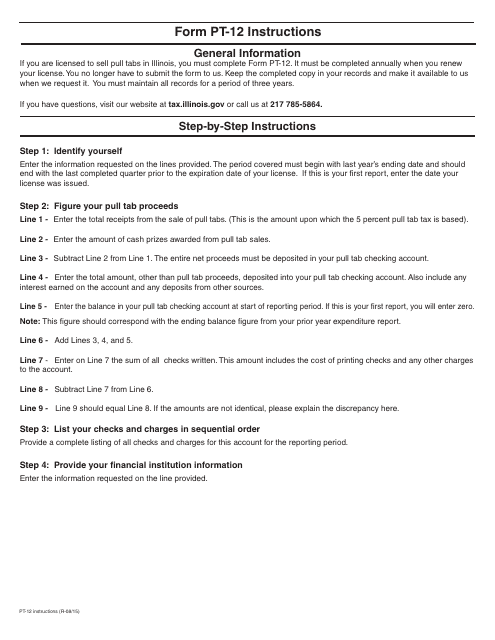

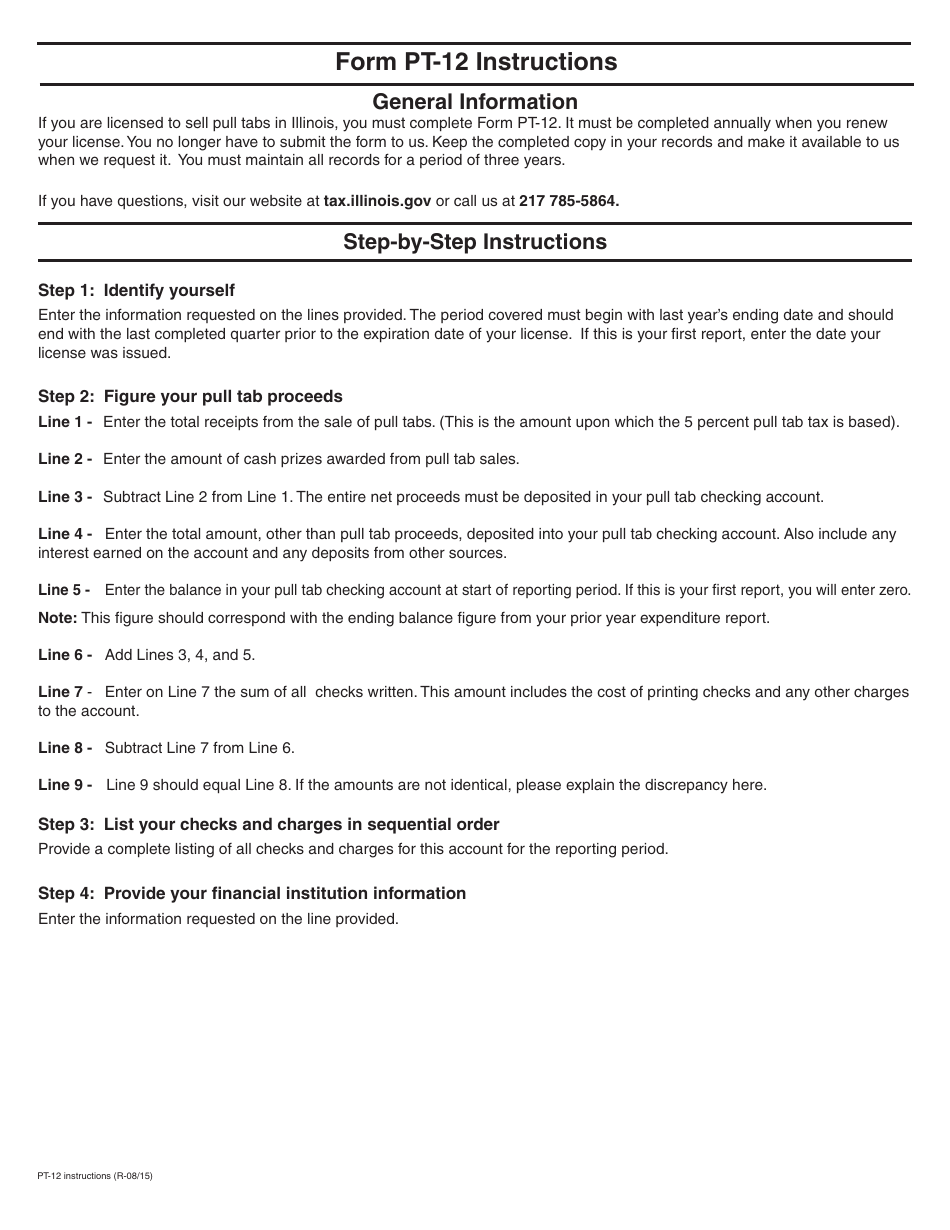

Instructions for Form PT-12 Expenditures of Pull Tab Funds - Illinois

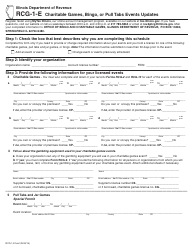

This document contains official instructions for Form PT-12 , Expenditures of Pull Tab Funds - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form PT-12 is available for download through this link.

FAQ

Q: What is Form PT-12?

A: Form PT-12 is a document used in Illinois to report expenditures of pull tab funds.

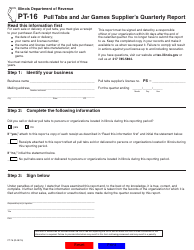

Q: Who needs to file Form PT-12?

A: Organizations in Illinois that use pull tab funds must file Form PT-12.

Q: What are pull tab funds?

A: Pull tab funds are proceeds generated from the sale of pull tab tickets, which are a type of gambling ticket.

Q: Why is Form PT-12 important?

A: Form PT-12 is important for organizations to report how they have used the pull tab funds and ensure compliance with regulations.

Q: When should Form PT-12 be filed?

A: Form PT-12 must be filed quarterly within 30 days after the end of the reporting period.

Q: Are there any penalties for not filing Form PT-12?

A: Yes, failure to file Form PT-12 or filing it late may result in penalties or enforcement actions.

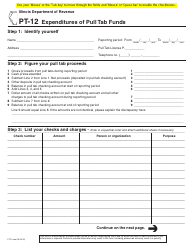

Q: What information is required in Form PT-12?

A: Form PT-12 requires information such as total revenues, itemized expenditures, and the purpose of each expenditure made with pull tab funds.

Q: Is there a fee for filing Form PT-12?

A: No, there is no fee associated with filing Form PT-12.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.