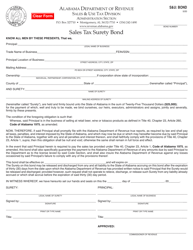

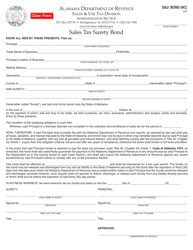

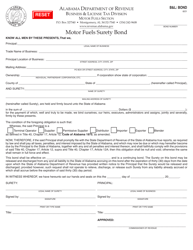

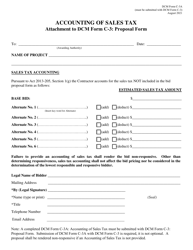

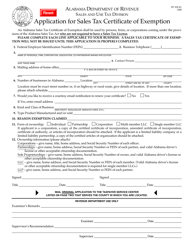

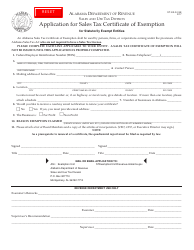

Instructions for Form S&U: BOND Sales Tax Surety Bond - Alabama

This document contains official instructions for Form S&U: BOND , Sales Tax Surety Bond - a form released and collected by the Alabama Department of Revenue. An up-to-date fillable Form S&U: BOND is available for download through this link.

FAQ

Q: What is Form S&U?

A: Form S&U is a form used for the Bond Sales TaxSurety Bond in Alabama.

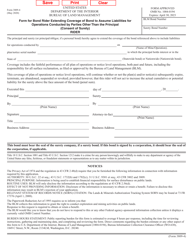

Q: What is a Bond Sales Tax Surety Bond?

A: A Bond Sales Tax Surety Bond is a type of bond that ensures payment of sales tax to the state.

Q: Why is a Bond Sales Tax Surety Bond required?

A: It is required to guarantee that the seller will collect and pay the correct amount of sales tax to the state.

Q: Who needs to fill out Form S&U?

A: Anyone who is required to obtain a Bond Sales Tax Surety Bond in Alabama.

Q: How do I fill out Form S&U?

A: Follow the instructions provided on the form and provide all the requested information accurately.

Q: Are there any fees associated with Form S&U?

A: Yes, there may be fees associated with obtaining a Bond Sales Tax Surety Bond.

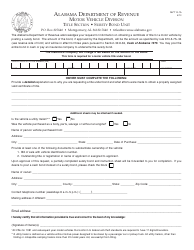

Q: What happens after I submit Form S&U?

A: After submitting Form S&U, the Alabama Department of Revenue will review your application and notify you of the approval or any further requirements.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.