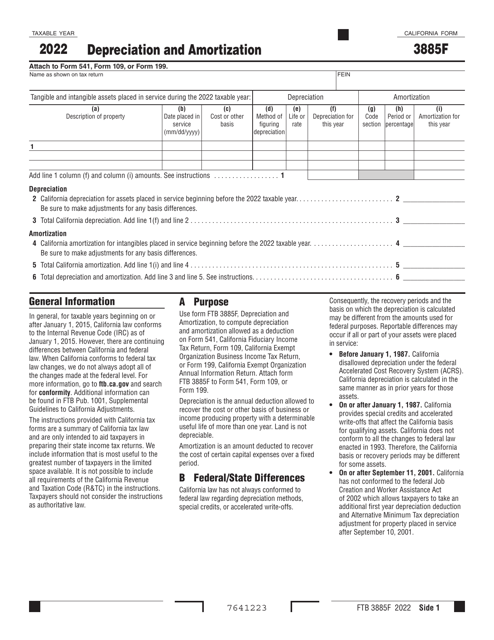

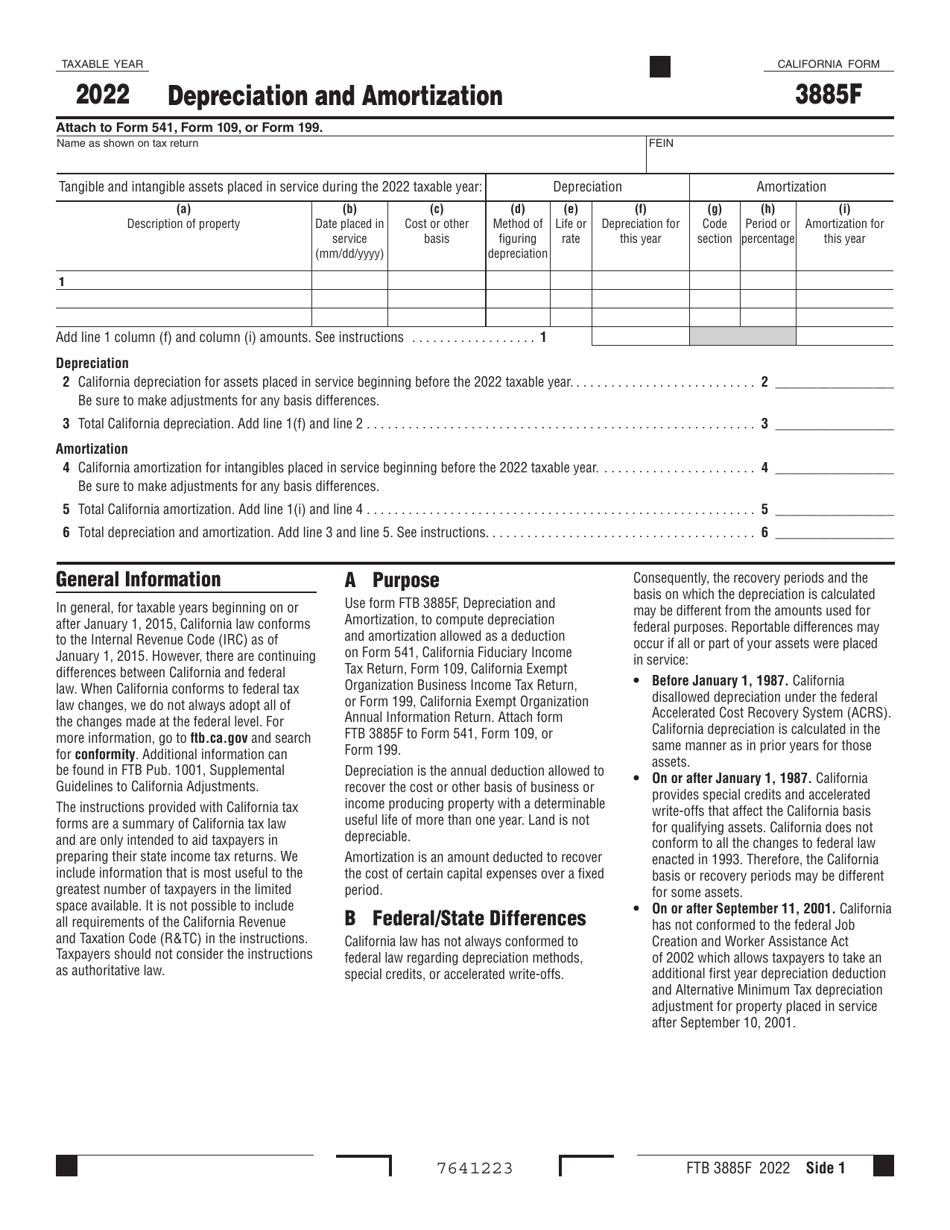

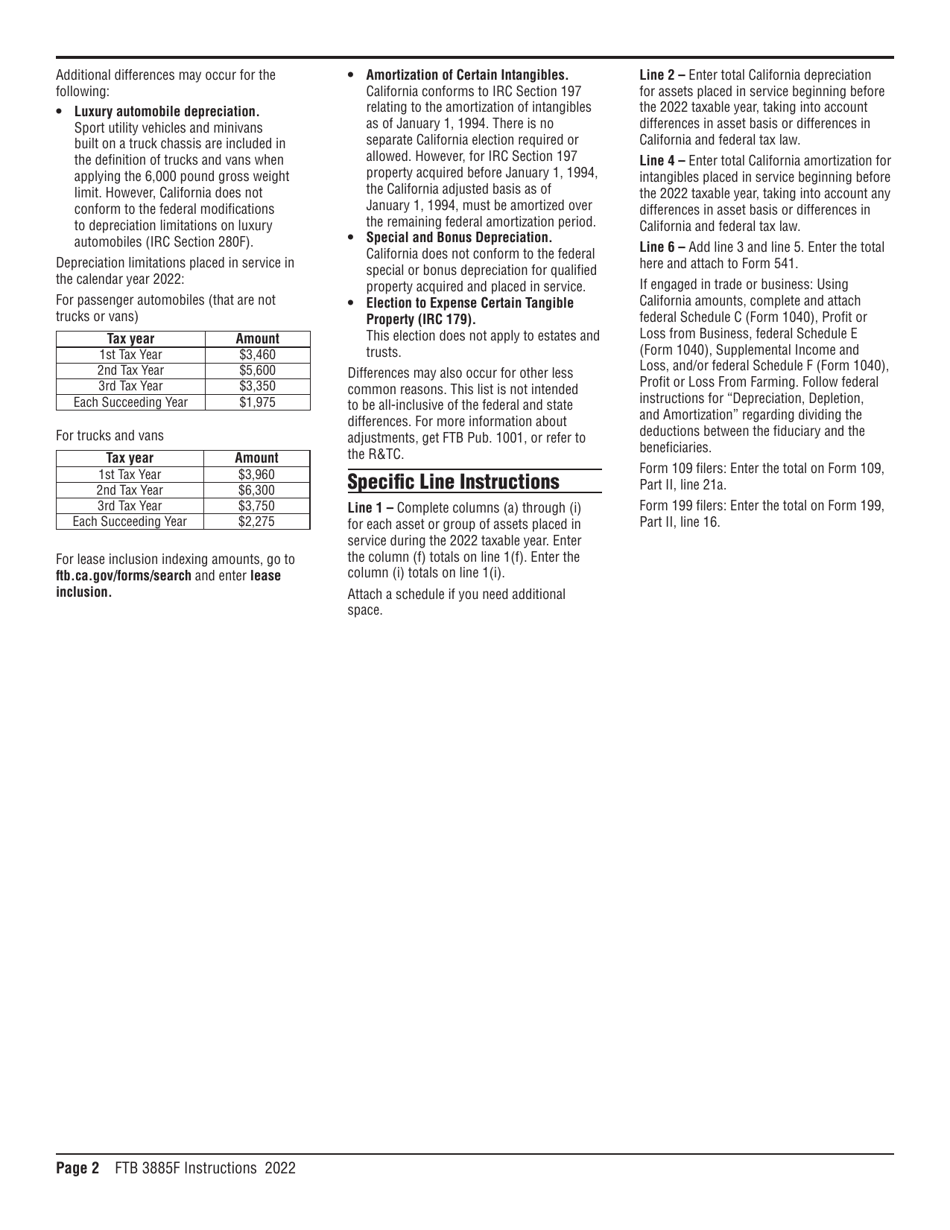

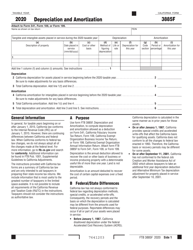

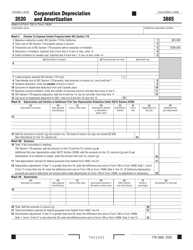

Form 3885F Depreciation and Amortization - California

What Is Form 3885F?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3885F?

A: Form 3885F is a tax form used in California to report depreciation and amortization expenses.

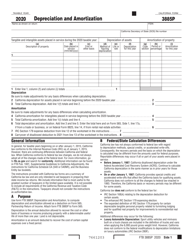

Q: Who needs to file Form 3885F?

A: Individuals or businesses in California that have deductible depreciation or amortization expenses must file Form 3885F.

Q: What expenses are reported on Form 3885F?

A: Form 3885F is used to report expenses related to the depreciation and amortization of assets used in business or income-producing activities.

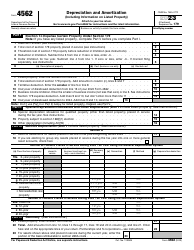

Q: Is Form 3885F required for federal taxes?

A: No, Form 3885F is specific to California taxes and is not required for federal tax purposes.

Q: When is the deadline to file Form 3885F?

A: The deadline to file Form 3885F is the same as the deadline for filing your California state tax return, which is typically April 15th.

Q: Can Form 3885F be e-filed?

A: Yes, Form 3885F can be filed electronically using approved tax software or through a tax professional who offers e-filing services.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3885F by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.