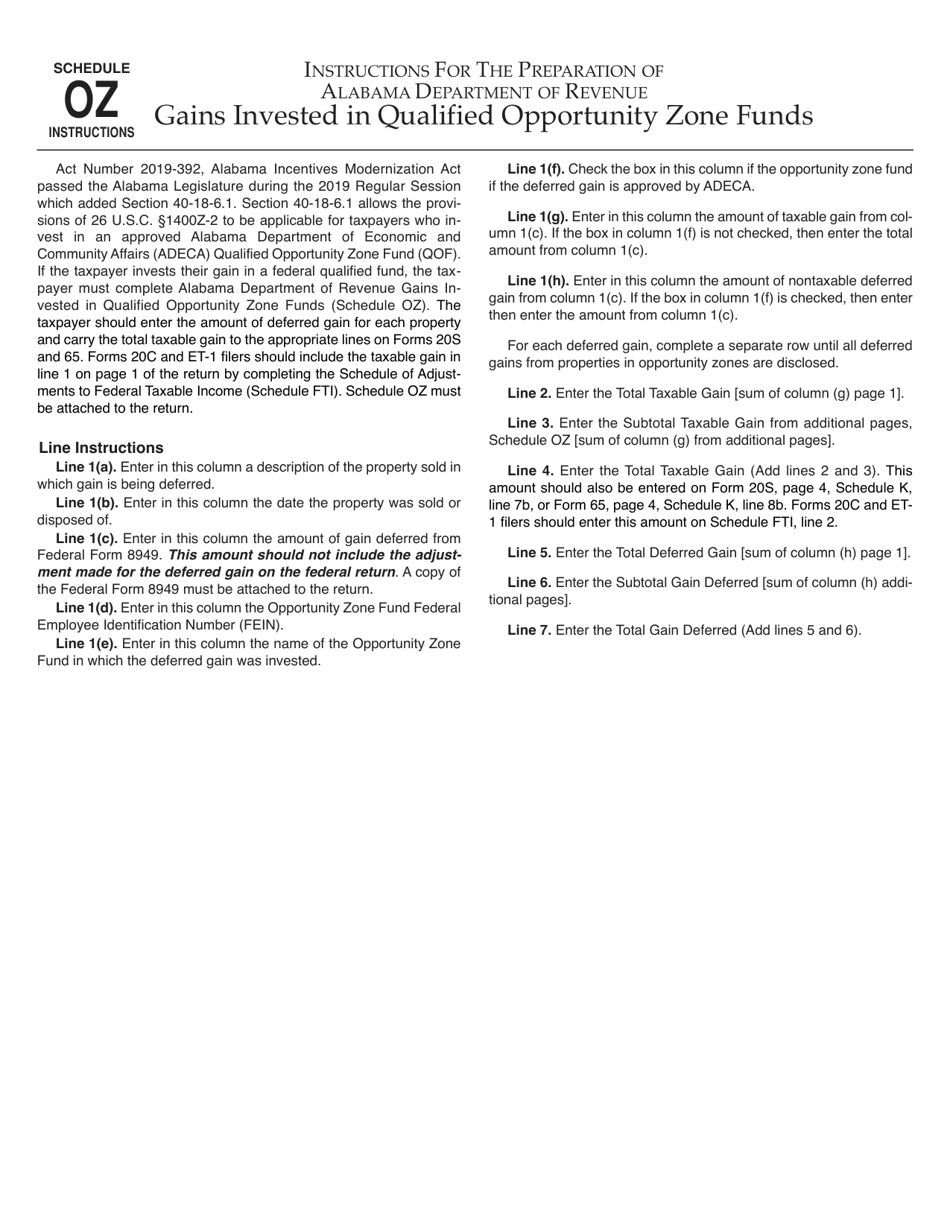

Instructions for Schedule OZ Gains Invested in Qualified Opportunity Zone Funds - Alabama

This document contains official instructions for Schedule OZ , Gains Invested in Qualified Opportunity Zone Funds - a form released and collected by the Alabama Department of Revenue.

FAQ

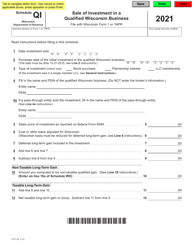

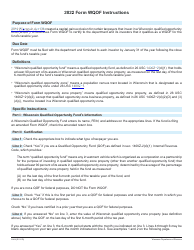

Q: What is Schedule OZ?

A: Schedule OZ is a tax form used to report gains invested in Qualified Opportunity Zone (QOZ) funds.

Q: What are Qualified Opportunity Zone (QOZ) funds?

A: Qualified Opportunity Zone (QOZ) funds are investment vehicles that allow taxpayers to defer and potentially reduce capital gains taxes by investing in designated low-income areas known as Opportunity Zones.

Q: Who is required to file Schedule OZ?

A: Individuals or entities who have invested in QOZ funds and need to report the gains on their taxes must file Schedule OZ.

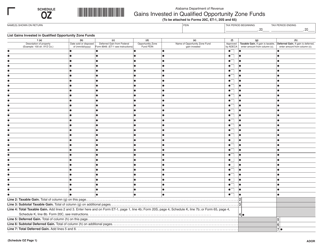

Q: What information is required on Schedule OZ?

A: Schedule OZ requires the taxpayer to provide detailed information about the QOZ funds in which they have invested, including the amount of gains invested, the name and Employer Identification Number (EIN) of the QOZ fund, and other relevant information.

Q: Are there any deadlines for filing Schedule OZ?

A: Schedule OZ must be filed with the taxpayer's federal income tax return for the year in which the gains were invested in the QOZ fund.

Q: Can I file Schedule OZ electronically?

A: Yes, you can file Schedule OZ electronically if you are e-filing your tax return.

Q: What are the benefits of investing in Qualified Opportunity Zone (QOZ) funds?

A: Investing in QOZ funds can provide tax benefits, including deferral and potential reduction of capital gains taxes, as well as the opportunity for long-term tax-free growth of the investment.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.