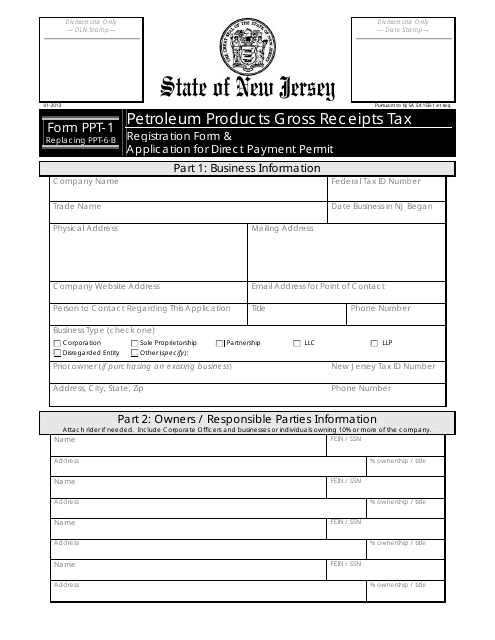

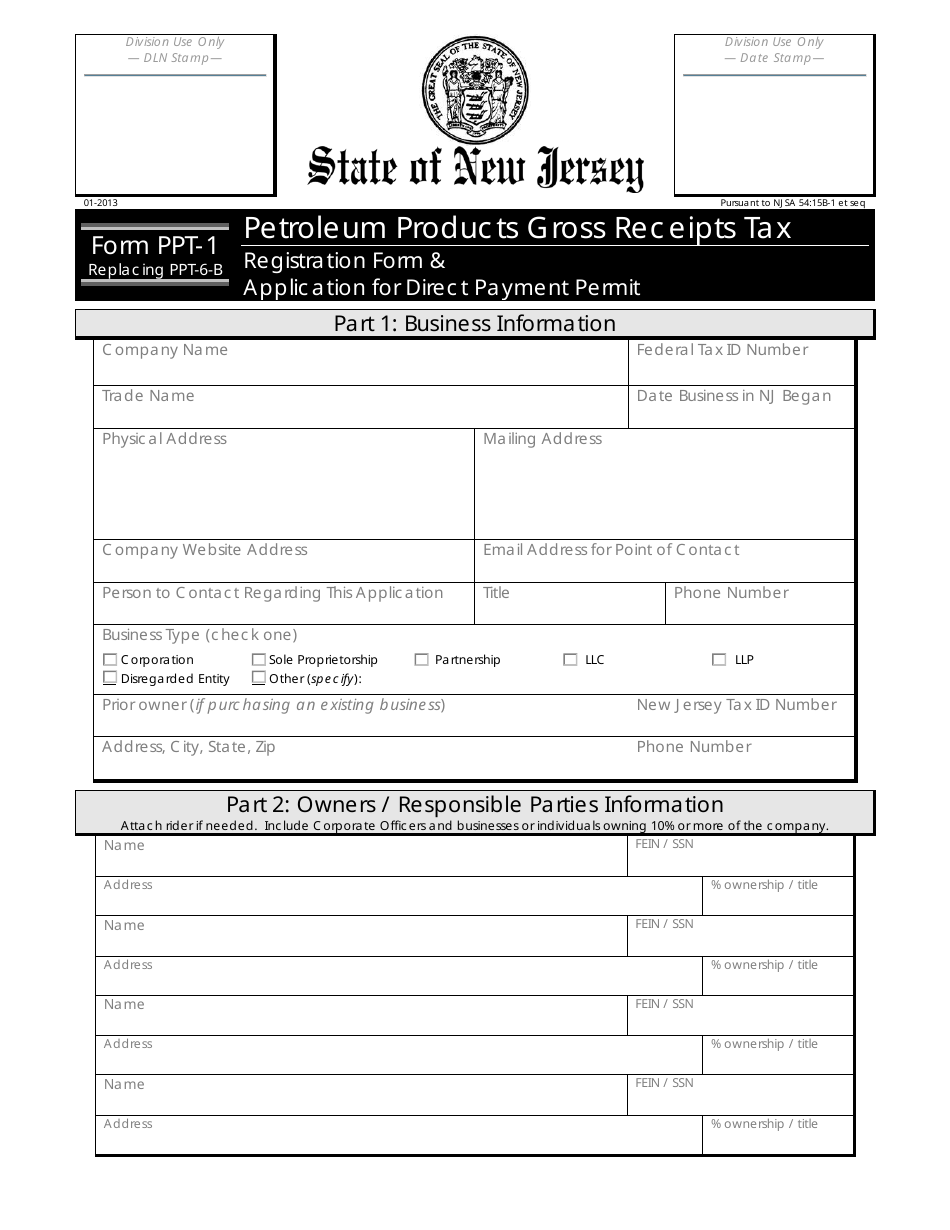

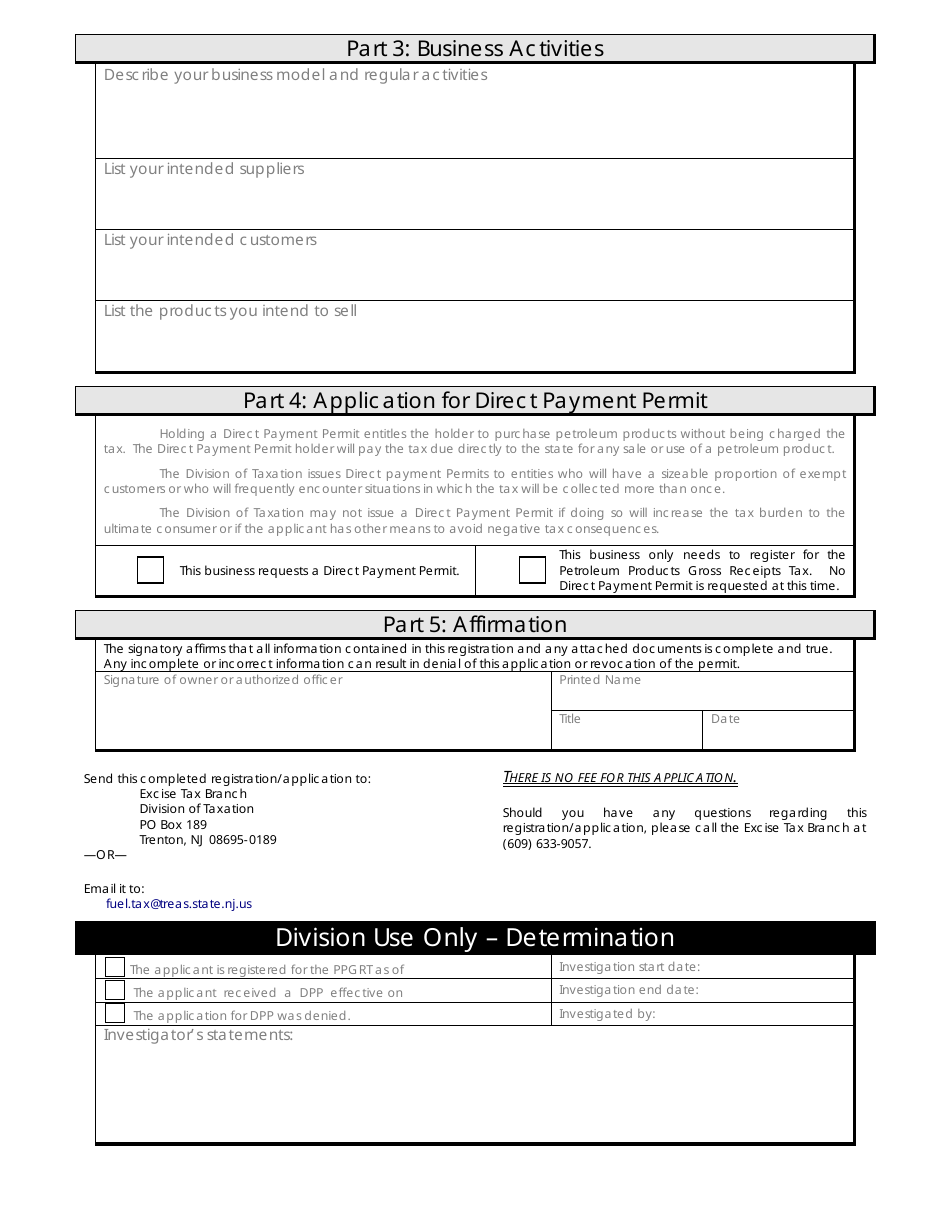

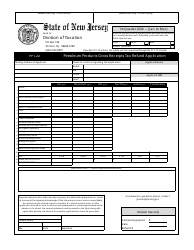

Form PPT-1 Petroleum Products Gross Receipts Tax - New Jersey

What Is Form PPT-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-1?

A: Form PPT-1 is a form used to report and pay the Petroleum ProductsGross Receipts Tax in New Jersey.

Q: What is the Petroleum Products Gross Receipts Tax?

A: The Petroleum Products Gross Receipts Tax is a tax imposed on the sale, transfer, or delivery of petroleum products in New Jersey.

Q: Who needs to file Form PPT-1?

A: Any person or entity engaged in the sale, transfer, or delivery of petroleum products in New Jersey is required to file Form PPT-1.

Q: How often is Form PPT-1 filed?

A: Form PPT-1 is filed on a monthly basis.

Q: When is Form PPT-1 due?

A: Form PPT-1 is due on or before the 10th day of the following month.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form PPT-1. The penalty is 5% of the tax due for the first month, with an additional 5% for each additional month of delay, up to a maximum of 25%.

Q: Is there a minimum threshold for filing Form PPT-1?

A: Yes, if the total tax liability for the reporting period is less than $10, no payment is due and a return does not need to be filed.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PPT-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.