This version of the form is not currently in use and is provided for reference only. Download this version of

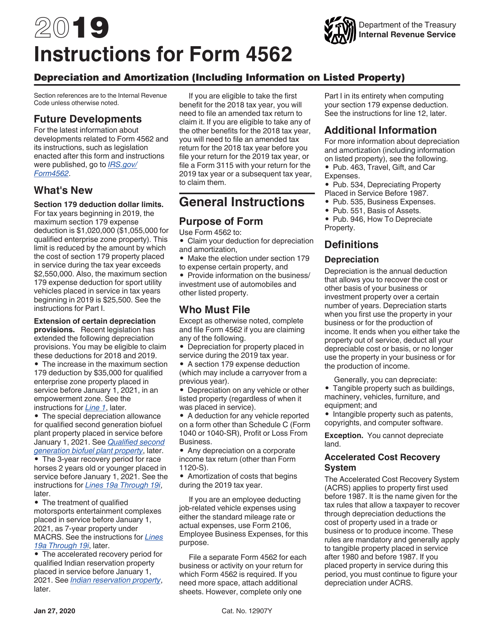

Instructions for IRS Form 4562

for the current year.

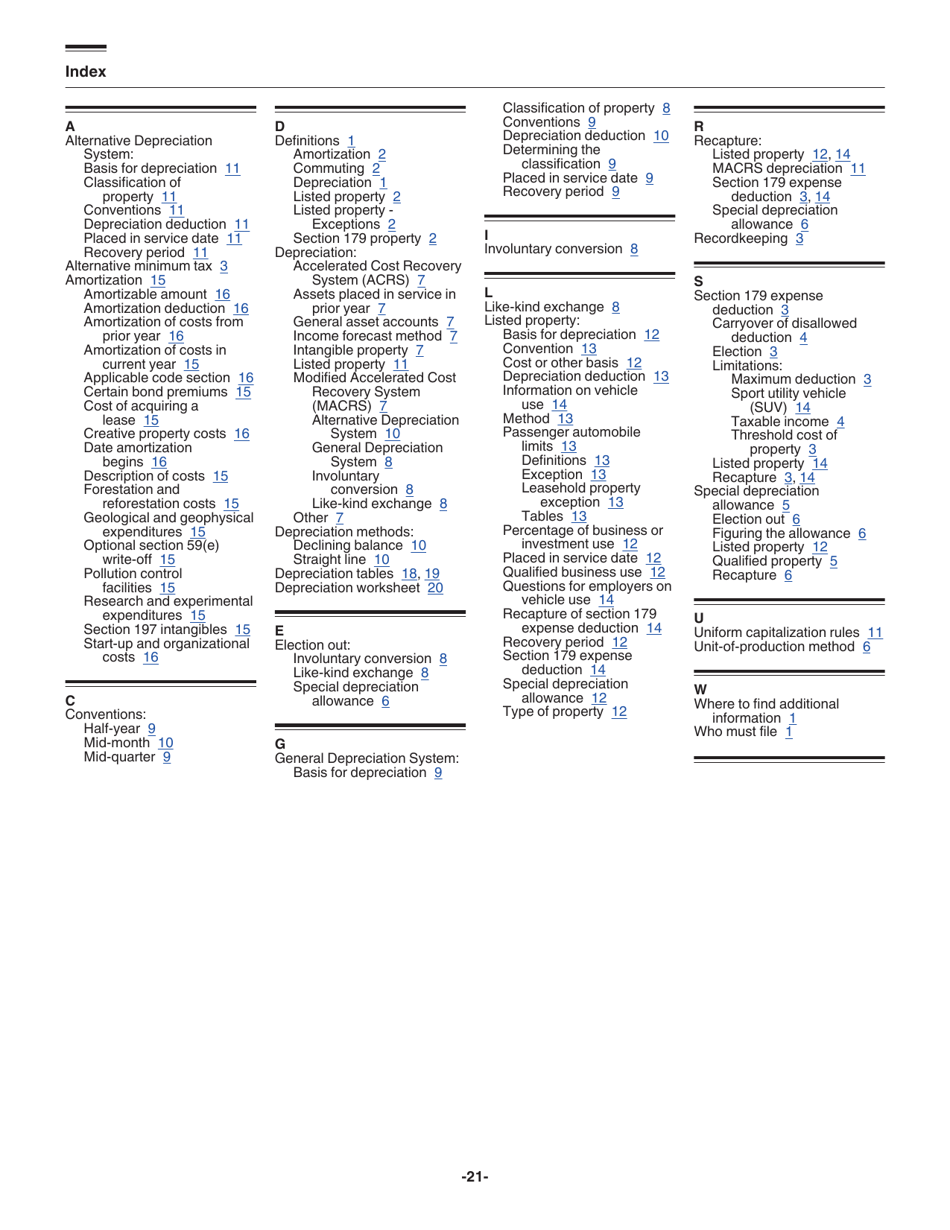

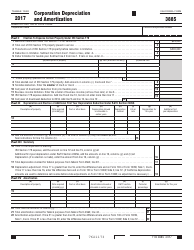

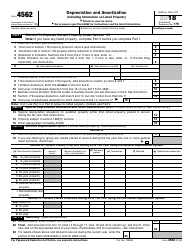

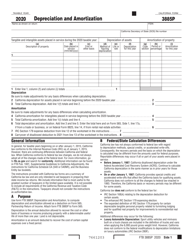

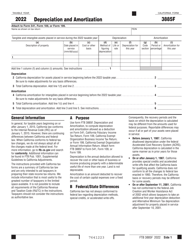

Instructions for IRS Form 4562 Depreciation and Amortization (Including Information on Listed Property)

This document contains official instructions for IRS Form 4562 , Depreciation and Amortization (Including Information on Listed Property) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 4562 is available for download through this link.

FAQ

Q: What is IRS Form 4562?

A: IRS Form 4562 is a tax form used to report depreciation and amortization, including information on listed property.

Q: Who needs to file IRS Form 4562?

A: Anyone who claims depreciation or amortization on their tax return needs to file IRS Form 4562.

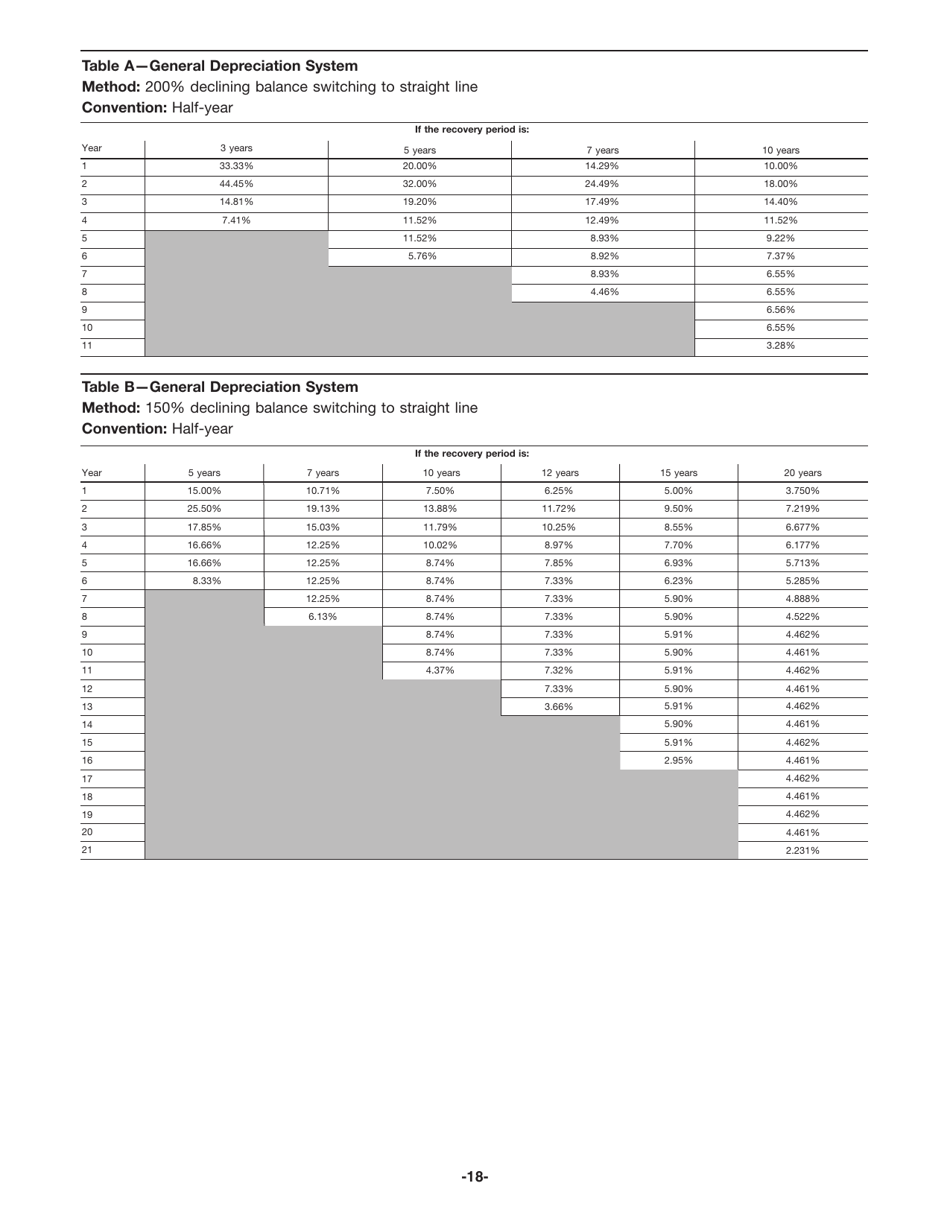

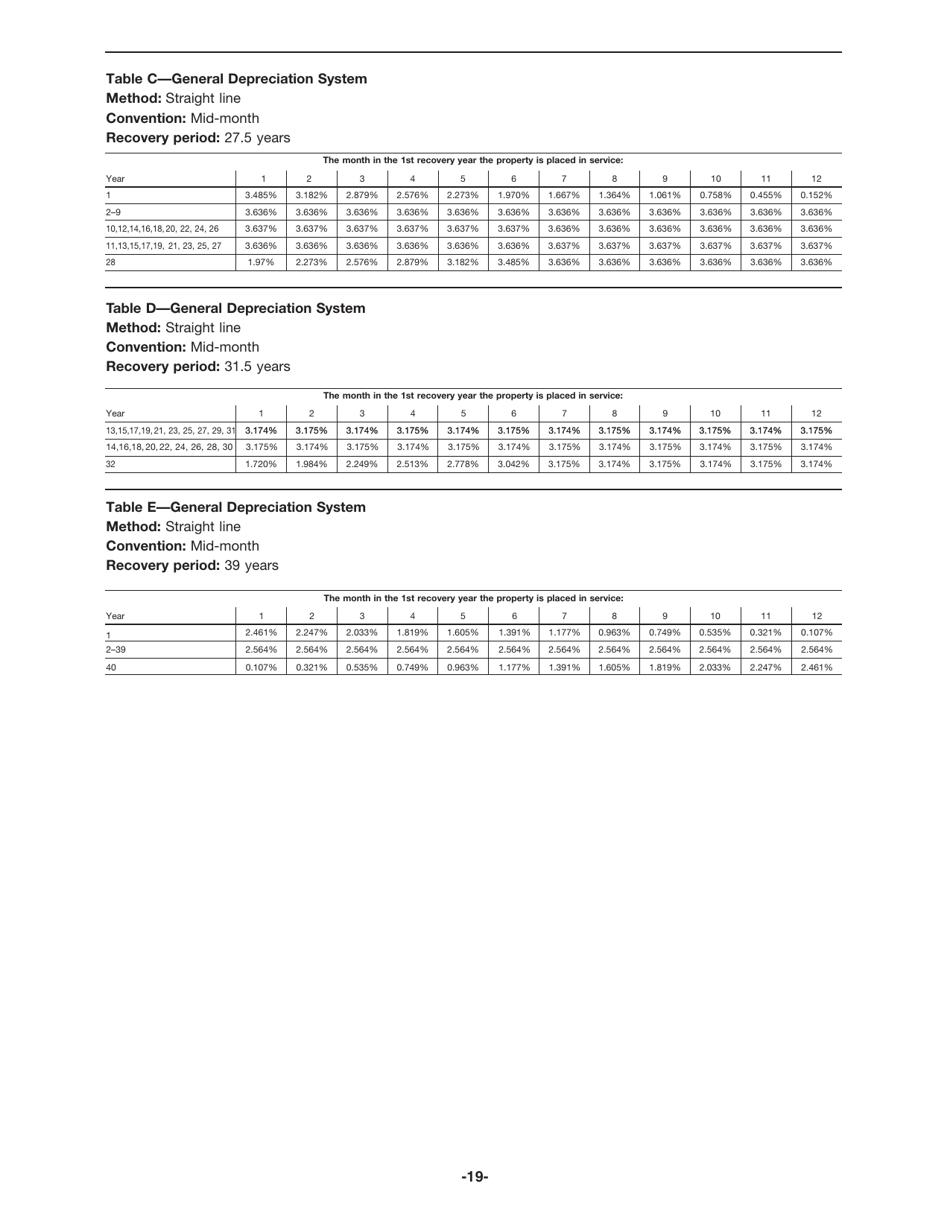

Q: What is depreciation?

A: Depreciation is the process of deducting the cost of an asset over its useful life.

Q: What is amortization?

A: Amortization is the process of deducting the cost of intangible assets (such as patents or copyrights) over their useful life.

Q: What is listed property?

A: Listed property includes items that can be used for both personal and business purposes, such as vehicles or computers.

Q: What information do I need to fill out IRS Form 4562?

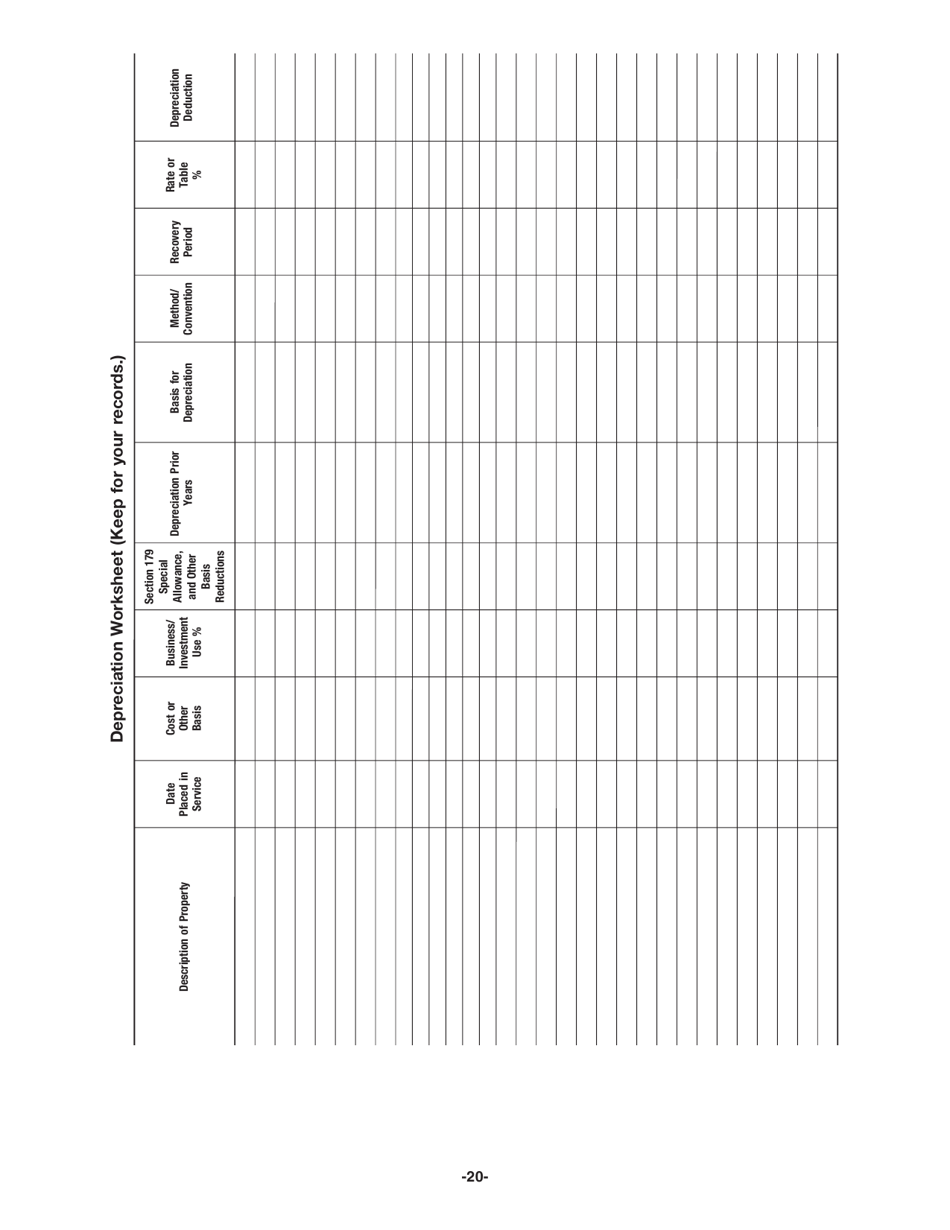

A: You will need information such as the cost of the asset, the date it was placed in service, and the depreciation method you are using.

Q: When is the deadline to file IRS Form 4562?

A: IRS Form 4562 is typically filed along with your annual tax return by the filing deadline, which is usually April 15th.

Q: What happens if I don't file IRS Form 4562?

A: If you don't file IRS Form 4562 when required, you may not be able to claim depreciation or amortization deductions and may face penalties.

Q: Can I e-file IRS Form 4562?

A: Yes, you can e-file IRS Form 4562 along with your tax return.

Q: Do I need to keep a copy of IRS Form 4562 for my records?

A: Yes, it is recommended to keep a copy of IRS Form 4562 and any supporting documentation for at least three years.

Instruction Details:

- This 21-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.