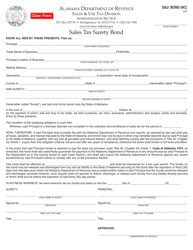

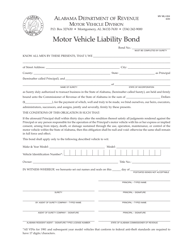

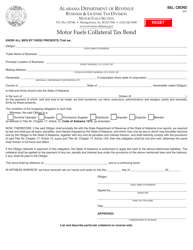

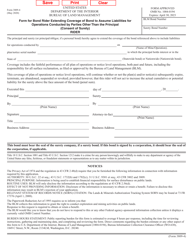

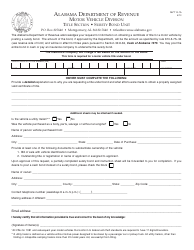

Instructions for Form B&L: BOND Motor Fuel Surety Bond - Alabama

This document contains official instructions for Form B&L: BOND , Motor Fuel Surety Bond - a form released and collected by the Alabama Department of Revenue. An up-to-date fillable Form B&L: BOND is available for download through this link.

FAQ

Q: What is Form B&L?

A: Form B&L is the Bond Motor Fuel Surety Bond form for Alabama.

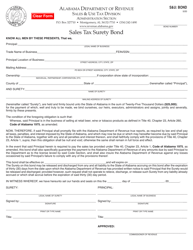

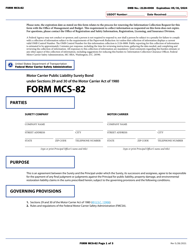

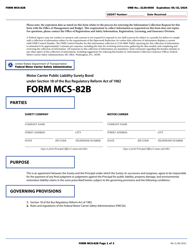

Q: What is a surety bond?

A: A surety bond is a contract between three parties: the principal (the party that needs the bond), the obligee (the party that requires the bond), and the surety (the party that issues the bond). It ensures that the principal will fulfill their obligations as outlined in the bond.

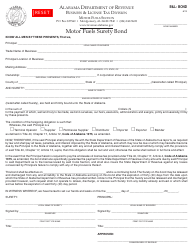

Q: What is the purpose of the BOND Motor Fuel Surety Bond?

A: The purpose of the BOND Motor Fuel Surety Bond is to provide financial security to the State of Alabama for the payment of motor fuel taxes.

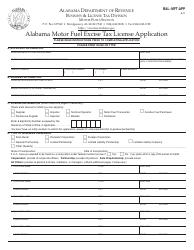

Q: Who needs to fill out Form B&L?

A: Any person or business that wants to operate as a distributor, terminal operator, exporter, or importer of motor fuel in Alabama must fill out Form B&L and obtain a surety bond.

Q: What information is required on Form B&L?

A: Form B&L requires information about the applicant's business, such as their name, address, and contact information. It also requires information about the surety bond, such as the bond amount and the effective dates.

Q: Is there a fee for filing Form B&L?

A: Yes, there is a filing fee for Form B&L. The fee amount is determined by the bond amount.

Q: How long does it take to process Form B&L?

A: The processing time for Form B&L can vary. It is recommended to submit the form well in advance to allow for processing time.

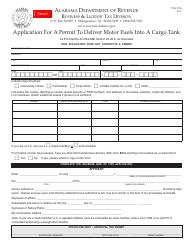

Q: Are there any additional requirements for obtaining the BOND Motor Fuel Surety Bond?

A: Yes, in addition to filling out Form B&L and obtaining a surety bond, applicants may also need to provide financial statements and meet certain requirements set by the Alabama Department of Revenue.

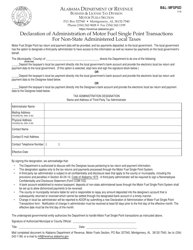

Q: What happens if I fail to file Form B&L?

A: Failure to file Form B&L and obtain the BOND Motor Fuel Surety Bond can result in penalties and the inability to operate as a distributor, terminal operator, exporter, or importer of motor fuel in Alabama.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.