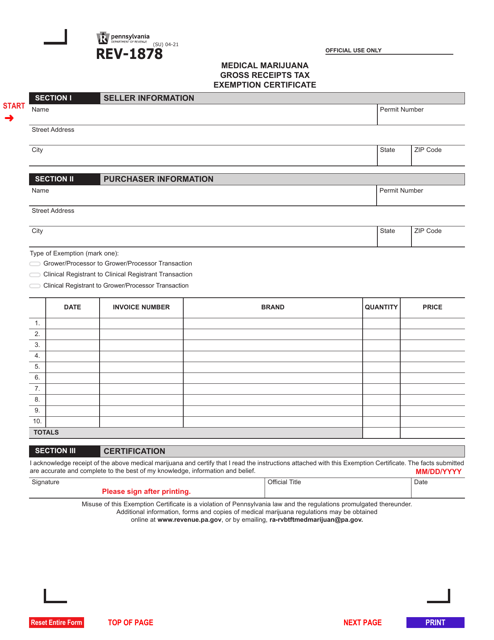

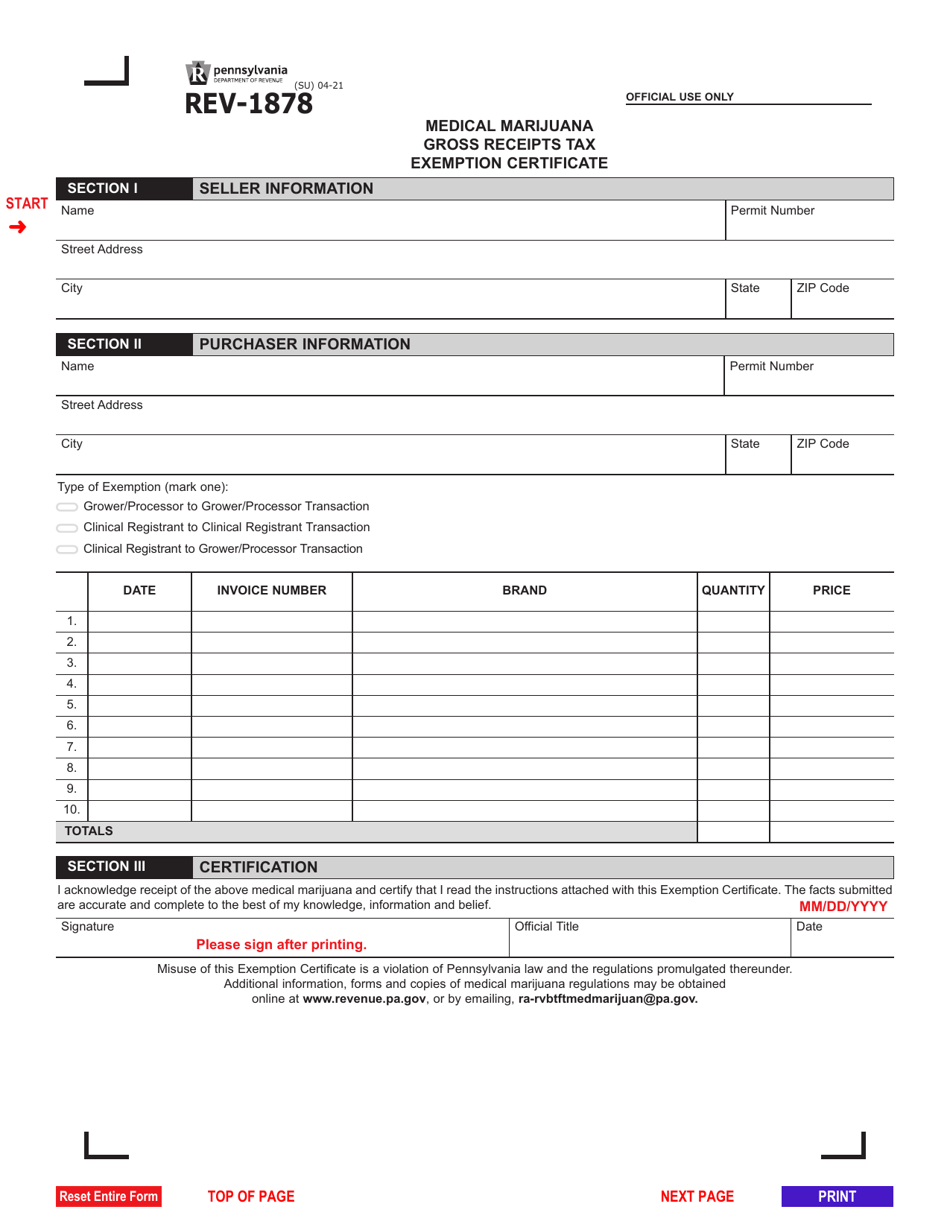

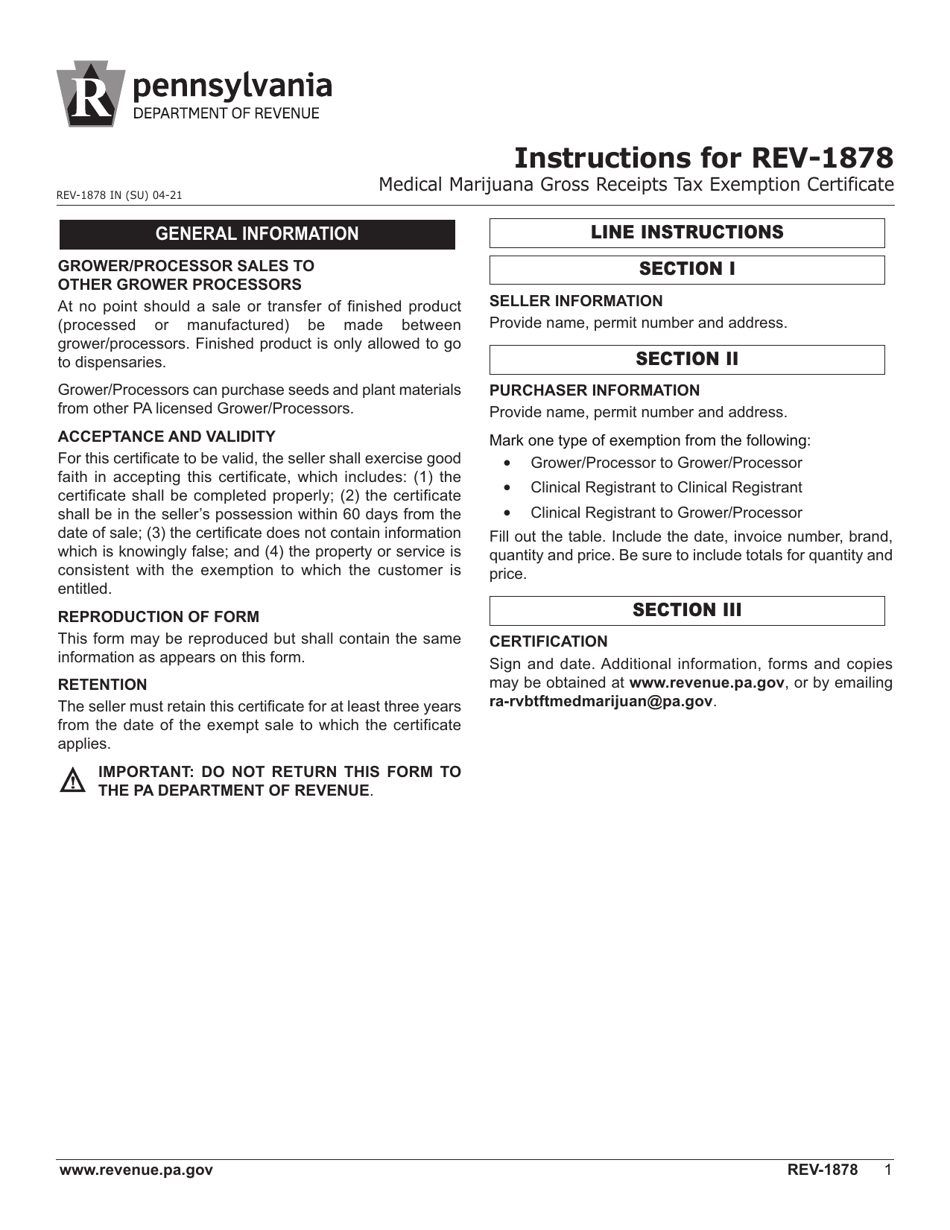

Form REV-1878 Medical(marijuana Gross(receipts(tax Exemption Certificate - Pennsylvania

What Is Form REV-1878?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1878?

A: Form REV-1878 is a tax exemption certificate for medical marijuana gross receipts in Pennsylvania.

Q: What is the purpose of Form REV-1878?

A: The purpose of Form REV-1878 is to apply for a tax exemption for gross receipts related to medical marijuana in Pennsylvania.

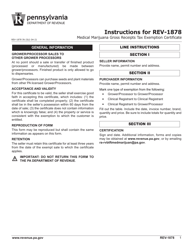

Q: Who needs to fill out Form REV-1878?

A: Businesses involved in the sale or distribution of medical marijuana in Pennsylvania need to fill out Form REV-1878.

Q: What is meant by tax exemption for medical marijuana gross receipts?

A: Tax exemption for medical marijuana gross receipts means that the business does not have to pay certain taxes on the income from the sale or distribution of medical marijuana.

Q: Are there any eligibility requirements to qualify for the tax exemption?

A: Yes, there are eligibility requirements that businesses must meet in order to qualify for the tax exemption. These requirements may include being registered with the Pennsylvania Department of Health and meeting certain financial criteria.

Q: When is the deadline to submit Form REV-1878?

A: The deadline to submit Form REV-1878 is usually on or before the due date of the tax return related to the gross receipts.

Q: What should I do if I have questions about Form REV-1878?

A: If you have questions about Form REV-1878, you can contact the Pennsylvania Department of Revenue for assistance.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1878 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.