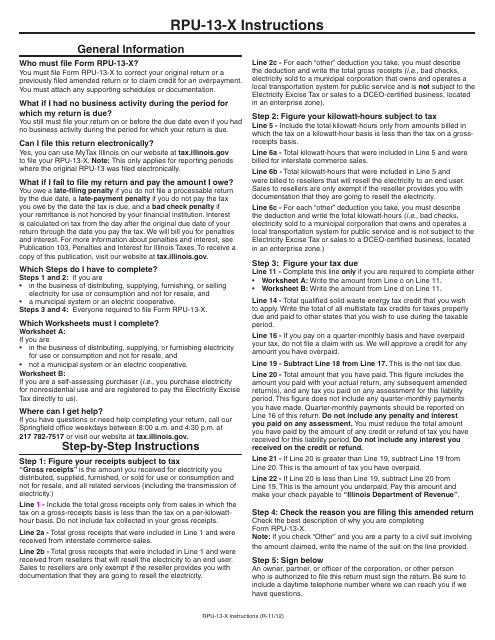

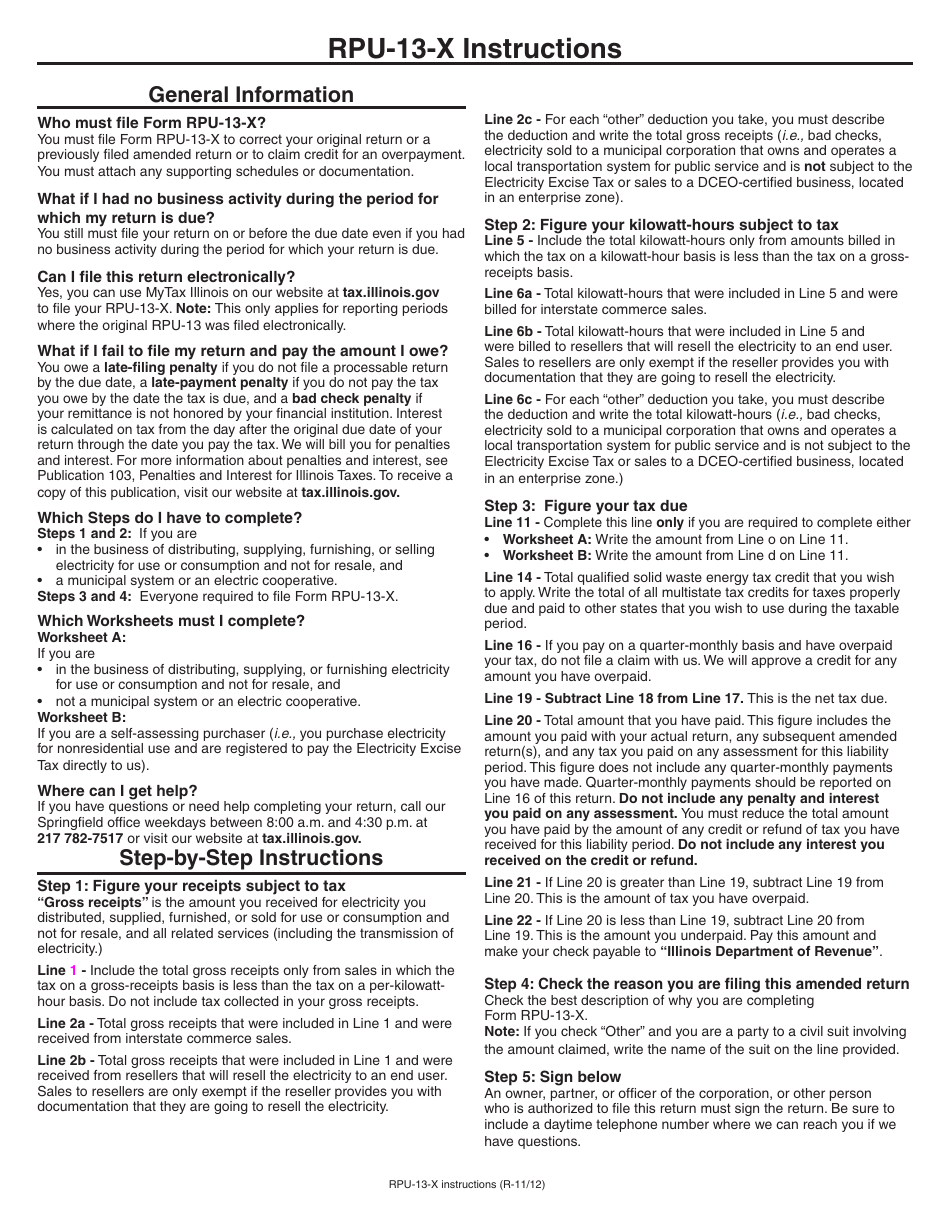

Instructions for Form RPU-13-X Amended Electricity Excise Tax Return - Illinois

This document contains official instructions for Form RPU-13-X , Amended Electricity Excise Tax Return - a form released and collected by the Illinois Department of Revenue.

FAQ

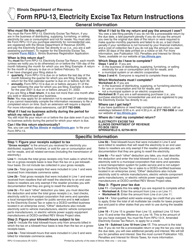

Q: What is Form RPU-13-X?

A: Form RPU-13-X is the Amended Electricity Excise Tax Return for the state of Illinois.

Q: When should I use Form RPU-13-X?

A: You should use Form RPU-13-X when you need to correct any errors or make changes to your previously filed Electricity Excise Tax Return in Illinois.

Q: How do I fill out Form RPU-13-X?

A: You will need to provide your business information, details of the original return, and the corrected information. Follow the instructions provided with the form to complete it accurately.

Q: Are there any deadlines for filing Form RPU-13-X?

A: Yes, you must file Form RPU-13-X within 3 years from the original due date of the return, or within 2 years from the date of overpayment, whichever is later.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.