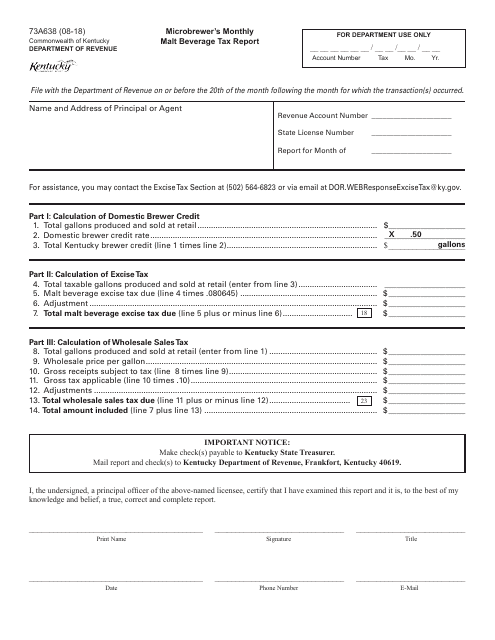

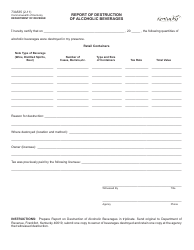

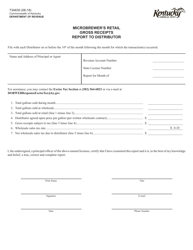

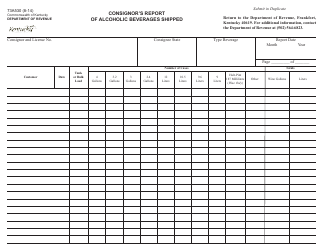

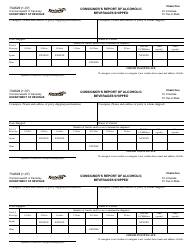

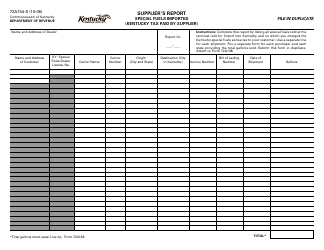

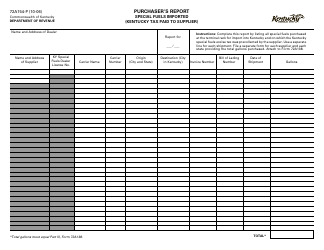

Form 73A638 Microbrewer's Monthly Malt Beverage Tax Report - Kentucky

What Is Form 73A638?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 73A638?

A: Form 73A638 is the Microbrewer's Monthly Malt Beverage Tax Report in Kentucky.

Q: Who needs to file Form 73A638?

A: Microbrewers in Kentucky need to file Form 73A638.

Q: What is the purpose of Form 73A638?

A: The purpose of Form 73A638 is to report and pay the malt beverage tax for microbrewers in Kentucky on a monthly basis.

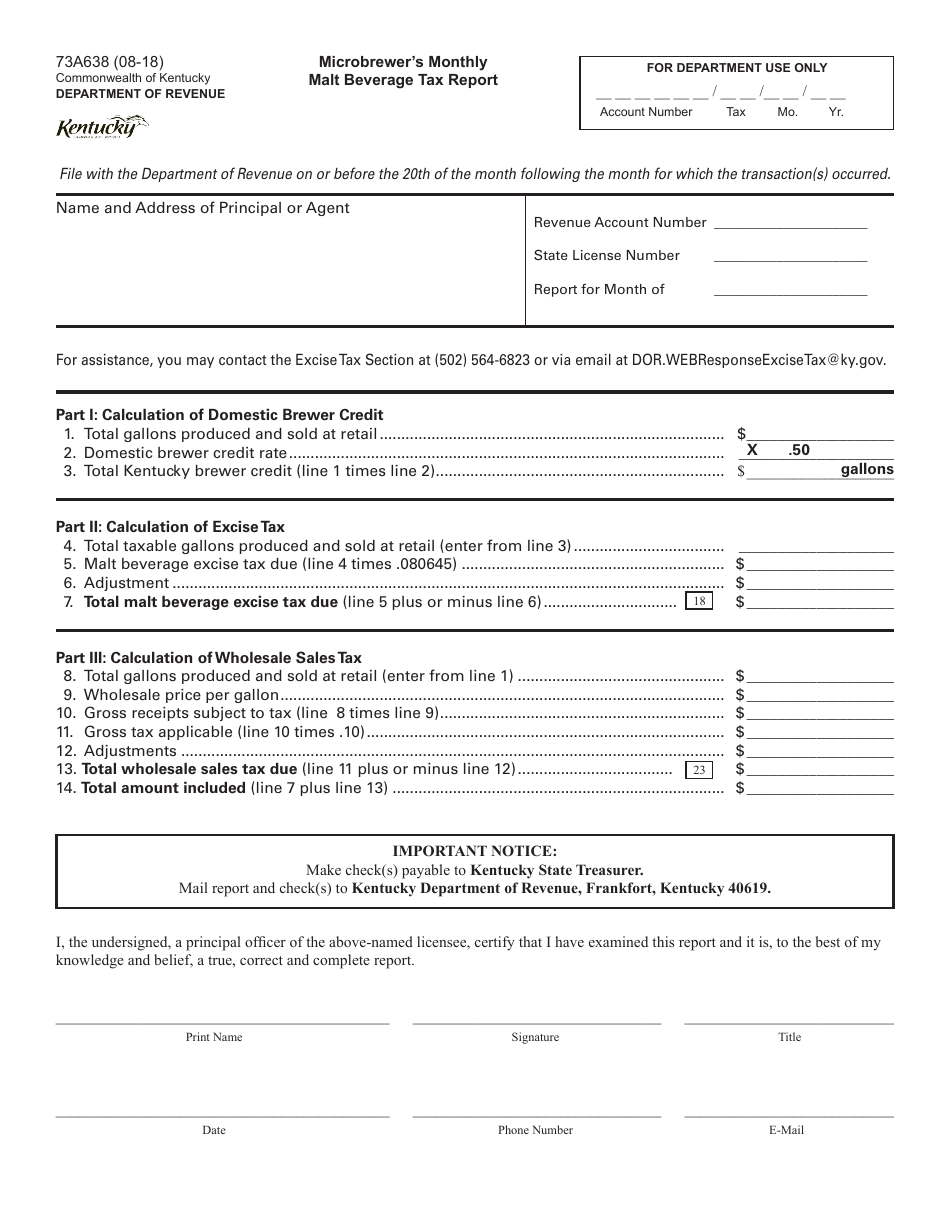

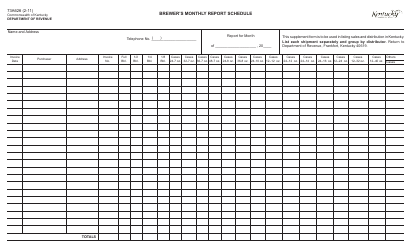

Q: What information is required on Form 73A638?

A: Form 73A638 requires microbrewers to provide information on the quantity of malt beverages sold, the amount of tax due, and other related details.

Q: When is Form 73A638 due?

A: Form 73A638 is due on the 15th day of the month following the reporting period.

Q: Are there any penalties for late or incorrect filing of Form 73A638?

A: Yes, there are penalties for late or incorrect filing of Form 73A638, including interest charges and possible enforcement actions.

Q: Is electronic filing available for Form 73A638?

A: Yes, microbrewers in Kentucky have the option to file Form 73A638 electronically.

Q: Can Form 73A638 be amended?

A: Yes, microbrewers can file an amended Form 73A638 to correct any errors or update information previously reported.

Q: Who can I contact for further questions regarding Form 73A638?

A: For further questions regarding Form 73A638, you can contact the Kentucky Department of Revenue.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 73A638 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.