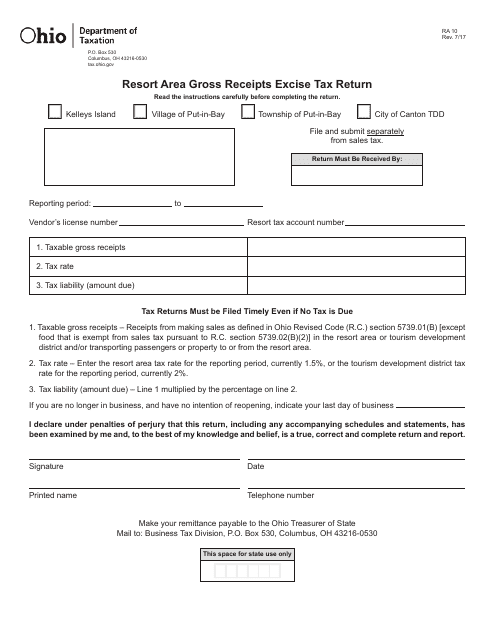

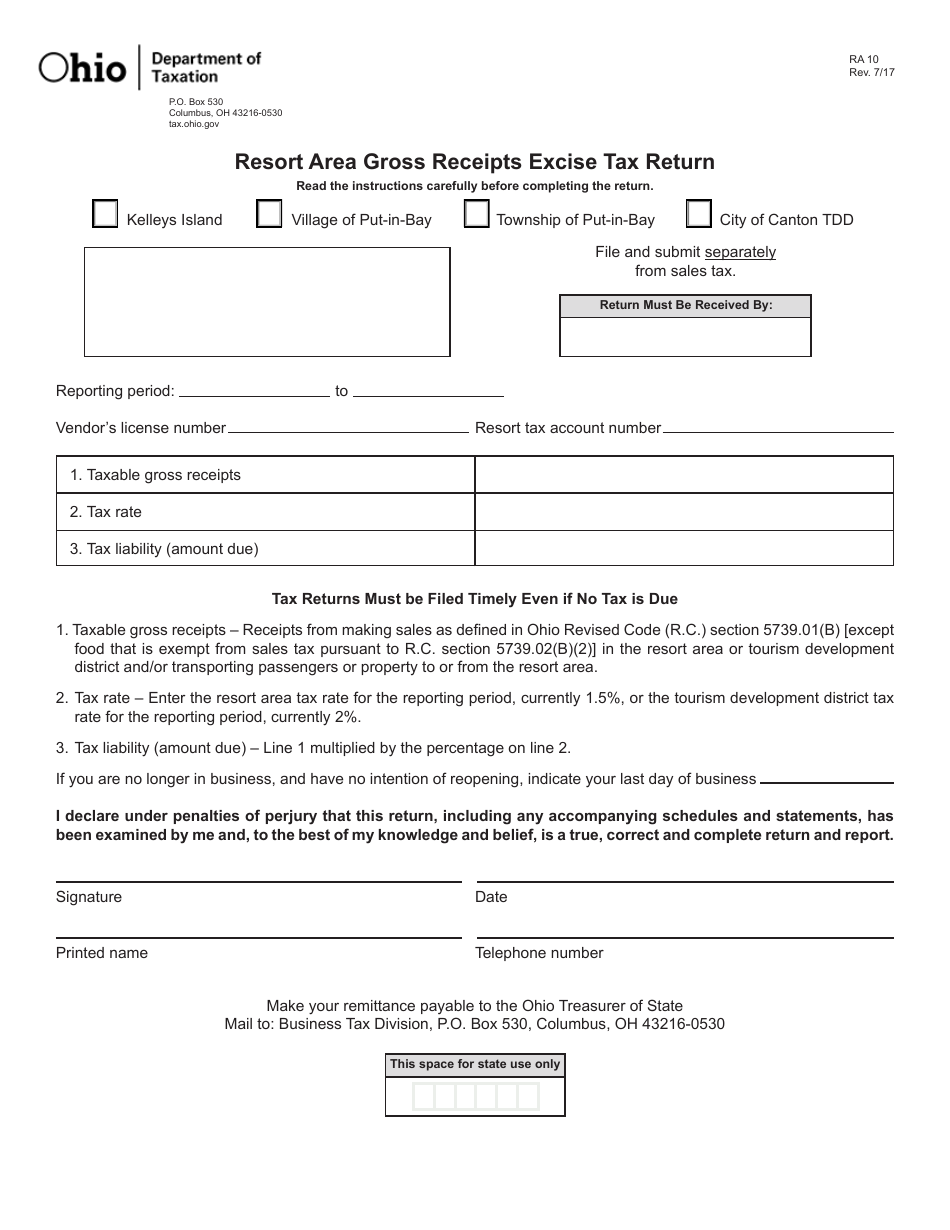

Form RA-10 Resort Area Gross Receipts Excise Tax Return - Ohio

What Is Form RA-10?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RA-10?

A: Form RA-10 is the Resort Area Gross Receipts Excise Tax Return in Ohio.

Q: What is the purpose of Form RA-10?

A: Form RA-10 is used to report and pay the excise tax on gross receipts for businesses in resort areas in Ohio.

Q: Who needs to file Form RA-10?

A: Businesses that operate in resort areas in Ohio and have gross receipts are required to file Form RA-10.

Q: What is considered a resort area in Ohio?

A: A resort area in Ohio is a location designated by the Department of Taxation as having significant tourist attractions or recreational activities.

Q: How often should Form RA-10 be filed?

A: Form RA-10 should be filed quarterly, with the due dates falling on the last day of the month following the end of each quarter.

Q: Is there a penalty for late filing of Form RA-10?

A: Yes, there is a penalty for late filing of Form RA-10. The penalty is based on the amount of tax owed and the number of days the return is late.

Q: Can I file Form RA-10 electronically?

A: Yes, you can file Form RA-10 electronically through the Ohio Business Gateway.

Q: What other documents should be included with Form RA-10?

A: Typically, businesses should include their sales receipts and any other supporting documentation related to their gross receipts.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RA-10 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.