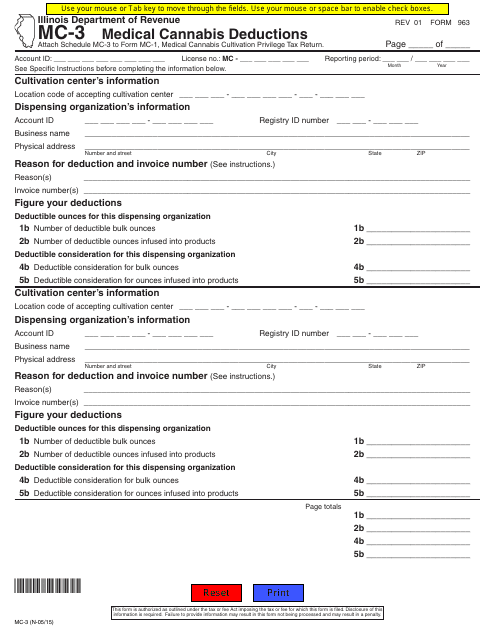

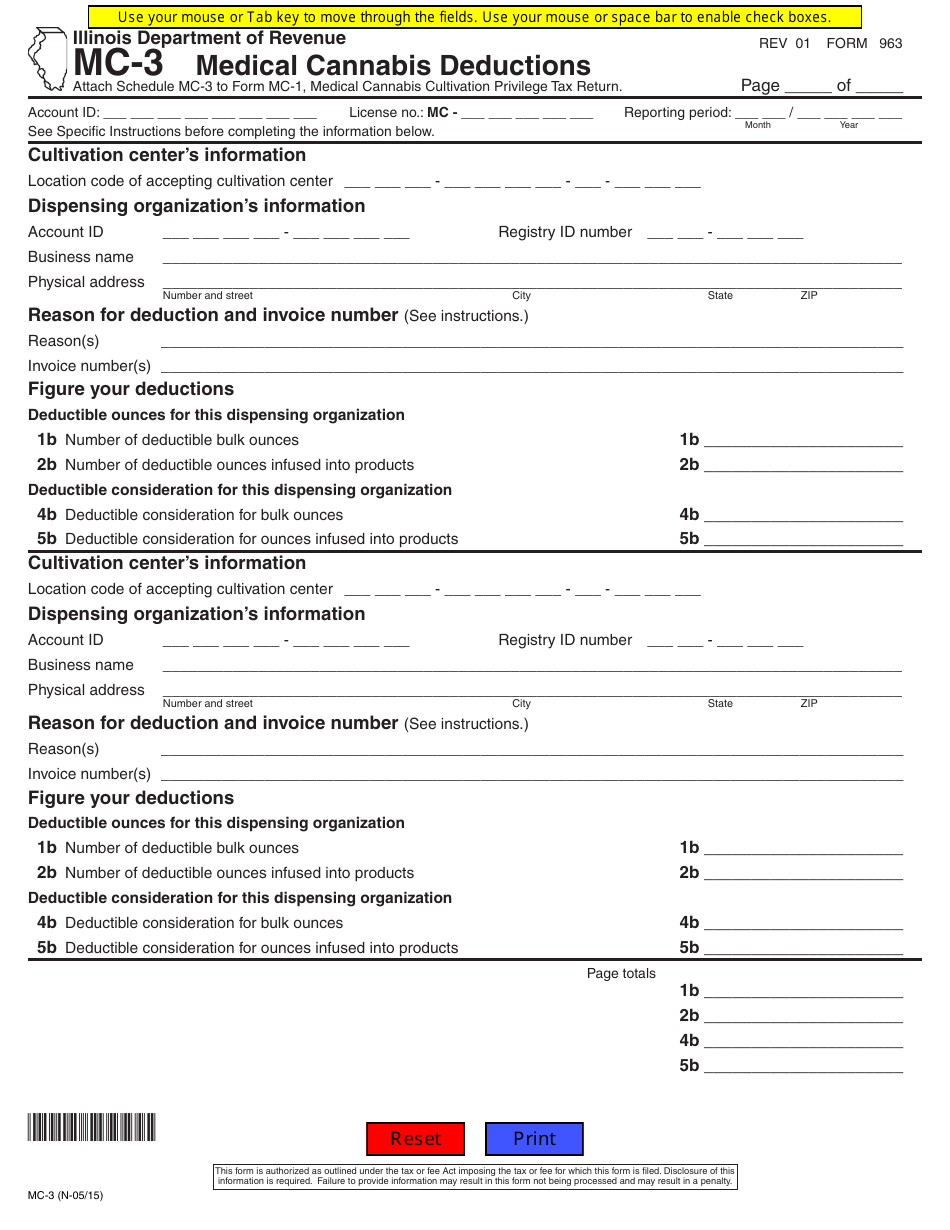

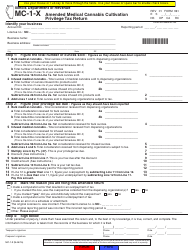

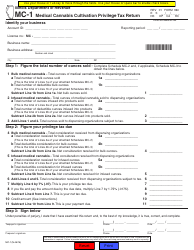

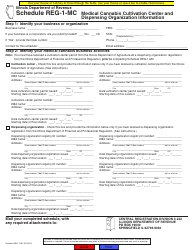

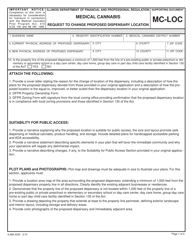

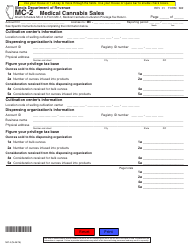

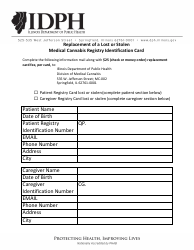

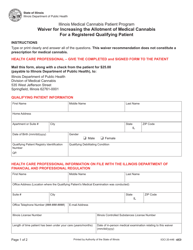

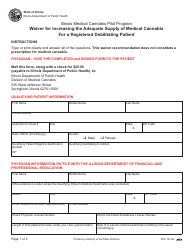

Form 963 Schedule MC-3 Medical Cannabis Deductions - Illinois

What Is Form 963 Schedule MC-3?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 963 Schedule MC-3?

A: Form 963 Schedule MC-3 is a tax form used in Illinois to claim deductions related to medical cannabis expenses.

Q: Who can use Form 963 Schedule MC-3?

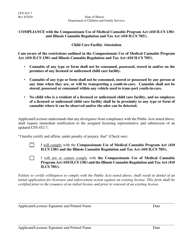

A: Residents of Illinois who have valid medical cannabis cards and incur qualifying medical cannabis expenses can use Form 963 Schedule MC-3.

Q: What does Form 963 Schedule MC-3 allow you to deduct?

A: Form 963 Schedule MC-3 allows you to deduct qualifying medical cannabis expenses, such as the cost of medical cannabis products.

Q: What documents should I keep to support my deductions on Form 963 Schedule MC-3?

A: You should keep receipts and documentation that show the medical cannabis expenses you incurred.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 963 Schedule MC-3 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.