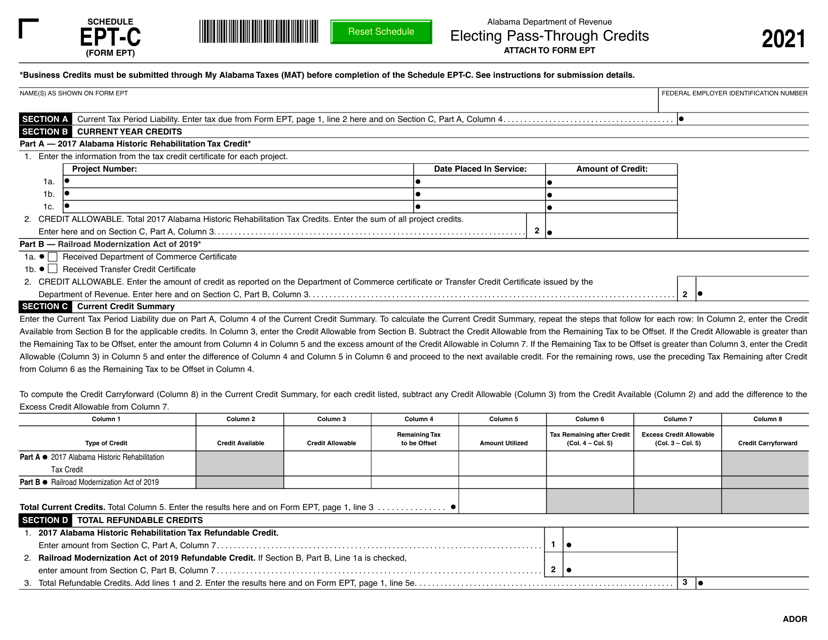

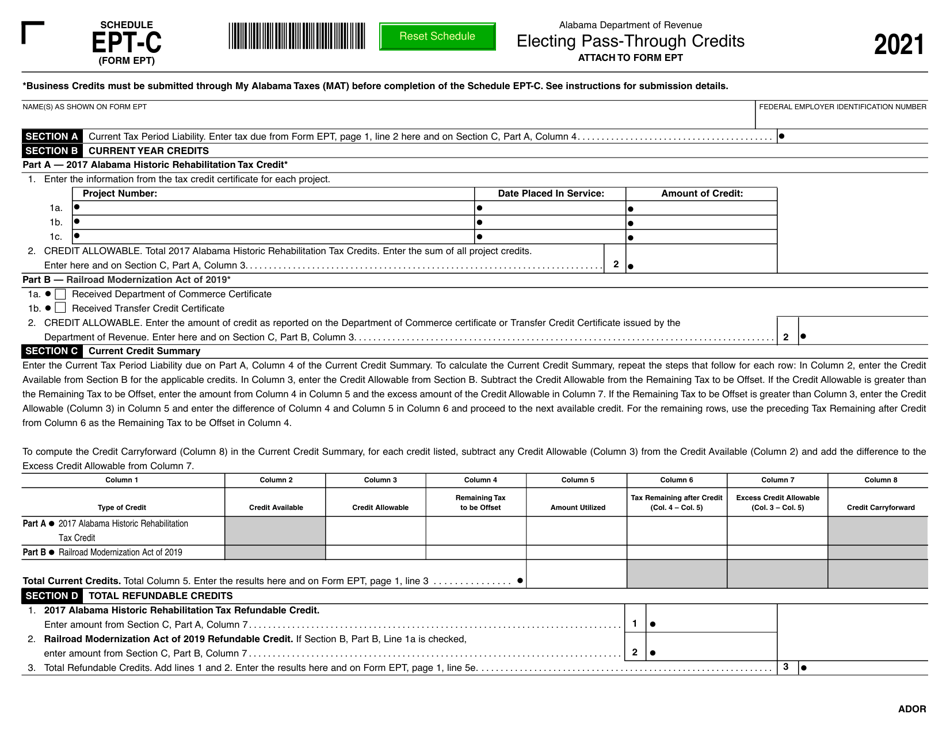

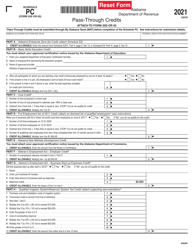

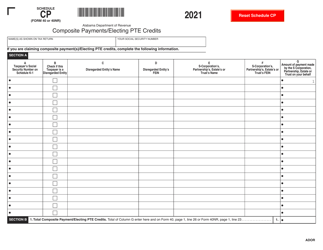

Form EPT Schedule EPT-C Electing Pass-Through Credits - Alabama

What Is Form EPT Schedule EPT-C?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EPT Schedule EPT-C?

A: Form EPT Schedule EPT-C is a form used by Alabama taxpayers to elect pass-through credits.

Q: What are pass-through credits?

A: Pass-through credits are tax credits that are passed through to individual taxpayers from businesses or entities in which they have an ownership interest.

Q: Who should use Form EPT Schedule EPT-C?

A: Form EPT Schedule EPT-C should be used by Alabama taxpayers who want to elect pass-through credits.

Q: What types of pass-through credits can be elected using this form?

A: This form can be used to elect various pass-through credits, such as historic structure rehabilitation credits, new markets tax credits, and rural or urban revitalization credits.

Q: Are there any requirements or qualifications to be eligible for pass-through credits?

A: Yes, there are specific requirements and qualifications for each type of pass-through credit. Taxpayers should review the instructions provided with Form EPT Schedule EPT-C or consult with a tax professional.

Q: When is Form EPT Schedule EPT-C due?

A: The due date for filing Form EPT Schedule EPT-C is the same as the due date for the taxpayer's income tax return, typically April 15th.

Q: Do I need to attach any supporting documentation with Form EPT Schedule EPT-C?

A: Yes, taxpayers should attach any required supporting documentation specified in the instructions for Form EPT Schedule EPT-C.

Q: What should I do if I have questions or need assistance with Form EPT Schedule EPT-C?

A: If you have questions or need assistance, you can contact the Alabama Department of Revenue or consult with a tax professional.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EPT Schedule EPT-C by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.