Instructions for Form CDTFA-240-A, CDTFA-241-A, CDTFA-242-A, CDTFA-243-B, CDTFA-244-B, CDTFA-269-BM, CDTFA-269-BW, CDTFA-269-WG - California

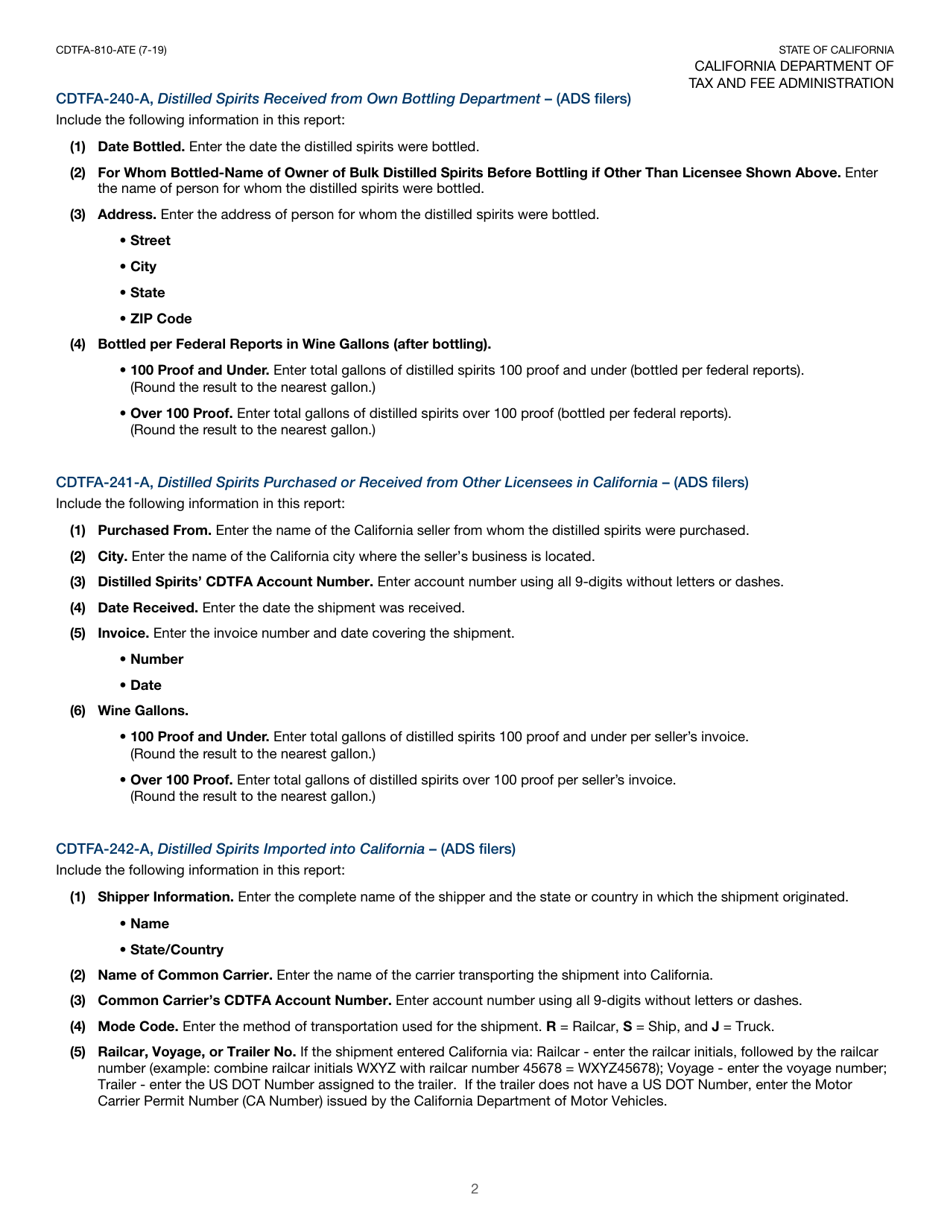

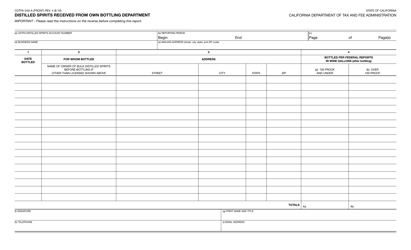

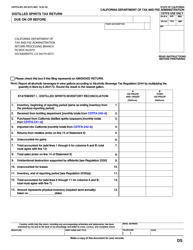

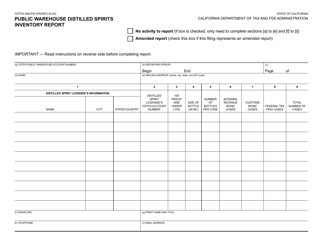

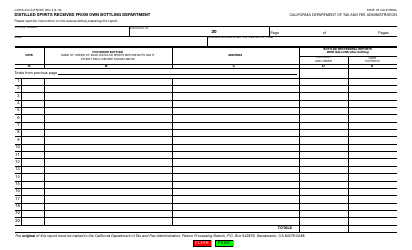

Form CDTFA-240-A Distilled Spirits Received From Own Bottling Department - California

Form CDTFA-240-A Distilled Spirits Received From Own Bottling Department - California

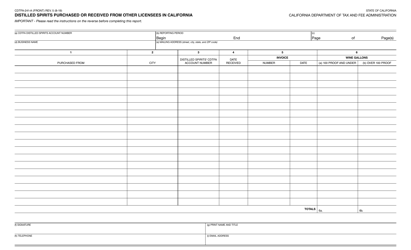

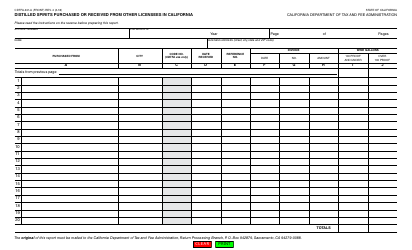

Form CDTFA-241-A Distilled Spirits Purchased or Received From Other Licensees in California - California

Form CDTFA-241-A Distilled Spirits Purchased or Received From Other Licensees in California - California

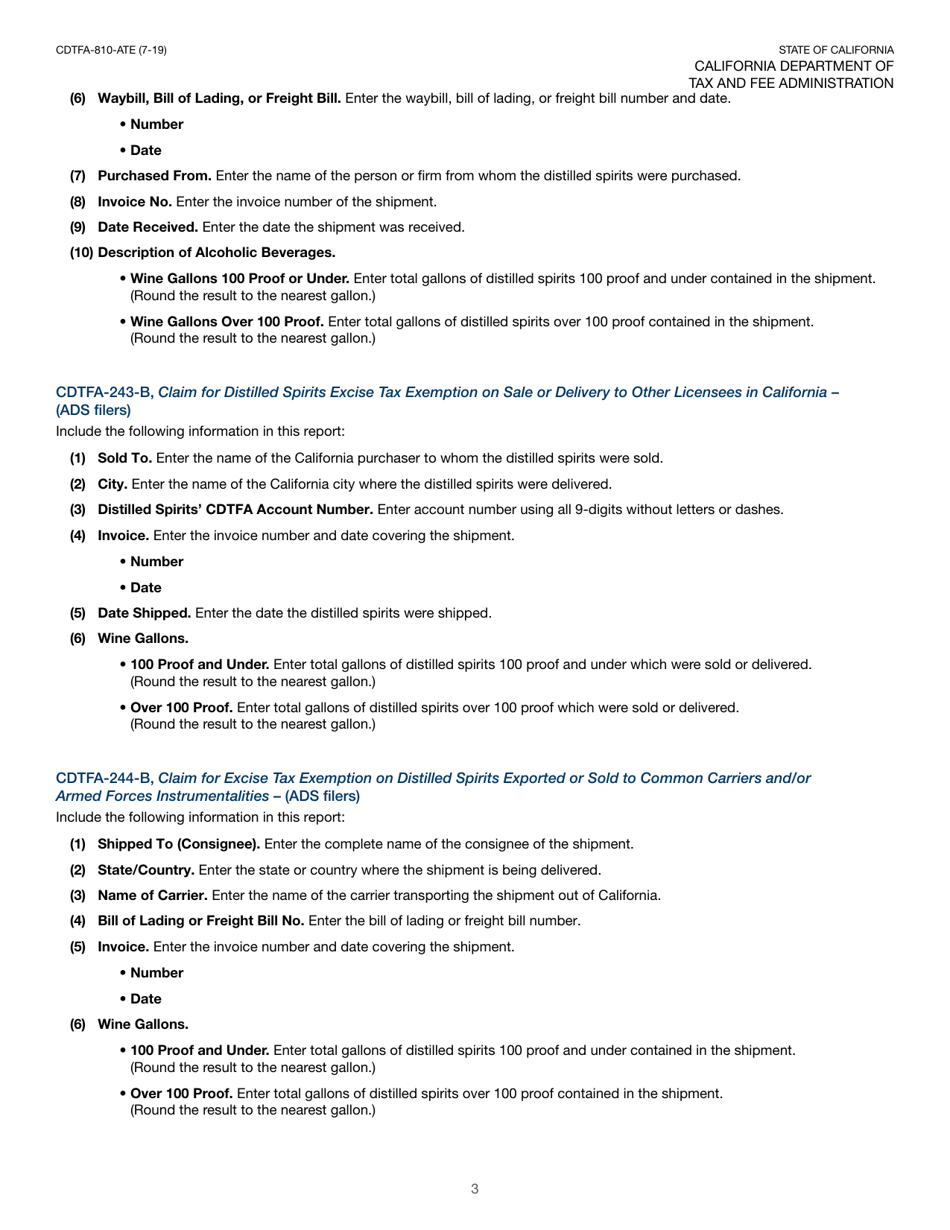

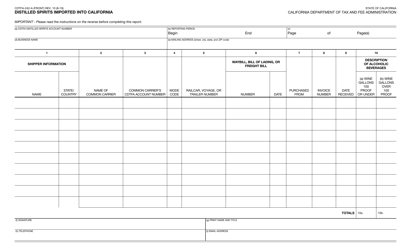

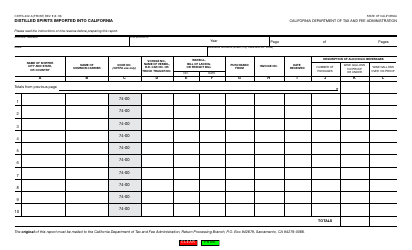

Form CDTFA-242-A Distilled Spirits Imported Into California - California

Form CDTFA-242-A Distilled Spirits Imported Into California - California

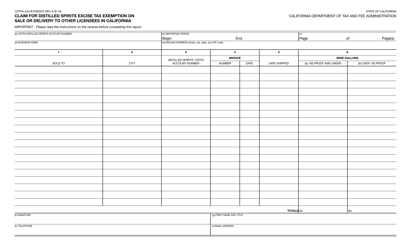

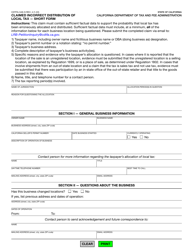

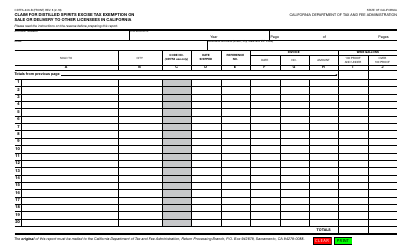

Form CDTFA-243-B Claim for Distilled Spirits Excise Tax Exemption on Sale or Delivery to Other Licensees in California - California

Form CDTFA-243-B Claim for Distilled Spirits Excise Tax Exemption on Sale or Delivery to Other Licensees in California - California

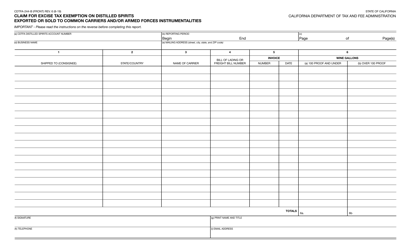

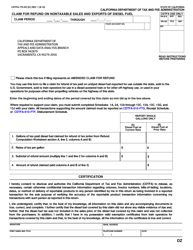

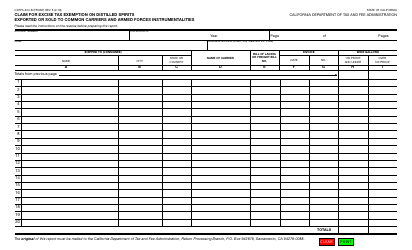

Form CDTFA-244-B Claim for Excise Tax Exemption on Distilled Spirits Exported or Sold to Common Carriers and Armed Forces Instrumentalities - California

Form CDTFA-244-B Claim for Excise Tax Exemption on Distilled Spirits Exported or Sold to Common Carriers and Armed Forces Instrumentalities - California

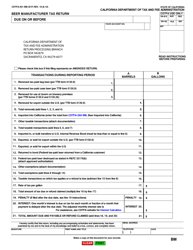

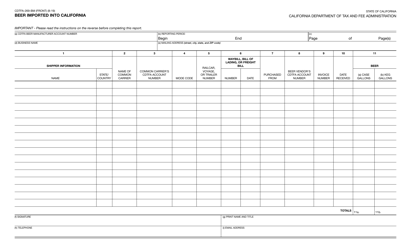

Form CDTFA-269-BM Beer Imported Into California - California

Form CDTFA-269-BM Beer Imported Into California - California

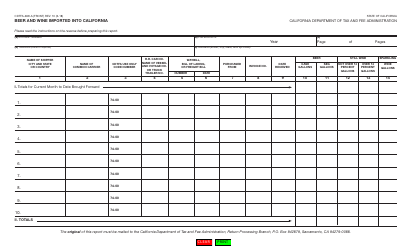

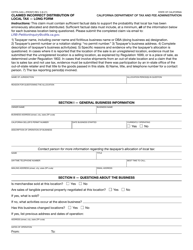

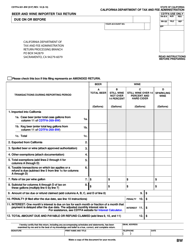

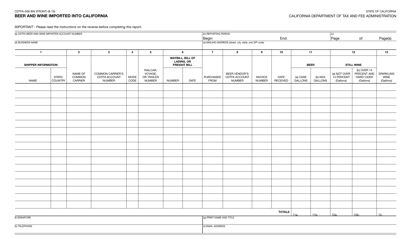

Form CDTFA-269-BW Beer and Wine Imported Into California - California

Form CDTFA-269-BW Beer and Wine Imported Into California - California

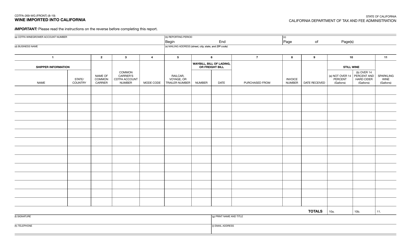

Form CDTFA-269-WG Wine Imported Into California - California

Form CDTFA-269-WG Wine Imported Into California - California

This document contains official instructions for Form CDTFA-240-A , Form CDTFA-241-A , Form CDTFA-242-A , Form CDTFA-243-B , Form CDTFA-244-B , Form CDTFA-269-BM , Form CDTFA-269-BW , and Form CDTFA-269-WG . All forms are released and collected by the California Department of Tax and Fee Administration. An up-to-date fillable Form CDTFA-240-A is available for download through this link. The latest available Form CDTFA-241-A can be downloaded through this link. Form CDTFA-242-A can be found here. The newest Form CDTFA-243-B can be downloaded here. An up-to-date fillable Form CDTFA-244-B is available for download through this link. The latest available Form CDTFA-269-BM can be downloaded through this link. Form CDTFA-269-BW can be found here. The newest Form CDTFA-269-WG can be downloaded here.

FAQ

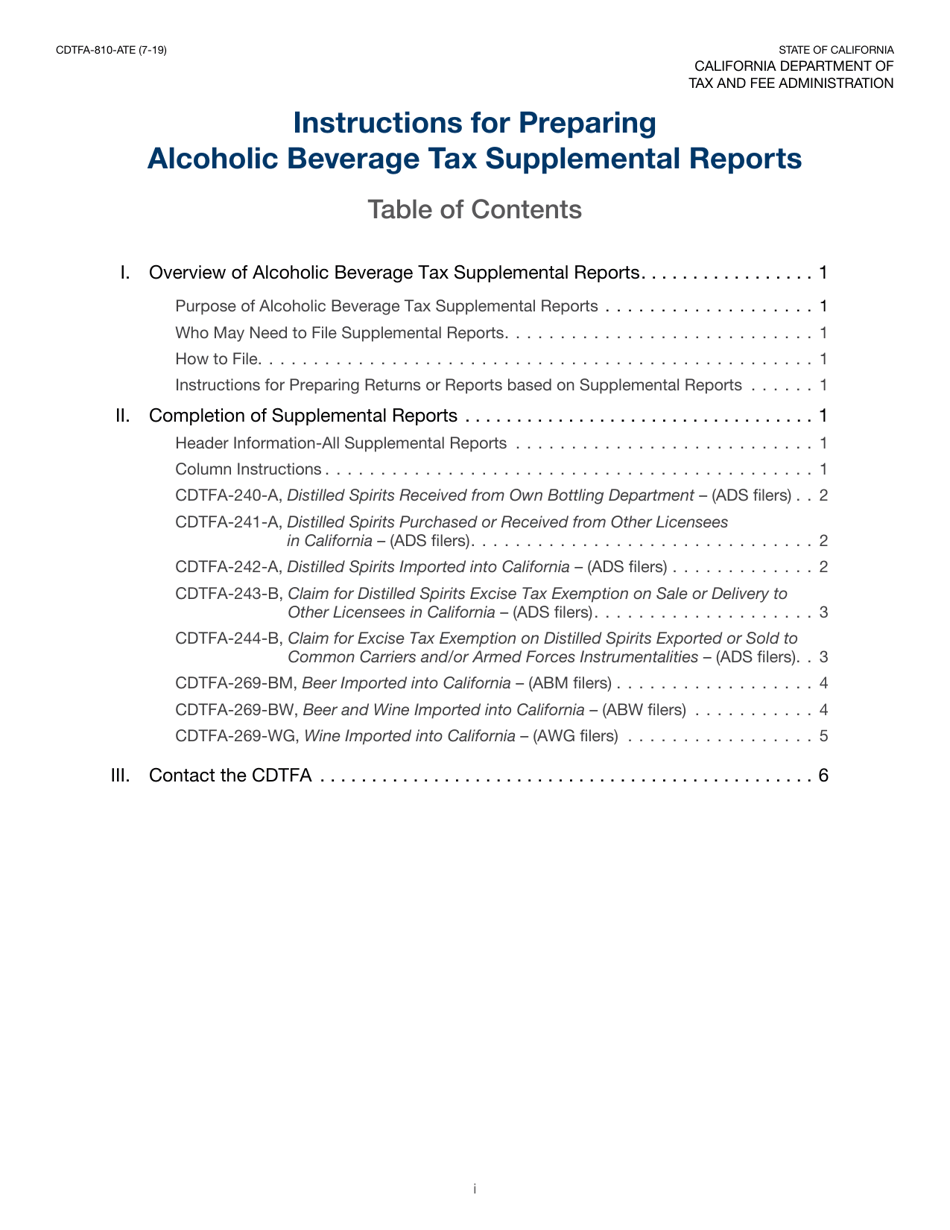

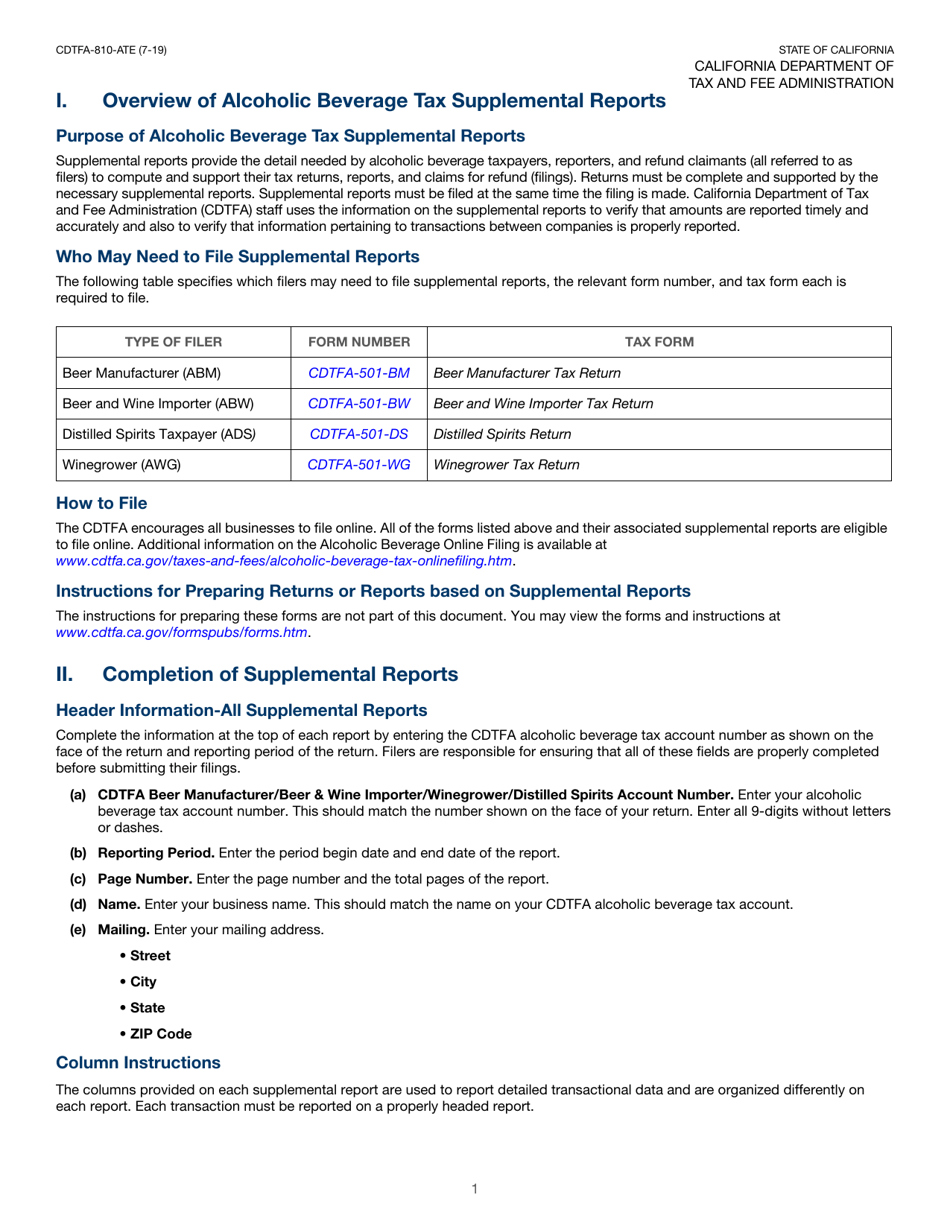

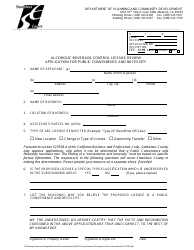

Q: What are Form CDTFA-240-A, CDTFA-241-A, CDTFA-242-A, CDTFA-243-B, CDTFA-244-B, CDTFA-269-BM, CDTFA-269-BW, and CDTFA-269-WG?

A: These are forms used in California for various tax-related purposes.

Q: What is Form CDTFA-240-A used for?

A: Form CDTFA-240-A is used to report various types of tobacco products that are subject to the California Cigarette and Tobacco Products Tax Law.

Q: What is Form CDTFA-241-A used for?

A: Form CDTFA-241-A is used to report the sales, use, or storage of cigarettes and tobacco products that have not been properly tax-paid.

Q: What is Form CDTFA-242-A used for?

A: Form CDTFA-242-A is used to report information related to the purchase, sale, or use of cigarettes or other tobacco products where a permit is required.

Q: What is Form CDTFA-243-B used for?

A: Form CDTFA-243-B is used to report the sales of cigarettes or other tobacco products through vending machines.

Q: What is Form CDTFA-244-B used for?

A: Form CDTFA-244-B is used to report the purchase, sale, or use of tobacco products for resale without payment of tax.

Q: What is Form CDTFA-269-BM used for?

A: Form CDTFA-269-BM is used to report the barrel or wine gallonage tax on wine produced or imported into California for home use.

Q: What is Form CDTFA-269-BW used for?

A: Form CDTFA-269-BW is used to report the water rights fee imposed on the extraction of groundwater in California.

Q: What is Form CDTFA-269-WG used for?

A: Form CDTFA-269-WG is used to report the tax on the sale, storage, use, or other consumption in California of bottled sweetened beverages.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Department of Tax and Fee Administration.