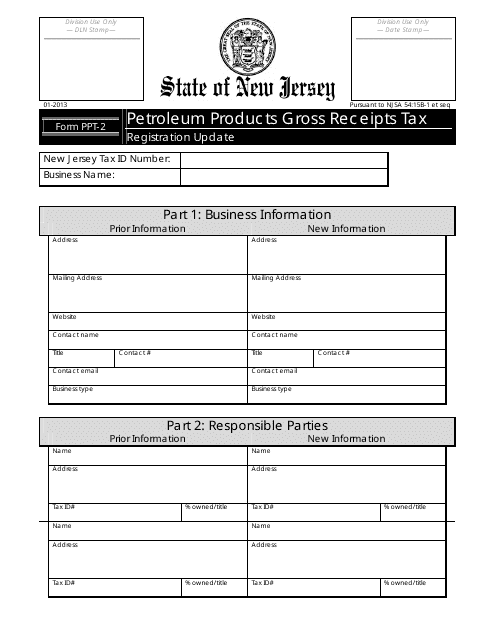

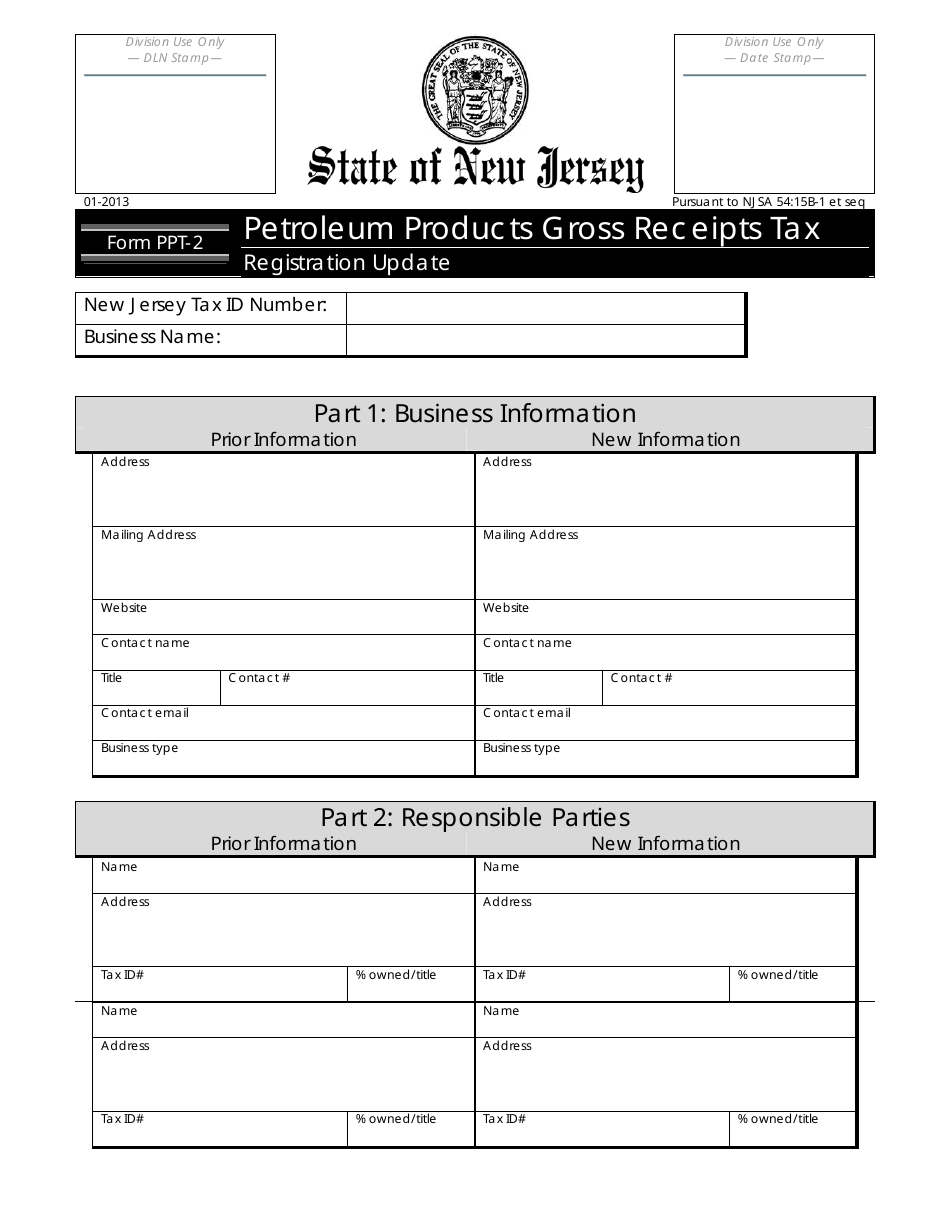

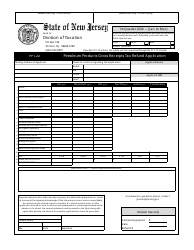

Form PPT-2 Petroleum Products Gross Receipts Tax Registration Update - New Jersey

What Is Form PPT-2?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-2?

A: Form PPT-2 is a registration update form for the Petroleum ProductsGross Receipts Tax in New Jersey.

Q: What is the Petroleum Products Gross Receipts Tax?

A: The Petroleum Products Gross Receipts Tax is a tax imposed on the sale of petroleum products in New Jersey.

Q: Who needs to file Form PPT-2?

A: Any business or individual engaged in the sale of petroleum products in New Jersey needs to file Form PPT-2.

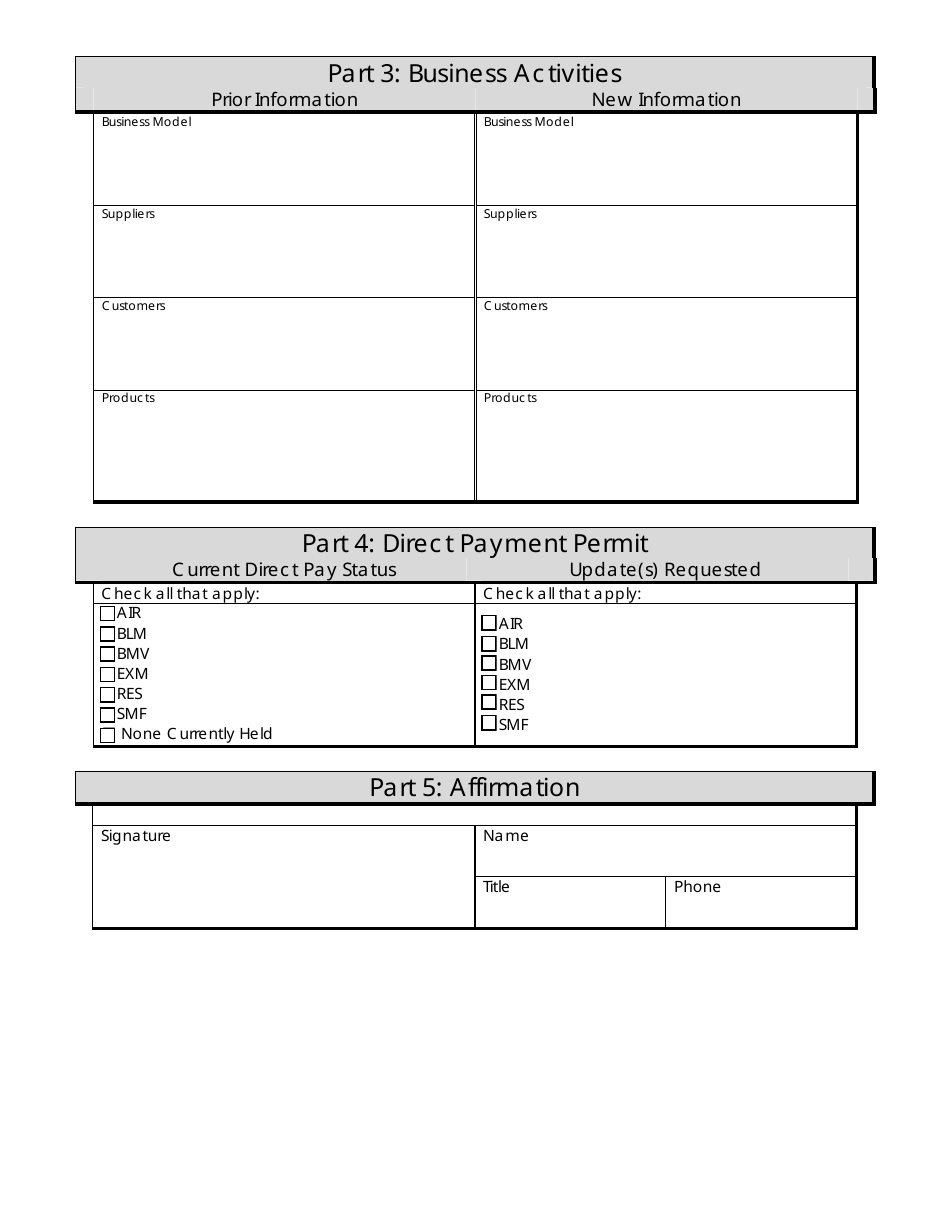

Q: What information is required on Form PPT-2?

A: Form PPT-2 requires basic information about the business or individual, such as name, address, and contact information.

Q: How often does Form PPT-2 need to be filed?

A: Form PPT-2 needs to be filed annually.

Q: Is there a deadline for filing Form PPT-2?

A: Yes, Form PPT-2 must be filed by February 20th of each year.

Q: What happens if I don't file Form PPT-2?

A: Failure to file Form PPT-2 may result in penalties and interest charges.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PPT-2 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.