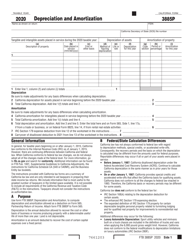

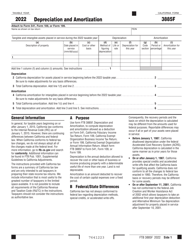

Instructions for Form FTB3885 Corporation Depreciation and Amortization - California

This document contains official instructions for Form FTB3885 , Corporation Depreciation and Amortization - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form FTB3885?

A: Form FTB3885 is a form used by corporations in California to calculate and report depreciation and amortization deductions.

Q: Who needs to file Form FTB3885?

A: Corporations in California that have depreciation and amortization deductions need to file Form FTB3885.

Q: What is depreciation?

A: Depreciation is the deduction of the cost of an asset over its useful life.

Q: What is amortization?

A: Amortization is the deduction of the cost of intangible assets over a specific time period.

Q: How do I complete Form FTB3885?

A: You need to provide information about the asset, its cost, the depreciation method, and the applicable tax year.

Q: When is the deadline to file Form FTB3885?

A: The deadline to file Form FTB3885 is the same as the deadline to file your California corporate tax return.

Q: Can I e-file Form FTB3885?

A: Yes, you can e-file Form FTB3885 if you are filing your California corporate tax return electronically.

Q: Do I need to attach any documents with Form FTB3885?

A: You may need to attach supporting documents, such as schedules and calculations, depending on your specific situation.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.