This version of the form is not currently in use and is provided for reference only. Download this version of

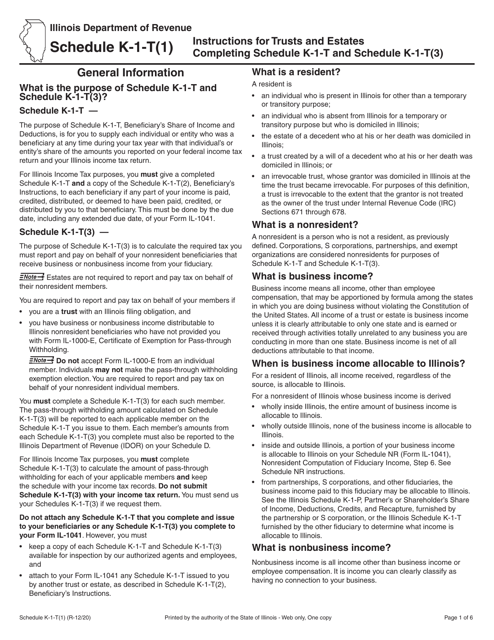

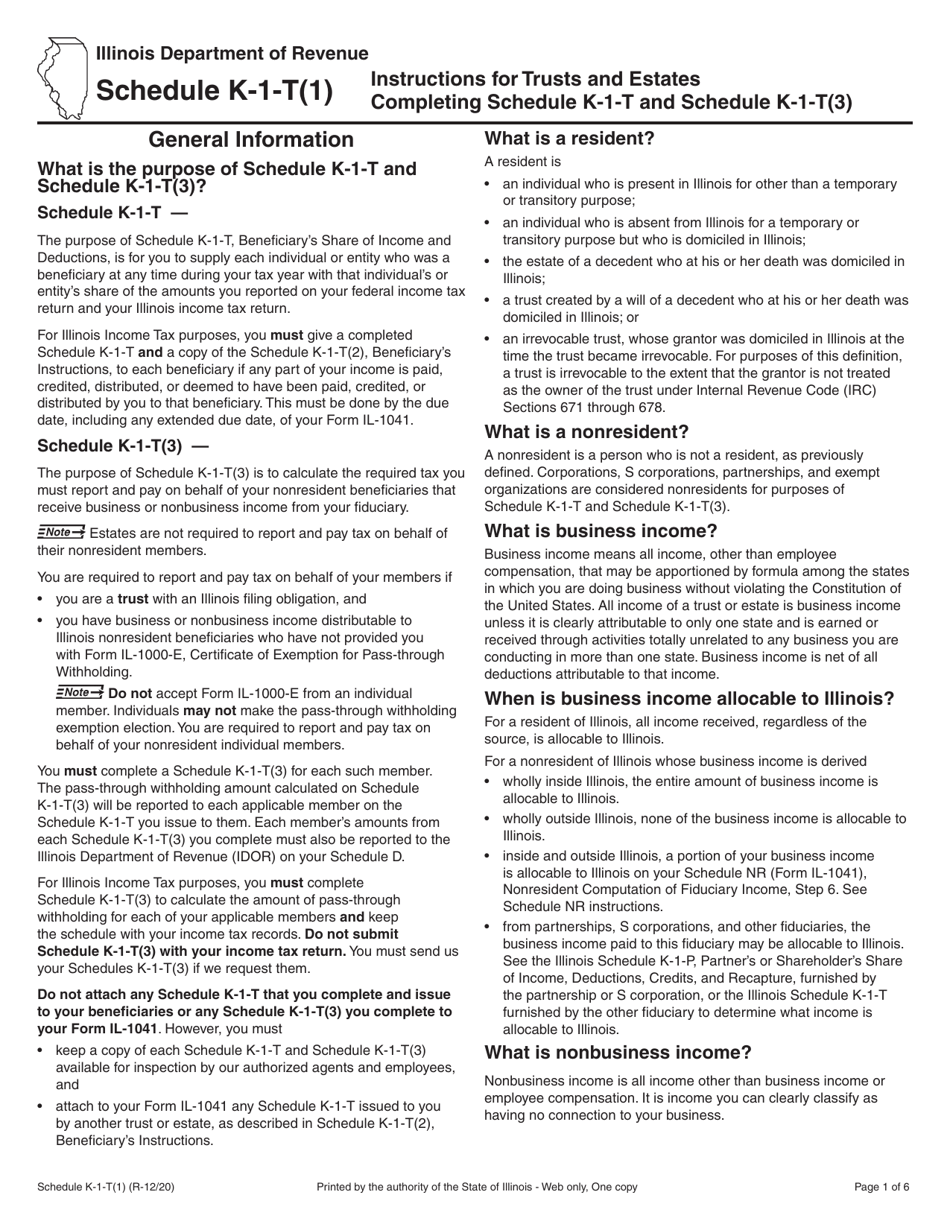

Instructions for Schedule K-1-T, K-1-T(3)

for the current year.

Instructions for Schedule K-1-T, K-1-T(3) - Illinois

This document contains official instructions for Schedule K-1-T , and Schedule K-1-T(3) . Both forms are released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Schedule K-1-T?

A: Schedule K-1-T is a tax form used by partnerships, S corporations, and trusts in Illinois to report the income, deductions, and credits allocated to each partner, shareholder, or beneficiary.

Q: Who needs to file Schedule K-1-T?

A: Partnerships, S corporations, and trusts that operate in Illinois and have allocated income, deductions, or credits to partners, shareholders, or beneficiaries need to file Schedule K-1-T.

Q: What information is reported on Schedule K-1-T?

A: Schedule K-1-T reports the recipient's share of income, deductions, and credits from the partnership, S corporation, or trust.

Q: Do I need to include Schedule K-1-T with my individual tax return?

A: Yes, if you are a partner, shareholder, or beneficiary, you will need to include Schedule K-1-T with your individual tax return.

Q: Are there any specific instructions for completing Schedule K-1-T?

A: Yes, the Illinois Department of Revenue provides detailed instructions for completing Schedule K-1-T. It is important to follow these instructions carefully to ensure accurate reporting.

Q: Can I electronically file Schedule K-1-T?

A: Yes, Illinois allows for electronic filing of Schedule K-1-T.

Q: When is the deadline to file Schedule K-1-T?

A: The deadline to file Schedule K-1-T is typically the same as the deadline for filing your individual tax return, which is April 15th.

Q: What happens if I don't file Schedule K-1-T?

A: Failure to file Schedule K-1-T or reporting incorrect information may result in penalties and interest.

Q: Can I file an extension for Schedule K-1-T?

A: Yes, you can file an extension for Schedule K-1-T by submitting Form IL-505-B, Automatic Extension Payment.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.