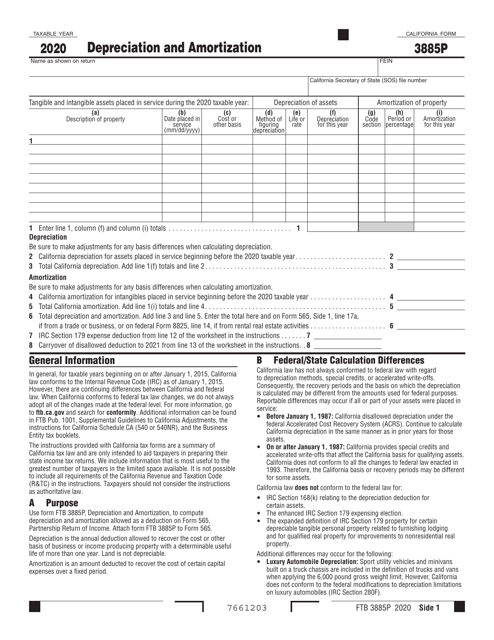

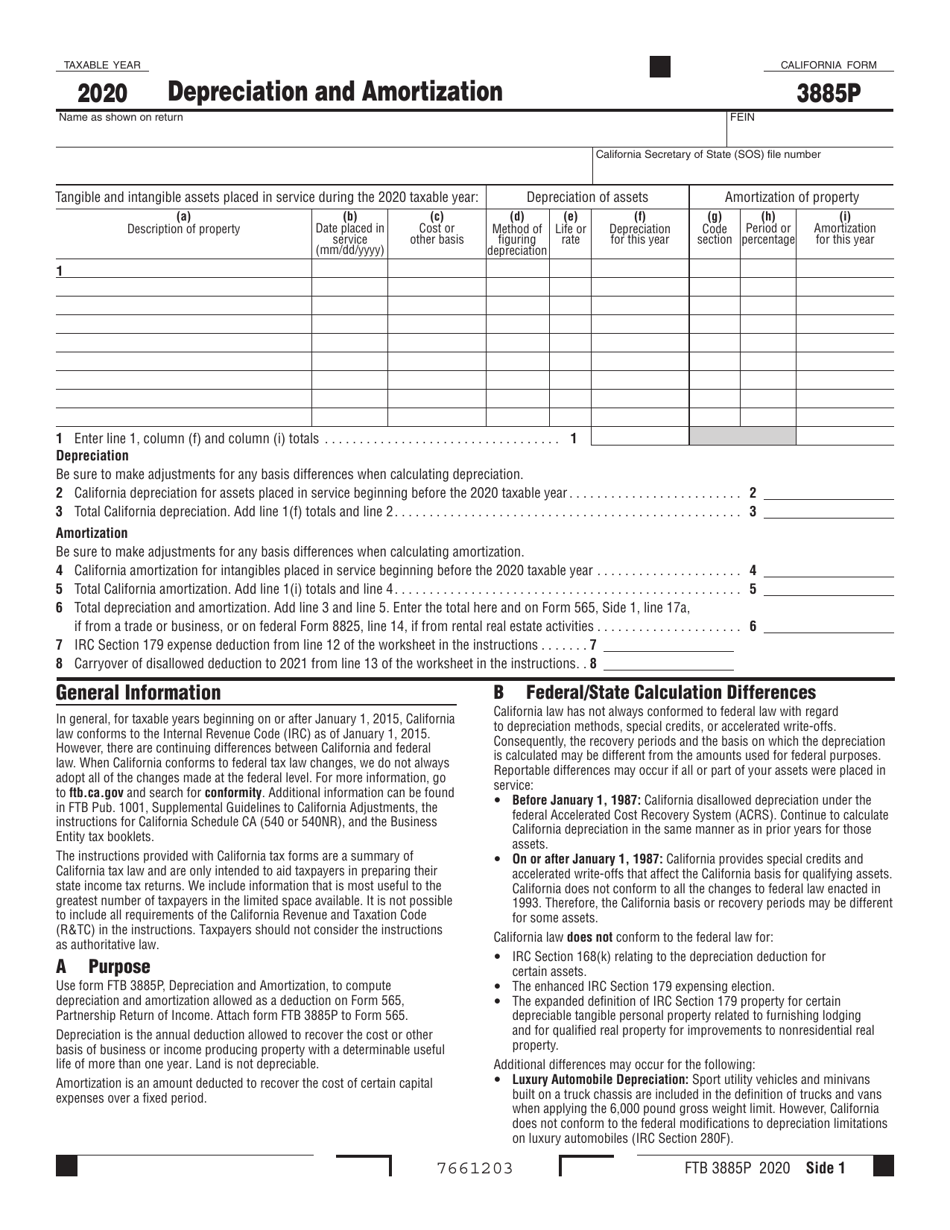

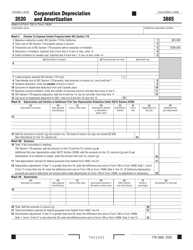

Form FTB3885P Depreciation and Amortization - California

What Is Form FTB3885P?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3885P?

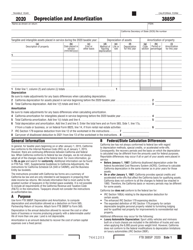

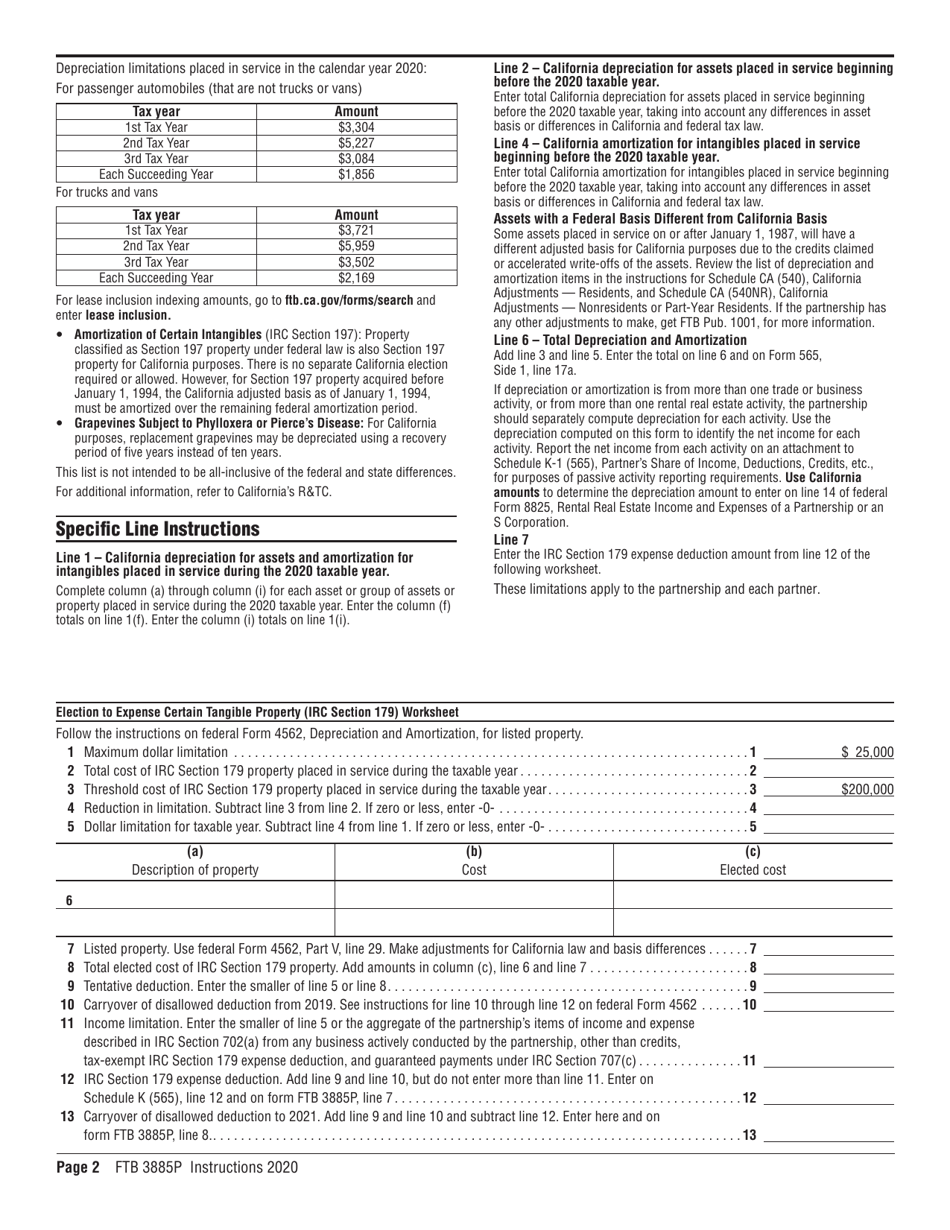

A: Form FTB3885P is a California tax form used to calculate the amount of depreciation and amortization that can be claimed as a deduction on your state income tax return.

Q: What is depreciation?

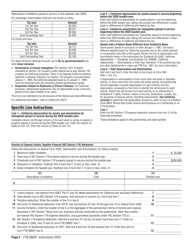

A: Depreciation is an accounting method used to allocate the cost of an asset over its useful life. It reflects the decline in value of an asset as it is used and gets older.

Q: What is amortization?

A: Amortization is a similar concept to depreciation, but it is used for intangible assets, such as patents, trademarks, or copyrights. It is the process of spreading out the costs of an intangible asset over its useful life.

Q: Why is Form FTB3885P important?

A: Form FTB3885P is important because it allows you to claim the depreciation and amortization expenses associated with your business or rental property on your California state income tax return, which can help reduce your taxable income.

Q: Who needs to file Form FTB3885P?

A: You will need to file Form FTB3885P if you have claimed depreciation or amortization expenses on your federal tax return and you want to claim them as a deduction on your California state income tax return.

Q: What information is needed to complete Form FTB3885P?

A: To complete Form FTB3885P, you will need to gather information about the assets for which you are claiming depreciation or amortization, such as the date they were placed in service, their cost basis, and their useful life.

Q: When is Form FTB3885P due?

A: Form FTB3885P is due on the same date as your California state income tax return, which is typically April 15th or the next business day if April 15th falls on a weekend or holiday.

Q: Is there a fee to file Form FTB3885P?

A: There is no fee to file Form FTB3885P. It is simply a form used to calculate the amount of depreciation and amortization that can be claimed as a deduction on your California state income tax return.

Q: Can I e-file Form FTB3885P?

A: Yes, you can e-file Form FTB3885P along with your California state income tax return if you are filing electronically.

Q: Can I claim depreciation and amortization on my personal residence?

A: No, you generally cannot claim depreciation or amortization on your personal residence. These deductions are typically only available for business or rental property.

Q: What happens if I make a mistake on Form FTB3885P?

A: If you make a mistake on Form FTB3885P, you may need to file an amended return to correct the error. It is important to review your completed form carefully before submitting it to the California Franchise Tax Board.

Q: Can Form FTB3885P be used for federal taxes?

A: No, Form FTB3885P is a California-specific form and is used only for calculating the amount of depreciation and amortization that can be claimed as a deduction on your California state income tax return.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3885P by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.