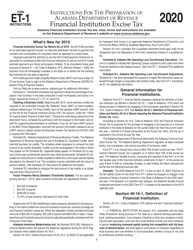

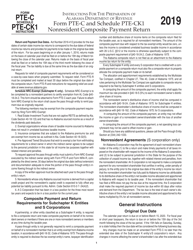

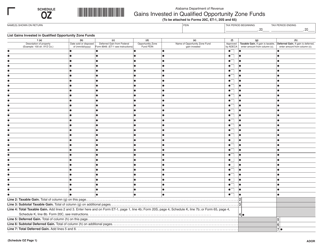

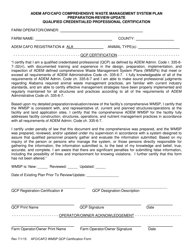

This version of the form is not currently in use and is provided for reference only. Download this version of

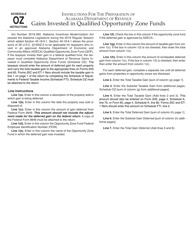

Instructions for Schedule QIP-C

for the current year.

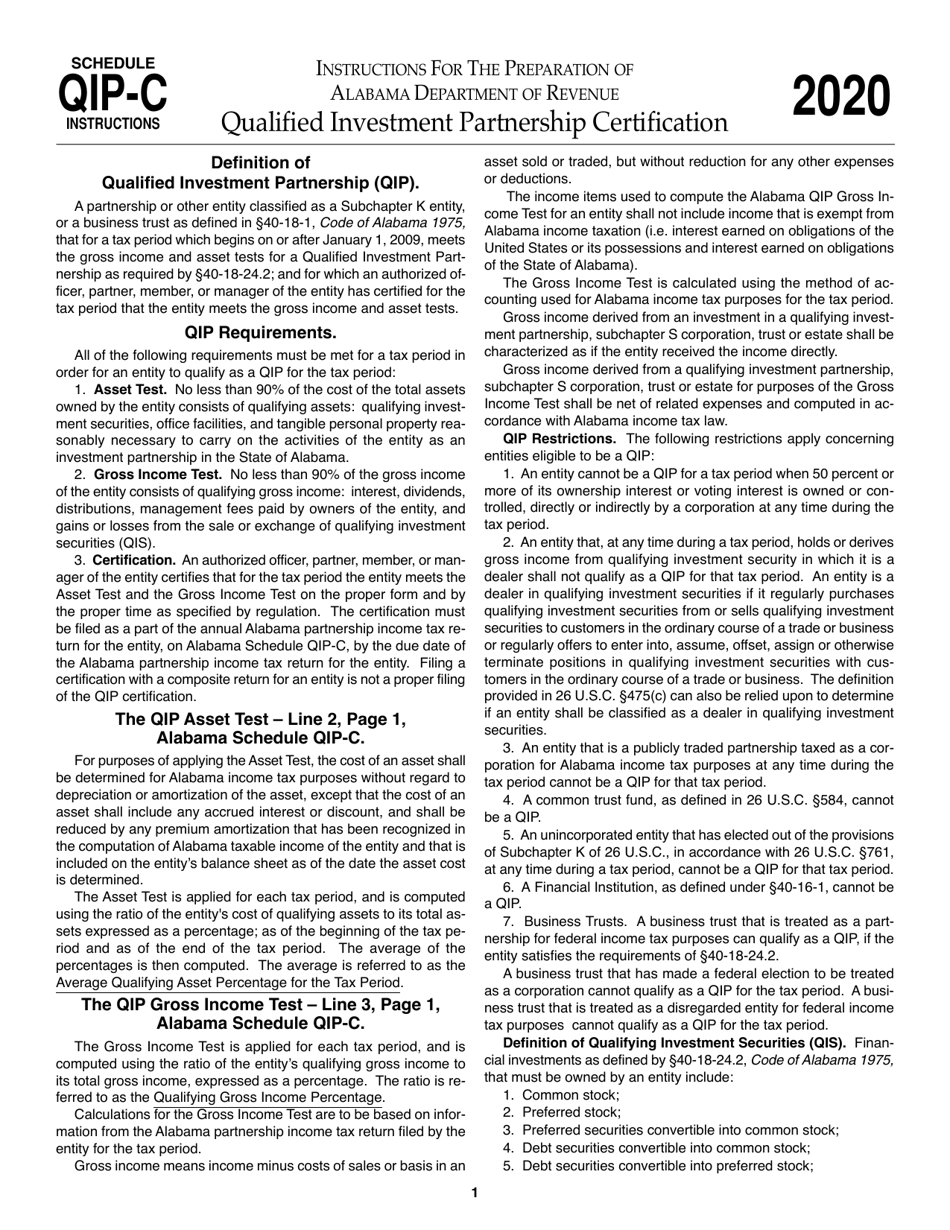

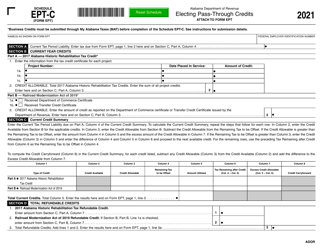

Instructions for Schedule QIP-C Qualified Investment Partnership Certification - Alabama

This document contains official instructions for Schedule QIP-C , Qualified Investment Partnership Certification - a form released and collected by the Alabama Department of Revenue.

FAQ

Q: What is Schedule QIP-C?

A: Schedule QIP-C is a form used for Qualified Investment Partnership Certification in Alabama.

Q: Who needs to fill out Schedule QIP-C?

A: Qualified investment partnerships in Alabama need to fill out Schedule QIP-C.

Q: What is a qualified investment partnership?

A: A qualified investment partnership is a partnership that meets certain criteria set by the state of Alabama.

Q: What information is required in Schedule QIP-C?

A: Schedule QIP-C requires information about the partnership, its partners, and its investments in Alabama.

Q: Is there a deadline for filing Schedule QIP-C?

A: Yes, Schedule QIP-C must be filed by the due date for the partnership's Alabama tax return.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.