Instructions for IRS Form 8866 Interest Computation Under the Look-Back Method for Property Depreciated Under the Income Forecast Method

This document contains official instructions for IRS Form 8866 , Interest Computation Under the Look-Back Method for Property Depreciated Under the Income Forecast Method - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8866 is available for download through this link.

FAQ

Q: What is IRS Form 8866?

A: IRS Form 8866 is used to compute interest under the look-back method for property depreciated under the income forecast method.

Q: What is the look-back method?

A: The look-back method is a way to compute interest on property that was depreciated using the income forecast method.

Q: What is the income forecast method?

A: The income forecast method is a way to depreciate property based on its estimated income over its useful life.

Q: Why do I need to use the look-back method?

A: You need to use the look-back method if you have property that was depreciated using the income forecast method.

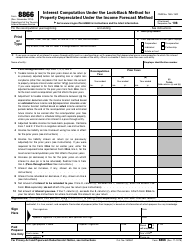

Q: How do I fill out IRS Form 8866?

A: You should follow the instructions provided with the form to fill it out correctly.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.