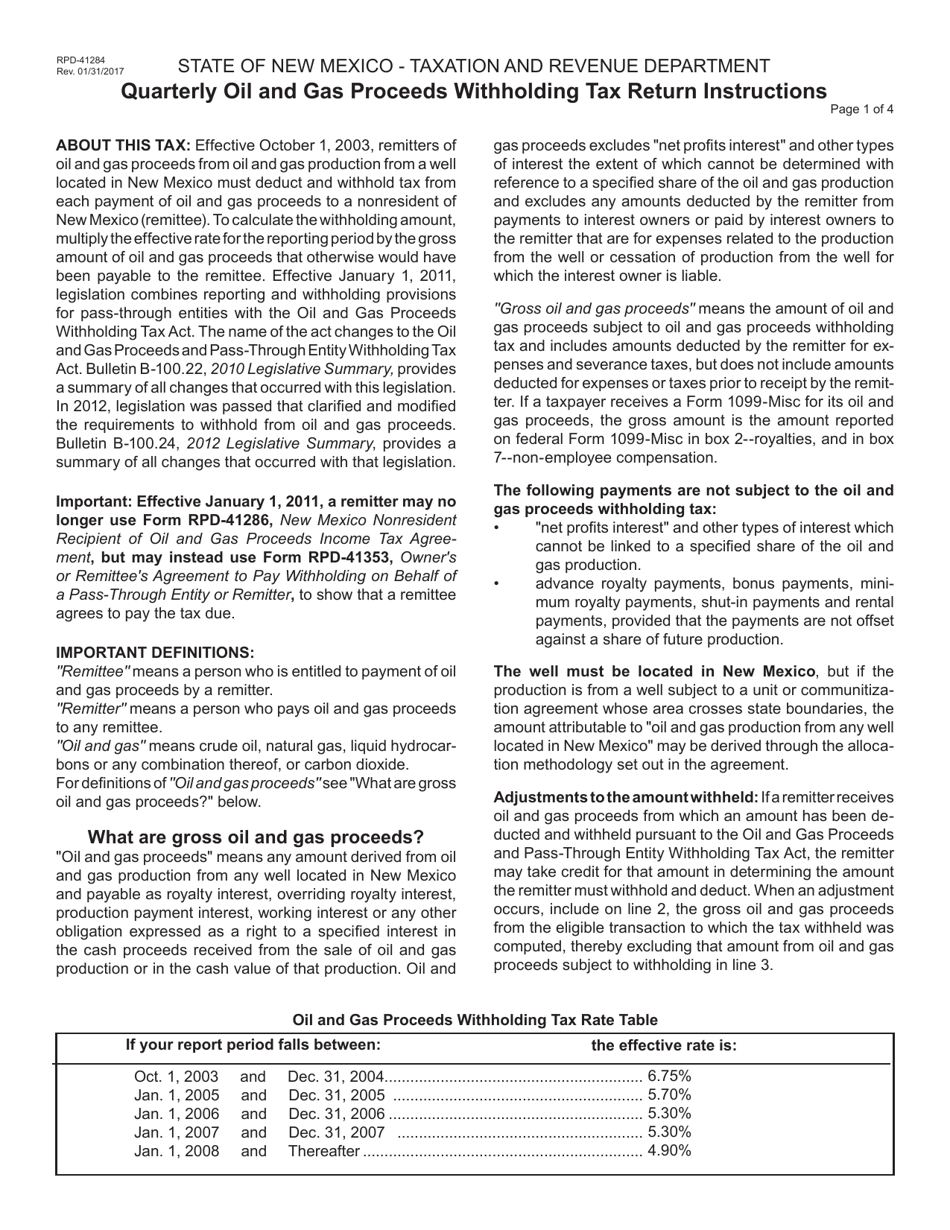

Q: Who needs to file Form RPD-41284?

A: Individuals or entities who receive oil and gas proceeds in New Mexico and are required to withhold taxes from these proceeds.

Q: What is the purpose of Form RPD-41284?

A: The purpose of Form RPD-41284 is to report and remit the withholding taxes on oil and gas proceeds in New Mexico.

Q: How often should Form RPD-41284 be filed?

A: Form RPD-41284 should be filed on a quarterly basis.

Q: What information is required on Form RPD-41284?

A: Form RPD-41284 requires information such as taxpayer identification number, name and address, and details of oil and gas proceeds and withholding taxes.

Q: Is there a deadline for filing Form RPD-41284?

A: Yes, Form RPD-41284 must be filed by the last day of the month following the end of each calendar quarter.

Q: Are there any penalties for late or incorrect filing of Form RPD-41284?

A: Yes, there may be penalties for late or incorrect filing of Form RPD-41284, including interest and possible legal action.

Q: Can Form RPD-41284 be filed electronically?

A: Yes, taxpayers have the option to file Form RPD-41284 electronically through the New Mexico Taxpayer Access Point (TAP) system.

Q: What should I do if I have questions or need assistance with Form RPD-41284?

A: For questions or assistance with Form RPD-41284, you can contact the New Mexico Taxation and Revenue Department or consult a tax professional.

Form Details:

- Released on January 31, 2017;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41284 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.