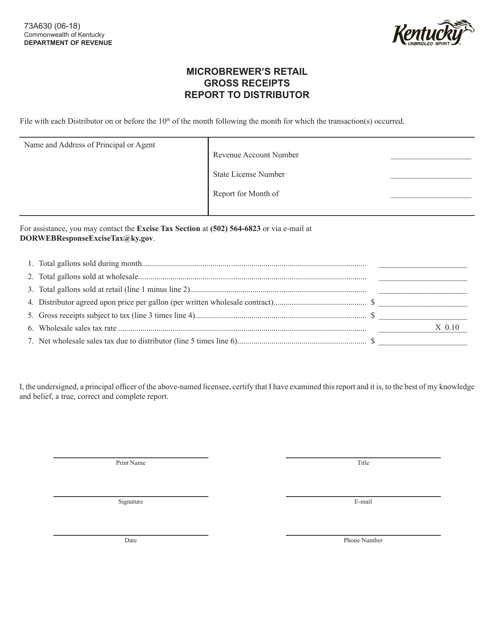

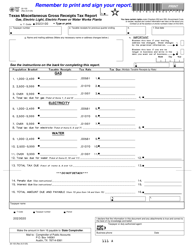

Form 73A630 Microbrewer's Retail Gross Receipts Report to Distributor - Kentucky

What Is Form 73A630?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73A630?

A: Form 73A630 is the Microbrewer's Retail Gross Receipts Report to Distributor in Kentucky.

Q: Who needs to file Form 73A630?

A: Microbrewers in Kentucky who sell beer directly to consumers need to file Form 73A630.

Q: What is the purpose of Form 73A630?

A: Form 73A630 is used to report the gross receipts from retail sales made by microbrewers.

Q: When is Form 73A630 due?

A: Form 73A630 is due by the 20th of the month following the reporting month.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A630 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.