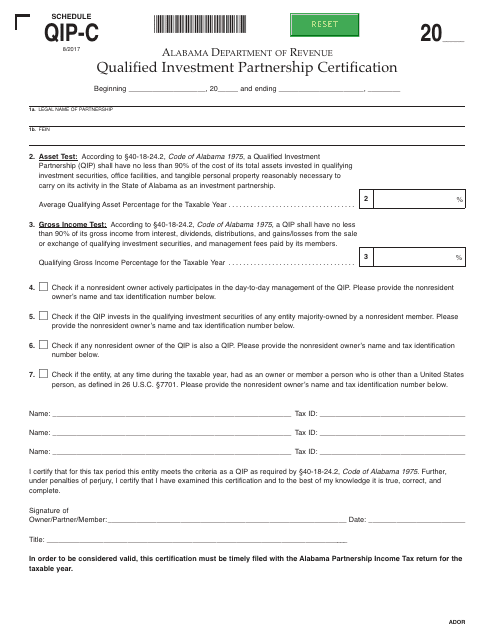

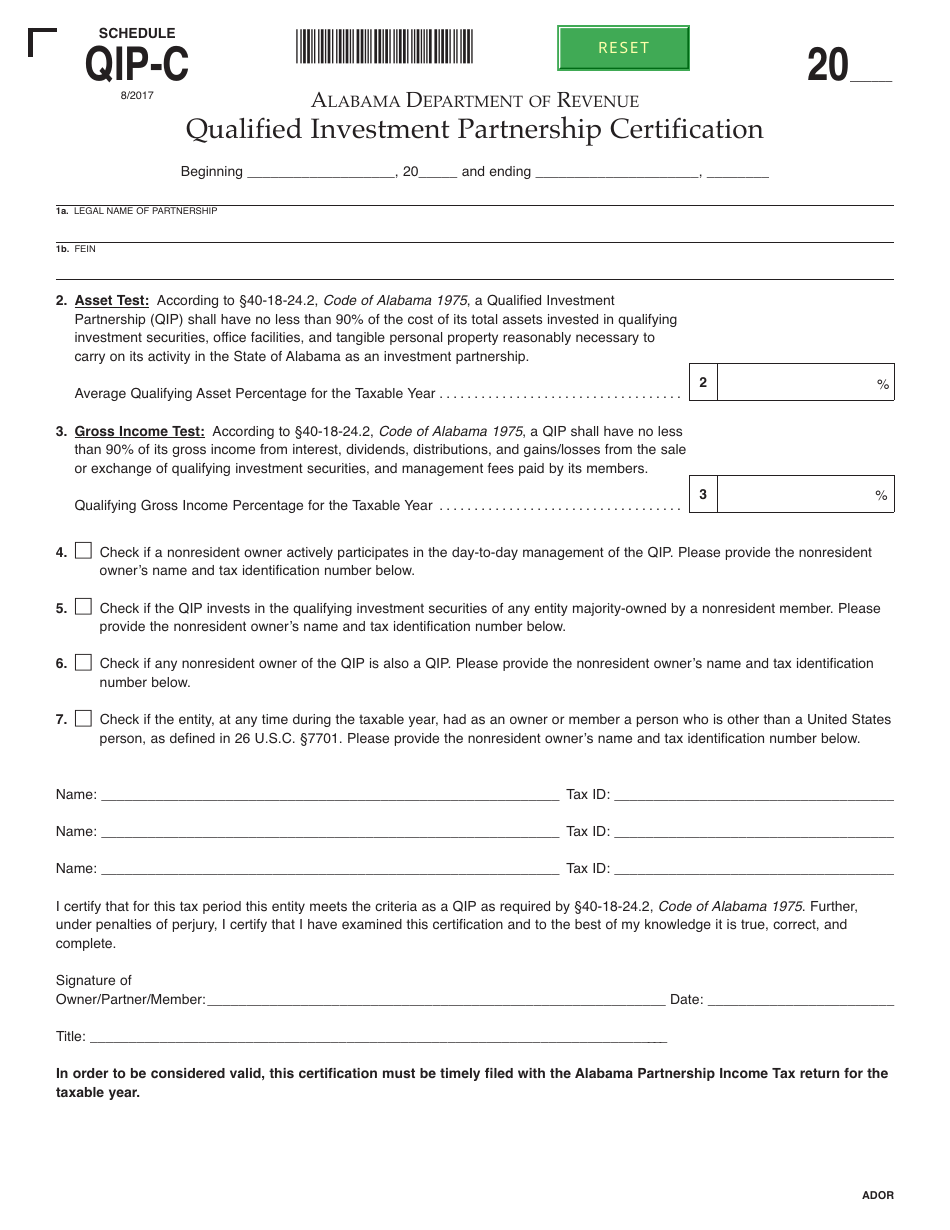

Schedule QIP-C Qualified Investment Partnership Certification - Alabama

What Is Schedule QIP-C?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is QIP-C?

A: QIP-C stands for Qualified Investment Partnership Certification.

Q: What is the purpose of QIP-C?

A: QIP-C is a certification program for qualified investment partnerships in Alabama.

Q: What are qualified investment partnerships?

A: Qualified investment partnerships are partnerships that meet certain criteria to qualify for tax benefits in Alabama.

Q: Who is eligible for QIP-C?

A: Partnerships that meet the requirements set by the Alabama Department of Revenue are eligible for QIP-C.

Q: What are the benefits of QIP-C?

A: QIP-C offers tax benefits to qualified investment partnerships in Alabama.

Q: How can a partnership obtain QIP-C certification?

A: Partnerships need to apply for QIP-C certification with the Alabama Department of Revenue.

Q: Is there a fee for QIP-C certification?

A: Yes, there is a fee associated with applying for QIP-C certification.

Q: What should partnerships do after obtaining QIP-C certification?

A: Partnerships should comply with the requirements and regulations associated with QIP-C certification.

Q: Is QIP-C certification renewable?

A: Yes, QIP-C certification needs to be renewed on an annual basis.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule QIP-C by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.