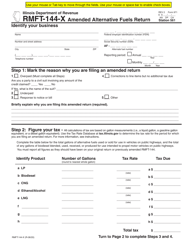

Instructions for Form RMFT-144, 970 Alternative Fuels Return - Illinois

This document contains official instructions for Form RMFT-144 , and Form 970 . Both forms are released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RMFT-144 is available for download through this link. The latest available Form RMFT-144 (970) can be downloaded through this link.

FAQ

Q: What is Form RMFT-144?

A: Form RMFT-144 is the 970 Alternative Fuels Return for Illinois.

Q: What is the purpose of Form RMFT-144?

A: The purpose of Form RMFT-144 is to report alternative fuels usage in Illinois.

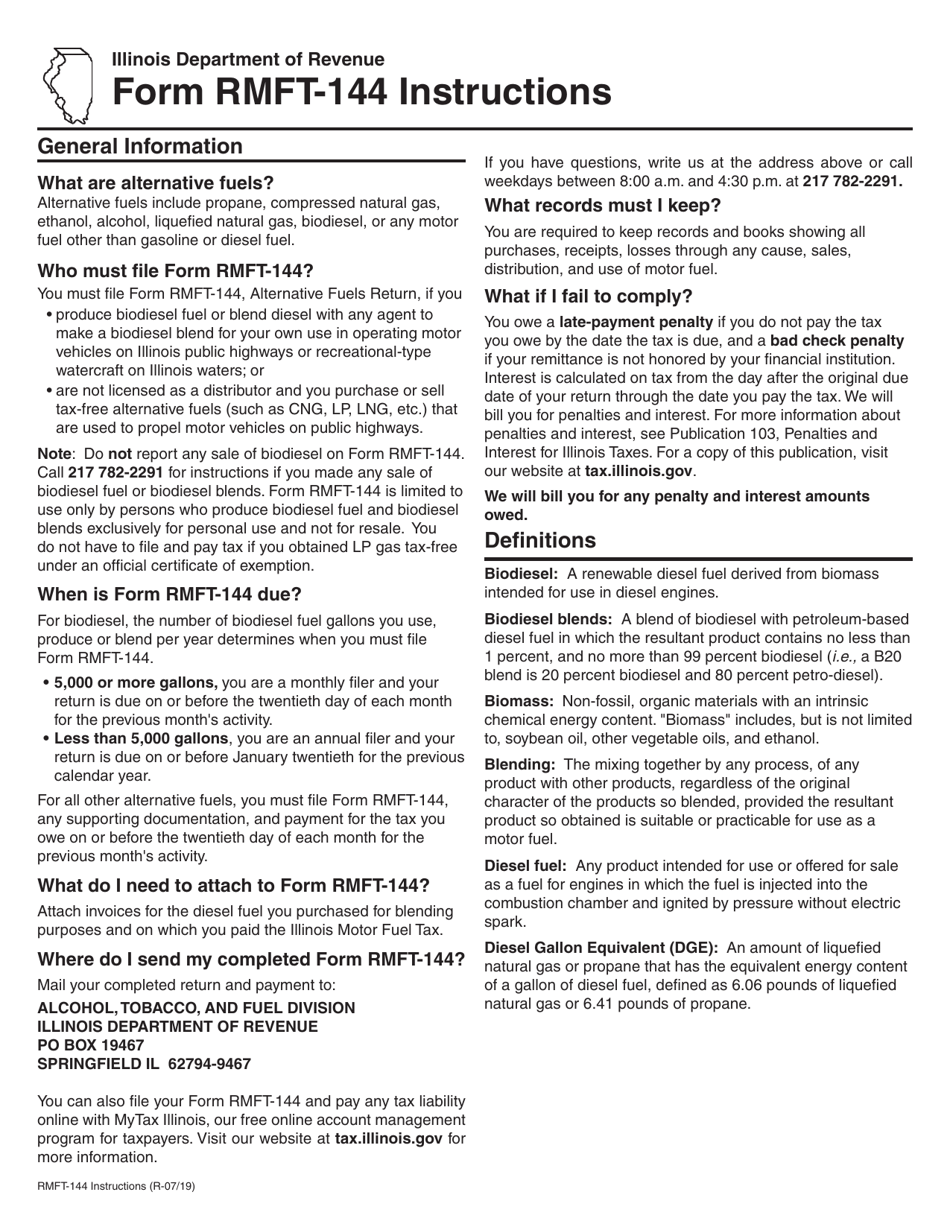

Q: Who needs to file Form RMFT-144?

A: Any taxpayer who sells or uses alternative fuels in Illinois needs to file Form RMFT-144.

Q: What are alternative fuels?

A: Alternative fuels include compressed natural gas (CNG), liquefied natural gas (LNG), and propane.

Q: Are there any exemptions from filing Form RMFT-144?

A: Yes, certain exemptions apply. Check the instructions for specific details.

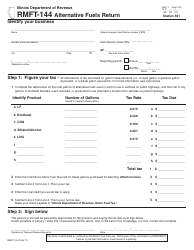

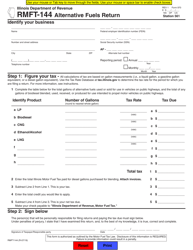

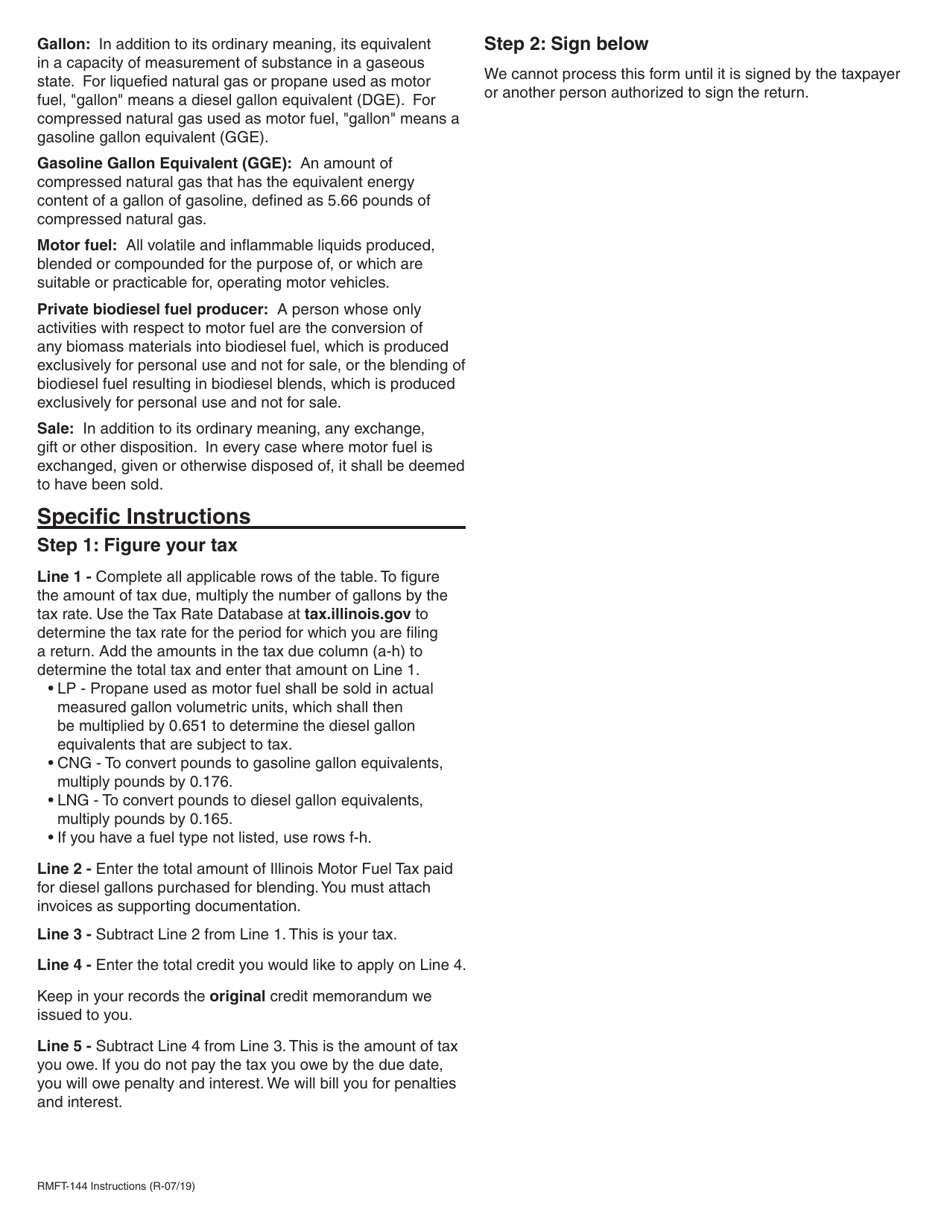

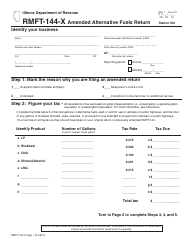

Q: What information do I need to complete Form RMFT-144?

A: You will need to provide information about the volume and type of alternative fuels sold or used, as well as the corresponding tax liabilities.

Q: When is the deadline to file Form RMFT-144?

A: The deadline to file Form RMFT-144 is determined by the filing period. Check the instructions for specific deadlines.

Q: Are there any penalties for filing Form RMFT-144 late?

A: Yes, penalties may apply for late or incomplete filings. Refer to the instructions for more information.

Q: Is there any additional documentation required with Form RMFT-144?

A: No, additional documentation is not required, unless specifically requested by the Illinois Department of Revenue.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.